The Biggest Thing You Can Do to Increase Your Cash Flow

The #1 most effective way to increase your cash flow today is to think like the bank. Banking generates voluminous cash flow. There are rules for how the bank operates that have established banking as the most powerful business model in the world. You can follow these rules to increase your cash flow, starting from whatever income you have today. This secret hidden in plain sight is the catalyst to increase your cash flow and take control of your financial destiny, without cutting back, working harder, or taking on more risk.

Let’s build your bridge to time and money freedom by increasing your cash flow with the one most powerful step. We’ll answer:

- Why focus on cash flow?

- What is cash flow?

- How do I increase my cash flow?

We’ll give you the seven rules banks use that give them the upper hand.

When you utilize these rules in your own economy, you’ll stop having so many dollars flow out of your hands, and you’ll start keeping and controlling more of your money.

You’ll leverage the magic of compound interest, so you earn it, instead of paying it.

Instead of making costly mistakes by following typical advice, you’ll think for yourself and take control.

Rather than building the empires of banks, Wall Street, and financial institutions, you’ll begin building your own financial destiny.

Podcast: Play in new window | Download (Duration: 55:50 — 51.1MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

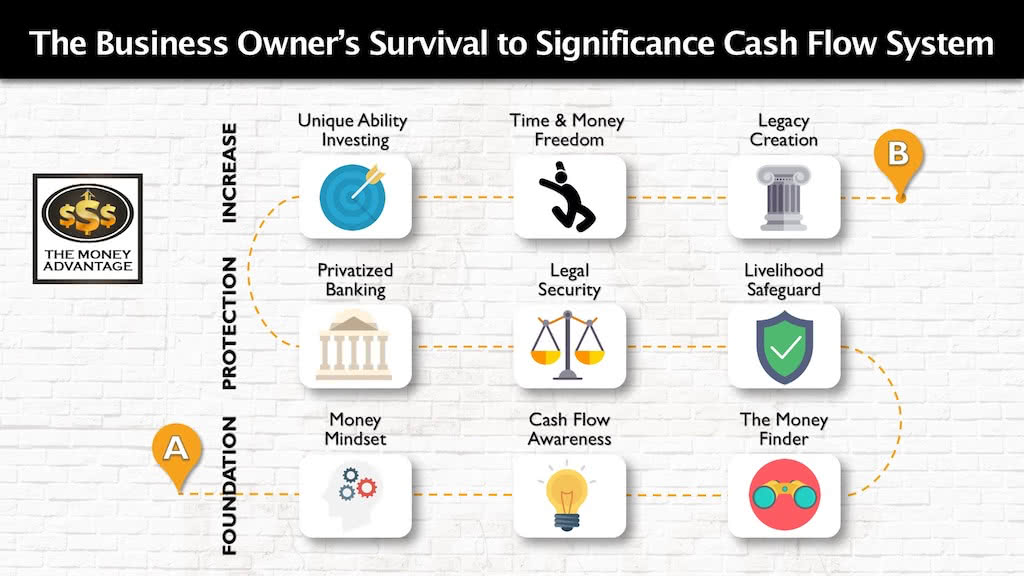

Where Increasing Your Cash Flow Fits into the Cash Flow System

It may seem obvious that increasing your cash flow is a critical component of your cash flow system. I mean, that’s the part of your life that is all about cash flow, right? But here’s how it fits in the bigger picture exactly:

The Cash Flow System moves you from survival, with little to no cash flow, to significance, where you have abundant cash flow from assets.

In the foundational phase, you start by keeping more of the money you make. In the next phase, you protect your money. Finally, you make more money and increase your cash flow.

Thinking like a bank is part of all three stages and allows you to increase your cash flow.

Most importantly, it’s part of your mindset in the foundational phase. Your mindset is what allows you to reduce your money leaks and keep more of your money.

In the second phase, thinking like a bank allows you to protect your money, earn uninterrupted compound interest, and save like the wealthy.

Finally, employing banking principles allows you to utilize cash-flowing assets to build time and money freedom.

What Is Cash Flow?

Cash flow is when you have more money at the end of your month.

Cash flow is the money that you’re not using up each month, that you can instead set aside and store up. When you have cash flow, you have money left over in your monthly economy.

Determine your current monthly cash flow with this simple equation:

Cash Flow = Income – Expenses

Having more cash flow gives you more options, and options give you freedom and control.

Two Levels of Cash Flow

There are two levels of cash flow. The difference between the two is the source of your income.

