Who Are the Financial Experts?

How do you know if the advice of financial experts applies to you? In fact, who are the financial experts? Does fame or popularity make someone an expert? What about having the biggest stage or the largest reach? Is it a degree, certification, or credential that qualifies them? Instead, the litmus test for a financial expert is that they give uncommon advice to people with uncommon income and uncommon goals.

To help you decide who to listen to in making educated financial choices to secure your future, we’ll answer:

- How do I decide who to take advice from?

- Who are the financial experts?

- How do I make sure I’m following the advice that leads me to my goals?

- How do education, personal responsibility, and the right guide work together?

We’ll help you gain confidence in who to listen to and how to apply advice in your specific situation, without guessing, having to DIY, or blindly trusting someone with your money.

You’ll go from overwhelmed with the financial noise, to confidently tuning in to what aligns and tuning out what doesn’t align with your goals.

Instead of getting stuck trying to figure everything out, you’ll have the information to take action and make progress.

You’ll gain confidence as you see a clear path from where you are to where you want to be, rather than wasting time wondering whether you’re going in the right direction.

Podcast: Play in new window | Download (Duration: 38:50 — 35.6MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

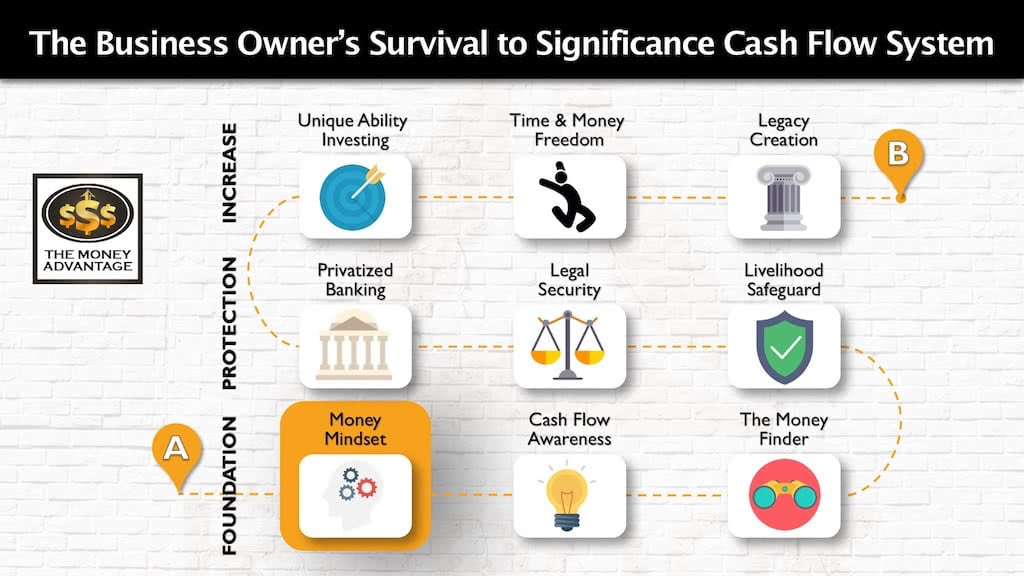

Where Financial Experts Fit into Your Cash Flow System

Finding out who the financial experts are is just one step in the greater Survival to Significance Cash Flow System. Once you’ve discovered who the experts are, you decide which of the four ways you want to implement their advice.

Identifying the experts and implementing financial advice make up a micro-step in the bigger picture of gaining time and money freedom. Here’s how:

Deciding who to listen to is part of the foundation of your mindset and how you think about money.

While your mindset may be the least tangible of all of the 9 steps, it’s critical to your success. Don’t ignore or skip the mindset step. Your thinking opens the door to all your financial possibilities and brings everything else into focus.

The Critical Need for Education and the Battle to Find It

Financial competency is the most ironic adult life skill. We’re not taught in school how money works, how to make it, how to set goals, or how to arrive at our intended destination. Yet we spend almost 100% of our waking hours in pursuit of making money, spending it, or thinking about it.

