Mobile Home Park Investing – Jefferson Lilly of Park Avenue Partners

When it comes to seeking out and mastering a profitable niche, Jefferson Lilly of Park Avenue Partners, a mobile home park investor, is a true leader. Looking for a stable way to provide value and earn returns, Jefferson began analyzing real estate deals in multifamily housing across the Midwest. What he found was perplexing, but he continued to pursue this path until he found out why. And he’s glad he did because it led him to his life’s work and his ideal investment niche!

Podcast: Play in new window | Download (Duration: 50:43 — 46.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Where most multifamily apartment buildings were returning 8%, a mobile home park in the same locality was paying 10%, showing that mobile home parks were more profitable. After he saw this phenomenon ringing true repeatedly in other areas across the country, he started researching to discover why they are such a better deal than apartment buildings, office, retail, or self-storage. His discovery led to investing personally and managing investor’s capital through partnerships over the last 11 years to acquire 25 mobile home parks in 13 states.

His mission is to create wealth for his investors and to expand the supply of affordable housing.

We’ll discuss this fascinating real estate niche that’s providing an opportunity for accredited investors to earn returns in the range of 8 – 15% cash on cash.

The Definition of Accredited Investor

If you may not know what accredited means, here’s a quick definition. This is an investor with at least $1 Million of net worth, not including the value of their home, or making at least $200K if single, or $300K if married.

We know that a majority of our listeners and audience fall into this category and are actively looking for ways to put their cash to work earning a return in the most productive way. If you aren’t there yet, this will be an excellent opportunity to expand your knowledge in preparation.

Where Investing Fits into the Cash Flow System

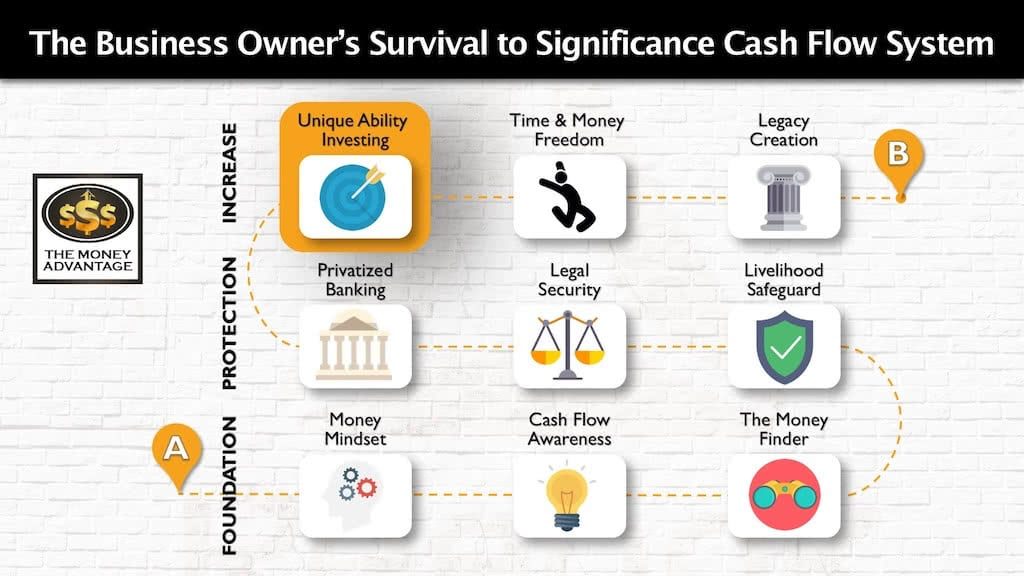

We are a community of wealth creators. We know that it is not enough to make a great income. Instead, you have to figure out how to keep more of the money you make, protect your money, and make more through the right investing decisions.

Investing is part of stage 3 in the Cash Flow System. As you build a cash-flowing asset portfolio of real estate and business, you accelerate your path to time and money freedom.

Who Is Jefferson Lilly?

Jefferson Lilly is the founder and managing partner of Park Avenue Partners. Jefferson is a mobile home park investment expert and educator. He is responsible for Park Avenue Partners’ strategic direction, acquisitions, and property operations. Before founding Park Avenue Partners, he co-founded Park Street Partners, a similar partnership also focused on acquiring mobile home parks nationwide. PSP’s investments are returning 8% – 15% cash annually to Limited Partners; appreciation is expected to increase returns further.

