Estate Plans that Transcend Generations with Andrew Howell

Do you want to leave a legacy with an estate plan that transfers wealth and empowers the next generation? Find someone who is helping others do it successfully. And that means tailoring a customized, bespoke plan specifically to your family.

Today, we’re talking with highly recognized estate planning attorney, Andrew Howell, about the principles and wisdom he’s distilled from working with ultra-high net worth families and business owners.

If you want to know how to entrust wealth to future generations, provide for unity within the family, and leave a legacy of wisdom and opportunity, so you can create an estate plan that transcends generations, tune in now!

Podcast: Play in new window | Download (Duration: 57:40 — 66.0MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | Youtube Music | RSS | More

Table of Contents

In This Episode About Estate Planning to Bridge Generations, You’ll Discover:

- Why traditional estate planning fails at increasing family wealth and promoting character development.

- How the core of the Entrusted model of estate planning is about meaningful relationships.

- How to transfer wealth in a way that incentivizes work and stewardship instead of producing entitlement.

- The top 3 eroding effects on generational wealth.

- Why traditional estate planning that divides assets limits your family’s ability to make an impact.

- Why leaving your money to charity creates a lost opportunity for your family.

- How to set up your family wealth as a bank to create opportunity, entrepreneurship, and accountability.

- Why the first priority in leaving a legacy is to know who you are as individuals and a family.

Where Estate Planning Fits into Your Cashflow Creation System

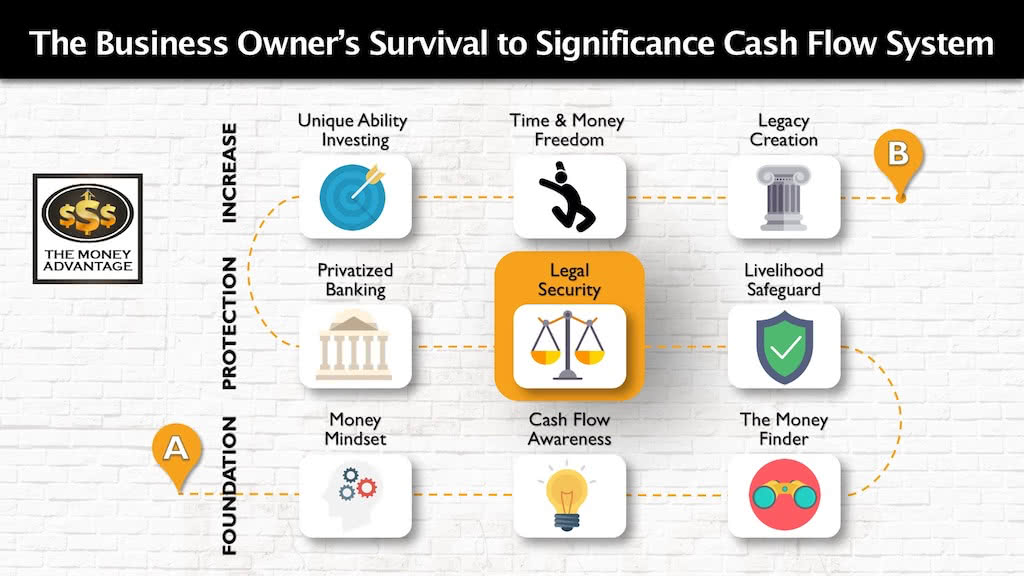

Encircling your family and assets with a bulletproof estate plan will maximize your peace of mind. But it’s just one small step of a greater journey.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access them as an emergency/opportunity fund. This step frees up and increases your cash flow, allowing you to save more and consequently invest more.

Then, you’ll protect your money with savings, privatized banking, and legal protection. This is where estate planning fits in. You’ll know that no matter what happens to you, your wishes will be carried out, your assets will remain intact, and your wisdom will empower generations after you.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

Family Vision, Mission, and Values

A successful estate plan isn’t just about legal frameworks – it’s also about meaning. According to Andrew Howell, families that thrive across generations often share more than just money. They also share a common vision, values, and a mission that unites them.

While this might sound like typical corporate jargon, it’s actually a practical way to keep your family unified when managing and distributing wealth. When your estate plan reflects your family’s shared beliefs and long-term goals, it becomes so much more than simple paperwork: you might describe it as a blueprint for continuity and stewardship.

Whether it’s entrepreneurship, education, or service, documenting your family’s purpose can help future generations make informed decisions about their own lives. In essence, that’s what makes a plan enduring, not just wealth transfer, but clarity of identity.

How to Transcend Generations

If your goal is to build something that outlives you, then your estate plan needs to do more than just pass down assets. It must create a system for longevity. That’s how you transcend generations, by equipping your heirs with not only resources but also the tools to manage, protect, and expand them.

