Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

Most investing returns fizzle far beneath our expectations. When we most want our money to generate cash flow, we end up flatlining, or even losing money. The prosperity and confidence we’d hoped for elude us, leaving us more anxious and uncertain instead.

Could it be that we have our sights on the wrong target? Let’s take a look at investing from a cash flow perspective to untangle the confusion and bring you investing clarity.

You need to understand why this investing performance failure occurs, in order to overcome it, get your money working for you, and create the financial peace and prosperity you desire.

This segment on investing tells you how.

Podcast: Play in new window | Download (Duration: 55:55 — 51.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

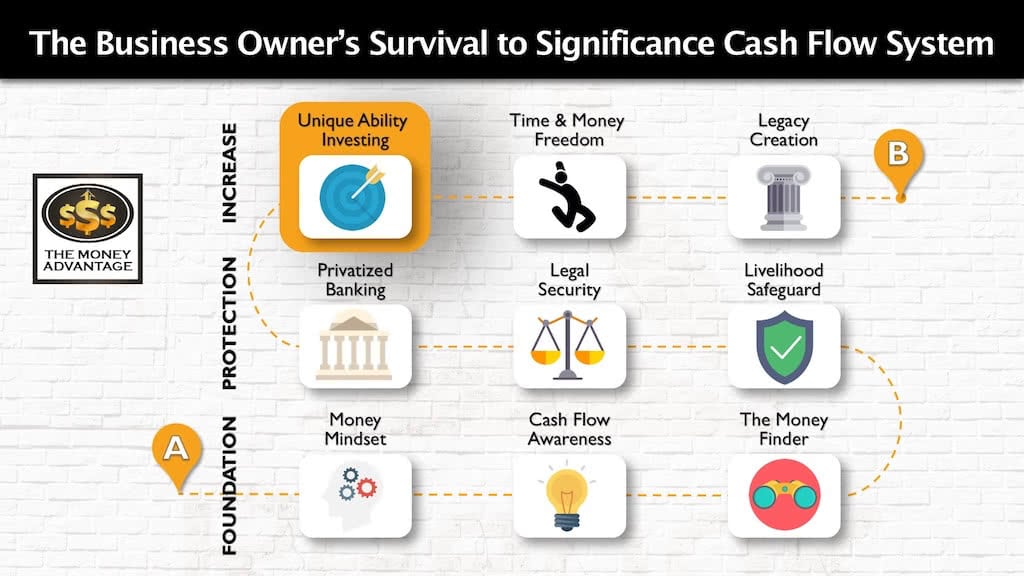

Where Cash Flow Investing Fits into the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Why Investing Is the Finale and the Catalyst of Saving

This article fits into a larger series on saving and investing.

We’ve explored the WHY, HOW, and WHAT of a successful savings strategy. We gave clear guidelines on how to create the habit of paying yourself first to build an Emergency/Opportunity Fund that’s safe, liquid and growing. We distinguished savings from investing and discussed the quality of various financial vehicles in fulfilling the role of savings.

But the discussion on savings wouldn’t be complete without a framework for what to do with your savings. Instead of leaving savings to accumulate slowly over time, we want to put those dollars to work in opportunities to accelerate financial freedom.

Putting our capital to work to earn a return is precisely the role of investing.

Saving and Investing, Better Together

You don’t save forever without the objective of putting the dollars to work. But you can’t put dollars to work until you’ve built them up first.

And then, once you’ve invested and are earning dollars with your dollars, how do you continue your savings habit which was the foundation for your success in the first place?

Saving and investing go hand-in-hand, like the chicken and the egg. Which came first, no one knows, but each continues to support and perpetuate the other.

Saving well will give you more money to invest. And investing well will, in turn, give you more money to save.

Both are equally important. Saving and investing maximize your whole personal economy, if you get them working together.

To top off this series on savings, we’ll now bring investing into the crosshairs. This article will explore the WHAT and WHY of investing.

Let’s key in on the finer points of investing to answer further:

- What are opportunities?

- What is investing?

- How is investing different from saving?

- What are the end goals of investing?

- How do investments change my financial life and create financial freedom?

Investing is much larger than the steps of a deal, investment returns, or the best stocks today. If you camp out in the HOW and WHAT but miss the WHY and the principles, you can end up way off track, losing money, and never reaching your potential.