Both personally and through his partnerships, Jefferson has acquired 25 MHPs in 13 states since 2007 totaling over $56mm in value. He started the industry’s first podcast (Mobile Home Park Investors) and the largest group on LinkedIn dedicated to investing in mobile home parks.

Before beginning to manage investors’ money in 2014, Jefferson spent seven years investing his own capital in mobile home parks and consulting to high-net-worth families with interests in the manufactured housing industry. Earlier in his career, he held a range of consulting and sales positions with Bain & Company, Viacom, and Verisign. Jefferson has been featured in The New York Times, Bloomberg Magazine, and on the Real Money television show. He holds a B.A. from the University of Pennsylvania and an MBA from the Wharton School of Business.

Jefferson’s favorite mobile home is the 1954 Spartan Imperial Mansion, upon which their logo is partially based. He finds the Bowlus Road Chief to be pretty appealing too.

Jefferson Lilly Conversation Highlights (Partial Transcript)

What Are the Benefits of Mobile Home Park Investing?

Small Niche and Reasonable Prices

Jefferson Lilly: [6:02] First off, just by virtue of there being so few of them. Nobody knows exactly, but let’s just say that for 100 multifamily apartment buildings out there, maybe 1% of multifamily is mobile home parks. So, it’s just not well known.

When it’s not well known, the “smart money” isn’t chasing it. So, prices tend to be more reasonable than for other sexier asset classes, like developing a shiny new office tower in downtown Miami.

Shrinking Supply Curve

Jefferson Lilly: [7:12] Secondly, it is now effectively illegal to build any more mobile home parks.

Nobody knows, but our industry’s best guesses that last year, something like 10 mobile home parks were developed nation-wide.

We’ve got a major affordable housing crisis going on, and only like maybe 10 parks were built in the last year. And probably hundreds were plowed under and developed into some higher and better use.

The supply curve is not just fixed, the supply chain curve is shrinking inwards.

There’s no other niche in real estate that I know of where your competition is slowly but surely going away. But that’s one of the other added benefits of mobile home parks.

The Unseen Demographic of Mobile Home Parks

Jefferson Lilly: [8:40] 99% of mobile home parks are decent, hardworking people without any significant criminal element. I’m not saying a crime-free zone, but they don’t really have an unusually higher rate of crime. But they’re viewed that way.

Also, there are a lot of families in mobile home parks. Single folks, younger men and women tend to live in apartments, but when they form a family, and they start to have kids, and they want to move out of an apartment building and have their own four walls and be able to park right in front of their house and have a path towards homeownership.

A lot of that demographic moves into mobile home parks. But the land in a mobile home park is largely not improved. There are roads and pipes, but this is not an apartment building. There aren’t significant improvements to tax.

You have a city or county government that has a lot of kids going into the school’s district, but they’re not getting a lot of tax revenue off that property. That’s another reason that the cities have effectively outlawed mobile home parks. They’ll tinker with the zoning, or they’ll play around with the density, they’ll make it not economical to develop a mobile home park.

Maintenance Costs Are Low

Jefferson Lilly: [11:17] Most of our tenants own their own houses. That means that the proverbial leaky toilet and leaky roof repair is all the responsibility of the tenants. It’s not on us as the landlord – the tenants have to do all the repair and maintenance for their home.

Frankly, when folks are homeowners, they take much better care of their homes.

It’s not that we’re shifting any unusual repair budget on them. Homeowners take better care of their house so their repair and maintenance will be lower; and therefore, ours is lower. That’s another positive.

Because they own their homes, they actually tend to not take them with them. They’re too expensive to move.

If they need to leave town, they’ll almost certainly just sell the home off of Craigslist to someone else. And then someone else moves in and begins paying rent.

So as long as that home is economically viable, somebody is going to be paying rent on it.

In our world, the tenant really is the mobile home, it’s the structure, not so much the person in it. Our turnover might be on the rate of maybe 5% a year as some of these homes eventually end of life or move. But compared to apartment turnover, which is generally in the 40% to 50% a year, we’ve got an order of magnitude less turnover.

That means more stable cash flows and lesser turnover cost.

Park Avenue Partners Ownership Model: A Community of Owners

Jefferson Lilly: [14:03] We own around 10% of our housing, that is, 10% of the mobile homes. Our properties have about 2200 pads in nearly two dozen mobile home parks nationwide. Of those homes, we own about 200.