If you aspire to transcend your current ranks and carve out a future of confidence, meaning, and security, it’s up to you to figure it out. So as an adult that’s mastered the education system, and probably marriage, family, and a career, you still have to figure out what to do about money.

Realizing that your financial independence is up to you is the first wake-up call.

The second is when you become aware of the sea of “financial education” that doesn’t agree or stack up, and you have the responsibility of figuring out who knows what’s going on that you should be listening to.

The Noise of Self Proclaimed Financial Experts

If you’ve been on the financial education path for a while, you’ve noticed the slew of conflicting information.

If opinions were highway road signs, one sign would read, “Retirement This Way. 20 Years Ahead. Guaranteed.” Another sign pointing the same direction would warn, “Danger Ahead. Do Not Enter.”

Confusion and chaos would abound. Either everyone would be darting this way and that, trying to make sense out of it all and crashing into each other. Or in despair, they might give up, hit the e-brake, and resign themselves to not figuring it out. They might even start ignoring the signs and follow the crowd, hoping they aren’t all wrong.

Likewise, if you tuned in to all the advice and opinions from self-proclaimed financial experts on tv and radio, financial advisors and institutions, and well-meaning family and friends, you’d end up with a headache, rather than financial clarity.

All the information in the world is worthless if you can’t figure out what to do.

Five Steps to Identifying the Financial Experts

Here’s the simplest way you can determine which financial planning advice is right for you.

#1) Determine the Interest of the Source

The first step in deciding who to take advice from is to figure out who they’re talking to and why. We’ll start by examining the self-interest of the source.

Regardless of your personality, it’s best to start with a bit of healthy skepticism. Everyone has their own reasons for what they do and say. If you can uncover the interest of the source, you’re light years closer to identifying whether the information is truly in your interest.

A word of caution here. Almost anyone providing

The Five Most Common Sources of Financial Advice

Here are some of the most common sources of financial advice, and how they may benefit from providing you with education.

Banks and Financial Institutions

Financial institutions follow the rules of the bank to increase their control, cash flow and guarantees, systematically. The advice they give you usually has your money flowing into their control and is in direct contrast to what they do.

Financial Planners and Investment Advisors

There are various titles for people who are licensed and credentialed to sell you financial products or financial planning. But, just because someone has letters after their name (i.e., CFP, CPA, CLU, ChFC, CFA, RIA, Series 6, 7, 63, 65, 66), or is held to

Financial Entertainers and Financial Experts On National Tv and Radio

Tv and radio personalities want to create an exciting show to gain followership. They may earn status and prestige in the form of likes, views, or ratings. Their objective may be to command a large enough audience that other advertisers want to buy ad spots during the show. These experts may also be paid by financial companies who gain business from their recommendations, or by advisors who are in their network.

The Successful

People who have achieved success may want to pass on their methods of success. Often, they package consulting or advice into a system to show you how they got results. Essentially, you pay them for mentorship to model their success.

Family, Friends, and Neighbors

People who care about you and your wellbeing may share opinions or what has worked for them. Frequently, this well-meaning advice may be a single winning fund, stock-pick, or product that lacks a comprehensive strategy surrounding it. Opinions may be rooted in beliefs and ideals about the right thing to do with your money.

#2) Determine Whether the Source Is Providing Common or Uncommon Advice

To reach the masses, many supposed financial experts broadcast typical financial strategies as if they apply equally to everyone. You’ll hear things like pay off all your debt, max out your 401k to plan for retirement, and buy term life insurance.

Your job is to determine who they are talking to. Does this advice apply to everyone, to the general population, or to someone just like you?

For a message to use a means like television or radio, there has to be a large enough audience to warrant it.