Our goal is to help you develop higher-level thinking about investing.

If you are clear on the principles that govern investing, you’ll be able to make investment decisions that accomplish your goals better and faster.

What Is Investing?

Broadly, here’s the definition of an investment: a devoting, using, or giving of time, talent, emotional energy, or money for a purpose or to achieve something.

The PRINCIPLE is: investing is anything that requires your time, energy, and/or money, in a way to produce more than what you put in.

It’s planting a seed to reap a harvest.

In relationships, this could be the investment of time and energy to achieve love, connection, and happiness.

In education, perhaps you’d like to learn a new skillset like real estate investing or digital marketing. It will require the investment of your time, energy, and money, with the hopes to increase your knowledge and competence.

Financially, investing is an opportunity to put your money or capital to work for you to earn profitable returns.

Robert Kiyosaki uses the Cashflow Quadrant to define investing as the position where you no longer are working for money, and your money is working for you.

How Is Investing Different from Saving?

To make sure you have as much clarity as possible, let’s re-draw the line between saving and investing. Remember earlier; we said they are two completely different roles – black and white, with no gray area in between?

If you come back to the criteria we used to evaluate savings, it was:

- Safety: No loss of value

- Liquidity: Access to your money

- Growth: Earns compound interest

Here’s a quick refresher. The primary objective of savings is to have safety and liquidity. You don’t want savings to lose value, and you need it to be “user-friendly,” not tied up where you have to have the permission of a gatekeeper to get to your money. With savings, compound growth is a necessity, but the rate of growth is just icing on the cake. Having a high return is not the main purpose of savings.

With investing, the roles reverse. You give up some safety and liquidity to achieve the most important goal for an investment: growth.

The Purpose of Investing: Two Types of Growth

Now that you’ve set your sights on growth, it’s time to decide what type of growth you’re after.

When you boil it down, there are two primary types of investment returns:

- Cash Flow, including interest, dividends, or income

- Accumulation, specifically growth or gains caused by appreciation in value

Cash flow returns would produce a realizable gain that increases your income. This may be dividends from dividend-paying stock, rental income from cash-flowing real estate property, or profits from a business.

In many cases, you have the opportunity to use this cash flow to increase your current income or to reinvest the cash flow.

Accumulation is an asset’s increase in dollar value. This may be an appreciation in property value from $200K to $300K, the growth of a share price from $56 to $100, or an increase in the value of your mutual fund from $500K to $600K.

Let’s look at this from another angle. If we zoom out for a moment to look at your whole Cashflow Creation System, there are three distinct jobs you can assign your money to. Money is earmarked either to:

- Be a place to store cash,

- Create cash flow, or

- Grow

For the most part, assets are like one-trick ponies. They do one job well but aren’t cross-trained. Each job requires a specific asset that does that job best.

The first objective, a place to store cash, is within the scope of saving. It is accomplished by building an Emergency/Opportunity Fund.

The last two goals, both cash flow and growth, are within the scope of investing. Notice how they line up with the two types of investment returns: cash flow or accumulation.

Before making decisions about which investments to choose, you first want to determine WHY you’re investing and what specific type of return you are looking for that investment to create for you.

A Word to the Wise: The Ultimate Goal of All Investing Is Cash Flow

There are many different goals to investing. One person may be investing to gain capital for another deal. Another person may desire an increase in cash flow, starting today. Another may not care what happens now, as long as they have a specific net worth at some future point.

In any case, fast forward out 30 years from now. What do you want your investments to be doing for you at that point?

Whether you built up a large retirement portfolio, own a cash-flowing real estate empire, or flipped properties for a living, you ultimately end up in the same position.

The goal of all investing is to create cash flow, a stream of income to live on.

The end game for every single person, at some point, is financial freedom. Financial freedom can be simply defined as the point that your income from your assets is greater than your expenses. At that point, you’re no longer dependent on your job as your source of income.

Eventually, either now or in the future, you will desire to turn your capital into cash flow. The real question becomes whether you want to spend your life accumulating, to get to the point where you can live off the interest, or to start creating cash flow today.

You could either spend today accumulating the nest egg to someday divest into cash flow, or you can begin now to turn as much cash into cash flow at an accelerating rate.

