Real Rate of Return: Why “Average” Is Not Real

The real rate of return is objective, rational, and substantial. It delineates the exact performance of your capital from start point to end point. It has actual value and meaning. Like concrete beneath your feet, it’s solid ground. At its core, it is the truth.

But finding the truth is often much harder than it appears. Searching for the real figure behind your average rate of return can be like battling optical illusions of smoke and mirrors.

Fund managers, the media, and Wall Street proclaim average rates of return. Every day, average yields are cited as some kind of absolute, predictive authority, assuming the clout that they have no right to take.

You need truth in your financial decision-making. Instead of staking your financial future on the shifting sand of average rates of return, it’s time you recognize them for the imposter they are.

Podcast: Play in new window | Download (Duration: 52:23 — 48.0MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | Youtube Music | RSS | More

Table of contents

What We’ll Cover

In today’s conversation, we’ll take an in-depth look at actual market returns over the last 118 years and why the average rate of return is often misunderstood or flawed.

And finally, we’ll reveal how to take control of your financial future and not just hope that your speculations and assumptions are accurate.

This conversation will answer:

- What do market returns mean for me?

- What is the real rate of return?

- What returns should I expect?

- How do I calculate the real rate of return?

- What should I do to best take control of my financial future and build time and money freedom?

- How do you calculate the average real rate of return?

You’ll get the tangible facts and concrete evidence to form your own opinions.

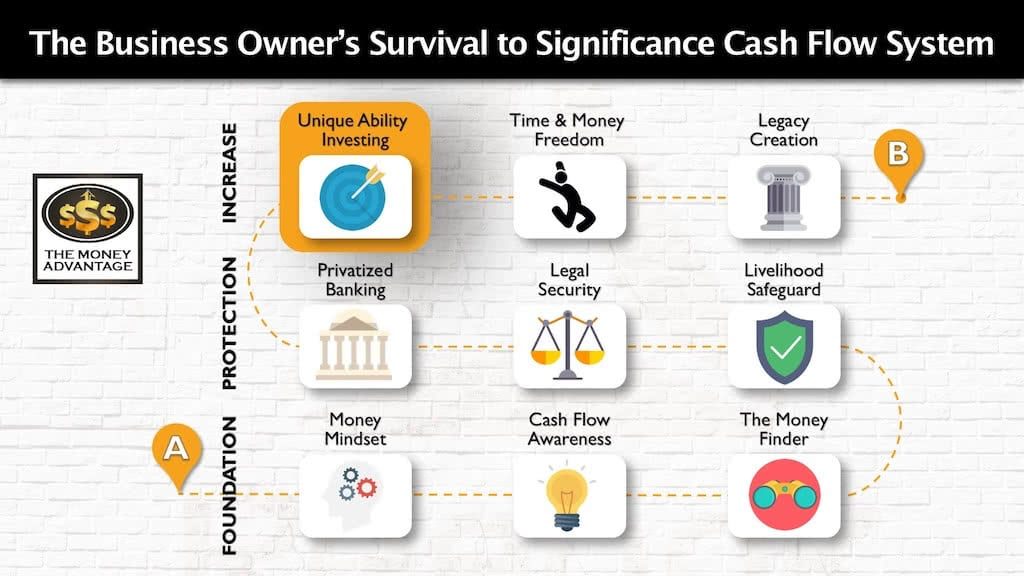

Where Your Investing Mindset Fits into the Cash Flow System

Understanding the real rate of return is part of ensuring your ability to reach your investing goals. But before that, this knowledge will help you calibrate your mindset to fine-tune your goals in the first place, so you actually end up where you want to be.

Both investing and mindset are a part of the Entrepreneur’s Cash Flow System.

Today’s comprehensive conversation will help you invest well in stage 3. But, to achieve investing success, we’ll help you approach it with the right awareness and mindset in stage 1, so your efforts don’t crumble.

The Stock Market and the Average Rate of Return Myth

Many people believe they can expect at least 5 – 7% gains each year in the market, that the market will always grow over the long haul, and that their money will compound over time. At the same time, your experience of market losses, and the anxiety about your own portfolio suggest that our expectations are wrong.

