Diversification Is Ignorance Protection

Diversification is typical financial planning advice that average investors use to protect themselves from losses. Simply put, diversification is ignorance protection. It is admitting that you don’t know what you are doing.

It is common to think of investing and the stock market as one and the same. However, investing encompasses much more than just the stock market. There are four main asset classes:

- Paper Assets: stocks, bonds, savings, the forex market, etc.

- Commodities: crude oil, gold, silver, wheat, etc.

- Property: rental real estate, fix and flip, etc.

- Business: owning a business, angel investor, etc.

Let’s step back and think more broadly about the big picture of investing. How can we best put our dollars to work to create more for us?

Where Investing Fits into the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

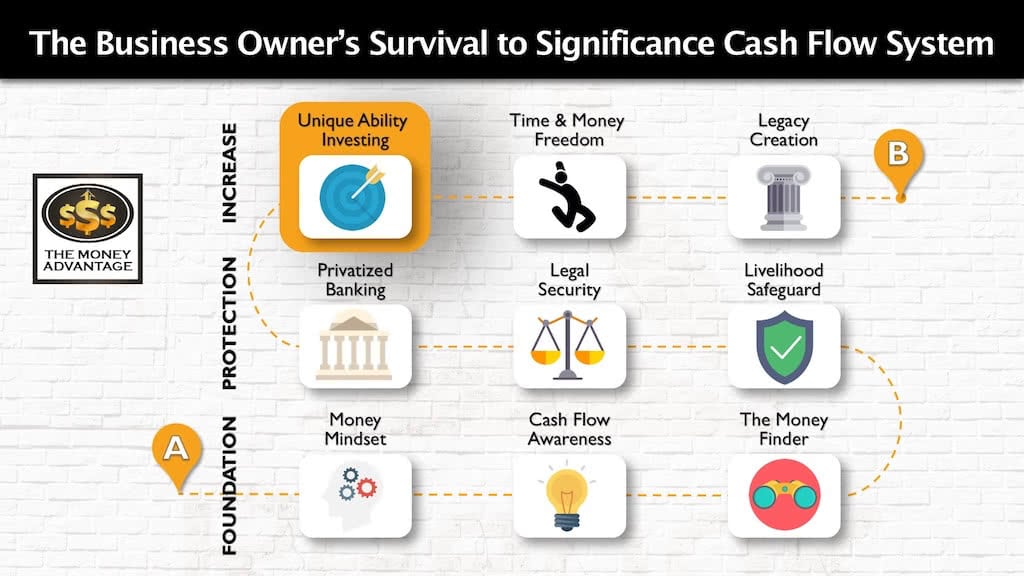

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Diversification Is Ignorance Protection

Most people diversify because they don’t know what’s going to work out. When most people talk about diversification, they mean spread your investments within the stock market. You pack all your bets within the paper asset space, leaving yourself open to systemic risk. Diversification is admitting that you’re going to lose money in some of your investments.

Successful investors like Warren Buffet do not diversify in this way. Instead, they focus on investing in companies that they understand and influence.

Diversification is protection against ignorance. It makes little sense if you know what you are doing. – Warren Buffet

All that asset management, diversification, that’s for idiots. You can’t diversify enough to know what you’re doing. – Mark Cuban

You see, diversification for the sake of diversification is ignorance protection. So it’s not just buying a basket of stocks and diversifying your risk across a stock portfolio. If you want to model the wealthy, it’s really about saying, how do I increase my knowledge, control, and focus?

What we want to do is focus on developing our investor identity, so we’re able to invest intentionally. It is this intentional focus that leads to our best investments, rather than spreading out our investment dollars and hoping that something works out.

When you’re focused with knowledge and control, you’re more likely to be successful.

Instead of diversifying, focus on what you know and control.

Create Your Time and Money Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreNon-Food Franchising, with Jon Ostenson

Are you looking for good investment opportunities to put your capital to work? Have you considered franchising as an opportunity for business ownership without starting a company from scratch? Today, we’re talking with Jon Ostenson, a top 1% Franchise Consultant, former Inc. 500 Franchise President and Multi-Brand Franchisee, and author of “Non-Food Franchising.” So if…

Read More