Creating Time and Money Freedom with Real Estate, Anna Kelley, REI Mom

In today’s show, we’re interviewing Anna Kelley. She’s a real estate investor who has created time and money freedom. And, she’s the founder of REI Mom, helping women create a legacy through real estate investing.

Podcast: Play in new window | Download (Duration: 59:17 — 67.9MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Where Real Estate Fits into the Cash Flow System

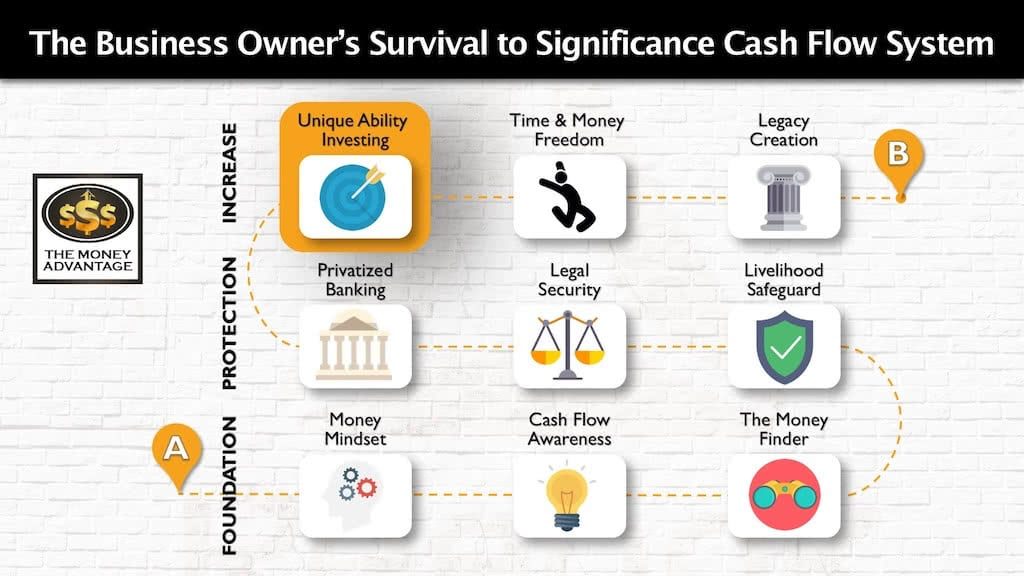

Here at The Money Advantage, we are a community of wealth creators taking control of our lives and financial destiny.

It’s not enough to just make a great income. You have to figure out how to keep more, protect that money, and finally, increase and make more through the right investing decisions.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you’ll protect your money with insurance and legal protection, and Privatized Banking. Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Today’s conversation will help you look at your investing in a way that is aligned with your unique abilities, produces value for people, and puts your money to work earning a cash flow return.

Who Is Anna Kelley?

Anna personally owns and manages a multi-million-dollar rental property portfolio and has ownership in over 2000 units as both an active and passive investor. She is a General Partner, Sponsor & Asset Manager for large multi-million-dollar multifamily real estate acquisitions, and through Zenith Capital Group, actively seeks out the best opportunities for her partners and investors.

Anna currently has $52M in assets under management.

She is also a frequent guest on Real Estate Investing podcasts, speaks at REI groups around the country, is an Amazon #1 Best Selling Author, and runs a local meetup group for Women in Real Estate.

Conversation Highlights

- How Anna Kelley started out in private banking, selling stocks, bonds, and mutual funds. But realizing that her very wealthy clients made their money in real estate put her on a path to build true wealth.

- Anna’s story of starting out in real estate with a failed flip, and then becoming a landlord before a homeowner.

- The personal hurdles she navigated as she realized she couldn’t rely on a W2 job or entrepreneurship. Instead, her family needed passive income from assets.

- How she navigated the market cycles and lending requirements over the past 16 years.

- Anna’s personal why to be able to be home with her kids allowed her to transcend obstacles.

- The creative financing strategies Anna used to continue buying real estate, even when banks wouldn’t lend to her.

- How she and her husband learned to be resourceful landlords when they were hundreds of thousands of dollars in debt and had no money.

- How Anna Kelley has honed her niche through testing, trying, and experimenting with various neighborhood classes, and why it’s so important to understand not only projected income from a property, but also balancing growth and preservation.

- Transitioning from active to passive income.

- Why you should use leverage for production.

- How she’s working to find, finance, and syndicate large multifamily apartments.

- Why the stock market is overvalued, and a correction has to happen.

- Real estate has a real value. There’s true, intrinsic value in property, but the stock market is primarily valued based on consumer sentiment.

- Why it’s so important to master your money, so money doesn’t master you.

Find out More About Anna Kelley and REI Mom

Connect with Anna Kelley on FaceBook, at Anna REI Mom Kelley, and find her group Creating Real Estate Wealth That Lasts with REI Mom. You can also email her at info@reimom.com.

Get Financial Clarity Today

If you would like to implement Privatized Banking, cash flow strategies, or alternative investments, so you can accelerate financial freedom, we can help. We’ll review your situation to help you decide what moves are best for you.

To start the conversation, book a call with our advisor team.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreBecoming Your Own Banker, Part 26: Top 7 Money Myths, Lies That Are Costing You Money

What if what you think about money turned out not to be true? Even worse, what if you’re believing lies that are costing you money? Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns,…

Read More

[…] Want to learn how to navigate changes in the economy and come out stronger? Listen as I discuss my journey through the height of the economy in 2007, through the Great Recession in 2008, and created Financial Freedom in the process. Learn why I believe Multifamily investing is a recession resilient strategy for investing for preservation, cash flow, and appreciation! Listen to the podcast […]