J Massey: Creating Cash Flow with Real Estate

If you’ve been in our community for a while, chances are, you love cash flow, and you know we do too! You’re interested in quickly creating income streams with cash-flowing assets. You want assets you know and control that

For years, J Massey has been creating cash flow with real estate and teaching others to do the same. His stories of loss, success, and the wisdom he’s developed through that experience will inspire you and show you what’s possible in building your own cash-flowing asset portfolio.

On a personal note, J Massey is a hero of mine! I’ve followed his podcast for several years, where my thinking has been challenged and transformed, and I’ve been introduced to pivotal relationships. Without even knowing it, J has been a catalyst to much of my work. To say I was a bit star struck to interview him is an understatement! You’ll instantly fall in love with his thinking, his good-natured humor, and his genuine desire to solve problems and create value. It’s such an honor to share this interview with you.

Podcast: Play in new window | Download (Duration: 1:02:36 — 57.3MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

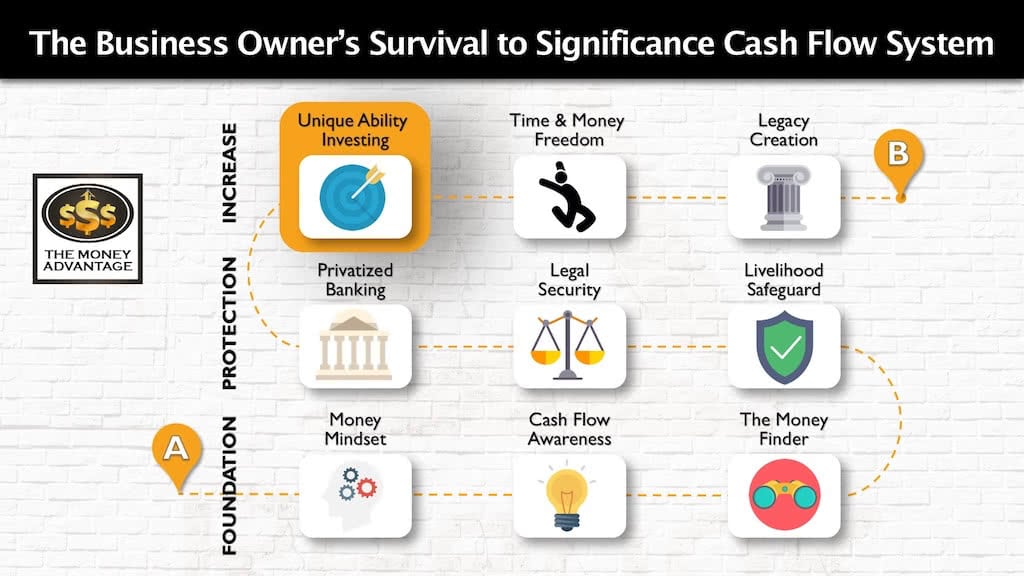

Where Real Estate Fits in the Cash Flow System

To build time and money freedom, you first want as much cash flow as you can get today, by keeping more of the money you make. Then, you protect what you’ve created. Finally, you increase your income.

Investing in cash-flowing assets like real estate is part of Stage 3 of the Cash Flow System.

Who Is J Massey?

A full-time real estate investor, entrepreneur, popular podcast host, author, speaker, coach and all-around problem solver, J Massey is well known for providing best-in-class advice and strategies to help new and experienced investors the world over.

J Massey’s platform is simple… He invests his time looking for investment opportunities (a.k.a., problems to solve through real estate transactions), closing deals and teaching others how to find and manage similar opportunities, including getting deals at discounts and raising private capital to

By turning his real-world fieldwork into killer training courses, new and seasoned investors alike learn win-win solutions to solve real estate “problems” for buyers, sellers and other investors. J’s cashflow-creation strategies are embraced on a global scale by people who want to learn better ways to achieve tangible success in real estate investing, and in his words become “bigger,

J is currently a landlord, lender, consultant, educator

J’s publishing credits include a book he co-authored titled “3 Money-Raising Questions.” In 2014, he released his highly acclaimed book, Cashflow Diary: 10 Steps to Creating Wealth in ANY Economy!

J Massey Conversation Highlights (Partial Transcript)

The Need to Take Ownership of Your Financial Destiny

J Massey: [20:50] The number one problem that every person literally on this planet right now has, is the fact that we do not have control over the value of the currency that we are currently using. We’ve got to level up our financial IQ to address that problem.

Here’s a very painful but true lesson: the cavalry is not coming. No white horse is coming over the mountain to rescue you financially.

I found it out the hard way long before Obama was handing out bailouts… No one came to bail out my wife and I. We had to go figure it out. To provide value, fundamentally, in a capitalistic economy, is driven by someone’s willingness and ability to solve problems for somebody else.