Here’s an Example:

Accumulation-Based Investing

Let’s say that you had $30K/year to invest. You put that into a typical investment account earning 6% (before taxes and fees) every year and continued investing from age 35 to age 65.

After 30 years, you’d have a little over $2.5 Million. If you think that this is enough for a good, solid retirement, think again.

Once we factor in a 30% tax on your investment earnings, you’ve now accumulated closer to $1.8 Million.

With no inflation, you could live on $70,000/year until age 109 and die with nothing left.

But to be more realistic, we’ll factor in a 3% annual inflation. Inflation reduces your earning power each year, requiring more dollars to do the same job in the future. You’ll need a much higher annual distribution that increases each year to give you a lifestyle equivalent to $70K today. If you withdrew an inflation-adjusted $70K/year from your investment portfolio of $1.8 Million, beginning at age 65, you would run completely out of money at age 76.

Four primary factors shrink your portfolio quicker: higher inflation, higher taxes, lower returns, and portfolio losses.

For the majority of households that are mainly dependent on their own assets to pay for their lifestyle throughout their whole life, this doesn’t paint a very comforting picture.

Cash-Flow Investing

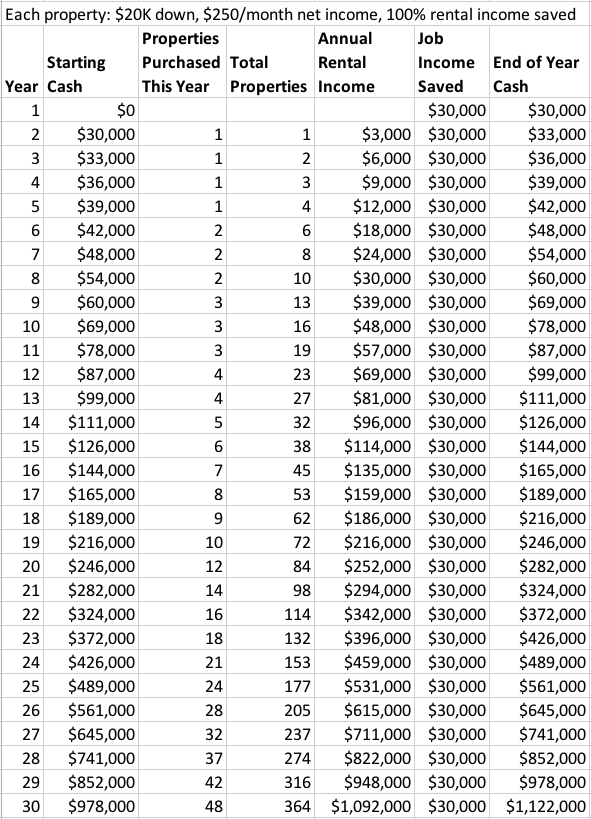

If, however, you put the $30K each year into savings. Every time you had $20K available, you purchased a $100K rental property with $20K down.

Let’s say your rental income was $1100/month, and costs (including mortgage, property taxes, insurance, and 1% for maintenance and upkeep costs, and property management) were $850/month. You’d cash flow $250/month, totaling $3000/year.

If each year, you saved all of your investment profits and continued to save the $30K from your job, you could continue buying similar properties every time you had another $20K in your savings tank. You’d build up quite a portfolio of cash-flowing assets over time.

By year 10, you’d be purchasing three properties/year, have 16 properties in total, with net rental income of $48K/year.

At year 20, you’d purchase 12 properties in a year, have 84 total properties, and over $250K in rental income per year.

By year 30, you’d purchase over 48 properties in a year, have over 350 properties, with over $1M in rental income per year.

This example assumes no equity from the properties was used for additional property purchases, which would only accelerate your acquisition rate and your cash flow.

And if you decided to quit your job 16 years in, at age 51, and stop saving the $30K/year from your job, you’d still end up with a portfolio of nearly 300 properties and over $880K in annual cash flow.

If properly structured, you’re able to minimize taxes on this income, and inflation won’t stand a chance against this accelerating asset-based income.

This income stream would have no end in sight, as it would be perpetually refreshed with new dollars every month.

