Save Automatically & Invest Intentionally

Often when we put money automatically into retirement plans, things like 401ks, 403bs, this is usually through a payroll deduction from an employer. This is commonly referred to as ‘saving for retirement.’ However, this is investing because that money is often at risk in the stock market, and can lose value. It’s time to save automatically & invest intentionally.

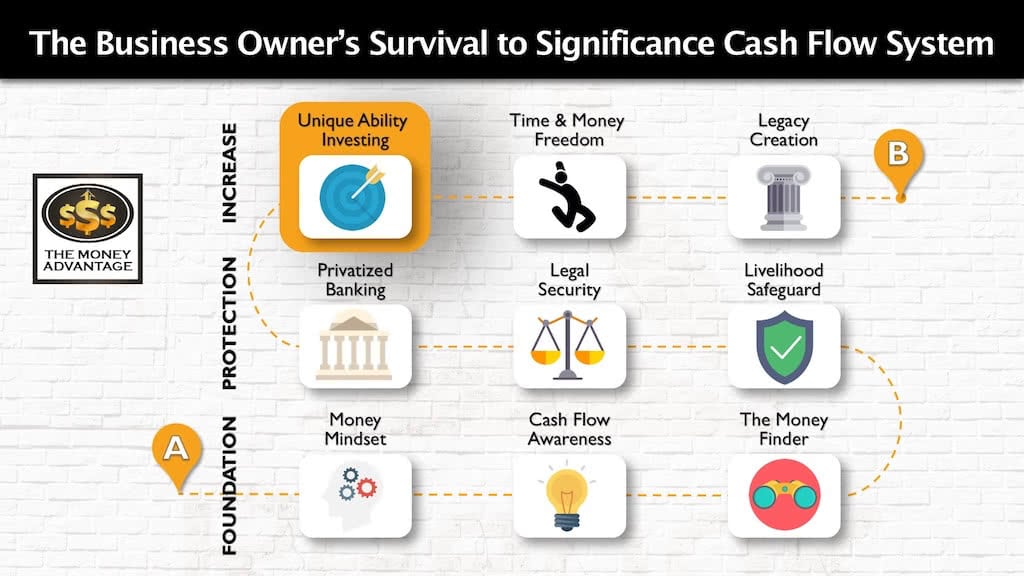

Where Investing Intentionally Fits into the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Average Investors Invest Automatically & Save What Is Left

Often, inadvertently, we end up investing automatically, without forethought, and then we save if there happens to be money left over at the end.

The wealthy do the complete opposite. They invest intentionally with a specific focus on investments that meet their criteria:

- Minimum investment amount

- Investments where they have control and influence

- Investments within their sphere of knowledge

They want to make sure their investments are aligned with their specific investor DNA.

Before investing intentionally they’re saving automatically. They have a rule built into their life that a part of all that they earn is theirs to keep. They are living on less than they earn. The way to do that is to put an automatic process in your life, just the same way a payroll deduction works. You can do this with an automatic transfer in your bank accounts. Have an automatic transfer every month that comes off the top before you spend anything. So you have from checking an automatic transfer over into savings.

This makes sure that you are automatically saving every month. First build up savings – liquid, available, usable cash that’s safe and in your control. Then you can make the decision: how do I want to use this to invest intentionally in opportunities that I know and I control?

The Wealthy Save Automatically & Invest Intentionally

Instead of investing automatically and putting money at risk and then saving if you get around to it, change that around, reverse the role and save automatically so you don’t have to apply your consciousness. It’s not wasting energy and mental processes in your mind. It automatically happens.

And then, use your mental energy to determine what are the best investments for you. Not just what is an investment that might happen to work out. But what are my best investments?

Create Your Time and Money Freedom

Do you want to begin building capital, putting it to work, and accelerating Time and Money Freedom? To find out the one thing you should be doing to increase your cash flow by keeping more of the money you make, contact us today.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreIs There a Banking Crisis? Silicon Valley Bank 2023

If you’ve paid any attention to the news recently, then you’ve probably heard about what’s happening with the Silicon Valley Bank. The news isn’t good, and it’s probably raising some questions. We’re here to unpack what you might be thinking about. Like, are we entering a banking crisis, and what does this mean for the…

Read More