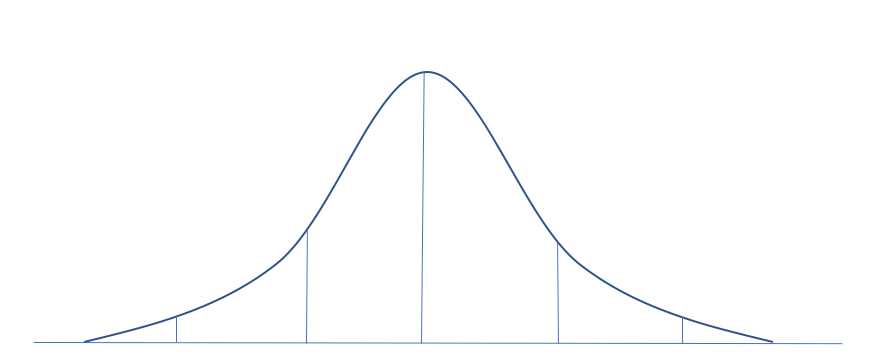

Imagine a bell curve. The majority of the population fits nearest the center, at the mean. With increasing standard deviations from the mean, the curve tapers off.

A narrow market segment at either extreme isn’t sufficient to bear the high cost of production, wouldn’t attract prime commercial spots, and wouldn’t be sustainably profitable.

Because of this, major programming doesn’t target the outliers, it focuses on the majority.

Similarly, public education must teach to the average child, the lowest common denominator. In reaching the majority, the top 10% of children may be left out.

For a financial show to attract the viewership of the largest audience, it must provide common advice that is relatable and entertaining to most people. To accomplish that goal, the “expert” targets an average viewer.

#3) Decide Whether You Have Common or Uncommon Income

If financial programming is targeting the average person and you are average, what’s the problem, right?

Your next task is to determine whether you are average, or something else. If you lined up the 126 million households in America side by side, where do think you fit in the range of income? Do you think you’re average, middle-class, high-income, in the top 1%?

For the record, most people we’ve talked to believe they are middle-class, with average income.

Our perceptions are often rooted in our environment and experience, not always in reality. Because we usually spend time with people who look like us, think like us, talk like us, and live like us, we come to believe that we are average. We may have limited exposure to the full range of socioeconomic demographics that exist right here in our own country.

How much income do you think you’d need to bring home to be in the top 1% of household earnings? $1 Million per year?

But just because you believe something, does that make it true? How does your perception stack up against reality?

To be in the top 1% of American households, you need an income of at least $465,626.

The top 5% make over $188,996.

The top 10% have incomes over $133,445.

To be in the top 25%, you need an income of over $77,714.

And if you make over $38,173, you’re in the top 50%.

Were you surprised? If you’re in the top 1%, 5%, 10%, or even the top 25%, you’re not average. You’re above average.

#4) Decide Whether You Have Common or Uncommon Goals

After recognizing that you probably aren’t average, now it’s time for a bit more self-awareness and introspection. From where you are today, what are your goals for the future?

Do you intend to continue earning at your current level, make less, or do you desire to scale the ranks of the wealthy?

If you’re looking for upward advancement, you’re moving further away from average.

#5) Decide Whether You Want Common or Uncommon Advice

If you have uncommon income and uncommon goals, common advice for the average person won’t get you there. In fact, the larger the audience, the less likely the advice will apply to you. Here’s why:

While this might be a shocker to you, making over $77,000 per year places you among those with uncommon income. At that income level, you make more than 75% of households in America. With even higher income, you’re further out on the fringes of being uncommon.

In their book, The Personal Economic Model, Don Blanton and Dr. C.W. Copeland write:

Who are the financial experts talking to? There are 1.4 Million households in the top 1% income bracket … You can’t have a TV show with that small of a potential audience. There are only 14 million in the top 10% … That is still not enough viewers to host a TV show. There are 35 million in the top 25%, and that may be sufficient to have a radio show, but not TV. There are 70 million in the top 50%, and now you have enough for TV and radio.– The Personal Economic Model

The point here is that if you are talking to the masses, you have to give information that applies to the masses. If you have a common income, you will find it difficult to get uncommon information listening to those talking to folks with common incomes about what they should do with their money.– The Personal Economic Model

Because common advice is for people with common incomes and common goals, it may actually prevent you from reaching your uncommon goals.

