Custom-Designed Estate Planning, with Stephen Haynes

Considering estate planning, but not sure how to make it work best for your family? Wondering how to balance your unique age, stage, personalities, and goals? Does estate planning feel constrictive, or your ambitions seem bigger than what you can accommodate with a finite plan? Do you wonder how you could possibly know what’s best 30 years from now when you’re not sure who your children will become?

Today, we want to help you wrestle the giant octopus of long-range planning. Bruce and I are talking with my estate planning attorney, Stephen Haynes, about solving special considerations with your estate plan.

And this will be a special treat! We’re not just going to talk theory about estate planning. We’re inviting you in and showing a sneak peek into how we created an estate plan for our family.

So if you want to recognize the pros and cons of various estate transfer strategies, achieve the best balance of asset protection, creditor protection, control, and ownership, and find out how to design your estate plan to solve your needs best so you can strengthen your family with how you pass on wealth, instead of causing future challenges, tune in now!

Podcast: Play in new window | Download (Duration: 57:29 — 65.8MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

In This Conversation about Custom-Designed Estate Planning with Stephen Haynes

- Deciding how to transfer trust assets to children in a way that provides for their needs and helps them become empowered and not entitled.

- Solving the tension of gifting assets outright vs. in trust, and why you may consider one over the other.

- How to achieve the balance of asset protection and creditor protection with control and ownership, and reduce the risk of estate taxes.

- The role of the trustee, the goal of the trust to be a relationship, how to select a trustee, and how to set up your children to have a good relationship with the trustee.

- Hear how we’re solving the potential problem of children seeing that a trustee is trying to keep them from their money.

- Finding the middle ground between leaving direct guidance to the trustee with rigid wishes vs. leaving discretion to the trustee.

- How to direct your money to be used the way you want, while also providing for the freedom and flourishing of each individual in generations beyond you.

- How you can use life insurance to create perpetual, generational wealth.

Where Estate Planning Fits into Your Cashflow Creation System

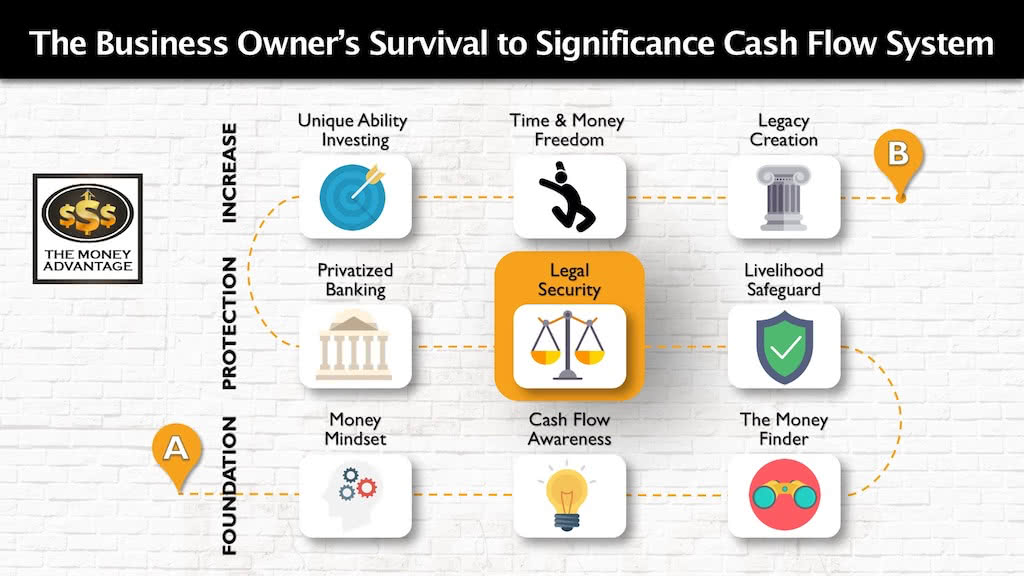

Encircling your family and assets with a bulletproof estate plan will maximize your peace of mind. But it’s just one small step of a greater journey.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, privatized banking and legal protection. This is where estate planning fits in. You’ll know that no matter what happens to you, your wishes will be carried out, your assets will remain intact, and your wisdom will empower generations after you.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

Take Action to Begin Your Family Legacy Today

Take the next steps today.

As Bruce says, “Make small steps, but quality steps.”

You don’t have to leap the whole chasm all at once.

Today’s small step may look like taking a minute to write down what’s important to you. This may become the start of your personal values or vision statement.

Or, if you are ready for a conversation about your estate planning or life insurance, your next step could be scheduling a conversation.

Find Out More About Stephen Haynes

Discover more about Stephen Haynes, Davis Law Group, or contact him directly at Stephen@dlgva.com.

Find Out Your Next Step to Time and Money Freedom

Do you want to use Privatized Banking, alternative investments, or cash flow strategies to coordinate your finances so that everything works together to improve your life today, accelerate time and money freedom, and leave the greatest legacy? We would love to help you.

Book an Introductory Call with our team today https://themoneyadvantage.com/calendar/.

By the way, to find out more about how Privatized Banking gives you the most safety, liquidity, and growth … plus gives you the ability to have your money do 2 things at the same time, boosting your investment returns. Additionally, it’s also the most effective wealth transfer tool because it buys net worth and guarantees a legacy to provide for your loved ones. This allows them to fulfill everything you’d dreamed of doing with them, and give them the financial foundation to flourish, no matter when you “graduate.”

Go to https://privatizedbankingsecrets.com/freeguide to learn more.

Thanks for Tuning In!

Thanks so much for being with us this week. Have some feedback you’d like to share? Please leave a note in the comments section below!

Don’t forget to subscribe to the show to get automatic episode updates for The Money Advantage podcast!

And, finally, please take a minute to leave us an honest review and rating on Apple Podcasts. They really help us out when it comes to the ranking of the show, and I make it a point to read every single one of the reviews we get.

The Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read MoreEstate Planning 101: Protecting Your Loved Ones

Can you confidently say your family’s financial future is protected? Staring down the barrel of a life-altering moment, I was forced to confront the fragility of existence and the critical importance of having one’s affairs in order. That harrowing experience became a catalyst for today’s soul-searching episode of the Money Advantage podcast, where we navigate…

Read More