The first level we’ll call cash flow from income. This is the most common income source. When you have cash flow from income, your primary income source is a job. Of those wages, you spend less than you earn.

The second level is cash flow from assets. In this position, you have assets like rental real estate or self-sustaining businesses that do not require you to put in your time to generate a profit. Your assets provide more income than you spend. This is the most desirable source of income and is the pinnacle of cash flow achievement.

Why Focus on Cash Flow Now?

Let’s answer the question, why cash flow today? You reach financial freedom when you’re in a position with income from your assets that exceeds your expenses.

For example, a person with lifestyle expenses of $10,000 each month who has an income of $10,000 from business and real estate has reached time and money freedom.

Robert Kiyosaki would call this breaking out of the rat race.

When you reach that point, you have the freedom to decide what to do with your time, and whether to keep working your job or walk away.

Increase Your Cash Flow Today to Accelerate Time and Money Freedom

Having a high income from a job, and not spending all of it doesn’t mean you’re financially free yet.

Imagine the path to time and money freedom were a race. Cash flow is not only the winning criteria and the modus operandi of the entire race, but it’s also the entry point. No one finishes without cash flow from assets. But more importantly, one of the best ways to compete is having cash flow from income today. Spending less than you earn today accelerates your path to financial freedom.

Here’s why:

Before you can buy assets that produce income, you must have either have the cash for the purchase or other people’s money to finance the acquisition.

Cash flow today builds cash you can use to acquire cash-flowing assets. That’s why increasing today’s cash flow is the ticket to building long-term time and money freedom.

Therefore, the most important thing you can do right now on your path to time and money freedom is to increase your cash flow today.

How to Increase Your Cash Flow

You increase your cash flow by widening the difference, or gap, between income and expenses.

Increasing your cash flow is simpler and much less painful than you think. When most people think of increasing cash flow, they think of how to cut expenses. You might have nightmares of forgoing the air conditioning, extreme couponing and eating only rice and beans. But that scarcity thinking is not only harmful to your health, relationships, and well-being, it will probably make you poorer in the long-run.

Instead, we’ll show you how to increase your income and reduce the outflows like taxes, interest, and opportunity costs that have money flowing out of your control.

The #1 most important thing you can do today to increase your cash flow is to install a new financial mindset and begin thinking like the bank.

The #1 Cause of Limited Cash Flow and How to Overcome It

Unfortunately, limited cash flow plagues many households who spend all or more than they earn each month.

Some of these situations are because of unfortunate circumstances beyond our control like losing a job or facing a medical emergency.

However, for the most part, much of this stunted cash flow is the result of a consumer mentality. In most industrialized nations, the comforts allow us to become really good at buying things to mask our insecurities about money. We become spenders who feel we can buy our way to happiness, belonging, peace and financial freedom with another purchase.

The spender is fearful of not enjoying life. They spend everything they make and have no cash flow left over.

The saver is fearful of running out of money. They pinch pennies so that they can hoard and accumulate money. They don’t end up much better off than the spender, because they still have not developed the skill set of production. They’ve just focused on reducing expenses. The result is that they create stagnant money and remain passive in handling their money.

Instead, we need to transition to a producer mindset and focus on becoming good at making money. Producers recognize that their money is a direct outflow of themselves and their capacity to create. The producer is a steward of their financial resources and is empowered to create money and increase their cash flow from assets.

This skillset takes a great deal of financial education, time, energy, personal effort, and intention to develop.

Dear reader, if you’ve read this far, you’re on the path to becoming a producer and a steward.

Three Mindset Shifts to Achieve Time and Money Freedom

Thinking like a bank allows you to make the three catalytic mindset shifts that you need to achieve financial independence.

Mindset Shift 1: From Accumulation to Cash Flow

Most people focus on accumulating money and building their net worth. They put money away their whole life to build up a nest egg large enough to live off the interest in retirement. To do this, they put money at risk in the market, stay in it for the long haul, and hope the market doesn’t crash. This thinking puts your cash in the control of financial institutions, and makes money managers rich, but offer no guarantees that it will work out for you.

Instead, if you focus on cash flow, you’ll have more income than expenses. Cash flow gives you breathing room and confidence. It helps you maintain a relaxed and peaceful state of mind that allows you to do your most creative work and make the most money. With more cash flow that you control today, you can decide whether to spend, save, invest, or give.

Mindset Shift 2: From Retirement to Financial Freedom

Most people focus on getting to retirement, the date they can quit their job. But retire literally means to put out of use.

