Wellings Capital: Opportunities in Commercial Real Estate, with Paul Moore

Wellings Capital provides access to value-add recession-resistant assets. They’ve accomplished this by partnering with expert operators in the storage facility, manufactured housing community, and multifamily apartment spaces. Wellings Capital funds offer accredited investors 15%+ returns without having to work so hard to find great individual deals.

Today’s conversation unpacks the current trends in these commercial real estate sectors. We’ll discuss their two accredited investment opportunities to help you achieve your objectives, whether your priority is income or growth.

Podcast: Play in new window | Download (Duration: 53:39 — 61.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Where Investing Fits into the Cash Flow System

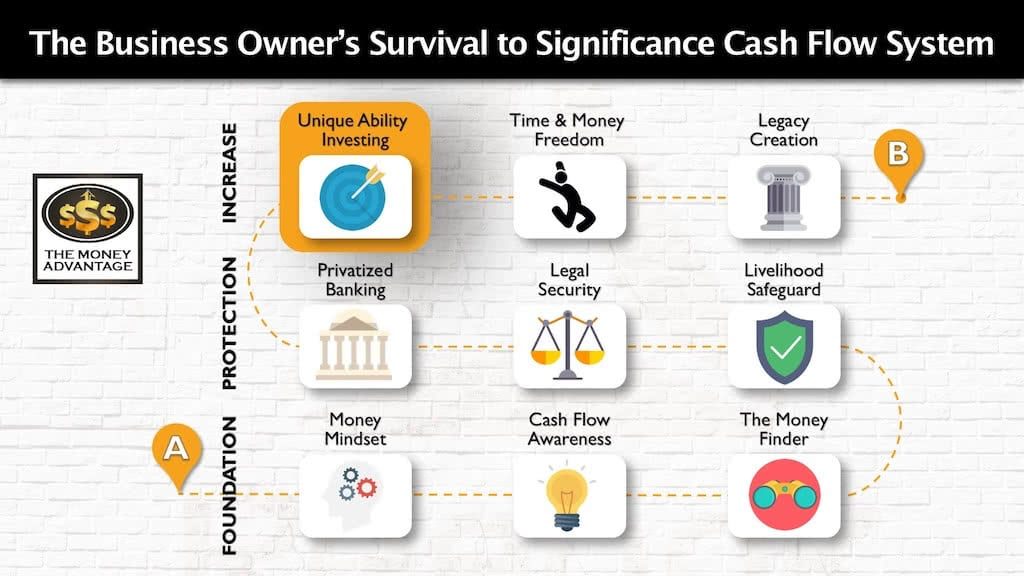

As important as investing is, it’s just one step in the bigger journey to

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to get from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks. Then, you’ll protect your money with insurance and legal protection, and Privatized Banking. Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Who Is Paul Moore?

Paul Moore is a second-time guest on The Money Advantage. In his July 2018 interview, Lessons from a Commercial Multifamily Investor, with Paul Moore, we talked about his background as a commercial multifamily investor. He shared his most important lessons: high risk does not equal high returns, the importance of giving, and knowing when to quit. You can grab more of his background and accomplishments there.

After entering the real estate sector, Paul completed 85 real estate investments and exits, appeared on an HGTV Special, rehabbed and managed dozens of rental properties, developed a waterfront subdivision, and started two successful online real estate marketing firms. Three successful developments, including assisting with the development of a Hyatt hotel and a multifamily housing project, led him into the multifamily investment arena.

Paul is now the Managing Director of two commercial real estate funds at Wellings Capital. He also co-hosts a wealth-building podcast called How to Lose Money and is a frequent contributor to BiggerPockets. Paul is the author of The Perfect Investment – Create Enduring Wealth from the Historic Shift to Multifamily Housing (2016), and has a forthcoming book on self-storage investing.

Wellings Capital Conversation Highlights

- How hitting singles is more important than looking for a grand slam in your investing strategy.

- Why a multifamily investor left multifamily syndication behind to establish two commercial real estate investment funds.

- Why many multifamily investors are turning to self-storage and mobile home parks for double-digit returns.

- How the value creation formula maximizes income and grows the asset value in the self-storage and mobile home park sectors.

- Wellings Capital’s funds that give accredited investors access to forced appreciation and income growth in real, non-correlated assets.

Find Out More About Paul Moore or Investing with Wellings Capital

Find out more about the Income Fund and the Growth Fund at Wellings Capital.

To hear more from Paul Moore, get the webinar Why Is a Multi-Family Investor Investing in One of America’s Most Boring Real Estate Asset Classes?

Get Financial Clarity Today

To personally implement Privatized Banking or discover your hidden money leaks, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

The Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read MoreEstate Planning 101: Protecting Your Loved Ones

Can you confidently say your family’s financial future is protected? Staring down the barrel of a life-altering moment, I was forced to confront the fragility of existence and the critical importance of having one’s affairs in order. That harrowing experience became a catalyst for today’s soul-searching episode of the Money Advantage podcast, where we navigate…

Read More