According to data from YAHOO! Finance, here’s the actual performance of the S&P 500 Index over various dates and timeframes: *

- +19.4% gain 12/30/2016 to 12/29/2017 (12 months)

- +9.4% gain from 12/29/2017 to 10/01/2018 (9 months)

- -19.6% drop from 10/01/2018 to 12/24/2018 (about 3 months)

- +5.04% annual real rate of return from 01/01/15 to 12/31/2018 (4 years)

- +2.85% annual real rate of return from 12/31/1999 to 12/31/2018 (19 years)

* It’s important to note that these returns do not account for transaction fees, management fees, or administrative expenses.

No wonder your experience isn’t matching your expectations! From these statistics, we see that the common assumptions are incorrect. 5 – 7% gains don’t always happen. Actual performance doesn’t always rise. And longer investment isn’t always better.

These examples also challenge the assumption that your portfolio will consistently match the average rate of return often advertised in financial media.

Let’s dig deeper to find out why.

To do so, we’ll explore several key variables that impact your real rate of return, which are often swept under the rug and ignored. These include the distinction between average and real returns, the start and end point of your investment, the impact of losses, taxes, inflation, management fees, and transaction costs, adding investment over time rather than all at once, and the fallacy of expecting the future to mirror the past.

What Is the Difference Between Average and Real Rates of Return?

What Is an Average Return?

Average returns are taken by calculating each individual year’s return within a period, then summing each return, and finally, dividing the total by the number of years in that period.

( Year 1 Return + Year 2 Return + Year 3 Return … ) / Total # of Years = Average Rate of Return

For instance, consider a four-year period with annual returns of -20%, +20%, -60%, and +100%. The sum total of all returns would be +40%. Dividing the sum by 4 years, we arrive at an average annual rate of return over that period of +10% per year.

( -20% + 20% + -60% + 100% ) / 4 Years = 10% Average Rate of Return

The Assumptions We Make Based on Average Rates of Return

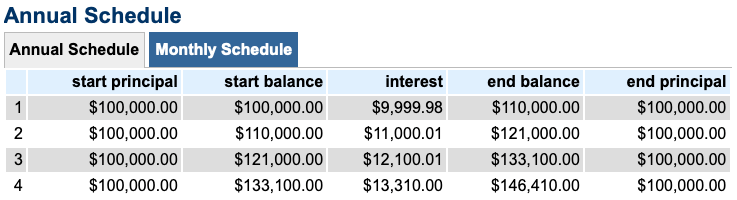

Average returns are often taken to mean that you received the average return each year. Applying this thinking to our example, we would expect an initial investment of $100K investment to gain 10% each year, achieving a total balance at the end of the 4th year of $146,410.

This type of thinking reflects common average rate of return assumptions—namely, that steady growth year after year is guaranteed. But that’s not how real performance works.

Discovering the Fallacy in Average Rates of Return

However, average returns unnecessarily focus on the incremental changes between years, losing sight of the big picture. To illustrate, let’s trace my actual account value each year if I received the returns listed above. I start with $100K. In year 1, I have a 20% loss, dropping my account value to $80K. The following year, I receive a 20% gain, which brings my account up to $96K. In the third year, I lose 60%, taking me down to $38,400. In the final year, my 100% gain brings my account balance up to $76,800.

Comparing my final account balance of $76,800 to my starting balance of $100K, I’ve lost money. Contrasting the positive 10% return with my actual performance, it seems that we can’t possibly even be talking about the same account. How can this be?

This highlights why average return can be misleading—it doesn’t reflect the actual outcome of compounding gains and losses over time.

How to Calculate the Real Rate of Return Formula

So, what is the real rate of return, and how do you calculate it? Real rates of return are calculated based on the starting value and the ending value of the account.

We calculate the real rate of return as follows:

( ( Ending Balance – Beginning Balance ) / Beginning Balance ) X 100 = Real Rate of Return

So, to discover the real rate of return on our investment above

( ( $76,800 – $100,000 ) / $100,000 ) X 100 = -23.2% Real Rate of Return

This real rate of return is finally a meaningful figure. Real returns help me understand why my balance is lower than it was when I started, whereas average returns bear no resemblance to my reality, whatsoever.

The Impact of Losses

Why this mathematical judo? And how does it cause the disparity between average and real returns? It comes down to the sequence of returns and the impact of volatility on your portfolio over time.

