Why the Wealthy Love Cash, Part 1

Have you ever had conflicting thoughts about cash savings? You’d feel better with more savings, but you’re not really sure it’s a winning financial strategy.

Savings is pure magic. Within its seed is infinite and tremendous potential. This article will help you see and unleash the power of savings to accomplish your financial goals.

Savings is a value of the ultra-wealthy. Having savings – liquid, accessible, safe cash – is critical and relevant, even in today’s economy, even with boring returns.

But because the hard pull of the media, financial messaging, and what everyone else is doing points the opposite direction, saving often becomes snubbed and overlooked.

Savings certainly doesn’t have the most electrifying connotation, I know.

Because today’s interest rates are at an all-time low, saving money seems wasteful. It seems you’re putting your money out of commission, letting it just sit on the sidelines.

In addition, financing is cheap and easy. It quickly becomes a go-to source of capital when you don’t have cash of your own.

To top it off, it seems like investments get higher returns than savings do, and that you’ll end up ahead if you invest instead.

But, could this be only part of the story?

Podcast: Play in new window | Download (Duration: 53:42 — 49.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

Where Savings Fits into Your Cashflow Creation System

Building a stockpile of savings is to help you weather months of tight income or unforeseen expenses will move you light years ahead towards peace of mind and financial stability. But it’s just one small step of a greater journey of building time and money freedom.

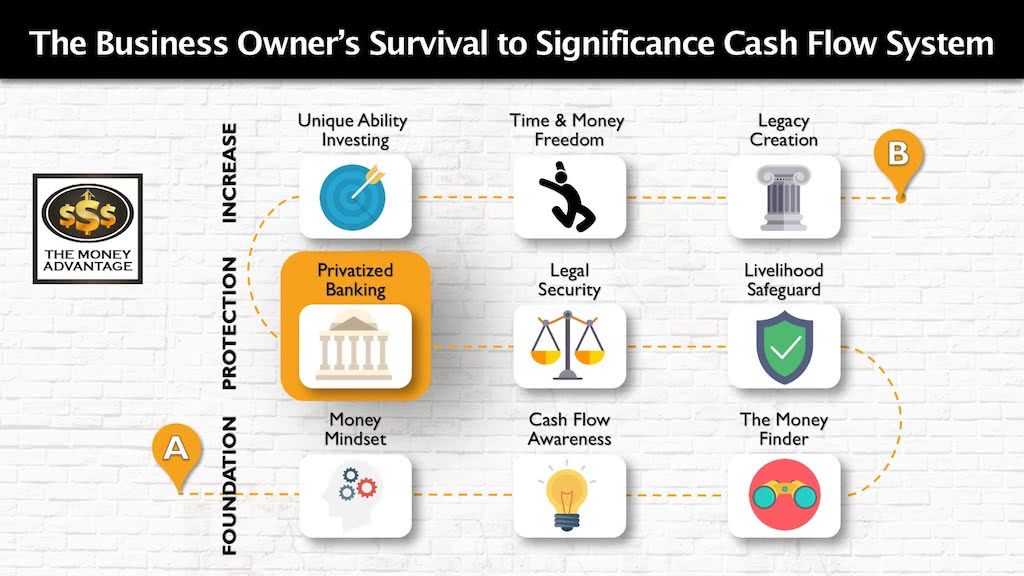

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, insurance and legal protection. Here, you’ll create the right canopy of protection in your financial life. This second stage encompasses all aspects of Privatized Banking, a key savings and capital deployment strategy that secures your access to capital, maximizing your control, by allowing you to be your own banker.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

The Big Why of Savings: It Protects Your Mindset

As we embark on this series about savings, we’ll walk through the reasons why having cash is so meaningful, from the perspective of the wealthy. It becomes apparent that they’ve thought differently than everyone who’s currently tethered to “average” status. It’s enough to take notice.

The wealthy know how to build financial wealth. But they recognize that true wealth is a richness of mind, body, spirit, and relationships. Their goal is a more fulfilling quality of life in every category of their life, today and in the future. They meticulously attend to creating a life that supports that objective.