Financial Freedom is a more honoring and freeing goal. This is the position when you have income from assets greater than your monthly expenses, and you can choose to continue working or not. We believe everyone is better off working in a productive capacity, where they can contribute, provide value, and earn.

Since the ultimate goal is to have cash flow in the future, the best way to build it is to have cash flow today that is directed into your control. This allows you to invest in assets that produce cash flow, leading to future cash flow.

Mindset Shift 3: From Scarcity to Abundance

The most common financial viewpoints are rooted in scarcity. They feel that money is a limited resource with not enough to go around. Worry, fear, and doubt overshadow their mindset about money, causing them to either fear spending too much or fear not enjoying life enough.

Instead, an abundance mindset sees that there’s more than enough money for everyone. A person with abundant thinking recognizes that the cause of all money is providing value. They know that the more value they provide to others, the bigger they expand their own slice of the pie, and the more that becomes available for others as well. When you’re thinking abundantly, you have gratitude, confidence, and creativity to see the opportunities to create wealth.

You and the Bank

The banks, financial institutions, and Wall Street enter into transactions with you when you pay a loan, buy stock, or put money into a fund.

Every transaction has two income statements – yours and the banks. Your loan payment is your expense and their income. Putting money into an investment or account is your outflow and their inflow.

You Can Start Thinking Like the Bank or Be a Customer of the Bank

If you follow the path of money, you’ll notice that most often, it flows back to banking and the wealthy. Have you considered that the truly successful who don’t worry about money think differently than the rest?

It’s because there are two opposite rulebooks: one for the bank, and one for the customers of the bank.

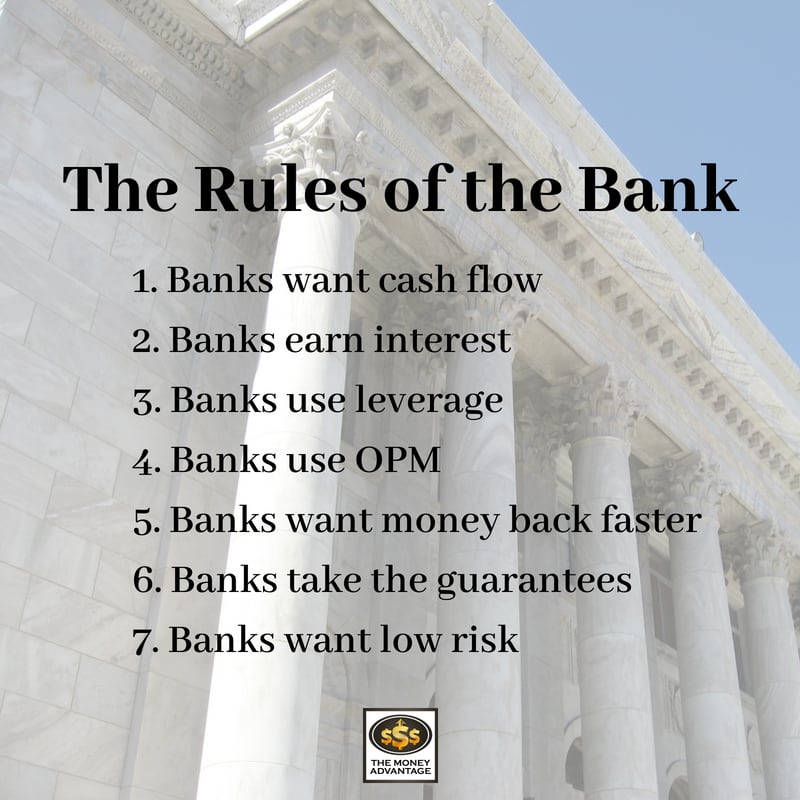

Here’s the short list of what the bank wants:

- Get as much money as possible

- Get money as often as possible

- Keep it as long as possible

- Give you as little back as possible

- Take as little risk as possible

But if you consider what you’ve been told to do, it’s quite radically the complete opposite:

- Put away as much money as possible

- Put it away as often as possible

- Keep it there as long as possible

- Take back as little as possible

- Take as much risk as possible

This night and day difference in the way banks think about money is what puts the banks on top when it comes to earning cash flow, stewarding it well, and profiting.

The rules we’re taught have us being forever a customer of the bank. We end up building the house of the bank and not our own.

Instead, if you apply the rules of the bank in your own personal economy, you’ll prosper.

Your mindset is like a door that opens into limitless financial possibilities. With the right mindset, you’ll be surprised by the creative strategies you’ll find to reduce your expenses and increase your income to widen that cash flow gap.