Losses are More Powerful Than Gains

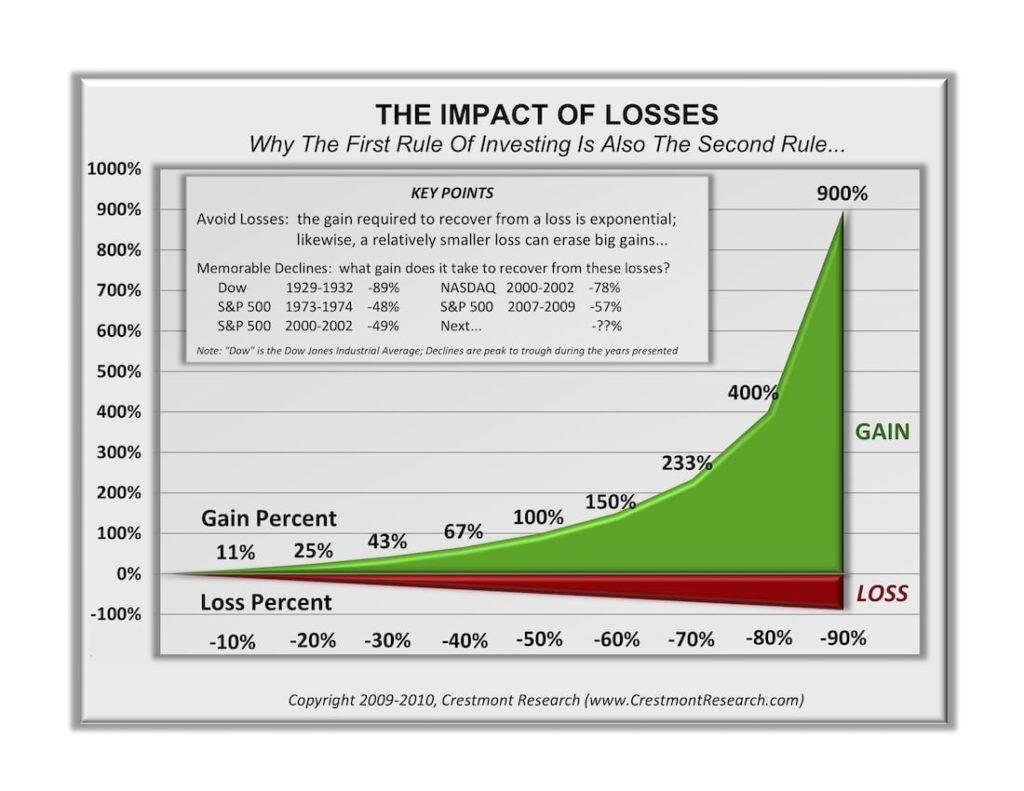

In short, it’s because losses are much more powerful than gains.

While negative and positive returns of the same number (i.e., +20% and – 20%) carry the same weight in an average return calculation, their real impacts are unequal.

If you sustain a loss of any amount, it requires a greater gain to restore your account to its starting point.

This happens because an equivalent percentage of a larger pie results in a bigger piece as your serving. For instance, 10% of 100K is more than 10% of 90K. This means that losing 10% of 100K is more impactful to your real rate of return than gaining 10% of 90K.

With Losses, Average Returns Are Always Higher Than the Real Returns

When the two different methods of calculation are used, you’ll find a consistent phenomenon: Real returns are lower than average returns any time losses are involved.

This is one of the clearest demonstrations of how volatility affects the real rate of return over time.

This disparity between the positive return required to bounce back from a corresponding loss becomes even more apparent with greater losses.

Imagine you had a -50% return, bringing your account down to $50K. A 50% gain would only bring you back up to $75,000, still not back to breaking even. You’d need a consecutive return of 100% to double your $50K and bring your account back to its starting level of $100K. Note that this performance would be slated with a 25% average return and a 0% real rate of return.

This demonstrates how the sequence of returns can dramatically impact your final outcome.

Finally, what if you lost 90% of your account value in the first year, dropping your account down to $10K? You would, in fact, require a 900% gain to recover to 100K. In this case, while your 0% real rate of return states your reality, average returns would proclaim an astonishing 405% average return.

Average vs. Real Returns in History

According to S&P Price data from Pinnacle Data, history proves this phenomenon of disparate average and real returns.

From 1971 – 2000 (29 years), average returns were 10.51%, while actual returns were 9.28%. In the 29 years from 1961 – 1990, average returns were 7.1%, while real returns were 5.96%.

This historical real rate of return data reveals a consistent pattern: average returns tend to overstate what investors actually experience.

Nominal vs. Real Rate of Return: What’s the Difference?