The Cash Flow Quadrant: Business Owners Solve Problems

J Massey: [23:49] Robert Kiyosaki developed this concept known as the cashflow quadrant. It’s a way of looking at how you earn your money. There are four basic categories. In the upper left, if you just draw a cross, in the upper left corner, you’ve got the employee. Bottom left, self-employed; upper right, business owner; and the lower right is going to be the investor.

The Exchange of Value Needed for Each Type of Income-Earner

J Massey: [24:15] What’s interesting to me is that the economy works on the basis of supply and demand.

For example, the employee is supplying time, skill set and knowledge, etc. But, to be an employee, they need a job. And that job is typically something that they take from the economy.

The self-employed person is someone who usually has more specialized knowledge in one particular area. They then offer that to the marketplace. And the person to whom they’re offering their service isn’t typically the average person. An attorney, or a mortgage broker, or any type of job that has a license, is looking for some person to deliver that service to.

The business owner owns a system that produces value for the entire marketplace. That’s literally their specialty to own and control the system that produces something of value.

To run that system, it usually needs some sort of grease, currency in this particular case. That typically comes from the investor who’s leveraging their currency to get more money.

The Business Owner Solves Problems for Everyone Else

J Massey: [25:59] For a business to run, the business needs employees, and therefore they provide jobs. The business needs an attorney to look over their shoulder, and therefore the attorney now has a client. And the investor needs a place to put their capital, and the business is the very thing that can produce more capital for them.

At the center is the almighty business owner.

The challenge that we’ve been experiencing is that we’ve created an imbalance in the supply and demand curve. There’s an overabundance of employees who take jobs, and there’s not enough people who create them, i.e., business owners and entrepreneurs. We need more business owners and entrepreneurs innovating and thinking of the next best thing for all of us to have a bigger, better lifestyle.

What to Do with An Expensive Mistake

J Massey: [33:49] … it’s not that it happened. That’s a massive thing. It’s what do you do now?

Do you leverage that lesson and become better, or do you allow that lesson to topple you and you become bitter? That, in and of itself, is a lot of work.

If you are willing to take those hits and lessons and become better, what’s on the other side of that is you become a much bigger service to society. And you’re able to provide even more jobs and more housing and do more good for more people and help more entrepreneurs move forward.

What J Massey Learned About Mutual Funds by Investing in Cell Phone Towers

J Massey: [35:46] And at the end of the day, the basic premise is that every one of your expenses is somebody else’s income.

Many of us have a device in our pockets, a cell phone of some kind. And instead of actually owning just the device, what if you own something that they needed: the cell phone tower…

That’s kind of how that thought process started. And all along that journey into owning a cell phone tower, I just discovered so many interesting things.

The Mutual Fund’s Money Must Be Invested

J Massey: [36:31] When you and I, or anyone who chooses to use a traditional 401k, or Roth 401k, we give those funds over to an entity. And then that entity begins to go about their job, their mandate by prospectus, to find a return for all of the people who are making that contribution every two weeks.

They’re really good at collecting capital and doing risk evaluation and those types of things. But that person isn’t also good at running a deal. That money has to go somewhere …

That mutual fund manager is looking for great business owners who can give them a higher return on their capital. One of the ways that they do this to buy streams of income.

I like that a lot because it can help a lot of business owners build their business bigger, better, faster.

Now, understand this in an inflationary economy. More money today is better than money tomorrow.

About Cell Phone Tower Contracts

J Massey: [38:26] Here’s what happens if I buy a cell phone tower. The cell phone company pays the owner a monthly rent, let’s say that monthly rent is $1,500. Twelve months of rent is $18K. Those contracts typically have a period of which they’re going to guarantee that can be as short as five years, and then they may have five, 10- or 20-year renewal periods that can be canceled at any time with just a 30-day notice. This was my contract: $1500 a month was coming, but we were into this period to where they could cancel it anytime with the 30-day notice.

Even though it says that they’re going to be around for 20 plus years, that doesn’t mean that they will. I saw that as a risk because I’m the one holding the lease. I don’t know when they’re going to decide that they no longer want to rent this particular tower and then I’m left with a tower I don’t really want to own.

Both Parties’ Problems Put J Massey On the Winning Side of the Transaction

J Massey: [40:00] I started searching and asking questions about the possibility of selling a cell phone tower, and then several hedge funds and institutions began contacting us. As it turns out, one of the things that they do is they will take a monthly stream of income and give the leaseholder a lump sum payment today.

To keep the math simple, here’s what happened: my $1,500/month got turned into a little more than $225,000 today.

They gave up their income, and I gave them the income stream. But who did I really give it to? Who really took that risk? They collected the $225K from a lot of 401k’s across the nation.

If that cell phone company decides that they’re done, whether they recoup their $225K or not, they’re just going to report that the deal did not go well.

If you had a choice between $1,500 a month for the next 20 years, or $225K today, take the $225K today. Because what can you turn that $225K into? A lot more than $1,000 a month.

The Opportunity for Entrepreneurs

J Massey: [42:22] If you just made another 401k contribution, understand how it’s funded. Those mutual funds are finding entrepreneurs who are out there making things happen, and then they’re giving those funds to entrepreneurs to go out there and do great things.

