Why the Wealthy Love Cash, Part 2

The concept of holding cash – savings – is such an intricate, multi-faceted one. This series will walk you through the WHY, the compelling reasons to value and build cash savings.

Then, we’ll show you how to apply it and reveal the key distinctions to keep you on track.

If you have a great enough

Since we love Simon Sinek’s Start with Why concept, we aim to apply it in everything we communicate. You may have noticed.

Podcast: Play in new window | Download (Duration: 54:10 — 49.6MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

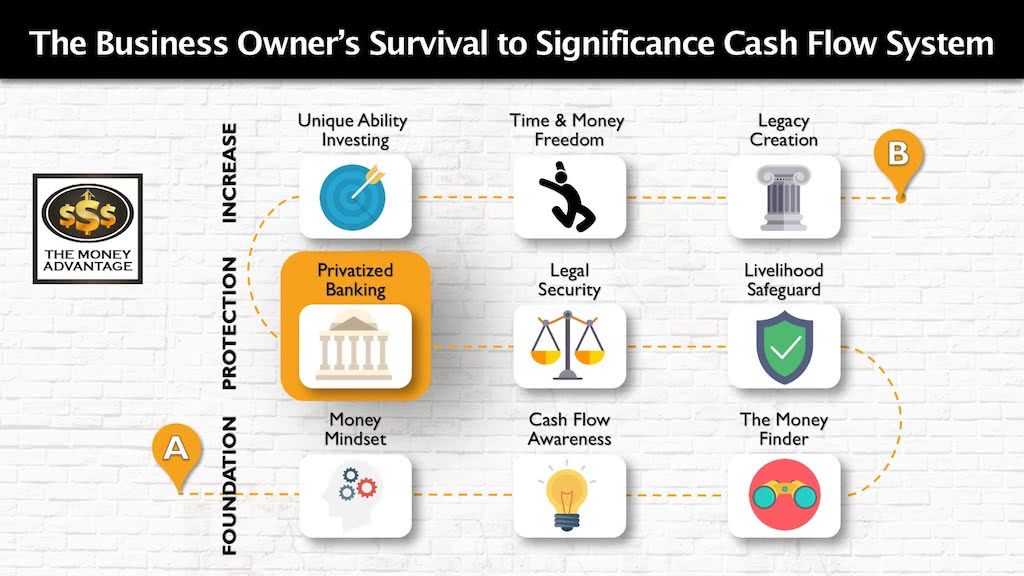

Where Savings Fits into Your Cashflow Creation System

Building a stockpile of savings is to help you weather months of tight income or unforeseen expenses will move you light years ahead towards peace of mind and financial stability. But it’s just one small step of a greater journey of building time and money freedom.

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, insurance and legal protection. Here, you’ll create the right canopy of protection in your financial life. This second stage encompasses all aspects of Privatized Banking, a key savings and capital deployment strategy that secures your access to capital, maximizing your control, by allowing you to be your own banker.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

Real Life Stories and Examples of the Ultra-Wealthy Who Have a Strong Cash Position

We know that theory without concrete evidence and facts to back it up is useless. In fact, it will probably just fade out of your mind like a sand castle washed away by the waves.

Today we’re digging into some examples of the ultra-wealthy who are comfortable being in cash. They don’t feel the need to be fully invested all the time.

We’ll discuss examples of Suze Orman and Mark Cuban, and their reasons for a strong position of safety and cash.

We’ll point you to a bank report showing that the super-rich with over $30 Million in investible assets often have about 35% of their total portfolio in cash.

And then, we’ll give you a Cash Flow Awareness Exercise you can do personally. It’s the same exercise that we use for our clients to help them think through their spending so they can free up more surplus cash each month.

An Empowering Philosophy of Saving

In Why the Wealthy Love Cash, Part 1, we discussed many of the ideas and philosophy about WHY savings is not only relevant but also crucial to your success.

Cash savings creates peace of mind so you’re able to operate from a mindset of abundance and confidence. With that perspective, you’ll make better decisions and have greater clarity.

Savings has guarantees. That creates more options in the future.

Because you have peace of mind and guarantees, you’re not desperate. You focus your time and energy on the right clients, activities, and investments that align with your Investor DNA. In this way, you create more value.

You have the cash to cover setbacks, unexpected expenses, emergencies, or failure. You’re able to rebound because cash is king, especially in a crisis.

Budgeting and paying off debt are two strategies often touted as the root of financial confidence and freedom. But neither create the same confidence that savings will.

Aside from saving for emergencies, one of the primary reasons to save is for opportunities. Not surprisingly, opportunities find people with cash.

Another reason to put money aside is for no-regrets fun. That way, you don’t have to feel guilty when you spend just for your personal enjoyment. Because you’ve prioritized that spending, you’ll no longer have the negative feelings of guilt tainting your experience. When you’re doing what you love and enjoying life, you are more energized and productive in every other area of your life.

Additional reasons to save include future taxes, inflation, planned obsolescence and technological advances.

After laying down clear reasons for why savings is a priority and what it allows you to do, we’re ready to look at some context.