Often, those will come with the park when we buy it. And of course, we want to own those homes, we don’t want them to get pulled out.

If there’s a renter, they can continue to rent.

But when they turn over and that whole home comes back to us vacant at some point, likely over the first two years of owning the park, we’ll then only put it back out on a rent-to-own basis, often for as little as $1,000 down.

It depends on the age and the value of the house, but on average, folks might then pay $300 a month, for another five or six years, and then they’ll own that house.

We look to build communities of owners. We really want to help. Of course, we’re a for-profit entity, but we do also have a social mission. We want to help people become homeowners.

Once they own the house, some of them do move it out onto their own land. But most people are happy just paying us just a little lot rent for the land. They own that home. They fix it up the way they want, add on a porch, or paint it, and it’s really a win-win for everyone.

We want to be parking lot owners with these very permanent vehicles tied down into our parking spaces.

But if we can get down to maybe only owning 5% of the homes and be 95% parking lot. That’s still a pretty good return for us.

Geographic Location of the Mobile Home Parks

Jefferson Lilly: [17:34] We’re looking wherever the cash flow is, and that tends to be in the Midwest. So far, for the parks that I’ve bought, Wichita, Kansas is roughly our geographic and economic center of gravity.

But that said, we do own coast to coast. I own property up in Spokane, Washington. I’ve got one over in Raleigh Durham, North Carolina, and one down in Lakeland, Florida.

When we can get Midwestern pricing in a coastal state, of course, we’re happy to do that. But probably 85% of our capital has been invested in places like Wichita, Kansas; Dayton, Ohio; Midland, Michigan; and Superior, Wisconsin. These secondary and tertiary markets that are still economically healthy with a stable demand for affordable housing.

Proximity to a Walmart

Walmart, we think, does pretty good demographic research. And when they’re investing in a super Walmart, we believe, in particular, they’ve done their homework well.

If you can buy a mobile home park within five miles of a super Walmart, we’ve found that you’ll almost certainly do well. We don’t need to have a booming economy like out here in Silicon Valley, we just need something stable. Being within five miles of a super Walmart almost certainly means that the economy and the population are stable.

We don’t want to be in places like Toledo, Ohio; Flint, Michigan; or parts of Detroit, where people are really leaving town. When the economy’s bad and people are leaving, that’s too much of a headwind for us.

Being within five miles of a super Walmart will almost certainly mean that the top line of our business, the revenue line, and the rents will work out.

Managing Expenses with Public Utilities

Then, you’ve got to watch your expenses.

The single biggest problem you can have in this business is if you have your own private utilities, like a well, or the bigger risk is that you have your own septic system, sewage lagoon, or packaging plant.

If something goes wrong with your utilities there, if your well runs dry, or you need to completely redo your method for treating the sewage, that can easily be a six-figure expense.

For people considering getting into the business for the first time, we say only to buy something where it’s city water and city sewer. Then you can be fairly assured that at least your expenses will be reasonable. You are much more likely to make money if your revenues are stable, because you’re in a good economy, and you’re on all city utilities.

Park Avenue Partners’ Goals for the 2019 Fund

Jefferson Lilly: [22:26] With Park Avenue partners, I’m continuing to own and manage parks myself. My goal is to buy 5 – 10 parks with this fund, and own and operate those ourselves. For better or for worse, the property operations responsibility buck stops with me.

We’re looking to buy wherever the cash flows. That will likely be in the Midwest. We are indeed raising money from accredited investors, and it’ll be probably towards a 10-year fund, although there may be liquidity before then. My offering documents cover greater detail about that.

SEC Requirements

Jefferson Lilly: [23:36] Having to take money only from accredited investors is a requirement put on us by the SEC, it’s not something that we would otherwise do. But in exchange for being able to market my fund widely, the SEC basically says that you can’t be raising money from proverbial widows and orphans.

Accredited Investor Definition

Jefferson Lilly: [24:12] The requirement for being an accredited investor is that you either have a $1 million net worth exclusive of any equity in your house or make a certain income. An accredited investor makes a minimum of $200,000 per year, if single, or if married, at least $300,000 each year.

Those are the restrictions that the SEC places on funds like mine, that you can only raise money from accredited investors.

Liquidity of the Investment

Jefferson Lilly: [24:49] We’re not planning to sell the properties until the end of the partnership in 10 years.