If you want to take control of your life and destiny and build financial freedom, here’s the roadmap to do just that:

Banking 101: The Seven Rules of the Bank

#1) Banks Want Cash Flow

Typical financial advice teaches that you need decades to create wealth. But it never takes the bank decades to create wealth, because banks don’t focus on accumulating money. Instead, they accelerate money by increasing their cash flow.

It’s favorable to the bank to have loans paid back more quickly, through shorter loans, bi-weekly payments, or extra payments to the principle. The more quickly their borrowers repay loans, or the more money investors put into their funds, the more cash flows into their control.

While paying off loans more quickly increases the cash flow to the bank, it decreases yours.

Because paying off debt faster will reduce the interest paid to the lender, many borrowers mistakenly believe that paying extra will reduce the cost of the loan. When you factor in opportunity cost, that is not always the case.

Besides, paying off debt faster can result in a liquidity crunch when you need the money, but can’t get to it.

Instead of paying off loans for the sake of paying off loans, prioritize financial moves that increase cash flow. Using the cash flow index will allow you to determine the efficiency of your loans and decide which ones to pay off and which ones to keep. In this way, you can pay off loans in a way that allows you to increase your cash flow and maximize access and control of your money.

#2) Banks Earn Interest

Banks use arbitrage, the spread between what they pay and what they can earn with the same money. They earn more than they pay by buying low and selling high in another market. They may pay 0.07%* on deposits but charge 18% to loan out the same money.

The bank earns the spread between the interest rates.

If the bank takes $1 in deposits and pays 1% (a penny), the deposit is the bank’s liability, and the interest rate is their expense. They can then loan out that dollar at 5% (a nickel). The loan is their asset, and the interest earned is their income. In this case, they would earn the difference of $0.04. You calculate the spread like this:

Earnings / Investment = Rate of Return

In this case, $0.04 / $0.01 = 400% Rate of Return

Let’s look at a more realistic example. The bank pays 2.00% on $10,000 in a 5-year CD, and they loan out the $10,000 for a 5-year car loan at 3.88%. They pay $200/year and earn $388/year on the same money. This generates a 94% Rate of Return for the bank.

If you’re able to borrow at 5% and use that capital to earn 15% in a business opportunity, you make the 10% spread, which is a 200% Rate of Return.

Make That Compound Interest

Banks are wise to the power of compound interest.

Those who understand compound interest are destined to collect it. Those who don’t are doomed to pay it. – attributable to Albert Einstein, Benjamin Franklin, or John Maynard Keynes

In every transaction, the bank seeks to earn more interest than they pay and consistently earn compound interest.

How can you apply this in your own economy? Looking at your own inflows and outflows, total up the payments you’ve made to financial institutions over your lifetime and the ones you’ve made to yourself. Who is earning the compound interest? Are you paying more interest on loans or earning more on your money?

Additionally, to model the bank, earn more compound interest than you pay by retaining control of your capital.

#3) Banks Use Leverage

When you have savings with the bank, that deposit is a liability on their balance sheet. The bank now has an expense to pay you interest each month. They go into debt to you. They also earn interest on that money by loaning it out. The bank takes your money and makes more with it, multiplying everything in their control. They use debt as leverage.

Because of the fractional reserve banking system, the bank must hold 10% in reserves. This means that they can loan out up to 10X the amount of money in deposits. When you deposit $1.00, they now have permission to create and loan out $9.00 more.

This leverage increases the spread they earn. Here’s how the bank increases their returns by using leverage: If the bank pays 2.00% on $10,000 in a 5-year CD, they can now loan out $90,000 at 3.88%. They pay $200/year and earn $3,492/year, a whopping 1,552% Rate of Return.

One way you can take your money and make more with it is to use the leverage of debt. If you can borrow capital and use it to make money, you’re a steward of that money. This is different than borrowing money to use for your own consumption.

For instance, purchasing a $100,000 rental property with $20,000 down, and a $200 net monthly cash flow after all expenses will yield you a 12% cash on cash return. If you had not used leverage and instead paid for the property in cash, you wouldn’t have to pay the loan and may net $800/month in cash flow. In this case, but your cash on cash return would be much lower at 9.6%.

To model this principle, use debt for production, not for consumption. Instead of fearing or avoiding debt, use it to make more money.

#4) Banks Use OPM (Other People’s Money)

Banks don’t wait to stockpile their own capital. Instead, they incentivize other people to deposit their capital into the bank, and then use those “other people’s money” (OPM) as the seed capital to make more. When you put money in, it’s now in their house, and they steward it to bring in cash flow.

