Beginner’s Guide to Buying Your First Property, with Jeff Schechter and Jack Gibson

Ready to invest in real estate, but don’t know where to start? In this episode, Jeff Schechter “Shecky” and Jack Gibson discuss buying your first investment property – a turnkey rental.

So if you want to springboard into asset-based cashflow, be fully prepared, and buy the right property so you can replace your income with a real estate portfolio, tune in now!

Podcast: Play in new window | Download (Duration: 43:44 — 50.1MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

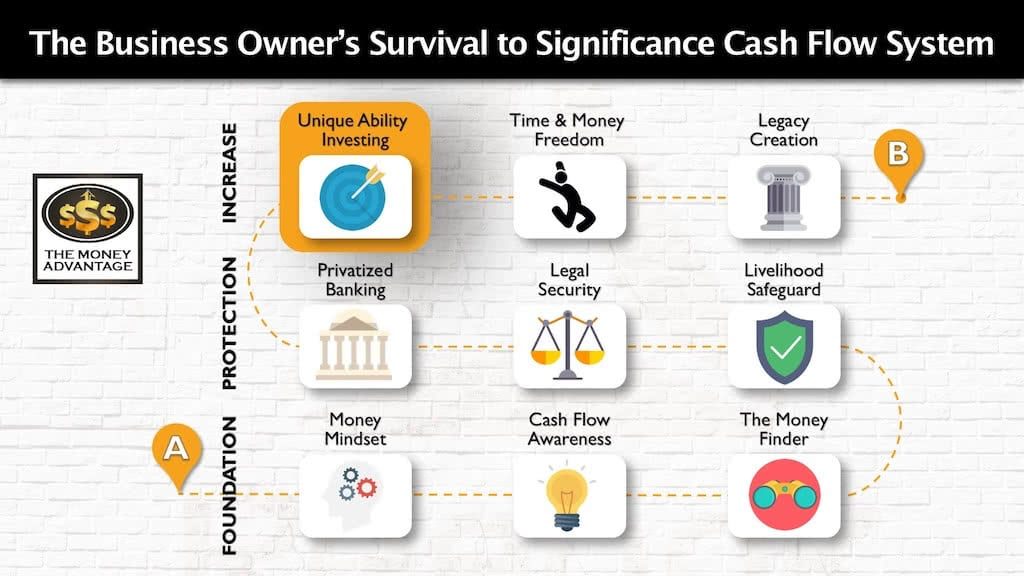

Where Does Investing Fit in the Cash Flow System?

Investing is just one step in the path to time and money freedom.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you’ll protect your money with insurance and legal protection, and Privatized Banking.

Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Today’s conversation will help you take the plunge into your first investment property.

Who is Jeff Schechter “Shecky”?

Jeff Schechter “Shecky” and Jack Gibson are the owners and operators of High Return Real Estate. We interviewed Jack Gibson about his background and the High Return Real Estate investment opportunity here.

Shecky’s accomplishments include:

- Started first business right out of college

- Developed sales and marketing strategies that have worked well across many industries

- Numerous businesses ventures

- Began flipping personal residences in the 1980s

- Bought and sold many properties

- Active investor

- Private consulting practice, coaching hundreds of business owners, and thrive on helping people realize their full potential, not just in business, but in all aspects of life!

In This Interview with Jeff Schechter, You’ll Discover:

- Once you have the cash, pick a property that makes sense, then pull the trigger.

- Have a holistic approach – more important than analyzing the numbers, know who you are doing business with and the reputation of the person you are buying from.

- Price and numbers don’t tell the whole story – there is always variance from the numbers on the pro forma.

- Work with someone who has the wisdom of experience, who can buy in volume and get better deals.

- A great turnkey provider will provide full transparency, before and after pictures, the scope of work, current condition with third-party inspection, and checklists of what was done.

- Cash-on-cash returns are a benchmark, but they don’t tell the whole story – instead, recognize the five areas of asset build-up that make real estate an IDEAL investment: Income, Depreciation, Equity build-up, Appreciation, Leverage.

- Take responsibility for your self-education.

- Revel in the experience and accept it as a learning experience – there is no better teacher than experience, don’t judge every nuance as good or bad.

- With the experience under your belt, don’t stop. Look for ways to scale and develop a performing portfolio to create financial independence. Replicate good investments. Put together your cash for the next investment.

- Never stop learning.

- If you’re looking for perfection, don’t get into real estate investment.

- Most importantly, stay in your lane – if you’re a professional or entrepreneur, stay hyper-focused on scaling your business. Then, take your profits, find out how to leverage the professional and invest with them. That’s how you cut the steep learning curve as you start on your investing journey.

Find Out Your Next Right Step to Time and Money Freedom

If you are ready to personally implement Infinite Banking, alternative investments, or cash flow strategies to keep more of the money you make, book your strategy call with The Money Advantage advisors today.

Turnkey Real Estate Links & Mentions From This Episode:

Learn more about how you can improve your results with turnkey real estate with Jeff Schechter, Jack Gibson and High Returns Real Estate: https://highreturnrealestate.com.

Get High Return Real Estate’s deals.

Thanks for Tuning In!

Thanks so much for being with us this week. Have some feedback you’d like to share? Please leave a note in the comments section below!

Don’t forget to subscribe to the show to get automatic episode updates for The Money Advantage podcast!

And, finally, please take a minute to leave us an honest review and rating on iTunes. They really help us out when it comes to the ranking of the show, and I make it a point to read every single one of the reviews we get.

Thanks for listening!

The Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read MoreEstate Planning 101: Protecting Your Loved Ones

Can you confidently say your family’s financial future is protected? Staring down the barrel of a life-altering moment, I was forced to confront the fragility of existence and the critical importance of having one’s affairs in order. That harrowing experience became a catalyst for today’s soul-searching episode of the Money Advantage podcast, where we navigate…

Read More