Learn from Success

One of the premises woven into our mindset at The Money Advantage is that, because success leaves clues, we’re able to learn from the successful few and discard the “advice” of the crowds who aren’t living the life you want to live.

As we do so, I want to encourage you to find where your thinking aligns or doesn’t, with these stories. Just because something is right for someone, and they have their reasons, doesn’t mean that your objectives are the same as theirs. We want to learn not only what they did, but why. Then we can model the successful few.

Thinking About Your Thinking

As we discuss the tangible action of saving, you may become aware of a different set of choices that you’d like to be making.

But, even more important than making a behavioral change, is making a powerful choice to work on your mindset.

You currently have a way of thinking and believing about money.

Your mindset is the foundation of every financial choice you’ve made in your life up to this point. It governs your impressions and judgments about the micro financial decisions you make daily about how and why to use your money the way you do. Whether and how much to save, whether to pay cash or finance a car, whether to pay off debt or spend the money, whether to contribute to a tax-deferred retirement plan or not, how you think about insurance … these are all money decisions on the surface, externally, that are driven by our mindset.

The same mindset that steers our choices and therefore, our results can make us closed-minded to new ideas.

Because our mindset directs our choices, it is more important than the actual choices we make.

The Responsibility to Develop Consciousness in Our Mindset

Your mindset may be passively adopted, or it may be a consciously chosen mindset that serves your goals.

As children during the ages of 3 – 12, most of our mindset is solidified, without our awareness or choice, by what we watched our parents do.

And, much of our mindset remains in the realm of our unconsciousness.

Maybe you’ve outgrown your old mindset and want to produce a different result than what “following in your father’s footsteps” may create. If we want to progress, we have a responsibility to become aware of our mindset, and to choose it consciously.

The other side of the responsibility is that, as parents, leaders, teachers, and influencers, we can become more aware of how our thinking develops the mindset of the people we lead and teach. Again, to create the best outcomes in the lives of those we influence, we must develop our mindset.

In this way, our behaviors that set the standard for our children’s mindsets to develop in the most healthy, positive way. We know that they learn more from what we do than from what we say. As we become more aware of our mindset and belief system around money, we can better align our actions AND our words to be congruent with what we WANT to create.

When you are aware of your mindset, you can give up ways of thinking that don’t serve you and pick up new belief systems that do.

Choose your mindset, don’t just accept it. It’s hard to change your actions without working on our mindset that drives them. You can’t make a sustainable choice to do something contrary to your mindset, even if you’re presented with a logical reason to do so. But if you change your thinking, you’ll change the course of your life.

The Purpose of Your Money

As you become aware of your mindset, you’re more easily able to identify your own financial philosophy and articulate the purpose of your money.

Only after you have a solid purpose for what you want to create in your financial life can you determine the best financial choices for you.

Otherwise, you’ll just run helter-skelter from one financial strategy to the next without having a really good foundational philosophy first.

As we proceed in our discussion of savings, I’d like to invite you to assess your own mindset.

Watch What They Do

The Conservative Strategy of Suze Orman

Suze Orman, an author, television host, financial advisor, and motivational speaker, discussed her personal financial holding in an interview for the New York Times in 2007.

At the time, her net worth was about $25 Million. She shared that she loves spending her money on flying on private jets, something she enjoys that likely makes her fresher and more efficient, and enhances her life in ways that are important to her.

When asked what she does with the rest of her money, she said,

Save it and build it in municipal bonds. I buy zero-coupon municipal bonds, and all the bonds I buy are triple-A-rated and insured so that even if the city goes under, I get my money. I take a little lower interest rate to make sure my bonds are 100 percent safe and sound. ~ Suze Orman

New York Times

Safe and sound. She prioritizes savings and having safety and guarantees in her own financial strategy.

If you’re familiar with her advice, you may know that her recommendations are often to put money in well-diversified mutual funds – an asset on the opposite end of the safe-to-risk spectrum – yet not much of her own money is there.

Her personal financial strategy is conservative, and she’s a big believer in savings and personal responsibility.

When asked whether she puts any money in the stock market at all, she says that she had $1 Million there, because she could afford to lose that much.

Regardless of how you feel about her financial advice and opinions, we can learn more from what she does personally than what she recommends that you do with your money.

The lesson here is that savings and safe assets are of great value. Those who have enough money that they can “afford to lose it,” are more likely to value protecting and keeping what they’ve built.

Mark Cuban Is 50% in Cash

Mark Cuban, Shark Tank star, investor, author, and the owner of the Dallas Mavericks, has built great wealth through a history of business ownership and a complex strategy of day-trading using puts and calls with stop-gaps. Today, he’s worth about $3.4 Billion.

In an interview, he shares that in the stock market

“there’s a lot of risk coming from places we don’t know, understand, can’t qualify or quantify … I recognize the risk and have money in other places…I have it in cash because it creates a transactional opportunity.” ~ Mark Cuban

Squawk on the Street with CNBC

He goes on to reveal that he has over 50% of his portfolio in cash so that he can sleep better at night and be prepared with the capital to jump on opportunities. He says he can use it for discounts or to pay down debt, and that it would be unwise to put that into the stock market looking for greater gains.