Mental health tops the list. With confidence and peace of mind, they’re at their best. They have the most creative, relaxed, confident version of themselves to bring to the table. It allows them to use their unique abilities to create value and serve others.

They go to great lengths to protect their mindset. They value savings because it protects their peace of mind and gives them confidence for the future.

With cash, they’re poised to take advantage of future opportunities, especially during a crisis.

We’ll learn what they are doing as they prepare for the future, with an ear to the ground, listening to what is around the corner.

Definition of Savings

To make sure we’re on the same page before we dive in, let’s answer this question first: What exactly is savings? In order to really focus our discussion, it’s important to take a clear look at this first.

What intrinsically makes savings, savings?

Savings is an asset that’s easily converted to usable cash, that’s not at risk of losing value.

In contrast, investing has the potential for returns, but also the potential for loss.

What types of accounts would be classified as savings?

This could be dollar bills in a coffee can buried in the backyard, money in the bank, CDs, money market accounts, or life insurance cash value you can access.

The Litmus Test of Savings: Not Losing Value

When we say savings doesn’t lose value, let’s talk about what value means.

There’s two primary types of value: (1) account value, and (2) buying power.

Account Value: Safe vs. Risk

Account value is related to the dollar value of the account.

Say your savings account has $100,000. Tomorrow’s dollar value of that account will remain $100K, unless you put more money in, take some out, or receive growth due to interest. The dollars will remain constant.

Because the underlying assets of savings are safe, savings doesn’t lose account value. You don’t have fluctuations in a savings account value up to $120K, down to $65K, and back up to $101K, because the account guarantees your principal in terms of dollars.

If you expose your account to risk, you now have the potential to lose account value. In a stock account or mutual fund, you have a claim to a certain number of shares of a company, and your ownership may gain or lose dollar value, creating a corresponding account value change.

Savers are rewarded because they don’t lose account value.

Buying Power: The Impact of Inflation

Buying power is the number of goods or services that you can purchase with a dollar. This relates to inflation. Because there are more dollars in circulation relative to goods and services now than, say, in 1920, one dollar purchases less today. That means that everything costs more over time. Gas, bread, jeans … you get the picture.

If inflation is 3%, that means it takes 3% more dollars to purchase the same thing.

Because of this, it’s possible to have the same savings account with $100,000 today be worth less in terms of what it can buy in, say, 100 years. However, you didn’t lose account value – you still have the same number of dollars – it’s just that each dollar in that account is worth less.

When account growth doesn’t at least keep pace with inflation, savings has the ability to lose buying power over time. This loss of buying power hurts savers, because, while they’ve preserved the quantity of dollars, the dollars they have are of lesser value.

This is precisely why savings feels like an antiquated way of handling money.

It’s important to note that even if your savings doesn’t maintain its buying power, it is still relevant. Having liquid cash gives you the ability to handle emergencies and seize opportunities. It’s not the savings itself that’s of greatest value to you, but what it has the ability to produce.

Two things maximize the efficiency of your savings:

- A better place to store cash that produces growth over inflation

- Your dollars moving through assets, not just to them, doing multiple jobs, and accelerating your cash flow

We’ll address both in future articles. For now, let’s turn back to the reasons why having accessible cash will level up your personal economy.

Savings Gives You Control, Which Creates Confidence

Because savings is safe and doesn’t fluctuate sporadically, you know what to expect in the future. You know that your money will be there for you, not at risk of having vanished or shrunk due to the impulse of the market.

And those guarantees aren’t overrated. They increase your peace of mind and help you sleep better at night.

If you have no control over your financial portfolio and no control over your future, worry and anxiety undermine everything you do.

However, with certainty for the future, you are in control. You’re not beholden to the whims of something outside of you, and you can have confidence for the future.

Savings Allows You to Focus on the Right Opportunities

If you don’t have to worry about whether you have enough to pay your bills, you can focus on the right opportunities and take on the right clients for you.

Alternatively, when you’re in a position that lacks that confidence, you get desperate. You’ll make poor choices and take on clients or investments that aren’t aligned with your unique abilities.

