Turnkey Real Estate Investing in Memphis, TN, with Mid South Homebuyers

Get to know the team at Mid South Homebuyers. This conversation will help you determine how and when turnkey rental real estate could help you invest for cash flow.

Who Are Terry Kerr and Liz Nowlin Brody?

Terry Kerr

Terry Kerr was born in 1970 in Memphis Tennessee. Except for some nomadic travel in his early twenties, has lived in Memphis his whole adult life. Terry enjoys water sports, hiking, and the Memphis Grizzlies with his family. He shares his life with his wonderful wife Elaine and two amazing kids, Amelia 17 and Andrew 13.

Podcast: Play in new window | Download (Duration: 58:12 — 53.3MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Founder and CEO of Mid South Homebuyers, Terry fell in love with making ugly houses pretty in 2001 and set out to master the business of passing bargains on to bargain hunters. Over the last 15 years, Mid South Homebuyers has purchased, renovated, and sold 1,500+ single-family houses in Memphis to real estate investors across the US and the globe.

As a turn-key seller, Mid South Homebuyers provides completely renovated investment property, with a built-in property management and maintenance team, to real estate investors who receive passive income while building wealth through real estate.

Terry is fortunate to call Memphis Tennessee home, where the price-to-rent-ratios for investment property are the best in the country. He is extremely grateful to his incredible team for positioning Mid South Homebuyers as the premier turn-key seller in Memphis and the US. Mid South Homebuyers has renovated over 1.7 million sq. ft. of real estate in Memphis TN.

Terry attributes the success of Mid South Homebuyers directly to the caring and passionate commitment of his incredible team of professionals who never stop trying to increase value and service for their investor partners.

Liz Nowlin Brody

Elizabeth Nowlin Brody is an avid real estate investor who has spent the last 16 years of her professional life working in multiple markets as a multi-unit property manager, a marketing director, a Realtor, a writer, and a public speaker. For the last 8, she’s been working side by side with Terry Kerr building Mid South Homebuyers into one of the most successful turnkey providers in the U.S.

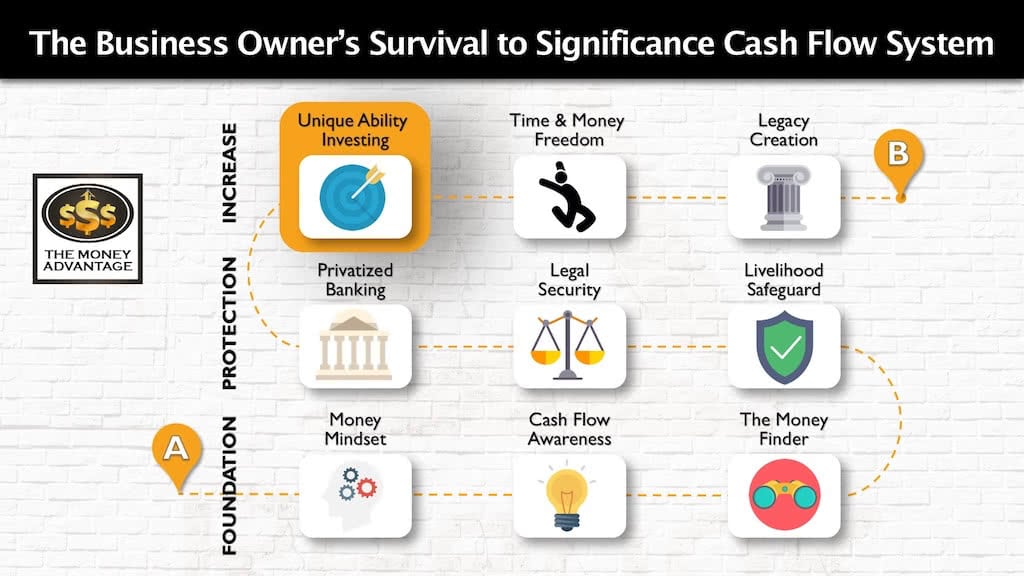

Where Investing Fits into the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Conversation Highlights (Partial Transcript)

Investments that Build Wealth Through Cash Flow

[07:48] It’s single-family, blue-collar real estate. These are solid houses in solid neighborhoods. Fortunately, about 52% of the Memphis population rent. This gives us a really large pool of folks to work with.