This is an SEC requirement that none of our interests can be sold for the first year. But after one year, any of our investors are free to sell their interest in our partnership, either to anybody they might find that would want to buy it or to anybody already invested in our funds.

That’s why I say the liquidity isn’t necessarily 10 years. We anticipate selling the properties, hopefully for a profit, in 10 years. But along the way, if somebody did need their money out, then they can sell their interest, and we are generally happy to help make introductions and help facilitate that.

We are a not a REIT, those are publicly-traded real estate investment trusts. We are a real estate investment partnership. You can’t just hit the sell key of your Charles Schwab account on your computer, Merrill Lynch or other brokerage account, and get liquid in three days. But at the same time, it’s not completely illiquid either.

Expected Returns

My previous partnerships have returned between 8% and 15% per year in cash.

The 15% is obviously at the high end. These partnerships do tend to do better over time, the partnership that is returning only 8% a year still hasn’t fully matured. For instance, we’ll still have vacant pads, we are bringing in mobile homes and increasing our occupancy, and that’ll still be another couple of years’ worth of work.

We give no guarantees, but that’s been my track record so far. I think the new fund, Park Avenue Partners, will do almost as well. I tend to err towards the side of being conservative. Basically, what’s happening in the business is that more people are getting into it, and so prices are increasing. I think what that will mean is that returns will be somewhat lower, but I think between cash and depreciation over that 10-year time horizon, folks should still be compounding their money somewhere between 10% and 15% a year. We believe that will be better than the stock market and most other real estate niches.

Commitment to Charging No Fees

Jefferson Lilly: [29:48] This is definitely something that makes me different. I am charging no fees: no acquisition fee, no divestiture fee, no management fee, no personal guarantee fee.

Even though I put up my house, my two cars, and my own stock portfolio as collateral on some of the mortgages, I don’t charge a fee for personally guaranteeing some of the debt that makes money for my partners.

I charge no fees whatsoever. This is pure alignment with investor interest. If my investors don’t make money, I don’t. If my investors do, I do.

I certainly don’t have an encyclopedic knowledge of all the other funds out there. But I’ve never heard of a fund that is pure investor alignment and charges, no fees. But that’s what I’m doing.

Park Avenue Partners Investment Process

Capital Raise

Jefferson Lilly: [30:43] As far as finance, I’ll raise money from accredited investors, the minimum investment is 50,000. Of course, there’s no maximum, we’ve had some folks invest upwards of a million dollars with us. And we’re certainly hopeful to tap into perhaps even some larger pools of capital. But anywhere from 50,000 on up folks can invest.

Locating and Acquiring the Parks

Jefferson Lilly: [31:08] My role then, is to find the parks. I do run my own podcast called mobile home park investors that helps generate deal flow. That’s not our exclusive way of finding deals, but it is one thing we do and makes us pretty different. My role is to find the deals and then arrange the financing.

Usually, we borrow between 70% and 75% loan to value.

We’ve done it all. We’ve done seller carry, where we’re buying from the person, usually a mom and pop that’s selling us a mobile home park. We’ve used bank debt. We’ve gotten CMBS debt, and we’ve gotten agency debt like

Jefferson Lilly: [32:18] I’m not in Warren Buffett’s League, but I’m basically a long-term buy and hold investor. I view this as being value investing, we’re just buying cash flows in the real estate market, just maybe not quite 50 cents on the dollar. However, we do look for some discount to what the intrinsic value is, we think.

Active Investing and Property Improvements

Jefferson Lilly: [32:46] And then we do improve the properties. We’re not passive investors here, we’re active.

We will, for instance, buy brand new, or sometimes later model used homes and bring those in and set them on vacant pads in our communities. So, we expand the supply of affordable housing.

We’ll increase our occupancy.

We will also usually raise rents.

Then, we will also, for instance, figure out the water system. A lot of parks are master metered, so the park owner just pays one big $5,000 or $6,000 bill for all the month’s water for all his or her tenants. We will actually put meters on the houses. We’ll bill the tenants for water. They’ll conserve. Usually, about one-third of their water has been wasted. And then, that’ll help us identify and find leaks between that master meter and those mobile homes, which is on us to repair.

We plug a lot of leaks. We’ve cut water consumption, in some cases, by 50% in some of our properties.

It’s nice when what’s right for your pocketbook is also what’s right for the environment. Just getting a handle on the water system is another thing that we’ll do to improve the profitability of the park.