When revenues go down, instead of sticking to core principles, businesses often add services that use up savings and take the focus away from their core business.

An Example: The Wrong Opportunities During Times of Desperation

For example, when Bruce ran his auto repair business in the early 2000’s, he lost a lot of customers due to the war in Iraq. His response was to try to not let go of any of his employees, but to build revenue by adding a service. He spent $50K of his savings for a new piece of equipment, and then he used a lot of time to train employees on the new service, using up cash reserves and time. This took the employees away from their core expertise, where they were most productive. Cash reserves, time, and energy were depleted on a peripheral venture that didn’t end up paying for itself, and he ultimately had to lay off many of his employees.

With hindsight, he would have managed his savings differently during the hard times, maintaining more of his cash in reserves. This would have bolstered his confidence, ability to pay employee salaries and to market his core business.

The lesson here is to preserve your capital, even during challenges.

Having cash during prosperous times allows you to expand and grow even further. Having cash during desperate times allows you to not to make rash decisions.

Reserves allow you to make the best decisions to create value. This is the #1 thing that will push a business forward through both prosperous and desperate times.

Capital Helps You Rebuild If You Lose Everything

The common theme among almost all stories of success is that there is usually failure and loss at some point along the way.

In case you’re not convinced, here are several well-known successes who first encountered failure:

- Albert Einstein was unable to speak until he was 4 years old or was not able to read until the age of 7. His teachers said he would never amount to anything.

- Abraham Lincoln failed 8 times to get elected to office before he ended up becoming president.

- Michael Jordan was unsuccessful in making his high school basketball team before becoming one of the greatest players ever.

- Oprah Winfrey was demoted as a News anchor because she wasn’t “fit” for television.

- Walt Disney was fired from a newspaper for “lacking imagination” and “having no original ideas.”

- The Beatles rejected by recording studios who said we don’t like their sound, they have no future in the business.

The great news is that no failure event is final. You can choose to see it as learning and feedback, make adjustments or pivots, and continue to grow.

Using a story about a gardener and his compost pile to reveal profound truths about failure, Stephen Palmer writes,

You see, nature uses death and decay to create life. All the green, vibrant, living plants you see in my garden are the direct product of death. Nature wastes nothing. She does not waste energy lamenting the death of any of her living creatures — rather, she uses every part of them to create more life. She understands that without death, there would be no life. All stages of the process are co-dependent on each other. ~ Stephen Palmer, The Compost Lesson

Being Prepared to Fail Well Allows You to Truly Succeed

We don’t want to fear failure, but to be prepared for the best and the worst of times.

Having cash reserves allows you to cross the bridge quickly from failure to learning, and on to success.

For example, in the early days, Kodak had nothing but growth. Then, the emergence of the digital era changed the industry faster than they were able to accommodate, and they didn’t have the reserves to allow them to pivot.

Being financially prepared with capital reserves allows you the financial latitude and the abundance mindset to innovate, in order to stay competitive in changing industries or markets.

Opportunity Seeks Liquidity

There are new opportunities around us all the time. Most of them lie undetected because we lack the capital to turn raw potential into something. When we have capital, we see the world differently, and every problem becomes an opportunity.

This is why cash is king. One of the grandest purposes of having capital is that it grants you the ability to seize opportunities.

No doubt, savings gives you the confidence to recover from emergencies. But if that’s as far as our vision can reach, we’ll terminate our savings habit when we’ve satisfied our rainy day fund goals.

Beyond building an emergency fund, continue building savings an opportunity fund. A reserve for opportunities holds liquid, usable cash that you can quickly deploy.

Using your reserves in cash-flowing investments gives you additional streams of income. In this way, your money works for you, so you are not dependent on only the income from your business.

In a crisis, when many assets are on sale, if you’re the one with the capital, you’ll find the greatest deals with the greatest potential and upswing.

There’s a famous quote by Baron Rothschild, who made a lot of money in the panic after the Battle of Waterloo against Napoleon when he was able to buy assets for pennies on the dollar:

Buy when there’s blood in the streets, even if the blood is your own.

If you have the capital, it serves as “dry powder” that you can initiate and explode into an opportunity.