Cash-Flow Investing Accelerates Financial Freedom

I realize this example is oversimplified and fails to account for numerous contingencies and costs, but it illustrates the exponential acceleration of wealth that results from the same input when you focus on increasing your cash flow.

The difference is that with accumulation, you build up a set amount of money and then you’re concerned with running out. Your path looks like a mountain. You’ve spent years making it to the top, building up your net worth, and now you have to make it back down the other side without running out of money before you run out of years.

With cash flow, you have an ever-flowing stream of new dollars. It’s like a waterwheel that keeps turning because the water from upstream keeps flowing.

Cash Flow Investing Increases Net Worth

The biggest problem with our culture’s obsession with net worth is that it can lead to broke millionaires – people who have net worth, but no income.

But net worth is not all that important. It’s more like a speedometer on the dashboard of your car. It tells you how fast you are going, but it isn’t the cause of your speed. It’s only the effect.

Cash flow is more the like the accelerator and the workings of the engine. It’s what causes wealth to happen, and as a byproduct, it also causes net worth (the speedometer) to increase.

When you have positive cash flow, you add more to savings, invest more, or pay off debt, either increasing assets or decreasing liabilities. By increasing your cash flow, you’ll increase your net worth as well.

Again, it’s always principles first, strategy second, and products last.

The PRINCIPLE here is: cash flow is the cause, and net worth is the effect.

A Closer Look at Your Financial Statements

To show you why, let’s look at the two basic financial statements that tell you about your personal economy. I want to dip your toe in the water of accounting just long enough to give you the most empowering view of your personal (and business) accounting you’ve ever seen.

- Your Balance Sheet tells you about your Net Worth. It gives you the value of your Assets and Liabilities.Assets minus Liabilities = Net Worth

- Your Income Statement tells you about your Cash Flow. It gives you the value of your Income and Expenses.Income minus Expenses = Cash Flow

Accumulation focuses on increasing your net worth. It emphasizes asset acquisition itself and prioritizes the appreciation in the value of that asset. Your asset impacts only your balance sheet.

A cash flow focus will be more concerned with the income the asset generates than with the market value of the asset.

However, if you focus on building cash flow, you’ve prioritized acquiring assets that impact both financial statements. The value of the asset goes on your balance sheet, and the positive cash flow goes on your income statement.

Additionally, in most cases, net worth only means something on paper. You could have a massive run-up in appreciation of stocks or real estate market value, but you wouldn’t lock in the gains until you sell the asset. Until then, you’re still in jeopardy of losing your appreciation if the market falls before you divest.

In Conclusion

In conclusion, we’ve defined investing as anything that requires your time, talent or treasure, with the purpose to gain something more than you put in. We’ve differentiated investing from savings, in that the main priority of investing is to create growth through cash flow or appreciation. We highlighted the two primary types of investment growth and illustrated the power of investing for cash flow to create peace, prosperity, and financial freedom.

Up Next

The next article, we discuss how to find your best investments. We will help you determine the best investments for you and give you the #1 secret strategy to lower your investment risk.

The 7-Part Saving and Investing Series

Check out the rest of the articles, podcasts, and videos in the series on saving and investing like the wealthy here:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- Saving vs. Investing: What Is Savings?

- Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

- Saving vs. Investing: What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Take Action

The starting point of investing is to determine specifically what you are trying to accomplish and why. Write out, in your own words, the goals of your investing strategy, and more importantly, why.

What were your thoughts when you read this article? Share one word in the comments section below.

If you’d like to maximize the use of your dollars and outline a saving and investing strategy that helps you meet your goals, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Why is Enough Never Enough, with Rabbi Daniel Lapin

Why is enough never enough? How do I know when you’ve made enough money, or when making money becomes too much of a concern, and you should be satisfied with what you’ve got? Joining us to discuss this abundance paradox is a long-time friend of The Money Advantage, Rabbi Daniel Lapin. Author of Thou Shall…

Read MoreSuccessful Parenting for Prosperous Families, with Dr. Lee Hausner

The glitz and glamour of the affluent world may seem highly appealing with its endless opportunities and vast resources. However, successful parenting within this context can present unique and sometimes complex challenges. This complexity stems from the need to balance comfort and indulgence with long-term development and well-being. In this episode, renowned expert Dr. Lee…

Read More