What to Do With Tax-Deferred Investments for Business Owners

Tax deferral may seem like the epitome of smart financial planning. But tax-deferred investments can be a tricky trap like the spiderwebs that caught Frodo in Lord of the Rings.

How should you think about retirement accounts if you’re a business owner?

In today’s conversation, we answer:

- What is tax deferral?

- What are the underlying assumptions that make this advice so widespread and common?

- When should I pay tax now, and when should I defer tax instead?

Then, we’ll give you the most important questions to decide whether you should postpone tax. We’ll show you why business owners should think twice before using tax-deferred retirement plans. And, we’ll talk about the one circumstance in which deferring tax could benefit you.

You’ll gain clarity to find strategies that work best in your particular circumstance, to achieve your objectives.

What if you’re not a business owner? This conversation still applies to you because tax deferral still works the same way. You’ll understand your financial options better and be more equipped to make decisions that put you in control.

Podcast: Play in new window | Download (Duration: 48:47 — 55.8MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

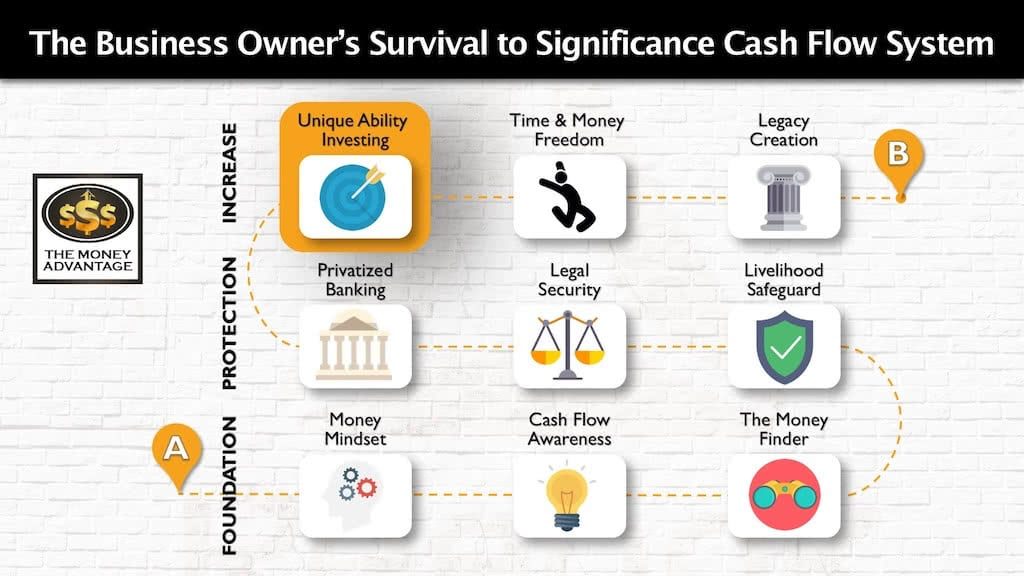

Where Do Tax Deferred Investments Fit into the Cash Flow System?

Selecting investment options and their tax treatment is just one step in the bigger journey to time and money freedom. You need to have all of the pieces in place to produce wealth systematically.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you protect your money with insurance and legal protection and Privatized Banking. Finally, you put your money to work, increasing your income with cash-flowing assets.

Investing is part of stage 3. It’s here that you select the best opportunities that help you achieve your goals, as well as the tax structure surrounding those investment decisions.

What Is Your End Game?

Before you set out to determine the wisdom and validity of using a particular financial product or strategy, you first have to know your end goal.

That’s because there are no bad products. There are only bad strategies.

More specifically, some strategies won’t work to get you where you want to go. For instance, a train is a fabulous invention, but it can’t get you from Boston to Sydney, Australia.

You first need to know if you want to defer tax.

Two Financial Destinations

When it comes to financial goals, one destination is financial freedom, where you have passive income (income from assets) that surpasses your monthly expenses. When your income is from assets, you no longer need to work as a source of income. To get there, your strategy will need to include investing in assets that produce cash flow returns. To apply this strategy successfully, you become an active investor and invest in what you know and control.

Another destination is accumulating a target investment dollar figure. This is also called a nest egg that you intend to withdraw an income stream from during retirement. To get this, you’ll see your primary responsibility as setting aside the funds each month and watching your balance grow with contributions and, hopefully, market returns.

The reason this is important is that tax-deferred investment accounts are generally not the best for cash-flowing asset acquisition.

What Is Tax Deferral?

Pre-Tax Investment Strategy

Tax deferral usually used for qualified retirement plans (retirement savings, including the SEP IRA and the Simple IRA for business owners, the 401(k), 403(b), traditional IRA, 457 account, and tax-deferred annuities.