Mark Cuban hangs onto his money by having:

nearly 50 percent of his net worth in cash and other liquid securities; an additional 30 percent is the value of the Dallas Mavericks. Investments in private companies he owns total just over 10 percent of his money. Eight properties, two private jets and a yacht reportedly make up the rest.

New York Times

World’s Largest Wealth Manager Says High-Level Investors Hold Cash

According to UBS, investors with at least $30 Million in investible assets tend to maintain high cash allocations, often in the region of 35% of their total portfolio. The report says the:

“Super-Rich Sit on Too Much Cash.” ~ UBS

Wall Street Journal

We like to dig behind the statements and realize the motivations behind the words and actions.

UBS has a reason to want investors to be more invested, where they can generate higher management fees and commission. They reprimand the investors, saying their reticence to invest is a fault.

However, there’s a reason why the ultra-wealthy value holding cash reserves.

Here again, we have more to learn from the actions of those we’d like to model than from the opinions of the banks that would like to claim a chunk of those investible assets for themselves.

What’s Your Why?

Back to the original idea that we proposed at the beginning of this article, understanding your own mindset and your own why will help you make decisions that help you accomplish those goals.

For us here at The Money Advantage, our goals include having cash in our control that’s available to use in our businesses to create value for others and continue to expand our impact. Having savings allows us to have the money to deploy for opportunities we know and control, reducing our risks and increasing our gains.

It’s no wonder we aren’t following the typical advice to put our money in qualified plans, take high risk, give up control, and defer taxes. We are not interested in putting our money at risk in stocks we have no control over. We don’t want to postpone taxes to a future date when we intend to be in a much higher tax bracket as a result of the fruits of our contribution to the world. If we invest in mutual funds, we may be investing with companies that don’t align with our purpose, mission, and values.

We have greater leverage by creating strong guarantees by investing in what we know and control and having the capital to continue to grow our businesses.

The point is this: you can’t decide who to follow until you get clarity on where you’re going and why it’s important to you.

The Cash Flow Awareness Exercise: First Steps You Can Do

If you would like to build more savings, more certainty, more abundance insurance to protect your peace of mind so you can produce more, one of the first steps is to become aware of your personal cash flow.

We don’t like budgeting, because it makes you think of everything you can’t do, can’t spend, and can’t have. It’s intrinsically negative and demotivating.

Instead, build an awareness of where your money is going with this thinking exercise.

If you’re intimidated and overwhelmed, start with what you think you’re spending, separating into two categories:

- Fixed Expenses, like mortgage, rent, and auto insurance

- Variable Expenses, like clothing, grocery, entertainment, and gifts

If you’re more kinesthetic or tactile, you may get more value from doing a pen and paper exercise to physically write down and add up your transaction history.

If you’re more visual, using mint.com or another tracking software may be more valuable for you to dig in and get a clear idea of where your money is going each month, and what spending trends you’re noticing.

The point is to free up a monthly surplus, not to or cut back or crimp your lifestyle.

If you’d like a little more guidance here, check out this blog, podcast, and video on cashflow awareness for more specific help with this.

Up Next …

As we’re working through this series on savings, we’ve started with the WHY. We’ve developed some consciousness around our mindset. If you’re on board with the WHY of savings, and your why is big enough, the next logical step is HOW and then WHAT?

Our next episode will be How to Save Like the Wealthy, where we’ll talk through some of the theory and ideas around HOW to save money.

Here’s what you can expect:

- Some of the natural laws you have to overcome in order to save

- The importance of tracking your money as a first step

- The “Pay Yourself First” principle

- And why it’s important to prioritize increasing your net investible income OVER maximizing returns

The 7-Part Saving and Investing Series

Check out the rest of the articles, podcasts, and videos in the series on saving and investing like the wealthy here:

- Why The Wealthy Love Cash, Part 1

- Why the Wealthy Love Cash, Part 2

- How to Save like the Wealthy

- Saving vs. Investing: What Is Savings?

- Saving vs. Investing: What Is Investing? Part 1 – Cash Flow

- Saving vs. Investing: What Is Investing? Part 2 – Your Best Investments

- The Family Office Model: Investing Like the Wealthy, with Richard C. Wilson

Create Your Financial Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Until next time… Success leaves clues. Model the successful few, not the crowd! And build a life and business you love.

Personal Finance for Beginners

Here’s a listener question about personal finance for beginners: “What is the foundation or the starting point of wealth building? What are the core things I would want in place to start building wealth?” You might be asking the same question. Do you have savings you want to do something with? Are you wondering if…

Read MoreAccelerate My Revenue: High Ticket Sales and Virtual Events, with Eileen Wilder

Did you know that it’s possible to compress your annual goals and accomplish them in a day? With virtual events, all things are possible. Here’s your permission to blow the lid off your expectations for your income! Eileen Wilder, known as “The Queen of Stages,” is a master communicator, trainer, teacher, and advocate for growing…

Read More