The Family Office Model: Invest Like the Wealthy, with Richard C. Wilson

In this episode, we asked Richard C. Wilson, the CEO of the Family Office Club, to share his experience in coordinating the wealth teams of multimillionaire and billionaire families

Most people use common financial thinking. This has them feeling out of control, losing money, hanging on for the ride, and hoping everything works out.

Instead, the ultra-wealthy have a completely different set of rules.

Most people use common financial thinking. This has them feeling out of control, losing money, hanging on for the ride, and hoping everything works out.

Instead, the ultra-wealthy have a completely different set of rules.

If you follow the status quo, you’ll get status quo results.

But if you want to create a life of wealth and freedom, learn from those who have created it. And do what it takes to follow suit.

Podcast: Play in new window | Download (Duration: 49:26 — 45.3MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

Where Investing Fits into the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

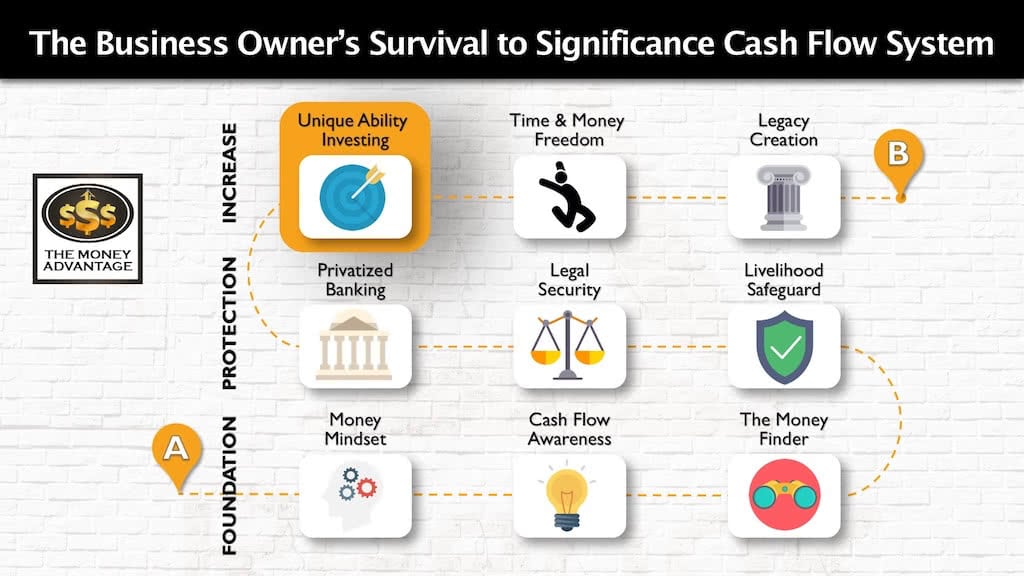

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Family Office: A Window into the Strategies of the Ultra-Wealthy

We’re making it easy because we’re bringing the financial world of the ultra-wealthy in close to give you the opportunity to see it for yourself.

Like studying something under a microscope, here’s your window into elite investing. You’ll have the opportunity to touch, feel, and explore it for yourself.

To achieve the extraordinary time and money freedom you desire, learn the way the wealthy think about investing. Study their principles, their reasons, their goals, and their why. Look through their lens and find out how they see the world differently.

Instead of honing your investing through blood, tears, and poor decisions, learn how to invest like the wealthy.

When you see what they are doing, you can model their decision-making. This allows you to accelerate your wealth creation beyond the limits of what you thought was possible.

We’ll answer:

- How do the ultra-wealthy invest differently than anyone else?

- How do they focus on what they know and can control?

- Why the ultra-wealthy value liquidity?

- How do the ultra-wealthy view diversification

- What is the importance of a family mission, values, goals, objectives, and governance in their investing strategy?

From this conversation, you’ll gain insight on how to invest like the wealthy in your own life.

The Big Picture

If you’re following along in this series on saving and investing, you’ve realized the power of saving first. You crave the peace of mind, stability, and confidence it brings you, and how it helps you create more.