Nominal returns do not factor in taxes, fees, inflation, and the fact that most people do not invest a lump sum at the beginning, but usually contribute monthly or annually, lowering overall returns, since not all capital is invested over the entire period.

The distinction between nominal and real returns is critical when evaluating long-term investment performance.

If we accounted for these additional factors, actual returns are even lower than stated above.

Annual Real Rates of Return Over Time

Let’s look deeper into the historical data to find out what the real rates of return have been over a longer period of time. Then we’ll be able to clearly see where our assumptions diverge from reality and draw accurate conclusions based on facts.

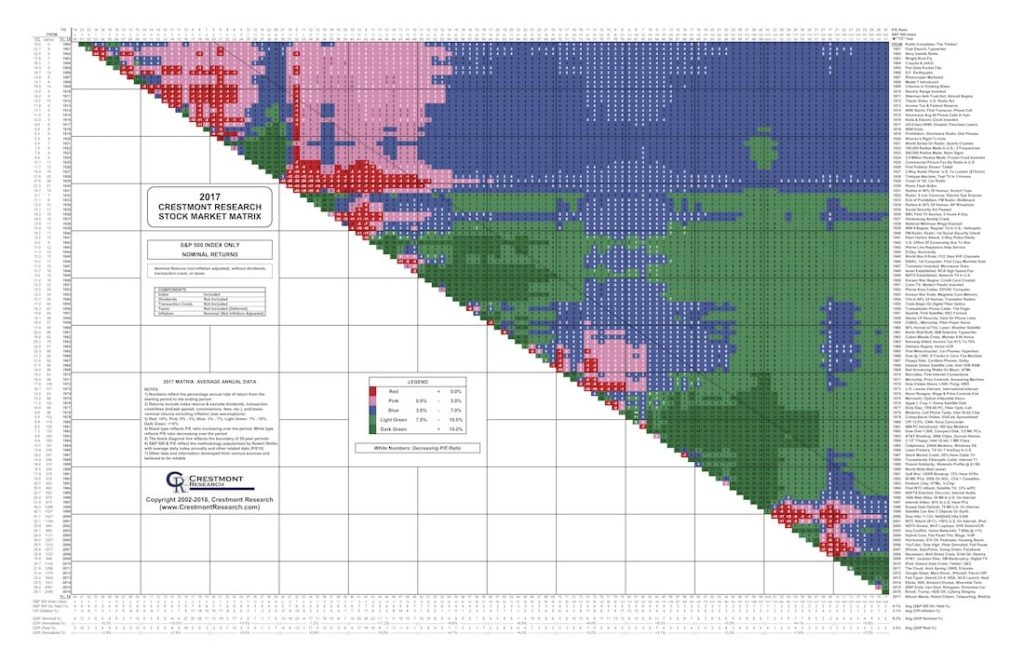

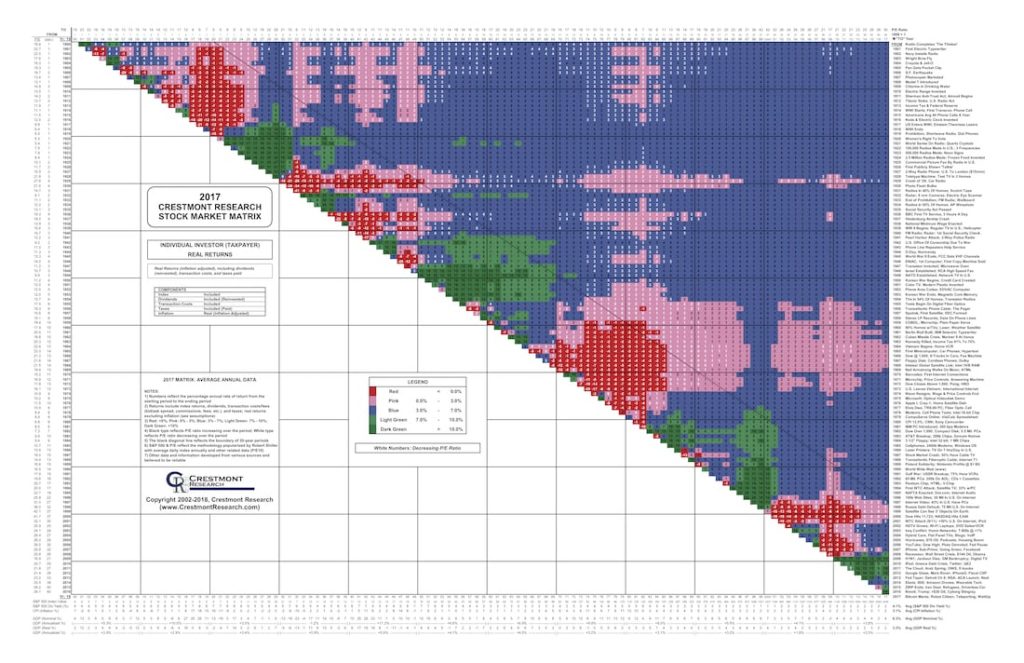

Crestmont Research has done a masterful job of compiling the data of the last 117 years since 1900, presenting the data in a way that provides excellent clarity. They’ve organized charts showing the S&P 500 Index’s returns every year. You can find charts based on the nominal and real rates of return. Every data point intersects a start (y-axis) and an endpoint (x-axis), providing the annual real returns over that period.

This first chart (nominal rate of return) shows the index’s nominal returns, based on nominal rates that do not include dividends, transaction costs, the impact of taxes, or inflation.

Due to the size and visibility of the chart, I’ll point out some important keys. Additionally, you may prefer to view the chart on Crestmont’s website.

Looking over the chart, you’ll first notice the color-coded categories of returns over that timeframe. Red is for returns of less than 0.0%. Pink marks the returns from 0.0 – 3.0%. Blue depicts the returns from 3 – 7%. Light green shows the returns of 7 – 10%. And finally, dark green highlights the returns higher than 10%.

The solid black diagonal line demarcates the end point of every 20 years since 1920. The colors along this line represent the actual returns of any person with a typical working career who invested over 20 years for retirement purposes.

Initial Conclusions

If that black line represented your “retirement deadline,” based on being invested in the market over the previous 20 years, you’d have a blind chance at whether things would work out well for you. For instance, if you happened to start your investment anytime between 1900 and 1931, you were just out of luck.

From this chart, you’ll notice that only about 15 years out of the 97 periods show real annual returns over 10%. However, about 27 times, your luck would have been a 3% or lower annual real return.

The most meaningful conclusion you can draw from this demonstration is that the most critical factors to your performance are the starting point and the ending point of your investment. It also highlights how average returns can be deceptive, painting an overly optimistic picture of what investors actually earn.

