Family Values: The Starting Point of a Legacy, with Richard Wilson

If you want to create a legacy of wealth, the starting point is a strong culture of family values. That’s because having the greatest impact and doing the most for your children hinge on their character and self-leadership. And their character and self-leadership depend on yours – your example, your relationship, and your communication.

So how do you model and teach the values necessary for your children to be successful? How do you build bonds that strengthen and unify your family over generations? Then, how can you fortify against the torrent of evils like regret, pain, and resentment that rip families apart? What can you do to prevent everything you’ve spent your life building from being crumbled away or used up?

If you want to strengthen and anchor your family, you need a value system that stands through generations.

Podcast: Play in new window | Download (Duration: 47:45 — 54.6MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Today, we’re talking about the importance of family values, instilling those in kids, posting your family values at home on the wall, and spending more serious time on the topic as a family unit.

Richard Wilson, CEO of the Family Office Club, is coming back to join us for this conversation. Because of his work with ultra-high net worth families, he sees what works and what breaks when it comes to family wealth. You’ll see exactly why family values are pivotal to your long-term impact.

You can find his first interview, The Family Office Model: Investing Like the Wealthy, here.

In This Show About Family Values, You’ll Discover:

- Why family values are more important than family wealth.

- Why family values are central to living well and creating the greatest impact and legacy.

- How writing down and posting your family values improves family culture.

- The surprising trick to remembering your values and brainwashing yourself so you can become the best version of you.

- How individual, marital, family, and business values are connected.

- The personal family values list of a leader in family wealth to get you thinking about your own values.

Where Family Values Fit In The Bigger Picture

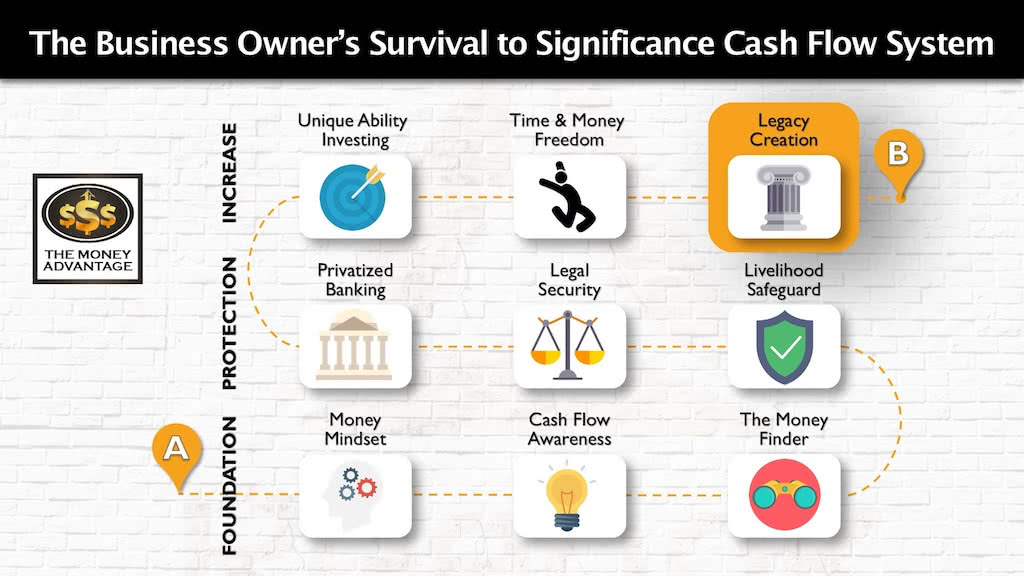

Family values are a part of your family guidance system when building family wealth. Creating and leaving a legacy is the capstone of a life well-lived. It’s the end goal of a life and business you love, and the greatest mission of our lives. But we need an entire financial system to support our ability to do the most good.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with privatized banking, insurance, and legal protection.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

About Richard Wilson

Richard is a third-generation Eagle Scout, husband and father of 3 living on the island of Key Biscayne, near Miami, Florida. He is the CEO & Founder of the Family Office Club, the #1 largest association of over 2,000 registered ultra-wealthy families and their family offices. Richard also represents 77 investors with an average net worth of $22M through his RIA Centimillionaire Advisors, LLC and the PrivateEquity.com investor portal – where he helps clients access top screened direct investments coming through his investor club.

Richard has written three #1 bestseller family office books on Single Family Offices, How to Start a Family Office, and Centimillionaires ($100M+ net worth families). The Family Office Club has the most-watched YouTube Channel in the family office industry and most visited website. Richard has an undergraduate degree in business, an M.B.A., and has studied post-masters psychology through Harvard University’s ALM Division.

Links and Mentions

Leave a Legacy: The Two Essentials for Lasting Impact

Do you want to make a difference that lasts for generations? If you have children or grandchildren that you want to benefit, bless, and uplift, you can make plans now to accomplish that priority. Before you start planning, though, there are two essentials you’ll need. These two components will help you get started and follow…

Read MoreFamily Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read More