These are tax-deferred investment accounts in which you invest pre-tax dollars. For employees, this is usually done through payroll deduction, so the money comes off the top before you’re paid, and it never even hits your bank account. Even if you contribute later in the year after you’ve already deposited your check, it’s filed as a deduction on your tax return.

Deferring tax is a way to lower your taxable income today, while setting money aside for the future.

Tax Postponement

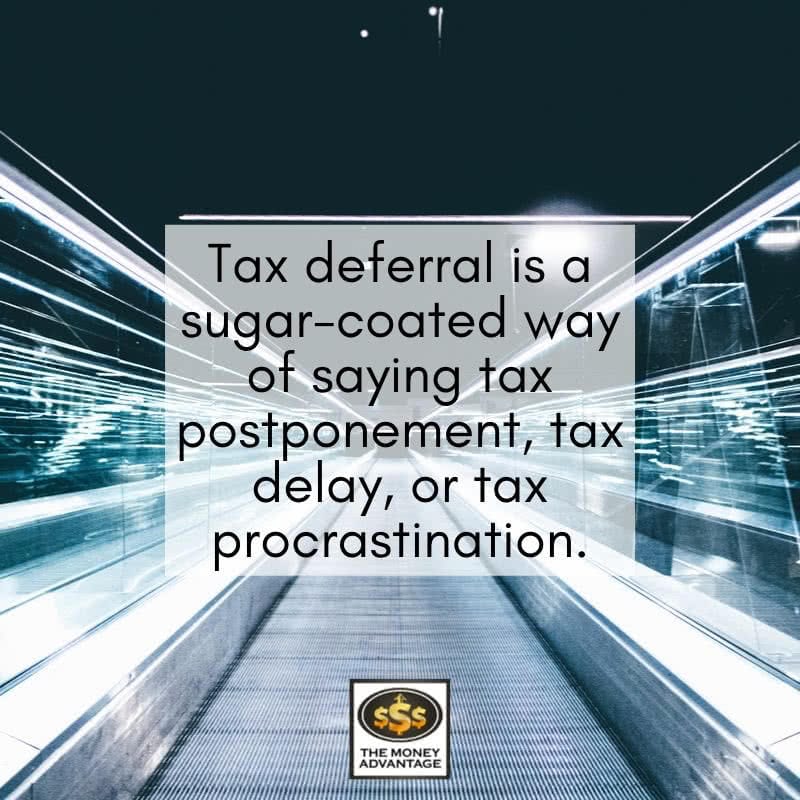

However, tax deferral isn’t tax savings, because you will pay tax on that money later.

Here’s how:

When you take your money out of the investment, you pay the IRS on your contributions and the growth at that time. That means that when you start taking distributions in retirement, you pay taxes. Or if you decide to use your money early through a withdrawal, you’ll pay taxes, and in this case, you’ll also pay an additional penalty.

So, tax deferral is a sugar-coated way of saying tax postponement, tax delay, or tax procrastination.

You haven’t avoided or saved taxes; you’ve pushed them out to a future date. And when you arrive at that future date, you’ll be paying taxes not only on your contributions, but also the growth inside of your account.

Loss of Control with Unknown Future Tax

When you put off something today, with a known set of variables, to a future, with a lot of unknowns, you take away your control.

I’ve learned a thing with procrastination. All through high school and college, I tended to wait to start on projects until uncomfortably close to the deadline. While the pressure caused me to perform better, it was severely taxing. I’d pull all-nighters almost predictably before papers or tests were due.

Now, with nearly a decade of business ownership under my belt and two children in tow, I know there’s an unprecedented number of things that could cause me to lose control if I procrastinate. There could be a snow day, a sleepless night, a call to pick up a sick kid early, or a spontaneous business opportunity that I’ll have to decline if I wait until the last minute.

If I don’t use my now well, I lose control.

Procrastinating taxes causes you to lose control. That’s because you don’t have control of the tax OR the tax calculation at the time of withdrawal.

It’s vital to realize that you’re setting money aside to pay future taxes at an unknown rate. If taxes were guaranteed to stay the same as they are today, the only variable would be your income, and hence, the tax bracket you fall into.

However, the government has in the past and can, in the future, change tax rates, tax thresholds, and tax brackets. In reality, you have no control over what tax rate you’ll land in 10 or 20 years from now.

That means you’re flying blind into an uncertain future. And that’s not a recipe for peace of mind.

You Pay More Taxes in the Future Than You Would Have Paid Today

You’re not just setting aside the tax bill to pay at a later date. Rather, you’ll pay the tax itself plus the growth of those taxes.

If I could defer $20K in taxes, to pay those same $20K of taxes in the future, that could even be a good idea. It might look like I’m getting the money to work for me when it’s most valuable and paying later after I’ve got the most use out of it, and it’s worth less due to inflation. But there’s more to the story.

You’re signing up not only to pay taxes, but also the growth rate on those taxes in the future.

