Saving vs. Investing: What Is Investing? Part 2 – How to Find Your Best Investments

In a sea of investment choices, it can be overwhelming to determine which are the best investments for you. But don’t let overwhelm keep you in the dark, procrastinating, making mediocre decisions, losing money, and perpetually frustrated.

The first step to confident investing is having a clear picture of exactly what you want and WHY. Knowing what you want allows you to set goals that will advance you towards your destination and measure your progress. Secondly, prepare. Next, you need to be armed with the tools to identify opportunities that match. Finally, you implement, measure progress, and repeat.

- Define success

- Prepare

- Identify opportunities that match

- Implement

- Measure progress

- Rinse and repeat

Podcast: Play in new window | Download (Duration: 38:12 — 35.0MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

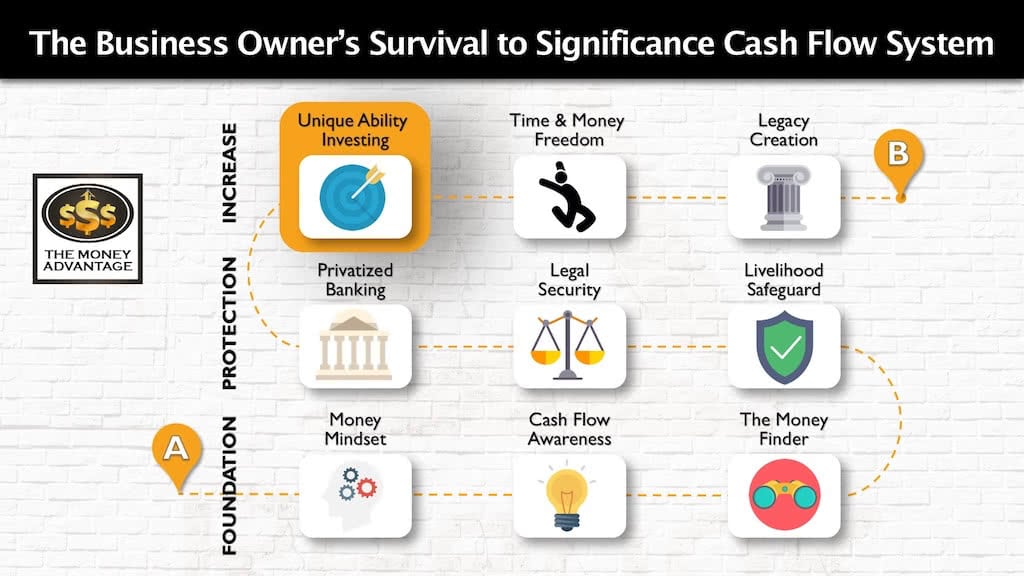

Where Investing Fits into the Cash Flow System

In the Cash Flow System, you first keep more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

In the last article, Saving vs. Investing: What is Investing? Part 1 – Cash Flow, we’ve illustrated the power of cash flow in creating financial freedom.

Before that, we discussed the preparation of habitual saving that allows you to build usable capital.

Today, we’ll help you select your opportunities by answering:

- How do I determine the best investments for me?

- How do I minimize risk?

We’ll help you determine investment options for you by showing you that the answer lies in the most unexpected place.

And then we’ll give you the #1 secret to lowering your investment risk.

How Do I Determine the Best Investments for Me?

Now that you have a vision for what you want your investments to do, let’s go shopping. How do you figure out what the best investment options are?

Asset Categories

Instead of narrowing down your choices, we first need to expand the options. Unfortunately, what you’re typically offered is like seeing the appetizer menu only, when there’s a full range of salad, soup, entrée, dessert, and cocktail menus to choose from.

While you may have been led to believe that your options are all housed in the stock market, the world of investing is much broader.

There are four main asset categories to choose from:

- Paper Assets

- Commodities

- Real Estate

- Business

Paper Assets

Paper assets include stocks, bonds, mutual funds, options, savings accounts, and the forex market.

Within this category are equities (stocks), fixed income assets (bonds), and cash equivalents that include money market accounts.

