The Truth About IULs, with Todd Langford

In today’s show, Todd Langford joins us to dig deeper into Indexed Universal Life. He is the CEO and developer of Truth Concepts financial calculators, better known as a financial Truth Teller. In this valuable conversation, we uncover the fundamental uncertainty of indexed universal life insurance further.

Podcast: Play in new window | Download (Duration: 1:05:48 — 75.3MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Recently, we had a conversation about the risks of Indexed Universal Life. I know this isn’t a popular view. Indexed Universal Life policies appear attractive because of the widespread perception of their safety and growth rate. That’s why it’s more critical than ever to talk about the warning lights to ensure you have the information to make the best decisions.

Because it doesn’t matter how great something looks on the outside. If it’s just a façade, but the structure is unstable, wouldn’t you want to know? If these policies start great, but decline and grow progressively weaker with time, wouldn’t that be something you’d like to know upfront?

Imagine buying a car, if you drove it off the lot in pristine condition, but the breaks, the axle, the engine, and even the body of the car started to deteriorate rapidly. If it was known that the car’s useful life was uncertain at best, and the engine and breaks had a 50% chance of weakening to the point of making the car undrivable in 3 years, wouldn’t you want to know?

The reason that we’re going to this length is that if it was just an opinion, it wouldn’t matter all that much. But the way to know if something is financially sound is to foretell its future mathematically. And there’s no one more qualified to do that than Todd Langford.

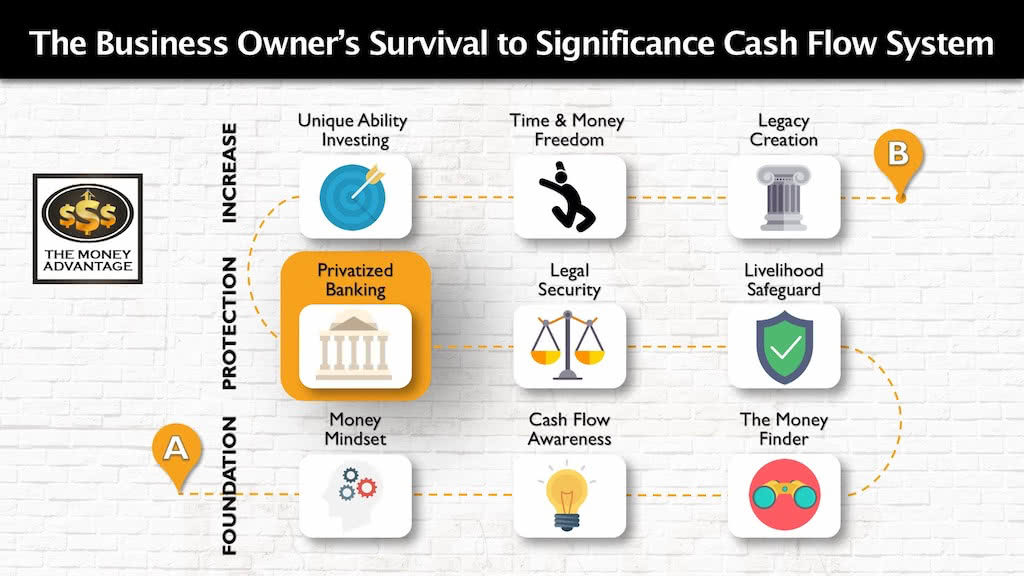

Where Life Insurance Fits into the Cash Flow System

Life insurance is a critical part of your financial life. However, it’s just one step in the bigger journey to time and money freedom. You need all the pieces in place to produce wealth systematically.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you’ll protect your money with insurance and legal protection, and Privatized Banking. Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Life insurance is part of Stage 2, protecting the wealth you’ve built. Not only does it provide the peace of mind of protection, but it can also be used as your cash flow management system.

That’s why it’s so important to make sure the policy you use can become a cornerstone of your wealth creation.

Who Is Todd Langford?

Todd Langford has been at the forefront of financial software development and training for over 33 years. In 1986, Todd was hired by Norman Baker, a successful financial advisor, to develop calculators that would “prove or disprove” the validity of certain financial strategies. Since then, he has been “Telling the Truth” and shifting paradigms about all things financial.

The calculators gave them a reliable way to compare strategies and test the soundness of ANY financial choice.

Todd has been an advocate of effective financial strategies, regardless of their popularity with Wall Street firms, the media, or investment gurus-of-the-moment.

Todd Langford Conversation Highlights

- There are no deals in the insurance industry. Everything is a tradeoff between price and risk. You either have higher

cost with lowerrisk, or lowercost with higher risk. - Actuarial science is about property loss.

- A large risk pool means the insurance company can reduce the cost of premiums for everybody.

- In finance, the math is often accurate, but wrong, because of the assumptions behind the facts. Usually,

financial analysis leaves out the critical piece of the time value of money. - Our lives are not a Monte Carlo simulation. If there’s a 90% chance of your money lasting to age 90, but you are one of the 10% that it didn’t work for, you experienced a 100% chance of failure.

- Most people who buy universal life policies do not understand the risk aspect. Universal life is often sold as the same thing as whole life, for half the cost. But if you understand the cost-risk relationship, if it’s half the price, it’s half the risk for the insurance company. That means you’re reducing the chance the insurance company is going to pay the claim out.

- IUL policies provide a floor, so you don’t have to participate when the market goes down. The tradeoff is the cap on returns, so you don’t get to take advantage of the full gains.

- A down market is more down than an

up market is up. Downturns have a greater impact than upswings. - The February 23, 2015 cover of

TIME magazine says: This baby could live to be 142 years old. Medical science is on an exponential curve up, and we don’t have any idea of how long we’ll live. So, it makes sense to have as many guarantees as possible to weather an uncertain future.

Resources to Find out More

Check out the Truth Concepts software or find out more about Todd Langford.

Get the side-by-side comparison between indexed universal life insurance and whole life insurance here.

For more information on universal life insurance, read the white paper exploring whole life + term vs. universal life, by the Prosperity Economics Movement.

Get Financial Clarity Today

If you would like to implement Privatized Banking, cash flow strategies, or alternative investments, so you can accelerate time and money freedom, we can help. We’ll review your situation to help you decide what moves are best for you.

To start the conversation, book a call with our advisor team.

Fractional Reserve Banking Creates Inflation: Infinite Banking is the Solution

Inflation causes everything to feel more expensive, so what do you do to protect your money from inflation? Today, we’ll explore the link between inflation and fractional reserve banking, and how Infinite Banking is the sound money solution. A thought-provoking journey through inflation, fractional reserve banking, and the revolutionary concept of infinite banking. This episode…

Read MoreBuy Term and Invest the Difference: Here’s What’s Wrong

Are you trying to decide which type of life insurance to buy? You want to protect your family in case something happens, so how do you do it best? Whole life insurance is often rejected as expensive and a poor “investment,” while mainstream opinion leans in favor of the “buy term and invest the difference”…

Read More