For instance, if I put $15,000 per year, every year for 30 years, into my tax-deferred IRA, I would have a total of $450K of contributions. If I deferred the tax in a 30% tax bracket, that’s $135K of taxes I didn’t pay along the way.

Now, if my account grows by 6% every single year (which it won’t, see

If I’m still in a 30% tax bracket, do you think I’d still pay $135K in taxes when I use the money?

Nope. Instead, I’ll pay 30% of the $1.2 Million balance, which is a whopping $360K in taxes – way more than the taxes I postponed earlier!

How does this happen? When you pay the IRS in the future on your tax-deferred accounts, you owe tax on the whole balance. That includes the contributions AND the growth. Once you set aside your dollars in the tax-deferred account, your money and the taxes both grew right alongside each other.

The Balance Isn’t All Yours

So, when you look at your account statement, the balance can be misleading, because it doesn’t all belong to you. Instead, putting money into tax-deferred savings is signing up for a profit-sharing plan with the government. You have to subtract out the IRS’s portion by applying your tax rate to the total.

Retirement Accounts Only Work in Your Favor If You Take Out the Money at A Lower Tax Rate

Now, if you defer tax when you’re in a high tax bracket, and you take your money out when you’re in a lower tax bracket, you win. In this case, you keep a higher percentage of your money than if you’d just paid the tax in the year you earned the income.

Let’s continue on the prior example with an ending account value of $1.2 Million. If I take the money out in a 24% bracket, I’ll owe $288K in taxes and get to keep $912K. Better for me, because my ending bracket is lower than my starting bracket.

However, if I put aside the money in a 30% bracket, but take it out in a 37% bracket, it works in the opposite direction. Now, less of the final balance is mine, and more goes to the IRS. In this case, I’d pay $444K in taxes, and keep just $756K.

So, you win if you take out at a lower rate, but you lose if you take out at a higher rate.

With this information, should you defer taxes? It depends on your income and tax rates in the future. And since both are unknown variables, you have to consider the most likely future of taxes to determine whether postponing taxes is a prudent financial move for you.

Will You Be in a Lower Tax Bracket in the Future?

Many “financial experts” will tell you that you should use a qualified retirement plan to defer tax. That’s because the typical assumption is that you will retire with less income than you have today, putting you in a lower bracket in the future.

This is like saying you plan on retiring poor.

Any premise important enough to stake our entire financial future on, is worth examining.

Your Future Taxable Income Could Likely Be Higher Than Today’s

If you’re like most business owners, your objective is financial freedom, and you plan to achieve it through exponential financial success. You’re creating a future that’s much bigger than what you have today. If you meet your goals, your income could likely be much higher than it is today, landing you in a higher tax bracket.

Now, of course, the wealthiest individuals also are the most strategic, and it’s possible to be tremendously wealthy, live big, and still maximize your tax strategy to owe very little to no taxes.

But even without that level of sophistication, two primary tax breaks are less likely to be available to you in the future. That’s the $2000 child tax credit per child, and mortgage interest if you itemize deductions but your mortgage is less than $750K. Why? Because your kids will no longer be dependents, and you’re more likely to have paid off your house.

Since both factors press your taxable income lower today, without them, it will rise in the future, even if your total income stayed level.

The Future of Tax Rates Is … Not Very Stable or Predictable

There’s no crystal ball to predict exactly what the tax landscape will look like in the future. But taxes aren’t a constant. They’ve changed often and drastically many times over our nation’s history. We can look at the current and historical factors driving tax rates to see which direction they’re likely to go.

As of today, the US Debt Clock reports national debt at over $22 Trillion. And that’s rising by a budget deficit of over $1 Trillion this year alone. Additionally, unfunded liabilities – the promise to pay in the future, without the capital to do so – is over $126 Trillion. That includes Social Security, Medicare, and federal employee and veteran benefits. The government’s only source of revenue to cover these rising obligations … is federal tax. It’s hard to imagine they would have the revenue to do so without increasing taxes in the future.

And raising taxes would certainly not be an unprecedented event. In fact, our last 30 years have had the lowest top tax rates comparative to an over 100-year history.

Since 1913, with the start of the

Today, despite the 21st-century wars in Iraq, Afghanistan, Pakistan, Syria, etc., we’ve continued to enjoy some of the lowest tax rates in American history.

I’m no prophet, but where there’s spending, income is required to cover it. All the signs point to higher tax rates in the future.

Changing Tax Thresholds

If you feel like the future of taxes is one giant balancing act, you’re not alone. To compound the uncertainty even further, the thresholds that make up tax brackets are also subject to change.

Perhaps the most notable and concerning adjustment to tax thresholds was in 1942.

If you filed taxes in 1941, you had to make $5 Million/year to reach the top bracket. The very next year, in 1942, the top bracket included anyone with an income over $200K.

