Complete Family Wealth, with Keith Whitaker

Will the work you do create a foundation for your kids and grandkids to prosper? Then how do you create long-term complete family wealth that does the most good for as long as possible? How do you make sure the money you make, the business you build, and the real estate and investments you acquire do more than just benefit you during your lifetime? How do you create rich kids, grandkids, and great-grandkids? To answer these questions, we’re discussing creating generational family wealth, with Keith Whitaker. Through Wise Counsel Research, he helps families grow into multi-generational enterprises, thriving together, preserving and growing family wealth.

Podcast: Play in new window | Download (Duration: 1:02:39 — 71.7MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

In this episode with Keith Whitaker, you’ll discover:

- Why wealth is more than money and how to grow all five types of capital.

- How to develop character so that generations after you will be wealth builders.

- The three keys of prosperous families who pass on multi-generational legacies of more than money.

- Easy, doable ways to write down and communicate the purpose of your trust.

- Why it’s essential to have a first-generation mindset.

- The crucial role of the rising generation to prevent the crumbling and disintegration of family wealth.

- How to develop your children’s character – the habit of choosing wisely.

- Why individual flourishing is the crux of complete family wealth.

So if you want to create strong and successful families, raise children to be stewards, and know that your money will do the greatest good long after you’re gone so you can empower future generations with wealth and wisdom, tune in now!

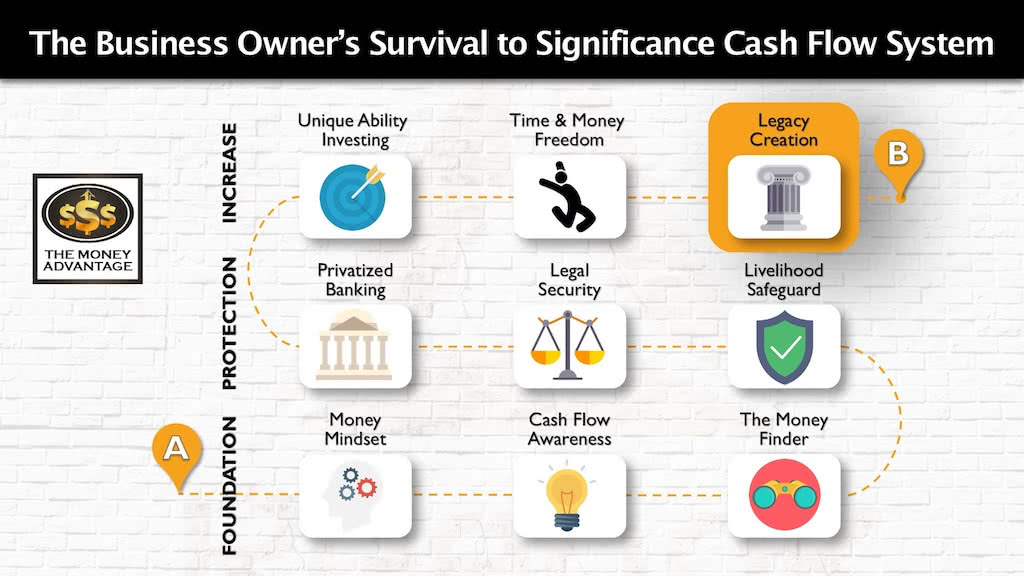

Where Complete Family Wealth Fits In The Bigger Picture

Building family wealth and creating a legacy is the capstone of a life well-lived. It’s the end goal of a life and business you love, and the greatest mission of our lives. But we need an entire financial system to support our ability to do the most good.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with privatized banking, insurance, and legal protection.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

Complete Family Wealth Conversation Highlights from Keith Whitaker

Avoiding the Pitfalls of Leaving an Inheritance

[3:57] When we talk with family members and family leaders, we ask them what’s really on your mind? What’s keeping you up at night? You eventually get to the concern, what’s this money going to do to my grandchildren and generations after that? Is it going to ruin them? And that’s exactly the concern that we try to address.

The Role of Excellence

[5:41] Socrates said, “Wealth doesn’t make a person or a city great and powerful and virtuous and excellent. It’s excellence or virtue that makes an individual or a city wealthy.”

[5:53] In other words, no matter how big your bank account, if you don’t have excellence of mind and character, then, in fact, you’re going to be poor.

[11:11] Families succeed in passing on complete family wealth, not just money, but also excellence, really do communicate. They communicate about their financial plans, estate plans, and their giving.

The Role of Communication

[11:36] If you’re making gifts to your children or grandchildren without communicating about them, behind the scenes or with very little discussion, you’re not really making a gift, you’re making what we call a transfer. Even worse, these gifts are going to become meteors that blast into people’s lives, without any preparation. That can be extremely destructive to young adults or even to older adults. So, people who do this well lay a foundation by developing character and financial literacy in their children.

[12:16] Look at the gift from the eyes of the recipient and ask, is this person ready to receive well? Is this person prepared to integrate the gift into his or her life? And if not, what can I do to help them develop that capacity?

[12:51] Silence is counterproductive. It’s a big opportunity cost that parents incur by not talking. It can build up the anger, resentment, and confusion in children who eventually receive these gifts.

