How To Get A Financial Bunker To Weather Economic Storms

Does the current market volatility make you wish you had a financial bunker to protect you from losing money?

If you would love to gain control by having the certainty of guaranteed money today and in the future … need to make traction towards financial freedom, regardless of the global economy … want to have investible cash available to buy the right investments when they go on sale … or stuck with wanting to have a strong cash position, but frustrated that bank rates are low and CDs and bonds aren’t very liquid … you’re not alone!

These are the concerns we see from investors and wealth creators everywhere as we all grapple with the financial turmoil and uncertainty in the markets today.

That’s why we’re talking about the lost art of protecting and preserving your wealth. After all, who doesn’t want to protect their portfolio from risk and loss?

So if you want to anchor your financial position so you don’t slide backward during market crashes and corrections, but instead, maintain control, and have cash for emergencies and opportunities so you can create wealth, regardless of global economic turmoil, tune in now!

Podcast: Play in new window | Download (Duration: 50:19 — 57.6MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Where a Financial Bunker Fits In The Bigger Picture of Creating Wealth

Protecting and preserving your money is super important right now. It’s also important in any market environment, because it’s a critical step in creating wealth.

But unfortunately, it’s the un-sexy, boring step that many people skip over in their excitement to invest.

But investing alone isn’t a sustainable financial system for long-term wealth building.

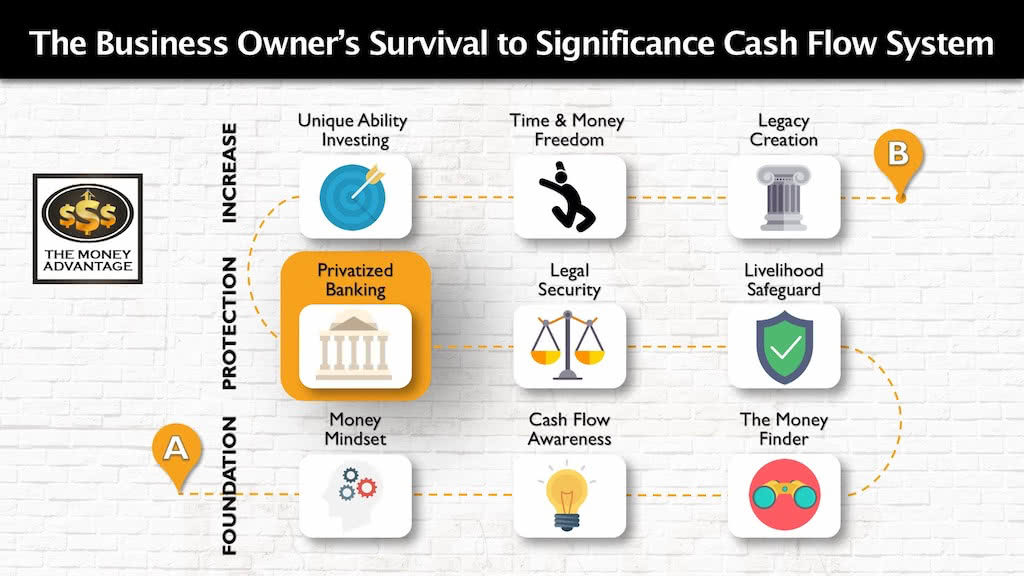

That’s why we’ve developed the 3-step Cash Flow System. It’s your roadmap to go from just surviving, to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable.

Then, you protect your money with insurance and legal protection and Privatized Banking.

Finally, you put your money to work, increasing your income with cash-flowing assets.

That being said, your financial bunker is the middle level of Protection. It’s not just an isolated, compartment of your financial life. Instead, having a financial bunker improves every other area of your financial life.

In This Episode, You’ll Discover:

- What you need to know about the economic state of the union, so you can make decisions.

- How to turn your generalized anxiety and worries about the looming economic crisis into peace and confidence.

- The pivot you need to make to step from a helpless observer in the back seat to the driver in control of your financial life.

- Why most people lack financial control, and how to gain a sense of agency, that you can desire, make plans, carry out actions, and get results.

- The conundrum you put yourself in when you become the recipient of a gift.

- Why it’s so much harder to make decisions for yourself instead of doing what everyone else is doing.

- Why you should never accept losing money as the price you have to pay, just because everyone else is losing money too.

- The reason I don’t pay attention to the stock market, and why you can give yourself the permission to make this outrageous, bold move too.

- Why not losing money right now is more important than making a lot of money.

- The #1 thing you can do to secure a financial bunker to protect yourself from financial storms right now, without shutting down your own personal economy, SO YOU CAN continue to grow your wealth at the same time.

- The #1 financial tool to get guarantees, safety, access to your money for emergencies and to buy assets when they go on sale.

- Why asking better questions is more helpful to getting you unstuck than finding the right answers.

The Most Unlikely Solution

The financial bunker that gives you peace of mind with safety, security, and ironclad guarantees is the most unlikely solution.

This ancient, traditional, no-frills, long-term wealth builder is a war chest that’s the best place to store your reserves. That way, you can cover emergencies, weather a crisis, and serve as investment capital for opportunities.

It has a track record stretching back at least 170+ years, surviving the Civil War, Great Depression, and Great Recession. And it’s is used by the wealthy, banks, and corporations as a safe harbor during economic turmoil.

In fact, banks increased their holding of this asset to $161.8 Billion, a growth of 146%, between 2004 and 2016, during one of the largest financial crises. Why? This move bolstered their Tier 1 Capital Reserves, a bank’s highest quality capital, and the measure of its financial strength.

What Is The Best Financial Bunker?

It’s a specially designed, high cash value, dividend-paying whole life insurance contract with a mutual company.

You may think that life insurance is just an insurance product with a death benefit, and it has nothing to do with storing cash or building wealth.

But nothing could be further from the truth!

Whole life insurance is the ideal financial bunker because it allows you to have a place to store cash, with safety, liquidity and uninterrupted compound growth. Your money is protected because cash value doesn’t lose value, AND because.

Now, instead of pulling your money out of commission and having half of your army asleep, you’re able to keep your money growing, while you also use it in other investments!

By the way, if you’d like to learn more about how you can use this specialized life insurance as an “AND Asset” to put the same money to work in two places at the same time, check out the Quick and Easy Guide to Privatized Banking here: https://privatizedbankingsecrets.com.

Get Your Financial Bunker Today

Do you want to get your financial bunker in place today to weather this current financial crisis and any turbulent waters ahead?

If so, we can help. Check our calendar and book your strategy call today.

Becoming Your Own Banker, Part 29: Words Matter

Ever felt like financial jargon was designed to confuse rather than clarify? Join us as we navigate the labyrinth of financial terminology, particularly within the infinite banking sphere. It’s not just about learning by rote; it’s about cementing a rock-solid financial strategy based on clear, precise language. By dissecting common misconceptions, we aim to transform…

Read MoreBecoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read More