Viewing the Annual Return with the Practical Lens of Taxes, Inflation Rate, Dividends, Management Fees, and Transaction Costs

Let’s take it one step further. This Crestmont chart follows the annual real rate of return of an individual investor’s actual experience. Accounting for taxation, the reinvestment of dividends, and the impacts of transaction costs, management fees, and adjusting for inflation, using the figures here.

To think this through, let’s first look at taxes. If you achieve a return in a taxable environment, you’ll pay either capital gains tax or ordinary tax on your growth, depending on the venue.

The second major influence on your experience of returns is inflation. Inflation is related to the time value of many as it eats into your returns by reducing your purchasing power. In a year that you received a 3% return, but the inflation rate was also 3%, your experience of those returns was 0%, in terms of what those dollars could actually do for you.

Dividends, on the other hand, improve your performance. Dividends would actually increase your returns based on the dividend rate of your investment, with some years providing higher dividends than others.

Finally, you need to understand the significance of those seemingly benign and insignificant management fees. Usually falling somewhere between 1 – 2%, the slice seems nominal, so the impact is often dismissed. However, because these fees are charged every year, irrespective of performance, they further weigh the already powerful losses and weaken the gains.

Taken together, these factors can meaningfully reduce your real rate of return—even when average returns appear positive on paper.

For instance, consider a $100K account. In Year 1, you received a -50% return, and in Year 2, you received a 100% return. Your average return would be 25%, with a real return of 0%.

Add in a 1% management fee, and your real return drops to -2.49% because of this phenomenon, not the -1% you might expect.

Comprehensive Conclusions Based on All the Factors

Now that we’ve added in all the naturally occurring variables from our real life, you’ll notice very sparse periods with real returns over 7% (green) here.

In fact, along the 20-year line, 36 of those years show less than 3% real returns per year (out of 97 possible periods). For the 20-year mark, only 8 periods demonstrated real returns over 7%, contrasted with 89 periods that had real returns less than 7%.

Investors often have expectations of real annual returns greater than 7 percent – the areas in green. But over 20 years or longer, rates that high are rare. – New York Times

Interpreting the Historical Data

Crestmont Research has focused on observation-based historical real rate of return data, rather than prediction-oriented future recommendations. So, rather than fortune-telling, they study and analyze past trends.