Here is the business model: We’ll buy a house, do a full-blown renovation on the house. It’s not a lipstick job. It’s not just paint and carpet. We rip off the roofs, gut the kitchens, gut the bathrooms, update the electrical, plumbing, new heating and air. The houses are in better shape typically when we finished rehabbing than it was when it was first built, just because of higher-end finishes.

And we provide the best value for the resident that exists in the Memphis market. We have slightly below market rents, with the best rehab, and so we have the lowest turnover, and that’s the key. We have the lowest turnover of any management company in Memphis, so the longest resident average stay. Turnover is the biggest killer for folks who own investment property, so if you can keep people in the house and keep them from moving out, that’s the ticket.

There are a lot of things that go into making that possible. In big, broad strokes, if the resident is happy and the resident stays, the owners make money.

Why They Hand-Selected Their Market Segment

[09:52] We’re looking for houses that need lots of work.

If a house just needs paint and carpet, there’s going to be so many folks offering and making bids on that property that we’re just going to be priced out. We’re going to get beat by a local that is going to buy it, paint it, put carpet in it, and manage it themselves.

We want the houses that other folks are like, holy cow, this roof’s been leaking for 10 years, and the investor who’s 90 years old, has owned this house forever, just decided to stop fixing stuff. That’s our market.

Since Memphis has 52% of the market renting, you can imagine all of the owner-operator landlords in this town that get to a point in their lives where they’re like, okay, you know, I’ve been managing these 20 or 30 houses forever. I’m 75 years old, I don’t owe any money on any of these houses, I’m cash flowing like a bandit, but I’m tired of working, so they just sell their rental portfolios.

You’ll see that houses that may have been owned by one investor for 20 years, and they’ll get to a point in their lives where they want to liquidate, it will go to somebody else. The cycle will never stop in Memphis, fortunately, because we do have a blue-collar town. There are a lot of folks here that rent, and this is a cycle that’s been going on for years and years. Other cities in the US have our type of demographic, but I’m just fortunate to be born and raised in a town where it’s conducive to cash flow.

The Definition of Turnkey

[12:17] A big part of the definition of turnkey is a continuing, ongoing relationship with the seller of the property after you have closed, particularly with your managers and your accountability being all in one place.

The horror stories that are out there are about people that bought a house, were told that it was an excellent condition and that the rent was $800. It’s handed off to a third-party management company. After three or four months of vacancy, they’re informed that the only way it will possibly rent is to drop the rent to $750 and then repair bills are nonstop rolling in. Then you’ve got a manager pointing at a seller, and a seller pointing at a manager, and you’re 2000 miles away, and not really sure what to do.

Turnkey is getting away from that, having all of your accountability in one place about how this property is going to perform, a proven track record with happy investors already working with that company. Ultimately, a very passive investment is the heart of it all, where you’re ultimately on the beach, not worrying about your properties at all.

Why Your Due Diligence as the Investor is Critical

[13:53] Whether it’s in Memphis or Detroit, if someone’s investing, you want to find somebody who’s got a proven track record … or there’s a lot of guesswork.

You can pull up rents on Zillow or call the management company that you’re going to be working with. Ask them questions like, what is your longest vacancy? Why is that vacant? What’s the most ideal property? What’s the stuff that you want to stay away from? Really dig in. And go to visit …

As much as we want to work with anyone that’s a good fit for us, we encourage folks, if they can, to make the time to go out and shake the hands of the folks that they’re going to be doing business with and really dig in and ask the hard questions.

Our due diligence questions are available for anyone to download and use to interview any turnkey seller.

What Sets Mid South Homebuyers Apart?

[15:26] At the heart of it, it’s about providing value. You’ve got to provide a good value to the resident, which means the rent’s got to be placed right. The property’s got to be in an excellent condition, so the repair bills don’t kill the owner.