Due Diligence Process to Find the Best Properties

Jefferson Lilly: [34:50] We’ll look at the size of the town, the average house price, which we like to be $100,000 and up.

If the property passes all those tests and we get it under contract, we’ll then run a test ad, ideally for one of the homes that are already sitting vacant in the park. We’ll put an ad up on Craigslist and see how much interest we get.

We’ll then turn those leads over to the owner, so they can follow up and hopefully get somebody in that house even before we buy the property. Running those sorts of test ads also helps us identify definitively how strong the economy is, and that will have implications for how fast we can infill the park with some of those new homes.

We also do a phase one to bring in an environmental expert to make sure there’s no toxic waste on the property.

We’ll still go and talk with the local police department and make sure that the park isn’t unusually bad from a crime standpoint.

There’s a long page of diligence items that we look at with each property.

I go on site before buying a property and will also try to meet some of the tenants, as well as the tenants of some competing mobile home parks. I want to understand the dynamics of that park, why tenants like it and live there versus other parks.

It’s an overall diligence process that typically takes about 30 days to complete.

If something checks out all the way through, then we go through with the purchase and buy and operate the park.

Timing of Returns

Jefferson Lilly: [37:43] Today, I’m focused on fundraising, not on acquisitions. And that’ll probably be for the next quarter.

Hopefully, towards the end of the first quarter of 2019, I’ll be making some acquisitions.

Folks could expect some return, starting in another couple of months. No guarantees, but historically, I’ve always been able to generate returns for investors roughly within the first two to three quarters that the fund is open. The fund may still be open and raising money, but we will have already made at least a few acquisitions and be returning some amount of money, even while we’re still in fundraising mode.

Going into that first year after closing the window for investment, then we get the funds fully invested. Again, no guarantees, but I’m thinking my investors should earn cash returns anywhere between 6% and 12% cash. And then there will be appreciation on top of that, which may have to wait until towards the end of that 10-year hold period.

I think that investors would get, well into the double-digit returns, with a mid-teens type of IRR when you take into account not only the cash that we pay out in the near term, but also the longer-term recognition of profits. There may be some large checks coming back towards year 10 when we get the parks sold.

At the End of the Hold Period

We may sell those to individuals, we may sell them to some other investment partnership … there is a range of options. I might buy the parks, we do have a mechanism whereby, if I choose to do that, the investors with me get to pick the appraiser. If it’s a fair price, I might buy out all the investment at that price set by an outside appraiser. I think the odds of that are low, but it’s possible.

There are several ways to liquidity, so this is not really an illiquid niche.

Investment Options

[43:37] I get a profit split. The A shares are going to be a 50%/50% split with any investors that buy the A shares.

The B shares pay a 12% preferred return and then participate in 10% of the additional upside.

I only get paid if there are profits to split, per those two waterfalls. My investors always come first.

Connect with Jefferson Lilly and Park Avenue Partners

Visit Park Avenue Partners to see the most recent projections and offering materials. Investors can buy into the fund only after reading the private placement memorandum, which is also available on the website.

If you would like to learn more, call (415) 228-6900 or email jefferson@parkavenuepartners.com.

Several resources are available for you at MobileHomeParkInvestors.com, including the podcast, the investor’s group on LinkedIn, and an industry calendar of events.

The podcast is called Mobile Home Park Investors, which gets about 16,000 downloads per month, and is available on iTunes and Stitcher.

The mobile home park investors group on LinkedIn is the biggest of its kind, with about 4500 members.

An industry calendar of events is available for downloading to your calendar, with upcoming trade shows and some earnings calls from some of the publicly-traded mobile home park REITs.

Create Your Time and Money Freedom

Do you want to begin building capital, putting it to work, and accelerating Time and Money Freedom? To find out the one thing you should be doing to increase your cash flow by keeping more of the money you make, contact us today.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreNon-Food Franchising, with Jon Ostenson

Are you looking for good investment opportunities to put your capital to work? Have you considered franchising as an opportunity for business ownership without starting a company from scratch? Today, we’re talking with Jon Ostenson, a top 1% Franchise Consultant, former Inc. 500 Franchise President and Multi-Brand Franchisee, and author of “Non-Food Franchising.” So if…

Read More

Interested in Mh reit. Where to find it

Contact info is in the “Connect with Jefferson Lilly and Park Avenue Partners” section towards the end of the article.