Often, paper assets are wrapped into a basket of mutual funds with various risk levels.

There are many ways to invest in the stock market, including using a broker or through an individual brokerage account. Strategies range from buy-and-hold, to options trading with puts and calls.

Commodities

Commodities are real, hard assets like gold, silver, crude oil, wheat, cattle, coffee, etc. They are the tangible, physical asset itself. Owning commodities is different than trading the futures market for these commodities, which would be classified as a paper asset.

Real Estate

Real estate is a tangible, hard asset of land and buildings. It includes rental real estate, wholesaling, or fixing up to “flip.” Property may be residential single-family homes, multi-family, or commercial real estate.

Business

You can invest by owning a business, franchise ownership, running the business, being on a board of directors, providing your time, or loaning people money.

Now that we’ve widened the universe of investing, let’s hone in on the selection criteria for where you put your money.

To do that, we need to start with the right perspective. This can best be illustrated with a story.

The Tale of Two Investors

The Frustrated Investor

Jordan woke up and read the news over his cup of coffee. Stocks expected to rally over a change of ownership. At least it was hopeful.

From his phone, he checked his portfolio, hoping to see something different than yesterday’s downward spiral that had left him sleepless for most of the night.

He internally debated, calculating the probability of a rebound. Could he recover his losses and make it worthwhile? Should he get out before he lost more?

The rest of his portfolio continued to soar with the recent gains in the market, but was it likely to continue? Would it be enough to compensate for his other losses? Should he expect the overall upward trend to continue?

He put down his coffee with a sigh. “Shoulda got out,” he muttered under his breath, resigning himself to the knot of helplessness in his stomach.

Before yesterday, he’d had record-breaking gains. He’d stayed in, hoping to cap out a little higher before pulling out. But yesterday’s devastating losses insulted his intelligence and erased that option.

Today, he considered getting out altogether and cutting the losses.

The Actualized Investor

Jim arose early enough to catch a 4 am call from his business partner, who was flying to the Japanese headquarters for a conversation to finalize the acquisition of a supplier.

He was watching the investment of his time and medical software knowledge flourish, as the company was growing by leaps and bounds. The company was more focused than ever before, now that he had clearly articulated its value of improving the quality of life for physical therapy patients.

Because he was up early, it left him more time to think and prepare before starting his day. He had just hired a top software developer to implement the capabilities of new technology for tracking in-home progress between therapy appointments. Because of the expanded capabilities, he’d closed a contract with an international medical device company that would place his tracker in hospitals and physical therapy clinics across the globe. He devoured a whole book on mission-driven hiring and was bursting with anticipation to initiate the talent search for three new key management positions, just as he noticed the sun coming up.

Two Views of Investing

Poor investing results stem from a fundamental misunderstanding of what investments are.

External Investing Is About Picking

Jordan illustrates the widely accepted, but incorrect assumption that investments are external, something apart from us. From this viewpoint our primary interaction is the mathematical and statistical analysis of a concrete financial proposition. It’s a product with clearly defined hard edges that is somewhere out there, separate from us. From this vantage point, good investing is about good math sense and probabilities.

For this person, it’s all about how to choose winners. They think that if they just pick correctly, they’ll win.

It’s not at all unlike betting on a racehorse before a race. You study past performance, make a good guess before you know the outcome, and then watch with baited breath to see how accurate your prediction was.

Internal Investing Is About Being the Person Who Invests Well

However, investing that actualizes your potential and moves you towards financial freedom is internal. When you understand the composition and construction of an investment, you’ll realize that it is much more personal and quite literally, a part of us. This was Jim’s perspective. He understood that successful investing is an outflow of the person. As such, it’s much more than picking well. It’s about being the person who invests well.

The internal view is the least expected, but the most important key to determining what is best for you. It’s what gives the successful their competitive advantage. And with it, you can recognize the unpardonable sin of investing and run with confidence in the opposite direction.