The person who collects the hedge funds, the 401k’s, the mutual funds, has a problem. Their problem is they have too much money, and now they got to do something with it.

They can’t just collect all that money every two weeks and do nothing with it. They have to find a place for it to work. That is why they do these types of transactions. They’re good at collecting the money and evaluating risk, but they need whatever they buy to be easy to manage.

That is the challenge, but also the opportunity for those who are willing to put in a little bit of hustle (or a lot of hustle).

Why Short-Term Rentals Are the Highest and Best Use of Lots of Real Estate Right Now

J Massey: [44:50] Now, just because you are familiar with the word Airbnb, do not believe that you understand what they are, who they are, or what the business model I’m about to say is.

The Surprising Opportunity

J Massey: [45:30] Many people would do better if they let someone else stay in their home just on the weekend than by going to work and stressing themselves out to make the same mortgage payment.

That same equation exists in so many places across the country. It is not uncommon for just two weekends of rental to make most people’s rent and or mortgage payment.

This type of business is an export. We have a trade deficit. Money comes from outside of your area for a person to come to enjoy your area. And we need more trade, more businesses that can help us balance the whole trade equation. This is definitely one way of making that happen.

It also is inflation resistant. That’s simply because, as the cost of anything goes up, the daily rate also goes up.

Make Money with Something You’re Already Paying For

J Massey: [46:59] And it’s something that utilizes space you’re already paying for anyway.

But how often are you actually at home? Just think about how much time you spend at home versus how much time you spend outside the home. And if you ever do a calculation of what it costs you on a daily basis just for the minutes you’re at home, you’ll probably freak out say I need to figure out how to do something completely different.

The opportunity has always been there. It’s just that technology has come into place to make it easy to find the customer who needs a space and to match them with the person who has the space.

If you’re willing to go out there and do the work, it’s some of the highest returns I have ever seen.

I’ve had some of our newest students be able to turn profits in 30 days and get 100% their money back within six to nine months. We’ve been doing it now for a couple of years, and we have students all across the globe, from many different jurisdictions. Canada, South America, Russia, the good Korea, and the stories are the same over and over and over again.

The Easiest Entry Point in Real Estate

J Massey: [49:00] It is the easiest entry point in real estate. And it gives us that little win along the way to keep focused on those long-term goals. And you have so many wins inside this business model while you get to have fun and meet new people and provide clean, safe, affordable housing to people in a completely different fashion.

It becomes a down payment generation engine. This can be your goose that keeps laying down payment eggs so you buy as much real estate as you want.

Privatized Banking with Whole Life Insurance

J Massey: [50:10] As I build that short-term rental portfolio, it creates a significant amount of excess cash or capital.

I then store that excess cash in a vehicle (Privatized Banking) that allows me to grow that capital tax-free or tax-deferred. Then I can take that capital back out without having to pay taxes on it again.

In essence, I’m using that as the beginning of the down payment, but also using it to build what I now affectionately term the “family bank.”

If you’ve felt like you may have been excluded in the past from being able to have enough cash to build your own family bank, here’s a business strategy that we’ve had people start for as little as $500 (always bet on about $25 per square foot).

If I can just find a way to make another thousand dollars a month without contributing another thousand hours, then I can make this work.

At the end of the day, we need a way to own and control the means of production. The only way to do that is with real assets that have intrinsic value. And being able to provide clean, safe, affordable housing is one of those.

Other Topics Discussed

- The rags to riches story that catapulted J into real estate

- J’s path of learning and action in real estate, including wholesaling, single-family houses, notes, commercial property, raising private capital, cell phone towers, and short-term rentals

- Solving problems for others makes you wealthy

- How to solve problems for all the stakeholders in real estate, including the investor, seller, buyer, the title insurance provider, and the person who needs clean, safe, affordable housing

- If you’re a real estate investor, you’re a business owner, and why you need to build a system that’s independent of you

- Bank stability vs. life insurance company stability:

- J’s work to teach and educate nonprofits to leverage real estate to create self-sustaining income

- J’s desire to own a sports team along with like-minded people he enjoys hanging out with is his motivation to educate and develop enough six- and seven-figure students who can contribute to the purchase price of owning a sports team and getting to hang out with like-minded people

Connect with J Massey

To help you move forward in your investing career, get J’s book, Cashflow Diary: 10 Steps to Creating Wealth in Any Economy! here.

Create Your Time and Money Freedom

Do you want to begin building capital, putting it to work, and accelerating Time and Money Freedom? To find out the one thing you should be doing to increase your cash flow by keeping more of the money you make, contact us today.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreSurviving the Storm: Navigating War in Israel with Rabbi Lapin

When war across the world could mean war close to home or a whole world war … when conflicts thousands of years old can’t be solved overnight … when truth seems defined by who’s in power … when totalitarianism seems stronger than freedom and free markets … when open borders looked like compassion but instead…

Read More