Custom-Designed Estate Planning, with Stephen Haynes

Considering estate planning, but not sure how to make it work best for your family? Wondering how to balance your unique age, stage, personalities, and goals? Does estate planning feel constrictive, or your ambitions seem bigger than what you can accommodate with a finite plan? Do you wonder how you could possibly know what’s best 30 years from now when you’re not sure who your children will become?

Today, we want to help you wrestle the giant octopus of long-range planning. Bruce and I are talking with my estate planning attorney, Stephen Haynes, about solving special considerations with your estate plan.

And this will be a special treat! We’re not just going to talk theory about estate planning. We’re inviting you in and showing a sneak peek into how we created an estate plan for our family.

So if you want to recognize the pros and cons of various estate transfer strategies, achieve the best balance of asset protection, creditor protection, control, and ownership, and find out how to design your estate plan to solve your needs best so you can strengthen your family with how you pass on wealth, instead of causing future challenges, tune in now!

Podcast: Play in new window | Download (Duration: 57:29 — 65.8MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | Youtube Music | RSS | More

In This Conversation about Custom-Designed Estate Planning with Stephen Haynes

- Deciding how to transfer trust assets to children in a way that provides for their needs and helps them become empowered and not entitled.

- Solving the tension of gifting assets outright vs. in trust, and why you may consider one over the other.

- How to achieve the balance of asset protection and creditor protection with control and ownership, and reduce the risk of estate taxes.

- The role of the trustee, the goal of the trust to be a relationship, how to select a trustee, and how to set up your children to have a good relationship with the trustee.

- Hear how we’re solving the potential problem of children seeing that a trustee is trying to keep them from their money.

- Finding the middle ground between leaving direct guidance to the trustee with rigid wishes vs. leaving discretion to the trustee.

- How to direct your money to be used the way you want, while also providing for the freedom and flourishing of each individual in generations beyond you.

- How you can use life insurance to create perpetual, generational wealth.

Where Estate Planning Fits into Your Cashflow Creation System

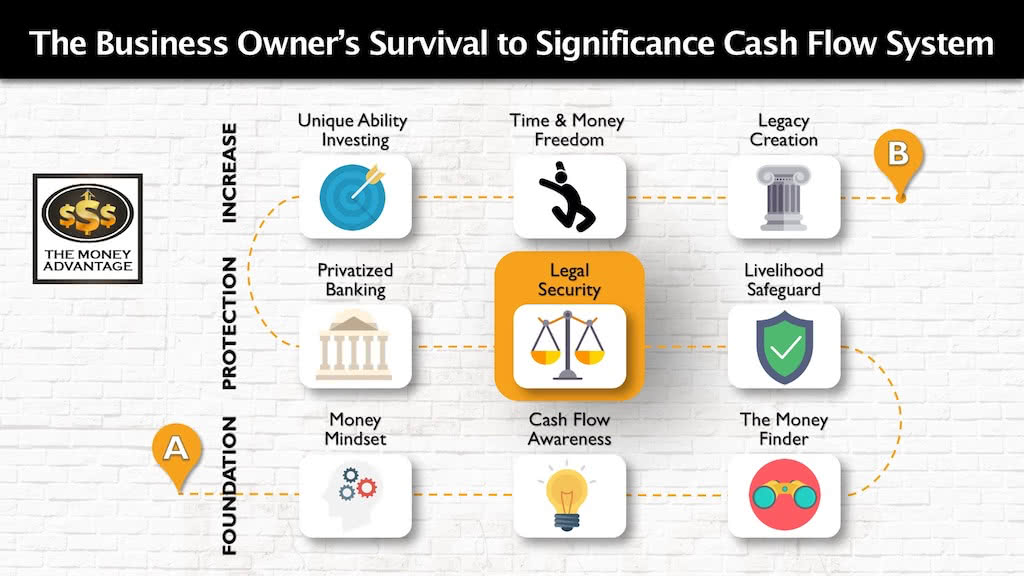

Encircling your family and assets with a bulletproof estate plan will maximize your peace of mind. But it’s just one small step of a greater journey.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, privatized banking and legal protection. This is where estate planning fits in. You’ll know that no matter what happens to you, your wishes will be carried out, your assets will remain intact, and your wisdom will empower generations after you.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

Take Action to Begin Your Family Legacy Today

Take the next steps today.

As Bruce says, “Make small steps, but quality steps.”

You don’t have to leap the whole chasm all at once.

Today’s small step may look like taking a minute to write down what’s important to you. This may become the start of your personal values or vision statement.

Or, if you are ready for a conversation about your estate planning or life insurance, your next step could be scheduling a conversation.

Find Out More About Stephen Haynes

Discover more about Stephen Haynes, Davis Law Group, or contact him directly at Stephen@dlgva.com.

Book a Strategy Call

We offer two powerful ways to help you create lasting impact:

- Financial Strategy Call – Discover how Privatized Banking, alternative investments, tax-mitigation, and cash flow strategies can accelerate your time and money freedom while improving your life today. Let us show you how to align your financial resources for maximum growth and efficiency. Book a Strategy Call with our team today.

- Legacy Strategy Call – If you want to uncover your family values, mission, and vision, and create a legacy that’s about more than just money, we can guide you through the process of financial stewardship and family leadership. Save time coordinating your family’s finances while building a legacy that lasts for generations. Book a Legacy Strategy Call to learn more about how we can help.

We specialize in working with wealth creators and their families to unlock their potential and build a meaningful, multigenerational legacy.

Thanks for Tuning In!

Thanks so much for being with us this week. Have some feedback you’d like to share? Please leave a note in the comments section below!

Don’t forget to subscribe to the show to get automatic episode updates for The Money Advantage podcast!

And, finally, please take a minute to leave us an honest review and rating on Apple Podcasts. They really help us out when it comes to the ranking of the show, and I make it a point to read every single one of the reviews we get.

Preserving Generational Wealth With Josh Kanter of Leaf Planner: The Missing Piece Isn’t Paperwork

The Questions No One Can Answer After Dad Dies A man spends his life building a sophisticated estate plan—brilliant strategies, impeccable legal work, a network of trusted advisors, and layers upon layers of entities. His son is a lawyer. He even gets 18 months to prepare before his father passes. And yet, within days of…

Will AI Replace Financial Advisors? Why Wisdom Still Wins in Real Life Money Decisions

The Moment “Confident” Sounds Like “Certain” A few weeks ago, we found ourselves talking about how quickly AI is moving. It’s not just that it can answer questions fast—it’s that it can sound certain while doing it. And when you’re staring at a big money decision—debt, investing, taxes, retirement—certainty feels like relief. It feels like…