What Investments Are

Usually, people look at investments at an arm’s length. If you’re going to be a person who invests well, you need to understand what it is that you do when you invest. To do that, let’s get up close and personal and take an inside look at the anatomy of your relationship with an investment.

What Is the Value Proposition?

At the heart of all financial transactions, lies the wealth principle,

This is just as true of investments as it is for making money in your job. All financial gains – compensation, returns, dividends, interest, appreciation, and cash flow – result from creating value. Money is always connected in some way to value.

That’s the piece that external investing misses. It places a fault line through the middle of that principle and divorces dollars from value. It evaluates an investment on financial merit alone, without considering the people on both sides of the investment transaction who are giving and receiving value.

To earn a return, you must provide value.

If you are providing the investment, you must recognize the needs and problems to solve, and you must be the kind of person qualified to solve them.

If you’re putting up the capital for an investment, you need to understand the value proposition of the opportunity.

This reveals two of the most hidden, but crucial truths:

- Investing is about people

- You are your own best investment

Investing Is About People

Behind every investment are real people with real needs. There’s always an end user of the investment, there’s the investor themselves, and there may be an investment provider or company, all of whom have needs. Investing is about meeting those needs.

If you invest in real estate, the property is not the investment. The people who rent or buy the property are the investment. You may be providing housing to people who are transitioning to an area for jobs, those who are downsizing to lower their cost of living, or to high income-earners who want to live in a luxurious community of like-minded neighbors and have ample space for entertaining.

Investing in organic coffee may provide workers with a sustainable working environment, and coffee-drinkers with more conscientious choices.

With any investment, there’s a human with a need that you can solve. The financial products are just a tool to exchange value. Rates of return are the thank you note certifying that value was exchanged, and somehow, someone’s life has been enriched or improved.

Recognizing the value transaction at the heart of all investments places people and relationships in the center of all investments.

You Are Your Own Best Investment

If you earn a return by providing value and solving people’s needs, then you increase your returns by solving more people’s needs better or faster.

For instance, if a company provides customized leadership training to C-level executives of Fortune 500 companies, they could increase returns by expanding into new territories, adding additional clients, or improving the efficiency of the training experience for existing clients.

How do they increase production or client acquisition, or elevate the efficiency of their current offering? They must increase their abilities internally by investing in building their knowledge and skills. This could mean moving training to an online platform instead of relying on a physical trainer’s presence or providing training for their sales team.

Just like that company, you are the bottleneck on your investment returns. Your returns are directly limited by your knowledge and abilities.

By expanding yourself and the value you create for others, you expand your returns.

The PRINCIPLE is this: YOU are your greatest investment.

Therefore, your most productive investment with the greatest potential for exponential returns is YOU.

You invest in yourself by taking the time to discover, deep down, your unique ability, and by expanding your skill set to deliver more value.

Your Greatest Value: Your Unique Ability

The great news is that there’s not some infinite, insurmountable volume of knowledge and skill you must add before you’re qualified. Far to the contrary.

You have an inborn set of strengths and abilities that are uniquely your own. They make up your unique ability.

This is the place where you shine, without even trying.

Maybe you recognize your ability to communicate and sell as your core superpower that solves problems for people. This is your unique ability, your personal leverage point. Any time you spend working in or developing this skill further will magnify your results. Investing in yourself may be spending more of your time communicating and selling, as well as reading and listening to great speakers. This allows you to sharpen your skill, translating to greater impact, and greater income to you.

Discovering and leveraging your unique ability will expand your impact and your returns exponentially. It’s a process that all the greats have given time and attention to. It may take weeks, months, or years to understand who you really are. I’d recommend the Kolbe test, The Fascination Advantage, CliftonStrengths Assessment, and Dan Sullivan’s Unique Ability 2.0, along with this fascinating article from Early To Rise on why it’s important.

The Formula for Financial Success

At the crux of finding your best investments are self-awareness, expanded mental capacity, value creation, and participation in the betterment of humanity.

Value people. Expand yourself. Beyond any other strategy, these two things will advance your ability to invest well.

