Why You Shouldn’t Retire

Retirement seems top of mind in almost every financial endeavor in our culture. It’s this buzzword at the culmination of all your financial pursuits, as if it’s the thing we all must strive for, and the trophy of financial success. The endpoint. The goal. The place where we get when we have finally “arrived.” Financial success seems to mean being able to retire well.

There are retirement plans, retirement savings, retirement communities, and retirement parties.

Admittedly, it’s pretty alluring to imagine spending your time relaxing with your feet up, snowbirding, vacationing to tropical destinations, and playing golf.

Podcast: Play in new window | Download (Duration: 44:45 — 51.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

But what if you are a business owner who’s spent your entire life building a business? You’ve called upon your inner strength at defining moments, evolved as a human, elevated others through your service, and crafted your legacy. Your business is an extension of you and your best work.

How do you think about retirement if you’re a business owner? Is retirement good for you?

In today’s conversation, we unpack:

- The history of retirement

- Why retirement is a limiting end goal

- What to do instead of retiring

We’ll show you why you’re better off without retirement and why your whole life will be richer, more fulfilling, and far more enjoyable without retirement.

You’ll stop measuring, evaluating, comparing, and pacing your financial life against an outdated construct.

With a renewed perspective, you’ll stop feeling frustrated and behind, and able to live more fully.

Even if you’re not a business owner, this conversation will provide the perspective adjustment that can improve the quality of your life.

Table of contents

The Definition of Retirement

To have an honest conversation about retirement, we first have to define our terms. Then we can make sure we’re on the same page with what we mean by the word retirement.

The retirement that we’re discussing today is the idea that, before the age of 65, you’ll work during your prime working years. Then, at the age of 65, you should be able to end employment and spend the rest of your life living off of what you produced during your previous years.

Why Retirement Is Not the Same Thing as Time and Money Freedom

While retirement may sound equivalent to financial freedom, it’s not. Retirement is like an imposter of time and money freedom that gets you to veer off course and never end up where you wanted to go.

Time and money freedom is the point where you’ve created financial freedom by having cash flow from your assets that surpasses your living expenses. That means that to buoy your lifestyle, you no longer need to work actively. Here, your investments, rather than your personal time, are what provide your income check.

Now, when you reach that point, you get to choose what to do with your time. Could you “retire” and quit working at that point? Sure! But should you retire? No way!

The real question we’re answering today, is this: should you stop working just because you can? More literally, should you spend part of your life working to earn the right to not work during the latter part of your life?

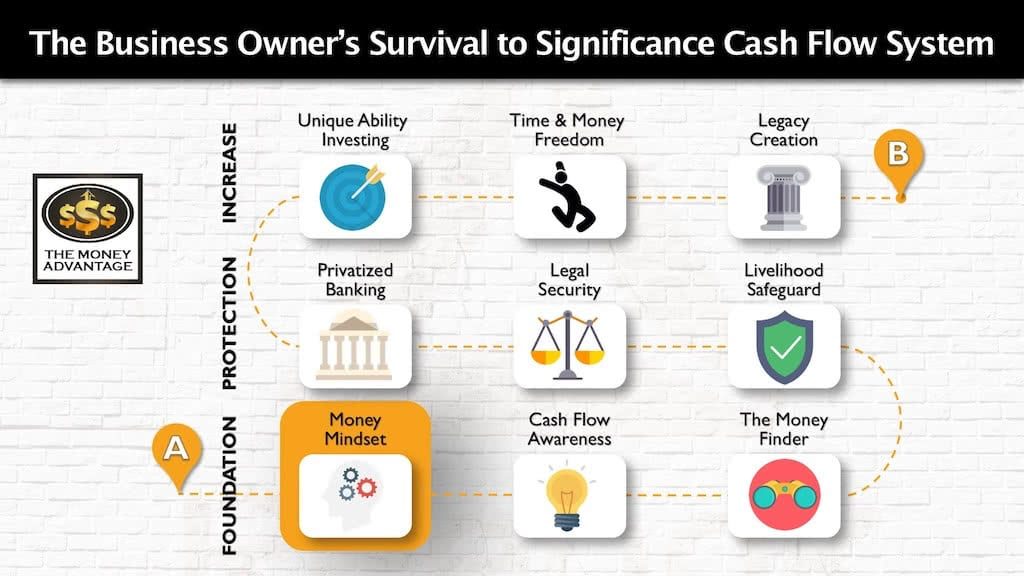

Where Does Retirement Fit into the Cash Flow System?

The short answer is, it doesn’t.

In truth, retirement doesn’t fit in the cash flow system. It’s not a part of creating cash flow. It’s not the destination. In fact, if retirement is your why and what you’re lining up everything else to reach, you won’t achieve time and money freedom.

The reason we’re talking about retirement at all is that it’s worked its way into the fabric of our financial ideology like it unquestioningly belongs. But rather than being a destination in a financially successful life, it’s more like a detour that winds up being a dead end.