With a savings system in place, you’ve explored ways to store it most effectively to maximize your safety, liquidity, and growth.

You are developing your investor identity to target your investing strategy. Because of this, you’re shrinking your risk and boosting your returns by investing in what you know and control.

Now, we’ll zoom in on the investing strategy of the wealthy. You’ll see how they’re investing to achieve exceptional results.

Richard C. Wilson: Family Office Advisor for Multimillionaire and Billionaire Families

Richard C. Wilson helps $100M+ net worth families create and manage their single family offices and currently manages 14 clients including mandates with three billionaire families and as the CEO of a $500M+ single family office and Head of Direct Investments for another with $200M+ in assets.

Richard is also the founder of the Family Office Club, the #1 largest community in the industry with well over 1,500 registered single and multi-family offices which manage more than $1 Trillion in Assets Under Management. At his 10 exclusive events per year, you hear from billionaire family members, top 50 multi-family offices, and secretive single family offices.

He has spoken at over 150 conferences in 17 countries, has the #1 bestselling book in the family office industry, The Single Family Office: Creating, Operating, and Managing the Investments of a Single Family Office.

He’s founded the largest membership-based family office association (FamilyOffices.com), and also provides single family office management (SingleFamilyOffices.com), a weekly podcast on iTunes, newsletter, webinars, and quarterly events.

He is the Chairman of Wilson Holding Company, the CEO and Head of Direct Investments in Real Estate & Operating Businesses with The Miami Family Office, the CEO of Billionaire Family Office, and the CEO of Family Office Executive Search.

What Is a Family Office?

Before we dive into how the ultra-wealthy invest, it’s crucial to understand the family office environment to gain some context.

A family office is a holistic wealth management solution for the ultra-wealthy. It consists of a financial suite of advisors that work cohesively on the wealth strategy for just one or a few families.

Family offices are exclusive wealth management firms that usually only accept clients with at least $10 – $20 Million of investible securities. They often assist with tax optimization, estate planning, charitable giving, foundations, business transfer, wealth transfer between generations, insurance, and wealth management services. The average family office client has $30 – $50 Million in assets.

According to Family Office Report,

A family office is 360-degree financial and wealth management firm and personal CFO for the ultra-affluent, often providing investment, charitable giving, budgeting, insurance, taxation, and multi-generational guidance to an individual or family. The most direct way of understanding the purpose of a family office is to think of a very robust and comprehensive wealth management solution which looks at every financial aspect of an ultra-wealthy person’s or family’s life.

A Single Family Office is a full balance sheet 360-degree ultra-affluent wealth management firm and CFO solution for a single individual or family.

Contrasted with a wealth manager, Richard helps these families start and develop their family office from scratch. He helps the family discover the reason behind their direct investments. His team helps find the appropriate experts in insurance, investments, legal, tax, and private banking world. After assembling the team and bringing them on staff, he coordinates their focus. He helps set up the family office, ensures the system is being followed and continually improves the family office.

How to Invest like the Wealthy

Create Wealth, Don’t Just Manage It

While wealth managers protect the wealth you’ve already created and diversify it to some extent, their job is typically not to make you wealthy.

On the other hand, most of the wealthy families that utilize family offices are first-generation wealth creators. They actively created their wealth through controlling their investments.

Focus, Instead of Diversifying

The most successful families often focus on the industries where they made their money.

To create wealth, diversifying within a direct investment portfolio could be one of the worst things you could do. There’s no synergy or learning curve gained by spreading your investments all around. Diversifying will not allow you to dominate anything because you’d have to be in multiple learning curves that don’t conjoin anywhere.

Consciously Choose What You Love

At the pinnacle of accomplishment, when the successful have everything covered and no longer have to work, they lock in on improving their game. They spend their time only what they’re very excited about, and love what they’re doing.

Define Success by What You Can Do, Not by What You Have

Rather than buying status with the largest boats and houses they can afford, the wealthy’s work takes on a new meaning. They work to prove to themselves what they’re capable of, not to prove to others that they’ve made it.