Trusts

[13:18] … trusts are the number one vehicle for holding wealth and transferring wealth for lots of good reasons. But at the same time, trusts can be something that make it harder to do that well because family members look at them as just legal things, complicated documents they can’t even read and understand. So, as a result, many beneficiaries grow up feeling controlled by trustees and fundamentally mistrusted by the existence of trusts.

[14:17] The answer to this problem is not to get rid of trusts, but to focus on making trusts human relationships.

[14:51] If the trust creator or creators are still alive, thoughtfully and clearly lay out your wishes for the trust. What kind of impact do you want to have in people’s lives? Beyond the asset protection or estate tax efficiency, what do you want this trust to do in the lives of the beneficiaries?

[21:11] This trust is a gift of love. Its purpose is to enhance the lives of the beneficiaries.

How to Communicate The Meaning of Your Legacy

[22:19] You can write down letters of wishes or intent. It doesn’t need to be a book. It can be a one-page document of five points or so. Another strategy I’ve seen people use is to write out, sometimes with the help of somebody interviewing them or recording them, something of their own life story. Where did this money come from? How did we acquire it? What were some of the disasters along the way that we had to overcome? They get across the values behind the family history and the growth of the wealth so that it isn’t just fun stuff, nice vacations, nice vehicles, nice houses, and nice schools. It’s a story of hard work of adversity of overcoming adversity of working with others, appreciating others, and being the recipient of others’ kindness and help along the way.

First Generation Mindset

[36:44] Wealth in a family can have the effect of making everybody other than the wealth creator feel lesser or unimportant so that the whole focus becomes the wealth creator or the wealth creator’s generation, and everything else is an afterthought. Having a first-generation mindset in your life means that your choices matter. So take them seriously.

The Rising Generation

[38:12] We use this term of rising generation rather than the next generation, saying that every generation has its room to rise, particularly for younger family members in a family with significant wealth or business. Rising means facing their own struggles, finding their own work, forging their own healthy relationships, and learning to communicate in a responsible way. That means not only listening, but also having and finding your voice. For the older or the controlling generation, this means making some room for the voice of rising generation family members.

[38:56] we see so often great respect and an almost sort of worship of the wealth creator in a family can cause everyone else to feel that I don’t really have anything to say, or I don’t really have anything worthwhile. Nobody really wants to hear from me anyway, they want to talk about dad or grandpa. So a silence falls on the rest of the family. And what happens if that silence continues from one generation to the next is that people feel that it’s not really important for me to learn. It’s not important for me to strive, I don’t really matter. Eventually, then people deplete both the qualitative capital of the family, their skills, knowledge, abilities, and the quantitative capital of the family.

[39:49] We have seen the silence of the rising generation to be the absolutely crucial cause of the failure of families to continue from one generation to the next in successfully stewarding their wealth.

Who Is Keith Whitaker?

Keith Whitaker is President of Wise Counsel Research. He has consulted for many years with leaders of enterprising families, helping them plan succession, develop next-generation talent, and communicate around estate planning. With a background in education and philanthropy, he enables family leaders to understand their values and goals better, as well as to have a positive impact on the world around them. Family Wealth Report named Keith the 2015 “outstanding contributor to wealth management thought-leadership.

Keith has served as a Managing Director at Wells Fargo Family Wealth, an adjunct professor of management at Vanderbilt University, an adjunct assistant professor of philosophy at Boston College, and a director of a private foundation. He was also a special assistant to the President of Boston University.

Keith’s writings and commentary have appeared in The Wall Street Journal, The New York Times, The Financial Times, Claremont Review of Books, and Philanthropy Magazine. His Wealth and the Will of God appeared in 2010 from Indiana University Press and he is co-author of The Cycle of the Gift, The Voice of the Rising Generation, Family Trusts, Complete Family Wealth, and Wealth of Wisdom: The Top 50 Questions Wealthy Families Ask, all published by Wiley / Bloomberg Press.

Keith holds a Ph.D. in Social Thought from the University of Chicago and a BA and MA in Classics and Philosophy from Boston University. He is Chairman of the board of directors of the National Association of Scholars.

Complete Family Wealth Links and Mentions

- Learn more about Keith Whitaker and Wise Counsel Research.

- Get The Family Balance Sheet Assessment by emailing Keith Whitaker at keith@wisecounselresearch.com.

- Complete Family Wealth

- Borrowed From Your Grandchildren: The Evolution of 100-Year Family Enterprises, by Dennis Jaffe

Leave a Legacy: The Two Essentials for Lasting Impact

Do you want to make a difference that lasts for generations? If you have children or grandchildren that you want to benefit, bless, and uplift, you can make plans now to accomplish that priority. Before you start planning, though, there are two essentials you’ll need. These two components will help you get started and follow…

Read MoreWhy is Enough Never Enough, with Rabbi Daniel Lapin

Why is enough never enough? How do I know when you’ve made enough money, or when making money becomes too much of a concern, and you should be satisfied with what you’ve got? Joining us to discuss this abundance paradox is a long-time friend of The Money Advantage, Rabbi Daniel Lapin. Author of Thou Shall…

Read More