When we plug these two truths together, here’s the wealth-building formula that emerges:

Relationship Capital X Mental Capital = Financial Capital

By focusing on serving and providing value to people, you bolster your relationship capital.

By expanding an abundance mindset to recognize new possibilities, digging deep to discover your unique abilities, mastering your craft and developing new skill sets, you improve your mental capital.

Together, these keys expand your ability to achieve your goals.

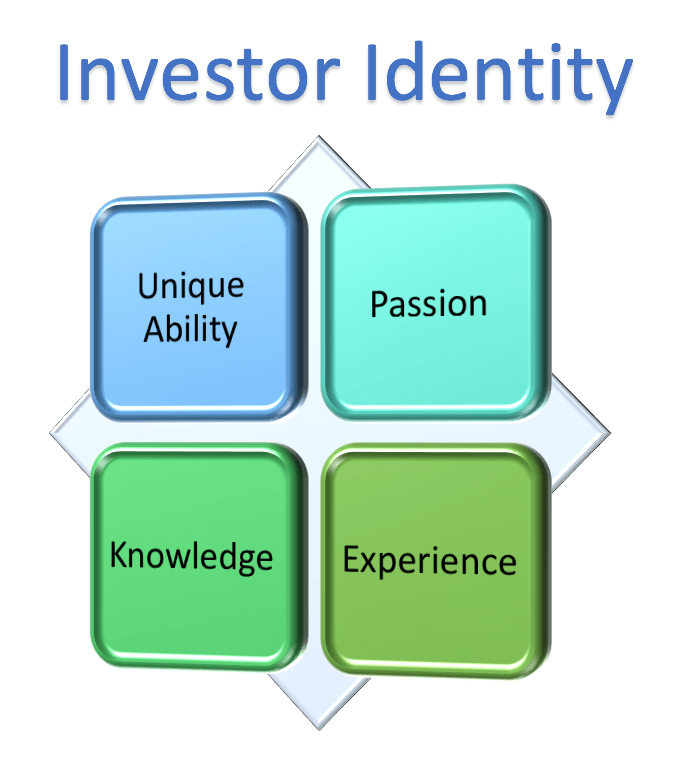

The Magic Ticket: Investor Identity

When you’re ready to invest in opportunities outside of yourself, using your investor identity as your selection criteria will point you to the investment options that maximize your results.

Here’s how it works. Your investor identity is made up of your unique ability, passion, knowledge, and experience. Your sweet spot is where all of these key elements are strongest. Ideally, you want to invest where you have the greatest passion, the greatest knowledge, the most experience, in opportunities most aligned with your unique ability.

“The trick in investing is just to sit there and watch pitch after pitch

Warren Buffetgo by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!, ‘ ignore them.”

