How to Save Like the Wealthy

If you want to seize opportunities like the wealthy, you will need to learn how to save money like the wealthy.

Building a financial system is a lot like barrel racing.

Far away from the roar of audiences, the outcome of the race is determined by the hours of preparation and conditioning spent outside the ring, out of the public eye, before the race.

Likewise, in building true wealth, developing a savings plan is the preparation and conditioning it takes to succeed.

Podcast: Play in new window | Download (Duration: 38:43 — 35.5MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

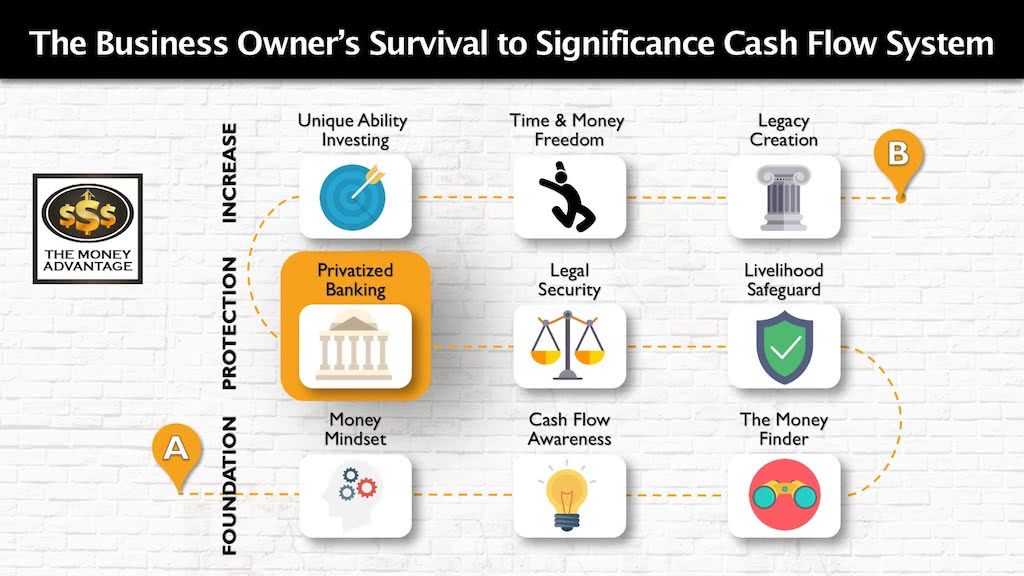

Where Savings Fits into Your Cashflow Creation System

Building reserves helps you weather months of tight income or unforeseen expenses, and will move you light years ahead towards peace of mind and financial stability. But it’s just one small step of a greater journey of building financial freedom.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cashflow awareness, and restructuring how you save money so you can access it as an emergency/opportunity fund. This step frees up and increases your cashflow, so you can save, and then use the extra cash to take advantage of opportunities.

Then, you’ll protect yourself with insurance and legal protection. Here, you’ll create the right canopy of protection in your financial life. This second stage encompasses all aspects of the Infinite Banking Concept, a key cashflow strategy that secures your access to capital, maximizing your control, by allowing you to be your own banker.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build freedom and leave a rich legacy.

Everything I Needed to Know I Learned from Equestrian Barrel Racing

As a teen, I rode horses. I got into competitive racing in speed and agility games like barrel racing, pole weaving, and keyhole.

Just about everything I needed to know about life, I learned from the process of training to win in the ring.

Where Winning HAPPENS

The climax of barrel racing was the high-adrenaline, crowd-cheering, dirt-flying 28 seconds careening around the cloverleaf pattern of the barrel racing course. Or it was the 11 seconds spent in the ring flashing through the pole-weaving course.

I lived for that part. The moment of truth. It’s where the winning happened.

From a spectator’s vantage point, it would be so easy to think it was the only part that mattered.

Where Winning Is CREATED

However, far more critical to the outcome were the hours upon hours of training and preparation.

To perform well, conditioning was essential.

There were warm-ups and cool-downs at a brisk trot. We raced for miles upon miles across varied terrain to build endurance and stamina. There were hundreds of hours of rides through the fields and forests, on trails, through swamps, and over fallen logs as we built agility and light-footedness.