Become a Titan in Your Industry

Once they’ve mastered success, they work even harder to get to the next level, often monopolizing a small niche with multiple operating businesses within one industry that support each other.

Verne Harnish discusses locating the choke point of your industry or business. Thinking strategically about your biggest bottleneck or limitation in your business allows you to turn it into one of your greatest assets through acquisition.

Always Have Ready Access to Capital

Many second or third generation wealthy families are very conservative and want their personal debt position to be low.

However, many want leverage to play the game more aggressively. Securing cheap debt now, when financing is available, even before they find the right deals, allows them to have capital prepared for when the time comes.

They have debt in their portfolio when buying an office park, self-storage, or multi-family building, but the focus is on acquiring a cash-flowing asset that is more than paying for the loan.

Attract the Right Deals and Add Strategic Value

Invest only in deals that are right for you. While many ultra-wealthy families are very private, naming their holding and investment companies allows them to attract those who are looking for capital in that sector.

The ultra-wealthy usually only invest in early-stage deals if it’s very familiar to them. Otherwise, they typically want to invest in something that’s already operating and profitable. They often want control, and seek deals where they can add strategic value.

Gold slippeth away from the man who invests it in businesses or purposes with which he is not familiar, or which are not approved by those skilled in its keep.– George S. Clason, The Richest Man in Babylon

A Successful Family Office Knows Their Mission

Anything you do before you know your values, objectives, and mission, is probably just a waste of time in part or in full. You don’t know if you’re aligning your energy with things that are appropriate if you don’t know what you’re trying to get done. Being very explicit and intentional about what you’re saying yes to, allows you to accomplish so much more.

Invest According to Your Investor Identity

Experience is the greatest advantage when deciding where to focus. The ultra-wealthy often invest in the industry they made their money in, or in what they’ve always been passionate or curious about.

To discover your investor identity, go through the Jim Collins’ hedgehog concept exercise to discover the intersection of these three circles: what you’re best at, what you’re passionate about, and what you can make a lot of money doing. Your investing has to match your DNA, or someone else who’s more passionate is going to run circles around you and try to make your life hard.

Say “No” Most of the Time

Because they know their investor identity, they don’t say yes to deals that don’t match. The wealthy can’t find enough excellent opportunities. They get a lot of deal flow but invest in 1 out of 200, or 1 out of 500 deals.

The difference between the successful and the ultra-successful is that the ultra-successful say, “No,” almost all of the time.– Warren Buffett

I’m as proud of what we don’t do, as what we do. – Steve Jobs

Don’t Want to Retire

Eighty percent of the time, the ultra-wealthy never truly retire. Instead, they often become chairman of the family office, building a highly-capable team, and still making decisions to direct the team by working two to four hours per day.

Other Topics Discussed in the Podcast

- How Richard Wilson has defined the unique ability of The Family Office Club and uses that to help attract investment deal flow to family offices.

- Richard shares how his business coach, Dan Sullivan, is helping him refine his unique ability and 10X his business.

- This episode is loaded with example after example of families strategically applying these principles in their wealth creation.

- How Richard Wilson is applying these guiding wealth principles in his own life and business.

Find out More About Richard C. Wilson and The Family Office Club

To start a family office, get Richard C. Wilson’s book, The Single Family Office.

If you’re interested in working directly with Richard and his team, check out their website: familyoffices.com, email directly at richard@familyoffices.com, or call (305) 503-9077.

The 7-Part Saving and Investing Series

Check out the rest of the articles, podcasts, and videos in the series on saving and investing like the wealthy here:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- Saving vs. Investing: What Is Savings?

- Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

- Saving vs. Investing: What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Start Creating Your Legacy Now

If you would like to create a comprehensive strategy to keep and control more of your money, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Leave a Legacy: The Two Essentials for Lasting Impact

Do you want to make a difference that lasts for generations? If you have children or grandchildren that you want to benefit, bless, and uplift, you can make plans now to accomplish that priority. Before you start planning, though, there are two essentials you’ll need. These two components will help you get started and follow…

Read MoreFamily Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read More