Continue building savings so that when the right opportunity presents itself, you have the ability to seize it.

Strategies That Can Create False Confidence

Having savings is the most effective ignition switch to financial confidence. The act of savings, living on less than you earn, is the principle to achieve it.

There are other strategies that have become very popular as a means to build financial confidence. These ideals can masquerade as principles. However, if you glorify the strategy, you miss the point of the principle.

It’s like the difference between a need and a strategy to fulfill that need. Your child demands Doritos or a Snickers bar. They think they need the junk food, but their demand is their strategy to meet their need for fuel and nutrition. If you argue about the strategy, the way to fulfill the need, you’ll have a war of opinion. But if you find the need, you’ll be able to create effective strategies to meet the need.

The same is true for financial opinions. There’s no end to the “one-and-only method,” the “get-rich-quick strategy,” or the “fail-safe process.”

Instead of getting confused or misguided, grab the compass of principle. Search beyond the method to find the underlying principle that’s always true.

Remember, principles come first. Strategies come second. And strategies are not principles.

Budgeting

One of the most prevalent strategies for financial confidence is budgeting. Strict penny-pinchers glorify coupon clipping as the way to financial freedom. It’s often hailed as a sanctimonious and moral way to handle money.

While spending less of what you make today does allow you to save more, budgeting is a strategy to accomplish the goal of having capital reserves.

It’s not the strategy, but the principle behind the strategy that deserves the most attention. A frugal budget doesn’t create confidence.

While you may spend fewer of the dollars you make today, if you lost all of your income, your savings is what carries you through the crisis, not the fact that you had a great budget.

Besides, budgets are grounded in a scarcity mindset. They tell you what you can’t have, and guilt you for enjoying life.

Conversely, we advocate having a cash flow awareness – giving attention to your spending decisions so you know where the money’s going – so you can align your actions with your value system.

Becoming Debt-Free

Another strategy that’s been placed in the limelight is becoming debt-free. From this perspective, financial confidence and freedom are equivalent to having paid off debt.

However, again, the underlying objective is to create more monthly cash flow to build savings.

Paying off your debt is one potential strategy to accomplish savings. With fewer monthly payments, you’ll undoubtedly be able to save more. But what about all of the time it takes before you can begin building your own capital reserves? During that timeframe, you give up the savings you could have created by using your cash flow to pay off the loans instead.

Imagine if all your debt was paid off and you lost your source of income. You may have no outstanding loan payments to make, but you still have no cash to live on.

Because you eliminated your debt instead of building savings, you now need to get a loan to put food on the table. The first thing the bank will require is that you have capital or income to pay them back. The fact that you’ve paid off your debt is irrelevant.

With no capital and no income, you’d be declined for the loan. If you have capital or income, you can recover. But with neither, you’ve painted yourself into a corner with fewer chances of recovery.

If you eliminate debt without having a personal savings plan in play, your only option to get capital will be to take out a loan, going back into debt again.

Prioritizing building savings, rather than being debt-free will always give you more options in the future. Having capital that you control is what creates freedom and confidence, because reserves will be the net to catch you.

Present and Future Purposes in Holding Cash

When you are saving, part of that should be for 100%, no-regrets fun! Plan to be able to spend to enjoy life today, and you’re better able to live in a better state of mind with confidence and clarity.

Here are additional reasons to save:

- Taxes in the future, even if they are higher than they are today

- Inflation’s impact of reduced buying-power, needing more dollars to get the same job done

- Technological advances that are currently not even invented, but will become desirable or necessary to future quality of life

- Obsolescence, and the requirement to replace technology to remain relevant and functional

A Different End Goal for Business Owners and Entrepreneurs

The financial industry has been slow to provide relevant financial perspective for the entrepreneur with an exponential growth mindset.

Most people are not satisfied financially. At the same time, the financial actions of “most people” are not producing the results that you want for your life. So why would you model what they’re doing?

You may be a business owner who’s stunted your own growth with a typical financial mindset. In this case, you’re self-employed, operating your business as a lifestyle business to create an income stream today. You’re doing your time, and then you plan to get out, quit, sell the business, and retire.