It’s Not Advice If the Financial Expert Didn’t Understand Your Complete Financial Picture

You couldn’t read a book about health and call it doctor’s orders. To give a prescription, a doctor must first see you, understand your full range of symptoms, perform tests, and give you a diagnosis. If they didn’t even talk to you, how could they know what you need? No person in their right mind would take a tv show as medical advice, just as no pharmacist would fill a prescription given by a tv commercial.

However, “financial experts” do this all the time. They paint with broad strokes and make recommendations for everyone without understanding the symptoms of the person first.

Financial strategies are like prescriptions. They only apply in a particular set of circumstances.

Because many financial entertainers give advice before understanding the full set of unique circumstances of an individual’s life, they often compel people to accept strategies as the whole solution. In doing so, people make financial moves that may be unwise. The problem with this is that the best strategy for you depends on your goals, financial picture, and the economic environment.

In contrast, principles are always true in every case. They’re timeless and eternal, applying equally to all people. However, financial principles aren’t usually considered news-worthy or interesting enough to garner adequate interest.

The issues with common advice of experts are numerous. They’re speaking to the average person with average income and average aspirations, which likely isn’t you. They declare strategies as the ultimate solution, but strategies come and go with the tide. And they give blanket advice which can’t possibly take your whole financial picture into consideration.

Determine How to Work Together with a Financial Expert

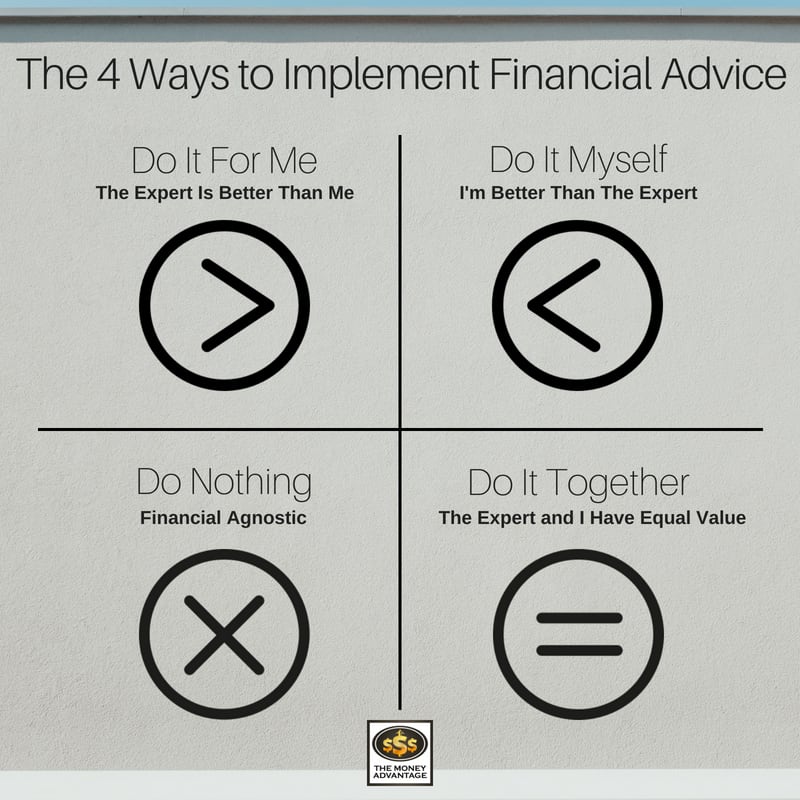

Now that you’ve identified the line in the sand between financial experts and those who claim to be, your next step is to decide how to relate to their advice. There are four ways you can choose to apply the education.

