Trump’s Tax Reform: What Entrepreneurs Need to Know, with Dustin Griffiths

Trump’s tax reform has made a lot of big changes to the tax code. Because of the overhaul, our proactive tax team posted a series of blogs outlining the changes and what they mean for you. When we read them, we knew right away that we wanted to share them with you.

So, we brought Dustin Griffiths back on the podcast to share the changes we think are most relevant to the small business owner. We’re also sharing the links to all of their blogs to help you gain more clarity.

Disclaimer: We’ve published this content for educational purposes only. For individual recommendations and advice for your specific situation, please consult with a qualified tax professional.

Listen to the Podcast

This conversation expanded on each of the following topics. We discussed examples and situations to help you understand how the changes will apply to you. To gain the greatest understanding, be sure to listen to the conversation.

Podcast: Play in new window | Download (Duration: 1:02:06 — 56.9MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

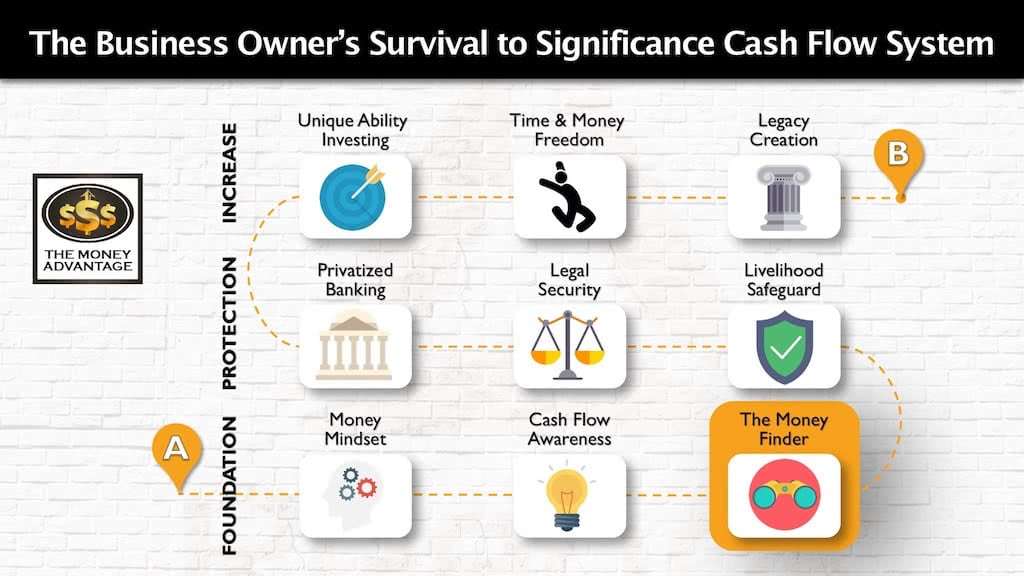

Where Taxes Fit into the Cash Flow System

Strategically (and legally) shrinking your tax liability is a huge part of fixing your money leaks. But it’s just one small step of a greater journey of building time and money freedom.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, insurance and legal protection. Locating and solving your money leaks is just a temporary bandaid if there’s risk that you could lose it.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

How Trump’s Tax Reform Affects You

Corporate Tax Rates

Corporate tax rates went down from 34% to 21%. However, C corps pay a double tax. They’re taxed at the corporate level and again at the individual shareholder level when you pay yourself. Your total tax rate must account for both, and may effectively create a total tax rate of 36 – 51%.

20% Deduction for Pass-Through Entities

Pass-through entities, like partnerships, S corporations, and sole proprietors, now will only have to claim 80% of business taxable income. However, there are additional calculations if your AGI is over $315K or ($157K if you’re single), and for service-based businesses, to determine if and how you can use this deduction.

This is a “YUGE” tax savings for many small business owners! Without doing anything differently, many of you are going to get a 20% reduction of your business’s taxable income.

Vehicle and Asset Purchases

Asset purchases have received an expansion of the Bonus Depreciation and Section 179 definition, as well as the depreciation limits. This allows you to deduct 100% of the depreciation up front, in many cases, being able to fully expense the purchase price in the first year, for new and used assets.

This expansion puts more dollars in your pocket for large asset purchases. However, the true test to determine whether to purchase an asset is whether you needed it in the first place.

Business Expense Changes

You can no longer deductions meals and entertainment expenses unless you use them for your employees.

If you find that you had a lot of these entertainment expenses or eating out with clients, business just got more expensive.

Changes in Real Estate Tax Laws

For residential or commercial real estate investors, the reform simplified the definition of property improvements and limited the 1031 like-kind exchanges to real property. Additionally, rules to inventory, including real property, allow you to deduct the purchase of inventory up-front, instead of at the sale.

Individual Tax Return Changes

For most people, tax rates decreased by around 2%. The standard deduction nearly doubled, and many of the itemized deductions were eliminated (including miscellaneous itemized deductions, mortgage interest deductions for HELOCs or for loans over $750k). This simplifies the filing for many people who will no longer benefit from itemizing their deductions to reduce their taxable income. Personal exemptions of around $4k per person were eliminated, and the Child Tax Credit was increased from $1k to $2k per child. The deduction for state and local taxes was limited to $10k. Medical expenses can be claimed if they’re over 7.5% of AGI, making it easier to deduct these costs.

Other Topics

- Transportation expenses – The employer is no longer able to deduct costs of employee transportation to and from work.

- Research and experimental – Now instead of having the option to expense this purchase or amortize over 5 years, you must amortize.

- Business Interest – Removed the ability to expense 100% of business interest if you’re over $25 million in revenue, but businesses under the $25 million mark still may expense 100% of business interest.

- Alimony Payments – Used to be deductible to the payer and income to the recipient. Now it doesn’t affect either party.

- Moving Expenses – No longer able to deduct the cost of your move, unless you’re a member of the Armed Forces.

- Qualified Education Expenses – Expanded the definition to now include elementary and secondary school expenses, so distributions from qualified education savings plans can be used to reimburse for these education costs up to $10k.

To Take It Up a Notch

If you would like to create a comprehensive strategy to keep and control more of your money, including how to pay less in taxes, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Links to Incite’s Original Blogs Regarding Trump’s Tax Reform

Incite excellently outlined what Trump’s Tax Reform changes mean for you in this series of six posts:

- [1 of 6] How Much Did Your Business Tax Rate Go Down?

- [2 of 6] Vehicle and Asset Purchases

- [3 of 6] Business Expense Changes

- [4 of 6] Real Estate Related Changes

- [5 of 6] Individual Tax Return Changes

- [6 of 6] A Few Last Mentionables

To learn more about Dustin and Incite Tax, or to contact them directly, visit their website HERE or email Dustin at dustin@incitetax.com.

The Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read MoreEstate Planning 101: Protecting Your Loved Ones

Can you confidently say your family’s financial future is protected? Staring down the barrel of a life-altering moment, I was forced to confront the fragility of existence and the critical importance of having one’s affairs in order. That harrowing experience became a catalyst for today’s soul-searching episode of the Money Advantage podcast, where we navigate…

Read More