In the beginning, there are so many kinks to be ironed out that you work for free for the first three years of the business, easily. You’re figuring out what neighborhoods work, what neighborhoods dont work.

Our goal is ultimately to provide the highest cash flow possible, and the sweet spot that we settled on here in Memphis was between $59,000 and 95,000, give or take a little. But Terry got to that point by under-investing in a little bit too rough of markets because the numbers looked great on paper. He ended up sleeping in houses, and if you have to sleep in the house to prevent people from breaking in, you’re in the wrong neighborhood …

You’ve got to cut your teeth and figure it out. The median home price in Memphis is $130,000, and folks out of state are shocked by the affordability here and how quickly you can be in owner occupant territory.

At the end of the day, there are hidden reasons that some properties don’t make as much money.

Mid South Homebuyers Paid Strong Cash Flow Through the Crash of 2008

[17:59] I love talking about the crash of 2008. Looking at it, obviously none of us know exactly where we are in the cycle right now, but it’s clear that it’s is warming up and definitely getting hotter.

I bought a primary residence here two years ago. The cool thing about buy and hold is that I don’t have to worry about where we’re at in the cycle, because I know the cycle will ultimately even out for me to be profitable. Thinking about home buying in general, in a residence, you can get stuck.

I look back in 2007 or so, Mid South Homebuyers was selling a totally renovated house that rented for $675 for roughly $55,000. We saw that rents and occupancy did not suffer in the crash, luckily. We’re really grateful for that.

The Focus on Cash Flow

[18:50] I did the math, and if I bought from Mid South Homebuyers in 2007, it was roughly $45,000 in gross cash flow that I would have made. Of course, that mortgage is fixed.

Would I have been upset that I was $10,000 upside down the next year? It’s a bummer, but we didn’t sell to anyone in 2007 that was intending to sell in 2008 or 2009. It’s a 10- to 20-year investment.

What I love about it is that it weathers the market. We were glad to see what happened here in Memphis was that so many former homeowners flooded into the rental market. The homeless population didn’t spike anywhere with the crash. You just had a huge shift, and it really propped up rental demand.

We never had a single foreclosure. None of our investors have ever had a foreclosure, and rents and occupancy stayed strong.

The property values took a dip, but the cash flow didn’t take a dip. It remained the same. And now the properties are worth more than ever.

Memphis is definitely a buy and hold market. Folks don’t come to Memphis because of the awesome appreciation. Yeah, we appreciate a little bit. But Memphis is cash flow town. And thank goodness for it.

It meant a lot to me that if you gave me a time travel ticket, and right now I could write a check from the $14,000 down payment that $55,000 house in 2008 would have been and swap it for all that cash flow. The fact that I would hop on that in a minute to buy a house in the worst time in American history to buy a house – that gives me personally as an investor a sense of comfort.

Current Inventory

[21:49] Right now, we’re rehabbing 83 houses. From the day we put a house under contract to purchase, it takes about 30 days to buy it. Then it takes us a couple of months to rehab it. Then we get the appraisal done. We typically sell them around the 90- or 100-, maybe 110-day mark. We’ll own a property for maybe five months at the longest.

I’m going to buy, rehab and sell about 450 houses this year.

I currently have 107 houses under contract with investors.

Mid South Homebuyers Process

[23:00] We purchase the property, we rehab the property, and then we sell the house in a completely renovated state. And then we also provide a one-year bumper-to-bumper warranty on the whole house. And then, of course, our property management company manages the house for our investors that have purchased the property. We just send them the rent.

[25:17] We’re proud to be able to offer a real estate investment that pretty much cash flows from the day you buy it because it’s already fixed up.

How Mid South Homebuyers Maintains High Occupancy and Low Vacancy Rates

[25:52] We’re staffed up in the repair, leasing, and resident retention departments.

We always ask an incoming applicant, “Why are you leaving your current management company?” Nine times out of 10 they say; my landlord won’t fix anything.