We took hundreds of practice runs at all paces, focusing on the fundamentals. There were lurching starts, and sliding stops at the gentle flick of a wrist. We practiced lead changes at a light pace with slight shift of weight.

We worked over and over on exactly the right lead changes at the exactly the right moment, leaning into the turns at exactly the right point in the turn with exactly the right angles. My horse and I learned to pay attention to the littlest things in order to be in tune with each other, listening, dancing.

Precision. Endurance. Agility. Speed. Conditioning was the make-or-break of racing.

Need I mention the even lesser-applauded routines like feeding, grooming, doctoring, and barn cleaning? Compared to the competition? Boring. No audience. No cheering crowds. No timers or metrics.

The point? If you focus just on the flashy event, you’ll miss all the components that make up the win: the preparation, the conditioning, and the set-up.

Winning Is in the Fundamentals and Conditioning, Not the Climax

But this is where the ability to win was built: in the fundamentals.

Many people put off the boring stuff of saving money now, thinking they need a windfall or higher income first.

Having a systematic way to save in your personal economy is what sets you up to win in the first place.

A disciplined, consistent, routine way of handling your money that perpetually builds savings is the preparation and conditioning required to create wealth.

The truly wealthy have a definitive WHY. They’ve developed their financial philosophy and rules. They concentrate on and value the preparation and conditioning, rather than the singular event.

They make the preparation the main thing.

Your Savings System

The habit and discipline of money-saving is financial conditioning that prepares you and creates the ability to win.

Without preparation, you shoot yourself in the foot. When the opportunity comes knocking, you’ll have to pass because you don’t have the money.

In Why the Wealthy Love Cash, Part 1, we revealed the most important reasons to have a significant buffer. When you have a considerable emergency/opportunity fund, you’re confident and secure. You sleep better at night, knowing that you’re safe even if unexpected expenses, like a broken water heater or a dip in income come around the corner fast. And, you have the cash to be able to jump at the best opportunities first.

Here, we’ll discuss how to start saving that you can use.

Let’s dive into how to design the most efficient system for managing your cashflow that automatically and systematically builds capital in a way that works for you.

We’ll start with the critical hurdle you’ll need to overcome to save money, and then bring it down to the strategy level to show you how to implement it in your own life. We’ll guide you through the actual steps, what it looks like in real life with the flow of your money through your accounts.

Why Most People Never Save Money

To win in barrel racing, you have to avoid disqualification like missing a barrel in the pattern.

In wealth-building, many people disqualify themselves before they even start.

The primary reason people don’t save money is that they spend all of their money, and there’s nothing left over to keep. Because of Parkinson’s Law, you spend every available dollar.

If you think you need to get a raise or start making more money to save, think again!

There’s always a corresponding increase in lifestyle spending that comes along with the rise in your pay. As soon as you make that $50K more, you’ll have already mentally spent it, and there will still be nothing left to save.

Whatever your current income, you’re accustomed to living at that level, and everything you purchase becomes necessary to your lifestyle.

This law is the reason why people who get a raise, wake up the next day feeling just as strapped as before.

Parkinson’s Law disqualifies most people before they even get started with saving.

Overcome Parkinson’s Law by Living on Less Than You Earn, Starting Today

If you want to save money, you must overcome this natural human tendency to consume everything we make.

The way to overcome it is to start now, spend less than you earn, and committing to pay yourself first.

The Role and Function of Savings For You and Your Family

The first HOW of savings is to get clear on the purpose of the dollars saved and set your savings goals.

You want your savings to be dollars that are safe, liquid and growing.

Savings is a portion of your personal economy that is accessible because you need the freedom to be able to tap those resources for two purposes:

- Emergencies – unforeseen expenses or a dip in income that require you to use other resources than your monthly paycheck. While they are unexpected, setting a process for handling emergencies allows you to be free from worry and anxiety when they do arise.

- Opportunities – an investment or chance to put your dollars to work where they will provide value to you or others, and you’ll receive compensation as a result. The best opportunities are where you have maximum knowledge and control over the opportunity and its performance.

In either case, having cash available to use frees you and your family to be able to make better decisions when the time comes.

