Why Cash Flow Today?

Why cash flow Today? The goal of the typical financial model is to accumulate a pile of cash. It is akin to climbing a mountain, where the journey to the top is all about creating a lump sum. At the top, you’re hoping the lump sum generates enough income to live the rest of your life.

This is the typical retirement model of thinking, and here’s why it often doesn’t work.

It’s very difficult to build a pile of cash large enough such that you don’t run out of money. It’s so challenging due to risks like inflation, taxes, interest rates, market risk, loss of principal, and longevity risk. All of these risks can require you to cut back your lifestyle, or work longer than you had planned.

The typical model of financial planning leads to one end goal: to generate income in the future to accommodate the lifestyle you want at that time.

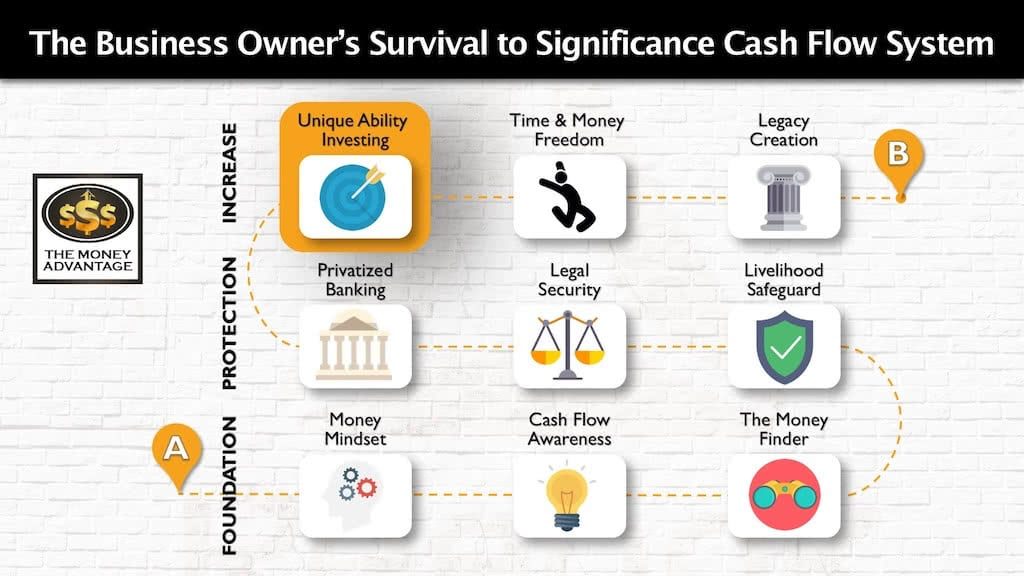

Where Investing Fits in the Cash Flow System

It’s not enough to just make a great income. Financial freedom starts when you create enough cash flow today from assets to sustain your lifestyle even if you do not show up to work.

You have to figure out how to keep more, protect that money, and then make more through the right investing decisions.

That’s why we’ve put together a 3-step roadmap to help business owners accelerate

Why Cash Flow Today?

Whether you focus on creating a pile of cash or streams of cash, both have the same end goal.

Let’s answer the question, why cash flow today?

Let’s say you have cash flow in your current life of $1,000 a month and you have been setting that aside in an opportunity fund. You then use that to invest in an asset, generating an additional stream of income. We’ll say $3,000 of income a year.

Thinking like a bank, you repeat and invest in additional assets, which increases your cash flow, giving you more money to put to work. Not to mention that over time you will also build equity, which you could use to accelerate this process.

Financial freedom is when you have enough cash flow today coming from assets to cover your expenses. You’re in a position where you have freedom of choice to do what you want to do with your life.

Realizing that the end goal of all financial planning is cash flow opens up your mind to think differently about being in control of your financial life. You’re ready to answer the

Your Decision Point

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Family Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read MoreStop the Hustle and Grind, with Christine Jewell

Are you an ultra-high achiever, but feeling the cost of that success? Christine Jewell, author, keynote speaker, faith-based executive coach, and host of the Breaking Chains podcast, joins us today to provide a fresh solution. In her new book, Drop the Armor, Christine teaches you a transformational approach that allows you to stop the hustle…

Read More