With our business model, there’s not a lot to fix, because we’ve already completely rehabbed the house. However, if an air conditioner does break, or a water heater does go out, or there is a roof leak, we’re staffed up. It’s easy for us to get someone out there quick because all of the technicians that maintain the repairs on the rental property we’re managing are the same technicians that are doing the installations on all the houses we’re rehabbing. Since we employ these folks as W-2 employees, we don’t have to call a plumbing company or a handyman. We just schedule it within our servicing department and put the repairs at the front of the list. And if the if the rehab has to take six hours longer because we’re fixing a water heater across town, then so be it.

Earlier I mentioned value to the resident. We provide the nicest house, excellent communication, quick turnaround if there were a repair, and under-market rents. That’s why we have the longest resident stay in Memphis.

When we ran a report about six months ago, and I know where we’ve had an uptick since then, our average resident stay was three years and four months. In Memphis, the average resident stay is right at two years, so we’re way out front. We may not make as much money per property as another management company, but no one’s leaving.

We don’t have the retention issue with investors leaving us, and we don’t have retention issue with residents leaving us.

Lifetime Vacancy Guarantee

[28:14] When there is the eventual turnover, we will average between 28.67 and 29.2 days from move out to move in.

A resident does not move in the day they call, the day they apply, the day they tour, or the day they put their deposit down. So many things have happened so fast: maintenance, the lawn mowed, signs dropped, and so many little things.

We have this lifetime vacancy guarantee that’s kind of unusual. Internally, we all think, how would you really have a 90-day vacancy? I speak to so many investors that have had 100+ day vacancies. If you’re already a week late on the maintenance, a week late like dropping the signs, your stack is full of return calls from potential renters, it’s so easy for each little process to slow down.

Optimized for Efficiency

[29:44] We systematized everything that we do to work on efficiency.

The day a resident moves out, that’s updated by our leasing team, and a pin drops on our rover map. Our rovers are the guys that are out there dropping or pulling for-rent signs, taking photos of the property, delivering late notices, etc.

Everyone’s managed through this internal proprietary system that we’ve built. All of our team members are working in their specific piece of the business and updating what they’re doing throughout the day. Depending on what one person does, it puts the ball in somebody else’s court.

When our team members come into work, they don’t have to wonder or remember what they need to do. They just use their energy on actually performing the task. That’s all the way across the board from leasing, collections, rehabbing the houses, the different pieces of the rehab: the electrical, mechanical, plumbing, everything we know how long it should take.

If a piece doesn’t get performed in the amount of time it should take, it sends an email to the person who’s responsible for that task. And if it’s still not updated within another 24 hours, it will send them another email and copy their manager. The managers don’t get copied because our team knows what they’re supposed to do. And the system makes it easy. It makes the working environment less stressful.

Property Management Fees

[32:52] We don’t think it’s fair for us to get paid if the owner’s not getting paid. That being said, we’re not going to charge a set fee and get paid regardless of what kind of rent comes to the front door. If the owner eats, we’re going to eat. If they don’t eat, we’re not going to either.

Property management companies tend to be feeding from the opposite side of the trough as the investor. That can pose a problem, and this is one of the reasons why it’s cool to have all the accountability in one place.

If you’re a turnkey seller that’s been doing it right, you have a selfish reason to make the property perform. You want the owner to come back and buy more property. As a property management company, it’s all about providing value.

[34:14] We have the lowest fees in town. We don’t charge a whole month’s rent to rerent the property. There’s a 10% fee on the actual rent, and then we charge half of the first month’s rent anytime we fill the property.

I’m not sure about other markets, but in Memphis, the average property management company charges a whole month’s rent to refill the properties. We only charge a half a month’s rent to refill the properties. A lot of property management companies charge a vacant fee or marketing fee on top of the whole month’s rent, and we absorb that.

Investor Returns

[48:00] It depends on whether someone pays cash or if they finance. If you’re leveraging with financing, you’re going to get a better return than if you pay cash. Obviously, you’re going to get a lot more cash flow if you pay cash, but your cash on cash returns are going to be less. Everyone calculates ROI differently. Do you do use appreciation, do you use principal pay down, so I just stopped talking about ROI, because really it’s all about cash flow.