How can you apply this rule in your own economy? Provide enough value that other people want to invest in your endeavors. Instead of using your own money for an investment, keep your own money compounding, and use OPM for the purchase.

#5) Banks Want Money Back Faster

Determine what they value by evaluating interest rates – from their perspective.

Deposits with higher interest rates attract you as a depositor because you’ll earn more on your money. For the bank, the higher interest rate they’re willing to pay you (their expense) means the money is more valuable to them. The entity holding your money will pay higher rates of return for longer period deposits because they have control of the money longer.

Loans with lower interest rates attract you as a borrower because you’ll pay less for the loan. However, the bank will earn lower interest rates on shorter loans because they get the money back quicker.

High rates on deposits and low rates on loans both put more cash in the control of the bank.

When you use interest rates to make decisions about loans, you often end up making the decision that’s best for the bank.

When you deposit more money with the bank, you increase money in their control, shrinking the cash you could have used to create cash flow. Likewise, when you pay higher payments to loans, you decrease the cash in your control and end up with less money to use to generate cash flow.

Instead, make financial decisions that put more of your cash in your control, not the control of the banks.

#6) Banks Take the Guarantees

When you invest your money through a fund, the financial institution’s income on your investments is the guaranteed management fees. Your income on the same investment may be subject to market risk. Whether your account performs well or loses money, the bank gets the guarantees, and you take all the risk.

In your personal economy, pursue guarantees, not risk.

#7) Banks Want Low Risk and Guaranteed Returns

When you seek a loan, the bank is most likely to give you money if you don’t need it. If you need money, you are the highest risk to the bank, and most likely to be turned down.

When assessing your debt-to-income ratio, a higher ratio means higher risk, because more of your cash flow is already earmarked to pay fixed loan payments. A lower debt-to-income ratio means you are financially more stable and solvent and more of your monthly cash flow is available to make payments to the newest loan.

The bank’s determination of your creditworthiness is all about your cash flow, and their ability to gain cash flow.

If you have no money, no income, and are seeking an unsecured loan, you are the highest risk to the bank, because they have little guarantee of being paid back, and no collateral to collect if you default.

If you have income and cash reserves and obtain a secured loan, you’re a lower risk to the bank, because they know they’ll be repaid. In the unlikely case that something goes wrong, they’ll still be able to collect.

To apply this rule in your own economy, invest in opportunities that are low risk that give you the highest chance of getting paid.

Model the Bank

You have a choice to make.

If you follow typical advice and focus on paying off debt and accumulating money, you’ll continue being a customer of the bank and giving up control of your capital. Banks and financial institutions, Wall Street, and the government will gladly be the recipient of your cash and your cash flow when you prioritize paying off loans, accumulate net worth in risky securities, and pay too much in taxes. These actions have money flowing out of your control.

Instead, of paying so much to financial institutions through investments and loans, you can choose to do what the bank does. If you model the bank, you’ll prioritize cash flow, earn compound interest, use leverage and OPM, get money back faster, secure guarantees, and invest in what is most likely to pay you back.

In this way, you’ll get as much money as often as possible, keep it as long as possible, give up as little as possible, and take as little risk as possible.

One of the Most Effective Ways to Model the Bank

One of the most effective ways to steward your wealth creation and apply banking principles in your personal economy is to use your own Privatized Banking System, with Specially Designed Whole Life Insurance.

You’ll capitalize your bank by storing your money where you have control, accessibility, guarantees, and will earn uninterrupted compound interest.

Then, you’ll identify opportunities that are low risk, where you have control.

Now, you have purchase options.

Instead of using your own cash, you can utilize a policy loan. This gives you the opportunity to use the insurance company’s money (OPM), while your cash value continues compounding uninterrupted.

And you’ll use arbitrage to capitalize on the spread.

As you repay your policy loan, you’ll replenish your bank to use for the next asset purchase.

Build Your Time and Money Freedom

To discover how you can accelerate financial freedom, starting from where you are now, book a strategy call to find out the one thing you should be doing to optimize your personal economy.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

*NOTE: For all examples, deposits and loans are calculated as APY, with an annual period of 1 period/year.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreSurviving the Storm: Navigating War in Israel with Rabbi Lapin

When war across the world could mean war close to home or a whole world war … when conflicts thousands of years old can’t be solved overnight … when truth seems defined by who’s in power … when totalitarianism seems stronger than freedom and free markets … when open borders looked like compassion but instead…

Read More