Andrew Howell’s approach encourages families to think of their wealth like a business or bank, one that future members contribute to, borrow from, and are accountable within. This framework encourages responsibility and purpose, rather than mere entitlement.

More than legal documents, this kind of planning builds culture. And when your strategy includes financial literacy, leadership development, and stewardship training, it does more than transfer money; it rewires how your family relates to wealth.

Role of Professionals in Building Legacy Plans

Creating an estate plan that lasts beyond your lifetime isn’t a solo effort. It’s a team sport, of sorts. While your attorney plays a key role in drafting and structuring the plan, there’s often more at stake, especially when your family’s business, charitable giving, or tax strategy is involved.

Andrew Howell emphasizes the importance of a coordinated team, comprising an attorney, CPA, and financial advisor.

Each brings a different piece to the puzzle. Your attorney ensures legal strength and clarity. Your CPA helps maintain tax efficiency across generations. And your financial advisor helps align your family’s investments with long-term goals.

When these professionals collaborate, your plan isn’t just legally compliant, it’s strategic, flexible, and built for the future. Andrew’s most successful clients are those who view estate planning as an integrated process, rather than a one-time event. Together, your team can help ensure your family legacy isn’t just preserved but thoughtfully carried forward.

About Andrew Howell

Andrew L. Howell is a Co-Founder of the Salt Lake City law firm York Howell & Guymon. His focus is on estate planning, asset protection planning, probate and estate administration, charitable giving, sophisticated business structuring and transactions, and tax planning.

Additionally, he is passionate about (and regularly assists clients with) family legacy planning, stock and asset sales and purchases, buy-sell and shareholder agreements, and business buy-out and business succession planning. Mr. Howell’s practice has a specific focus on ultra-high-net-worth families and business owners.

Mr. Howell is a leader at the forefront of responding to the industry-wide shift in estate planning resulting from client demand for a more holistic approach to wealth transfer. He assists his ultra-high-net-worth clientele in creating dynamic estate plans, focusing on what they can do to increase harmony and purpose in their planning.

Mr. Howell is the co-author of Entrusted: Building a Legacy That Lasts, which features seven core disciplines of successful wealth transfer of high-net-worth families going back hundreds of years, as well as Riveted: 44 Values That Change the World.

Andrew Howell is routinely recognized as a Mountain States Top Lawyer and was credited by Salt Lake Magazine as a Rising Star on the Mountain States Super Lawyers List in 2010, 2015, 2016, 2017, 2018, and 2019. Utah Business Magazine named him among Utah Legal Elite from 2011 through 2016. Mr. Howell is recommended as one of the Top 100 Lawyers in Utah by The National Advocates.

York Howell & Guymon was celebrated as one of Utah’s Fast 50: Emerging 8 companies in 2016 and is ranked #1,073 on Inc. 5000’s Fastest Growing Companies in America. During Mr. Howell’s five years as Managing Partner, the Firm has grown from three lawyers to sixteen and now employs thirty-five people.

Find Out More About Andrew Howell

Learn more about how you can improve your results by entrusting wealth to future generations.

Discover more about Andrew Howell and the Entrusted planning process, or contact them directly at teamandrew@yorkhowell.com.

Book A Strategy Call

Are you ready to take control of your finances and build a lasting legacy? We offer two powerful ways to help you create lasting impact:

- Legacy Strategy Call: If you want to uncover your family values, mission, and vision, and create a legacy that’s about more than just money, we can guide you through the process of financial stewardship and family leadership. Save time coordinating your family’s finances while building a lasting legacy for generations. Book a Legacy Strategy Call to learn more about how we can help.

- Financial Strategy Call: Discover how Privatized Banking, alternative investments, tax-mitigation, and cash flow strategies can accelerate your time and money freedom while improving your life today. Let us show you how to align your financial resources for maximum growth and efficiency. Book a Strategy Call with our team today.

Preserving Generational Wealth With Josh Kanter of Leaf Planner: The Missing Piece Isn’t Paperwork

The Questions No One Can Answer After Dad Dies A man spends his life building a sophisticated estate plan—brilliant strategies, impeccable legal work, a network of trusted advisors, and layers upon layers of entities. His son is a lawyer. He even gets 18 months to prepare before his father passes. And yet, within days of…

Will AI Replace Financial Advisors? Why Wisdom Still Wins in Real Life Money Decisions

The Moment “Confident” Sounds Like “Certain” A few weeks ago, we found ourselves talking about how quickly AI is moving. It’s not just that it can answer questions fast—it’s that it can sound certain while doing it. And when you’re staring at a big money decision—debt, investing, taxes, retirement—certainty feels like relief. It feels like…