Everyone calculates ROI differently. Do you do use appreciation? Do you use principal pay down? I just stopped talking about ROI, because really it’s all about cash flow.

On our website, there’s a “customize my cash flows” section, where you can click on your purchasing option. Either all-cash purchase, financing, the down payment, interest rate, and you can include or exclude property management, you can include or exclude insurance. We allow folks to customize the way they think about ROI and get their own number.

We run ROIs that we show on the website based off what I would call a normal month. A normal month is rent paid in full, minus management, minus your mortgage payment. That’s what 36 months out of 38 months look like for me, as a Mid South Homebuyers customer. Once you add property management, our financed ROIs are 26 to 29%. The only thing that’s excluding is maintenance and vacancy, which is crazy affordable and low with us.

For a cash purchase, it’s in the 12 to 14% range the way we look at it, which is down payment versus cash flow after taxes, insurance, and debt service. I’ve seen people push it way higher with appreciation and tax benefits.

The Greatest Lessons They’ve Learned

[52:15] There is such a thing as too much opportunity. Get focused on what you want and then do it. Then analyze the deal and look at look at what went right and look at what went wrong. Then do it again.

I think the best businesses are built, whether that business is us as a flip company or an individual investor who is buying a house for cash flow, when you find something that you can repeat as an assembly line and do it over and over and over again.

It’s focus. Whether you want to buy, fix and hold yourself, or if you want to buy from a turnkey seller, or if you want to flip retail, whatever it is you want to do, don’t go into something unless it’s duplicatable.

You want every partner of a deal to want to do that deal again. What changed my world was that he (Terry) needed the lender that loaned our investor the money to be happy, the guys swinging hammers on that investor’s house, and the renter and the employee that rented it. He wanted each single part of that deal to want to do it again, and he worked to ensure that along the way. He’s done that successfully, and it’s created so much momentum.

Other Topics Discussed

- Attracting top talent and creating a great team culture, leading to low employee turnover.

- Investors like working with Mid South Homebuyers so much that they often become repeat buyers.

- Why Mid South Homebuyers commitment to not charge application fees increases applicant volume and fills properties faster.

- Investor resources include the

- Due Diligence Report

- Insider knowledge on the best investment lenders nationwide to get the best closing costs and interest rates

- Great relationships with a closing attorney and landlord-specific insurance company

- A designated point of contact who checks in every week with investors under contract with a status update

- Mid South Homebuyers is working backward to get you the highest cash flow and most passive investment possible.

- Mid South Homebuyers guarantees include

- 1-year warranty

- 90-day rent guarantee

Invest with Mid South Homebuyers

[51:00] Email Liz@midsouthhomebuyers.com. My team is the go-to for everything.

Visit midsouthhomebuyers.com, which is completely up to date with our inventory. You can see our actual numbers, pricing, rent, the renovations…

You can click through all those houses on the website. You’ll start seeing how the kitchens are all the same, the azalea bushes, the shingles. You’ll really get a sense for who we are.

You can download our management agreement from the website. You can download our lease. We really pride ourselves on transparency. Our philosophy’s up there.

My team can get folks that are interested started really easily.

Create Your Time and Money Freedom

Do you want to begin building capital, putting it to work, and accelerating Time and Money Freedom? To find out the one thing you should be doing to increase your cash flow, contact us today.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreLifetime Annuity Income

By popular demand, we will be continuing our conversations from last week on annuity strategies! This time, we are joined by special guest Joseph DeFazio! Joe is a seasoned financial educator and will bring a fresh perspective on lifetime annuity income and how annuities can benefit your financial life! If you’re interested in guaranteed lifetime…

Read More

I wanted to know what you can pay for a house I have at 3259 Brakebill Cove. It has 1656 sq. ft., 3BR/2BA with W/D hookups. It also has a 2 door garage.

I would reach out to Memphis Invest, the turnkey provider mentioned in the blog post You can email Liz@midsouthhomebuyers.com, or go to midsouthhomebuyers.com to get their contact information.