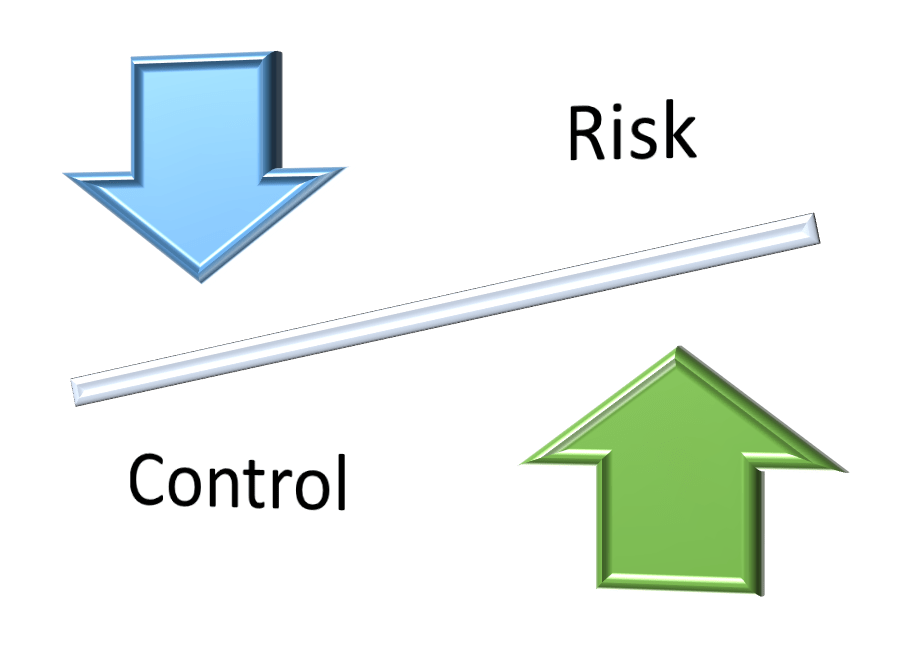

The #1 Secret to Lowering Investment Risk

While investments inherently carry risk, and many people believe that higher risk equals a higher reward, you don’t have to accept that losing money is just a part of investing.

Your goal is to minimize the risk of loss as much as possible.

As you increase each of the elements of your investor identity, you maximize your control over the outcome.

Control and risk have an inverse relationship. Risk comes from the lack of control. And when you have the greatest control, you have the least amount of risk.

The PRINCIPLE is this: Invest, simply, in what you know and can control.

Active vs. Passive Investing

Your best investments are the ones that maximize all four elements of your investor identity, thereby expanding your control.

If you see only the external components of the deal, you’re a passive investor who must rely on the judgment of fund managers, stockbrokers, and retirement planners to pick well. Because of this, you end up in a position where you lack control over the outcome of.

Instead, by giving attention to the internal elements of investing, you take the role of an active investor who proactively assesses how well an opportunity matches your strengths. You vet your deals, doing your own due diligence, and select the ones that meet your criteria. When you have the most knowledge, passion, and understanding of the value proposition, you have a greater degree of control in the investment. This gives you a strategic advantage that increases your returns and lowers your risk.

Your Second-Best Investment

Your second greatest investment is your business.

It’s where you’ve developed your expertise and created the ability to serve people and provide value. It’s an outflow of your unique ability. And it’s the one thing, outside of yourself, that you have the most control over.

Investing Outside Your Experience

When you consider the asset classes, along with the infinite ways to provide value to people, the investment opportunities are literally endless. Your investor identity is your true north, revealing what will maximize your returns and minimize your risk.

Your investor identity is continually evolving. You’ll develop and refine it as you gain experience.

Sometimes you will need to rely on the knowledge and control of someone who has more experience.

A successful business owner of an IT company may have invested well in themselves and their business, and now desire to expand into rental real estate. Instead of spending time and energy learning a new industry, they may want to invest with a professional real estate company that has the knowledge and experience. You may give up some control to branch out into a new asset class. However, they can increase their control by having an excellent grasp on the value proposition of the deal before moving forward.

Focus vs. Diversification

Most people diversify to protect themselves against losses.

Warren Buffett says this instead:

Diversification is protection against ignorance. – Warren Buffett

All that asset management, diversification, that’s for idiots. You can’t diversify enough to know what you’re doing. ~ Mark Cuban

Without the knowledge of investor identity, people are relegated to the role of passive investors who have to spread out their bets in case their guesses fail. Ironically, when most people talk about diversification, they mean to spread your investments across various risk levels within one asset class. They’re still packing all their bets within the paper asset space and opening themselves up to systemic risk.

However, the successful gain traction by focusing on their areas of strength, not diversifying.

When you’ve zeroed in on your investor identity and you know what your ideal investments look like, you’re equipped with the tools of an active investor. This allows you to target your resources in investments where you have the most control.

To hedge against systemic risk, you would want to diversify across asset classes, for example, holding real estate, businesses, and commodities.

Best Investments Thinking Exercise

Ask yourself these questions to help you make fruitful investment decisions:

Passion

- Other than monetary return, why would I invest in this opportunity?

- Is it something I care about that’s meaningful to me?

- How is it connected to my passion, mission, and values?

- How can I use my unique ability to increase the value?

Knowledge

- How well do I understand this investment?

- Do I have experience that informs my decision-making?