A Simple 5-Step Strategy to Save More Money

These 5 steps are the most important money-saving tips for saving money and reaching your long term goals.

How to start saving money and start paying yourself first in 5 easy steps!

Cash Flow Awareness

Some people call this a budget but we prefer to call it a spending plan. Decide what is most important to you. Spend money on those things.

Keep track of your money and your expenditures. You can use a program like Mint.com, or just review your online bank statements at the end of each month.

Review your spending habits in each category, like an observer, not a judge.

Observe your trends to see how much money and where it’s going each month. Make sure you analyze everything and look at things like student loans, grocery shopping, online shopping, credit card debt, home costs, energy costs, cell phone, etc.

Just being aware of where your money is going allows you more freedom to make decisions that are aligned with your value system.

Determine Your Cashflow

The point of cashflow awareness is to free up money you could save each month.

Look for things that you don’t use or can use less of like streaming services or a gym membership. Additionally, look for spending that is not serving you like credit cards, trips to the movie theater, etc.

After you’re aware of your average monthly outflows, adjust your spending to give yourself a gap between income and expenses.

This difference is your monthly cashflow.

Income – Expenses = CASHFLOW

Cashflow can also be called, surplus or profit.

Start with what’s comfortable now. A great savings goal is to work up to saving at least 20 – 30% of your monthly income. Start saving 5% or 10% today, take action, and continue to adjust and ratchet it up where you can.

Pay Yourself First

Put your monthly surplus into savings. If we adjusted the equation to be more direct, it would look like this:

Income – Expenses = SAVINGS

Warren Buffet said,

Do not save what is left after spending, but spend what is left after saving. – Warren Buffett

Rather than spending first, and then saving money with what might be leftover at the end of the month, turn the equation upside-down.

Set your savings amount first and use this equation:

Income – SAVINGS = Expenses

Save money off the top first, and then spend the rest, guilt-free.

Save on Autopilot with a Sweep Account

Next, we want to eliminate the barriers that make savings something that might happen, if we remember. Remove the mental energy required to maintain the habit by setting up an automatic transfer from your checking account to a savings account at the beginning of the month. Start with the amount you can reasonably save today.

We’ll call this savings account a Sweep Account.

Ideally, you’d have at least 20 – 30% of your paycheck on auto-transfer to your Sweep Account per month.

This auto-transfer will automatically go to savings every month before you spend anything.

Treat it like a required bill, paid to yourself.

It has to be easy to get the money into the account in the first place, so you’ve eliminated the first hurdle.

Ideally, it’s also easy to get the money out, because it’s your first line of defense if you don’t have the cash in your everyday checking account to cover an unexpected expense. Once the money is in the Sweep Account, use it only for true emergencies outside your usual monthly spending and for opportunities to make more money.

If you’re prioritizing your future financial stability, paying yourself is your top priority.

Increase Your Net Investible Income

When you save, you’re setting aside for emergencies AND opportunities. Once you’ve filled up your emergency fund, your savings over and above that amount is the portion able to be invested.

If you have a target percentage of your monthly income dedicated to saving money first, you’ll save more as your pay increases.

If you hold the percentage steady, you’ll watch your net investible income rise over time. As your overall income increases, you’ll have a higher dollar amount going into savings that you can use for opportunities.

3 Target Cash Accounts

- Cash On-Hand – Build up 1 – 2 months’ worth of expenses in small-bills that you can access immediately, primarily for emergencies.

- Bank Account – At least 1 – 2 months’ expenses of “15-minute” money you can access easily.

- SDLIC (Specially Designed Life Insurance Contracts) – Continue to build capital that’s safe, liquid, and growing to be used for emergencies and opportunities.

How Much to Have in Bank Savings

Assess your comfort threshold with how much you want to be able to access within 15 minutes.

With your income and expense levels, you have familiarity with the volume of cashflows you typically see in your bank accounts. If you know the volume and timing of expenses may overtake your buffer and drop you into a negative account balance, you’ll start to feel uneasy.

Your comfort threshold sets your floor for how much cash to keep close to the belt for quick access. It may be $5,000, or it may be $500,000, depending on your economy and financial situation.

How Much Do I Need in My Emergency Fund?