However, if you’re entrepreneurially minded, you’re operating a living, breathing entity that’s constantly changing.

If you’re frustrated with the mismatch between typical financial advice and your goals in business, it could be time to uplevel your financial thinking.

The Savings Perspective of the Entrepreneurially-Minded

Many business owners are stuck in a scarcity mindset, putting money outside their business. They aren’t storing reserves to support them through lean times.

Most business owners who put their money into investment accounts outside their business are hoping to get 5 – 6% return. However, in almost every case, if you asked them what they would expect to earn on $100,000 investment into their business, they would say at least 15 – 20%. If you know you can produce 15 – 20% by investing in what you know and control, why would you settle for storing your own capital outside your control and hope to get 5 – 6%?

An entrepreneurial person wouldn’t put money out of their control, where they cannot use it. They would not hand it over to someone else, where they can’t access it in times of crisis without severe penalty and put it at risk of vanishing at the whim of the market.

Instead, they put money into savings so they can constantly grow the business and take advantage of opportunities.

Check your savings mindset to see where you may have the opportunity to take more control of your money.

Take Action by Writing down Your Why

Today we discussed the reasons why the wealthy value and hold cash. By working to set yourself up for long-term success, not just a quick win, you can make the same decisions.

It’s all about connecting with your why. Your why is a powerful motivator. It’s your reason to keep you committed, even during challenges and adversity.

Take a moment to reflect and write out your why.

- Why do you want to build financial freedom?

- Why are you in business?

- Why do you want to be successful?

- What is your vision for the future life you want to create?

Get a clear picture of what it would mean to you to build peace of mind and have the ability to focus on your core business, the resources to rebuild or innovate, and the liquidity to invest in opportunity.

Put this in a visible location where you see it every day or read as part of your daily success routines, and share YOUR WHY with us in the comments below.

Accelerate Your Savings

If you’re an entrepreneur that values having cash and liquidity, learn how to turn your reserves into a powerful machine. Get our 20-minute guide on Privatized Banking The Unfair Advantage.

Here’s What You Can Expect Next

In our next article, Why the Wealthy Love Cash, Part 2, we’ll share some examples of ultra-wealthy people who have shared their why behind their own personal cash stash to bring these ideas a little further out into the daylight.

- We’re going to talk through a few examples of the ultra-wealthy being comfortable being in cash, and not feeling the need to be fully invested all the time.

- We’ll discuss examples from the personal lives and financial strategy of Suze Orman and Mark Cuban, and their reasons for a strong position of safety and cash.

- We’ll point you to a bank report that the super-rich with over $30 Million in investible assets often have about 35% of their total portfolio in cash.

- And then we’ll give you a Cash Flow Awareness Exercise you can do personally. This is the same thought exercise that we use for our clients to help them think through their spending, so they can free up more surplus cash each month.

After we’ve revealed the true beauty of savings, we’ll dive into how to build savings that matter, and what action steps to take in your personal finances to make it possible. You’ll gain even more clarity on how to overcome the mental hurdles to savings: low interest, financing as a ready source of capital, and the seeming inferiority to investing.

The 7-Part Saving and Investing Series

Check out the rest of the articles, podcasts, and videos in the series on saving and investing like the wealthy here:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- Saving vs. Investing: What Is Savings?

- Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

- Saving vs. Investing: What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Create Your Time and Money Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Until then … Success leaves clues. Model the successful few, not the crowd! And build a life and business you love.

Is There a Banking Crisis? Silicon Valley Bank 2023

If you’ve paid any attention to the news recently, then you’ve probably heard about what’s happening with the Silicon Valley Bank. The news isn’t good, and it’s probably raising some questions. We’re here to unpack what you might be thinking about. Like, are we entering a banking crisis, and what does this mean for the…

Read MorePersonal Finance for Beginners

Here’s a listener question about personal finance for beginners: “What is the foundation or the starting point of wealth building? What are the core things I would want in place to start building wealth?” You might be asking the same question. Do you have savings you want to do something with? Are you wondering if…

Read More