That’s because retirement is a limiting end goal that restricts your financial and human potential.

Instead, the 3-step Business Owner’s Cash Flow System is your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom. The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you protect your money with insurance and legal protection and Privatized Banking. Finally, you put your money to work, increasing your income with cash-flowing assets.

When we talk about retirement, we’re discussing how you think about the point and purpose of all your financial pursuits. Therefore, this conversation is about your mindset.

Retirement Is an Outdated Concept

Retirement as this idea of leaving a job and ceasing to work began over 130 years ago.

First, Germany forced everyone over 65 to retire and receive a government pension because they were “disabled from work by age and invalidity.” Then, during the Industrial Revolution, the retirement idea caught on in America.

Generally, after age 65, people were thought to be “merely uncreative” and hogging jobs that younger, more competent workers deserved.

But, that’s back when life expectancy was much shorter, and jobs were more physically demanding.

Fast forward to today, with longer lifespans, better health and longevity, and a primarily service-based economy. It’s impractical to continue imposing an antiquated and arbitrary deadline on our working capacity.

Work Is Inherently Valuable

In his timeless book, Thou Shalt Prosper, Ten Commandments for Making Money, Rabbi Dr. Daniel Lapin explains the principles that underlie success in business and money.

He says that work has intrinsic meaning and beauty in and of itself. It’s a way of serving and doing something that others deem valuable. And that connects us to others and gives us a purpose.

Don’t think of work as a chore to slog through and endure on your way to a paycheck, the weekend, or retirement. Instead, recognize that work itself has a purpose. The fruit of your labor is more than the money. It’s the pride, satisfaction, and sense of accomplishment you get from applying your abilities to the betterment of others. And it’s those things that contribute to your sense of fulfillment.

And remember the first principle of wealth creation, that dollars follow value. Getting paid for your work is a guaranteed way to know that it was valuable to someone else and asserts your place and role in society.

You are a Producer, Not a Consumer

Think of yourself as a producer, not a consumer.

Producers have a purpose. They create. Consumers take and use up resources.

When we view ourselves through the lens of being a producer of ideas, insight, and creativity, our work becomes expansive and giving. If you think of work as the means to a paycheck, it can be easy to think of employment as merely consumptive.

But as any great leader knows, your people are your greatest assets. They add to and expand your possibilities.

Your Income Potential Increases with Age and Experience

As you accumulate wisdom throughout your years of working, you hone your strengths and expand your capabilities.

This increases the value you can provide, increasing your income potential.

Why would you want to be “put out to pasture” at the time of your life that you’ve amassed the greatest knowledge, foresight, and problem-solving capacity, and are of the greatest value to anyone you serve?

Retirement Is Bad for You

To top it off, retirement can be bad for your health. According to this 2013 BBC article, retirement increases the chances of loneliness, immobility, mental illness, clinical depression, and physical illness.

Retirement Is a Limiting End Goal

Lapin remarks that retirement should not be a goal. He says that you should integrate your vocation and your identity by thinking of life as a journey rather than a destination.

In golf, you would end up with a flawed swing if the target of your drive is the ball. Instead, you should master an excellent follow-through.

Similarly, in life, set a goal of finishing your whole life well.

If you think of retirement as the goal, you limit what you have the potential to create.

How to Think About Retirement If You’re A Business Owner

Owning a business adds another layer of meaning to producing quality work because it’s the primary method you deliver value to others.

Because of that, retirement can be a confusing and even demoralizing proposition that means losing status.

The founder has spent a lifetime building their business, so to admit they’ll someday leave it almost feels like a defeat. They’re not just leaving a job they loved; they’re giving up the prized asset they created. So … “when are you going to retire?” feels like, “when are you going to become insignificant?”

https://www.theamericancollege.edu/

Rather than retiring, it’s more important to work to reach profitability early and enjoy the fruits of your labor along the way. Build a self-sustaining business that continues to cash flow.

You’ll need to figure out how you’ll eventually leave your business someday, but that doesn’t need to look like the typical retirement.

Start Building Your Cash Flow System Today

Instead of planning for retirement, start now to create financial freedom.

You’ll not only be happier and more fulfilled along the way; you’ll probably reach it faster. But you won’t think of it as the stopping point, just another landmark on the way to doing your best life’s work.

To personally implement Privatized Banking, discover cash flow strategies to keep more of the money you’re making, or locate alternative investments, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Family Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read MoreStop the Hustle and Grind, with Christine Jewell

Are you an ultra-high achiever, but feeling the cost of that success? Christine Jewell, author, keynote speaker, faith-based executive coach, and host of the Breaking Chains podcast, joins us today to provide a fresh solution. In her new book, Drop the Armor, Christine teaches you a transformational approach that allows you to stop the hustle…

Read More