- If not, am I passionate enough to commit the time and attention to develop my knowledge in this area?

Understand the Value Proposition

- Who is providing value? Do you know them? How well do they know the investment? Do they have experience creating results?

- Who is receiving value?

- What is the need being met or the problem being solved? How?

Control

- Do I have control over the outcome of this investment?

- Do I have the ability to make it produce more?

- If something goes wrong, do I have the ability to turn it around or make it better?

- What is my exit strategy?

Cash Flow

- Does this investment provide me with cash flow income?

- Is this the best use of my capital?

The Unpardonable Sin of Investing

By now, you can see what a cheap and ineffective shortcut it is to analyze investments like racehorses.

Inadvertently, because of the external view of investments, most people commit the unpardonable sin of investing: copying.

If investments are about choosing best, I can copy the best “chooser’s” choices, and get their outcomes.

However, copying is snubbed across all disciplines. In art, it’s a replica. With a signature, it’s a forgery. In writing, plagiarism. Botany, artificial. In the mirror, the reflection. In theater, acting or impersonation.

Copying elevates the object over the author or the investment over the person. In truth, it’s the person that makes or breaks the investment, not the other way around.

Copying creates a disadvantage that we can never recover from. It causes us to us to miss the real value in ourselves and prevents us from developing our own original, which is the secret sauce for selecting your best investments.

When you value yourself, you’ll develop your potential and create your own original masterpiece.

This is why investing is internal. You must first understand yourself and how you create value. Then you must put yourself like the key into the ignition of a car to turn it on. You are the catalyst, the prime ingredient. Without you, your knowledge, and your value, the opportunity is just another person’s wish that something would be better.

In Conclusion

In conclusion, we’ve expanded the options for investing to include paper assets, commodities, real estate, and business. We revealed that the secret to finding the right opportunities lies within you and that your top two investments are yourself and your business. We’ve illustrated using the four elements of your investor identity, passion, knowledge, understanding the value proposition, and control to minimize risk by investing in what you know and control. And we discussed the unpardonable sin of investing: ignoring your investor identity and copying the investment picks of someone else.

How Investing and Saving Work Together

Saving and investing well is crucial to the health of your personal economy.

Build the discipline of saving where your capital has safety, liquidity, and growth.

Stay in cash until you find the best investments that resonate with your investor identity, and then use your capital to invest in what you know and can control.

When you generate income from your investments, use it to replenish and build your capital available to invest.

In this way, you accelerate financial freedom.

Take Action

Think through your unique ability. What are you great at? How can you invest in yourself to develop your skillset to provide more value to more people? Invest in discovering your unique ability.

Use the Investor Identity Thinking Exercise to evaluate your next opportunity.

What is providing you passive income right now? How can you invest in that, so you are more valuable?

What do you have the most knowledge or are willing to dedicate the time to develop the knowledge?

Share your thoughts with us in the comments below. How your perspective has been enhanced, expanded, or challenged?

The 7-Part Series

Check out the rest of the articles, podcasts, and videos in the series here:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- What Is Savings?

- What Is Investing? Part 1 – Cash Flow

- What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Create Your Time and Money Freedom

If you’d like to maximize the use of your dollars and outline a strategy that helps you meet your goals, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Until then … Success leaves clues. Model the successful few, not the crowd! And build a life and business you love.

Stop the Hustle and Grind, with Christine Jewell

Are you an ultra-high achiever, but feeling the cost of that success? Christine Jewell, author, keynote speaker, faith-based executive coach, and host of the Breaking Chains podcast, joins us today to provide a fresh solution. In her new book, Drop the Armor, Christine teaches you a transformational approach that allows you to stop the hustle…

Read MoreWhy is Enough Never Enough, with Rabbi Daniel Lapin

Why is enough never enough? How do I know when you’ve made enough money, or when making money becomes too much of a concern, and you should be satisfied with what you’ve got? Joining us to discuss this abundance paradox is a long-time friend of The Money Advantage, Rabbi Daniel Lapin. Author of Thou Shall…

Read More