An Emergency Fund should have at least 6 – 12 months’ worth of reserves, no matter where it is stored. This buffer would allow you to cover monthly living expenses, even with no income.

Never Stop Building Your Opportunity Fund

After you have an Emergency Fund set up that you can readily access, continue to save money. Don’t stop after getting to a set dollar amount. There’s no limit or ceiling to what you could save.

Continue to move money systematically into an opportunity fund.

In Why the Wealthy Love Cash, Part 2, we discussed the reasons that the ultra-wealthy continue to build liquid savings. Professional investors are comfortable being in cash. When a crisis occurs, massive wealth transfers happen, and those with capital are in a position to buy assets at bargain prices.

You can use this safe, liquid, accessible, growing money in your business or another cash-flowing investment very quickly.

Your goal is to maximize stewardship and find the best use of this capital. Even if you don’t know what you’ll invest it into today, build the habit of saving a part of all you earn.

Ultimately, the best stewardship of your opportunity may be paying off a loan, investing in your own business, or buying another business. It depends on your knowledge and goals.

One of the most powerful, but often overlooked principles of wealth is that opportunity seeks liquidity. When you have cash on hand, opportunities find you.

Luck is when preparation meets opportunity. – Seneca, Roman philosopher

Luck requires two major components. First, you must be prepared with the cash to invest. Secondly, you must recognize and understand the opportunity.

Having the liquidity available when the opportunity arises is precisely what’s needed to be successful.

SDLIC: An Ideal Storage Tool for Your Emergency and Opportunity Funds

Once you’ve reached your comfort level for your Emergency/Opportunity fund in a savings account, you could save the rest in SDLIC(s).

Specially Designed Life Insurance Contracts (SDLICs) are a safe, liquid tool that you can use in your personal economy to minimize opportunity cost. Your money can continue to grow at rates much higher than bank savings. It’s one of the most efficient places we’ve seen to store cash.

You can access cash value with a simple request, and you’ll have a check in-hand within a week.

For more information get our free guide: Privatized Banking The Unfair Advantage.

Preparation and Conditioning Translate to Both Business and Personal Economies

The fundamentals of building wealth aren’t reserved just for your personal life. They apply in your business economy as well.

Just as consistency in the fundamentals is the key to winning in barrel racing, the same goes for every other area of your life. Planning and preparation are required in building a business, a high-quality marriage, and in wealth creation. Principles work in multiple disciplines.

Building a savings system will prime you to leverage opportunities in your personal and business finances.

Don’t limit yourself to one Emergency/Opportunity Fund. Build savings both in your business and in your personal economy.

Set aside a portion of business revenue to handle extraneous expenses in the business. At the same time, set aside a part of your personal income to be the buffer for unexpected personal expenses.

The two economies should mirror and complement each other.

Additionally, running your personal finances like a business will allow you to make better long-range decisions.

Stability in your personal economy supports a healthy business, while a healthy cashflow system in your business increases your personal confidence.

Having a well-oiled savings system will prepare you with financial speed and agility. Having liquid capital to use when it matters most gives you the competitive edge to win at building wealth.

Up Next in This Series

In our next episode, Saving vs. Investing: What is Savings?, we’ll define the WHAT of saving and investing. What makes savings savings, and what makes investing investing. This clarity will help you to maximize your savings and invest like the wealthy.

For More Ways to Save Money Check out the 7-Part Saving and Investing Series

Check out the rest of the articles, podcasts, and videos in the series on saving and investing for ways to save money:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- Saving vs. Investing: What Is Savings?

- Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

- Saving vs. Investing: What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Book a Strategy Call

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Is There a Banking Crisis? Silicon Valley Bank 2023

If you’ve paid any attention to the news recently, then you’ve probably heard about what’s happening with the Silicon Valley Bank. The news isn’t good, and it’s probably raising some questions. We’re here to unpack what you might be thinking about. Like, are we entering a banking crisis, and what does this mean for the…

Read MorePersonal Finance for Beginners

Here’s a listener question about personal finance for beginners: “What is the foundation or the starting point of wealth building? What are the core things I would want in place to start building wealth?” You might be asking the same question. Do you have savings you want to do something with? Are you wondering if…

Read More