Do It for Me

In a consumer culture, it’s common to believe we can buy happiness with a purchase. The person who hands over financial responsibility to someone else is hoping to buy financial success. They think they aren’t skillful or capable of becoming good with money, and that only a financial advisor can manage their money. The truth is that they simply haven’t broken free from a consumer mindset. They’ve masked their financial insecurity by being really good at buying things but haven’t accepted the responsibility of becoming a producer who creates wealth.

There’s no substitute for owning your own destiny.

Do It Yourself

Because of ego and not wanting to look bad, many people never seek the personalized guidance of true financial experts. They think they don’t need the help of anyone else. They DIY everything, believing they can do it better themselves.

But while they may be excellent at making money, they ignore their blind spots. They are too prideful to get help and aren’t willing to see from another perspective. Because they don’t seek the counsel of experts, they leave themselves exposed to the risks of what they don’t know.

Don’t Do Anything

Perhaps because of overwhelm, confusion, or despair, some people decide not to do anything about their money.

Believing they can’t make good financial decisions, or that they’re incapable of financial success causes many people to stay stuck. Their ignorance becomes a self-fulfilling prophecy. They’re like a financial agnostic who doesn’t seek out education or advice. Maybe they are complacent because everything is ok now, and it’s easier not to think about anything going wrong. They defer planning and decision-making to the future and never get around to it.

They may ignore their finances, but by choosing to do nothing, they’ve chosen to remain the same.

Do It Together

Working together with an advisor is the healthiest balance with the greatest potential for success. This relationship is one of shared responsibility, where you recognize that you and the financial advisor have different knowledge, but equal value. You’ve taken ownership and personal responsibility for your financial education and outcomes, but also have the humility of recognizing that you have blind spots.

The relationship causes you to expand your knowledge as you engage in a partnership to do the most with your money.

Your Financial Destiny Is Yours for the Taking

Now that you’ve sorted through the murky waters of financial opinion, education, and advice, you have a choice to make. You can either listen to common advice geared for most people, who aren’t where you want to be. Or, you can seek out uncommon advice for the successful few.

The #1 way to tune in to what aligns with your goals, and confidently chart a path to where you want to be is to decide if you have uncommon income and uncommon goals. Then you’ll find uncommon advice, take ownership, be teachable, and work together with an advisor to help you maximize your money.

Financial Experts offer Uncommon Advice

The Money Advantage is on a mission to provide uncommon advice for those with uncommon income.

Instead of mirroring typical financial strategies designed for the average person, we offer thinking to model the successful few, not the crowd. We focus on what the successful are doing by bringing on guests like real estate investors J. Massey and Paul Moore, as well as Richard C. Wilson, who works with billionaire families.

Uncommon advice honors your individuality, offering education and principles to all, but reserving strategies and advice for only after we understand your complete financial picture.

We want to raise awareness for uncommon strategies in every area of your financial life. That’s why we provide tax strategists and legal advisors, etc. who advise people with uncommon income and uncommon goals. These true financial experts know and do things not everyone else is doing. In rising above generic advice, we seek to elevate your thinking and provide access to uncommon advice.

Build Your Time and Money Freedom

If you have uncommon income and the uncommon goal of building financial freedom by increasing your cash flow from assets, discover the uncommon path of the successful few.

If you want to work together with a team of experts to implement uncommon advice, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Sources:

- https://www.irs.gov/statistics/soi-tax-stats-individual-statistical-tables-by-tax-rate-and-income-percentile

- https://www.investopedia.com/news/how-much-income-puts-you-top-1-5-10/

- http://www.businessinsider.com/us-census-median-income-2017-9

- The Personal Economic Model, by Don Blanton and Dr. C.W. Copeland

- Icons credit http://hadrien.co

Family Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read MoreStop the Hustle and Grind, with Christine Jewell

Are you an ultra-high achiever, but feeling the cost of that success? Christine Jewell, author, keynote speaker, faith-based executive coach, and host of the Breaking Chains podcast, joins us today to provide a fresh solution. In her new book, Drop the Armor, Christine teaches you a transformational approach that allows you to stop the hustle…

Read More