Although either income level was rare in those days, the shift makes it that much harder to believe in a favorable future of taxes. It becomes even more apparent that the government will change taxes to accommodate the funding they need.

Is Now A Good Time in History to Be Deferring Tax?

Remember that it makes sense to defer tax only if you defer in a high bracket, only to take out the money in a lower bracket. The 401(k) was introduced in 1976 when top tax rates were around 70%. Fast forward 40 years to today, with a top tax rate of 37%. For those early adopters who are taking their money out in the lower tax rate environment today, postponing tax payment certainly made some economic sense.

But can we say the same today? If we’re deferring tax in an artificially low tax environment, what happens to all the tax-deferred accounts if taxes are significantly higher when everyone wants to take their money out?

Are You Sure You’ll Be in a Lower Tax Bracket in the Future?

Tax-deferred investments can work if you’re in a lower bracket in the future.

But, if you plan to retire on less income than you make today, you have to consider the ranges of each bracket. Many people retiring on less income will still find themselves in the same bracket.

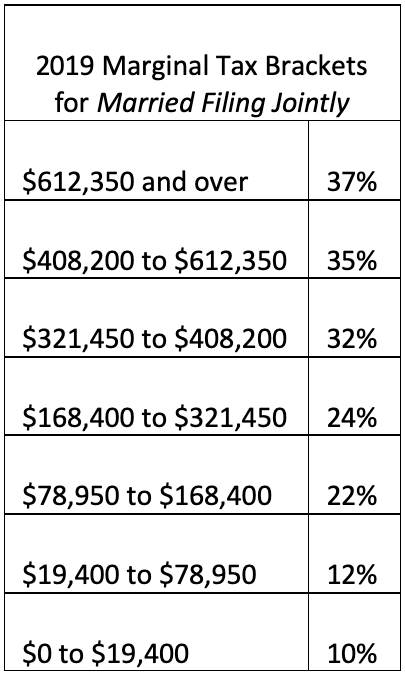

Here are the marginal tax rates for 2019 for someone married filing jointly:

Let’s say your taxable income today is $160K, putting you in the 24% bracket. If you expect to retire at $125K, even though that is on less income, you’d still be in the same tax. In that case, it wouldn’t have benefitted you to defer tax, just to end up paying the same rate in the future.

A business owner with an income of $500K would land in the 35% bracket. If they currently live on $200K and plan to do so in the future as well, they might retire down two brackets. If their expected future rate was 24%, they might save some tax overall by deferring in a high bracket today and taking the money out in a lower bracket in retirement.

This is the only case when tax deferral makes financial sense; providing the tax landscape doesn’t shift.

Decide if A Retirement Account Is for You

Ask Yourself These Questions to Find Out if You Should Defer Taxes

Could you have higher income in the future? If you’re growing your business and along with it, your income, you could land in a higher bracket in the future, even if tax rates and thresholds stay the same as they are today.

Do you think taxes could go up in the future? If you believe tax rates could increase in the future, don’t sign up to pay a bloated tax bill when you use your money.

Do you want to have control, guarantees, access to be able to use your money? If so, the typical retirement planning environment doesn’t meet the criteria. Not only do you not know how much tax you’ll pay in the future, you also don’t know what the market will do, and you don’t have access to use your money to actively invest in cash-flowing assets.

If you’re an established business owner, what returns do you think you can get in the market? How does that compare to the returns you can get in your business? If, as most business owners, you can get your money to work harder by investing in your business, then tax-deferred investing is inferior and not worth your time.

Do you want to invest in cash-flowing assets actively? Or do you want to invest passively with the accumulation model by handing money over to mutual fund managers and hope you grow a large enough nest egg to retire?

If you want to create time and money freedom with cash-flowing assets, the accumulation premise of tax-deferred investments won’t get you there.

Is retiring even a good idea for you? If you enjoy what you do and would rather be productive during your best years, then why would you ever want to consider retiring?

Gain Clarity to Make The Best Decision For You

Answering these questions for yourself will give you clarity and freedom to make financial decisions that are congruent with your goals and objectives and move you closer to financial freedom. With that confidence and peace, you’ll know you’re making the right decision.

Start Building Your Financial Freedom Today

To personally implement Privatized Banking, discover cash flow strategies to keep more of the money you’re making, or locate alternative investments, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read More$100M Careers: The 5 Fastest Paths to Wealth Beyond Your Wildest Dreams, with Emmy Sobieski

What do the 25,000 self-made $100M families in the US have in common? Discover the secrets to skyrocketing your career and achieving wealth and happiness with our special guest Emmy Sobieski, a CFA, Amazon #1 bestselling author of $100M Careers, and an expert in investing and entrepreneurship. Emmy’s journey from humble beginnings recycling aluminum cans…

Read More