You’ll notice that it’s difficult to recover when you start in a downturn timeframe, no matter how long you stay invested. For example, if you started in 1964 and pulled out in 1984, your overall returns were about -1%, with relatively no chance of pulling above a 3% real return, no matter how long you stayed invested after that.

This demonstrates that

The overall market is highly volatile and affected by generally long cycles…. Ten, twenty, or even thirty years is not long enough to ensure successful returns in the market. – Crestmont Research

The New York Times echoed this conclusion by stating that

After 60 or 70 years, returns are relatively stable, but this time frame is longer than the relevant horizon for many retirement plans. – New York Times

The Impact of Market Timing

Looking back over the last 117 years, one thing is certain: it’s all about when you start and when you finish. Staying in the market for the long haul only works out in your favor if the timing of your entry and exit points is favorable.

The New York Times article illustrates that if you began investing in 1961 and exited in 1981, you would have experienced the worst actual returns for a 20-year period of -2% per year, all factors considered, including average taxes and fees and adjusted for inflation.

If you happened to win the lottery on timing the market, landing from 1948 – 1968, the best combination of 20 years in the last decade, you would have had an actual return of 8.4% per year.

But 1948 is in the past, and we don’t get a chance to relive it. In fact, when you start and finish are primary investing factors that you don’t get to control – factors that make cash flow today more valuable than waiting for future gains. This is a classic example of sequence of returns risk, where the order and timing of gains and losses can dramatically shape long-term outcomes, even if the average return stays the same.

While we can see the trends and timing in the rear-view mirror, it’s impossible to know what’s coming up on the horizon at the point you’ll want to take your money out.

The very people who preach against individual investors timing the market are, at the same time, asking us to time the market 30 years in advance. – Andy Tanner, 401(k)aos

Do you have time to wait if your intended finish year isn’t good? With the long cycles, how do you know you started at the right time?

Adding Investment Over Time, Rather Than All at Once

One additional consideration that is even harder to measure is the timespan of your investment. When calculating returns, it’s often assumed that you invested a full lump sum at the start point, waited several years, and then withdrew the entire balance at the endpoint.

However, in real life, most people invest over the years and then consecutively withdraw over the years. This is usually referred to as an accumulation period, followed by a distribution period.

This approach aligns with the principle of dollar-cost averaging, where regular contributions are made regardless of market conditions, potentially smoothing out volatility and offering more return stability over time.

The “over time” nature of both periods impacts your overall returns.

During your investing years, most people point to dollar cost averaging as the remedy that cures all ails.

However, imagine you experienced most of your large gains in the beginning years when there was less total money in your account. If you then suffered losses primarily in the later years, with a more substantial account due to your added contributions, you can imagine the added drag on the overall return.

Consider the following depiction of the factors reducing average returns to real rates of return. You’ll notice the reduction from 8.21% down to 6.83% when annual contributions were made to the investment, instead of a single lump-sum investment at the outset.

The Fallacy of Expecting the Future to Mimic the Past

Even as we account for all the factors to understand past real returns, it still doesn’t give any certainty for the future. The future is uncharted territory.

Since average returns are different than real returns, and the past is different from the future, can you see the absurdity in assuming that the next 30 years of real returns will look like any other past 30-year average? Relying on historical averages to predict what comes next is fundamentally flawed.

In Summary

Today, we’ve debunked the myth that you can rely on historical average returns as an indicator for your real future performance.

The financial industry reports average returns on your investment accounts, using historical average returns for a fund to demonstrate future performance.

However, assuming your investing strategy will work out according to past averages will likely lead you to frustration.

Average isn’t real. You can’t trust average past returns posing as future real returns, no matter how official they seem.

One of the primary reasons that average returns are often naively high is that averages fail to account for the true power of losses. Because of this phenomenon, you can have the fake optimistic news of positive average returns, even while you lose money with negative real returns.

To determine your actual returns, you’ll need to choose the difference in account value between your start and endpoint. You’ll need to account for management fees, taxes, inflation rate, and your investment over time.

That’s why overestimating average returns can mislead even disciplined investors—and cause them to make decisions based on false confidence.

So, why would we naively expect the future to be predicted with a calculation as crude as a historical average return?

Your Decision Point

You might be wondering what to do with this information so that you can make empowered financial decisions.

Firstly, recognize that we are talking about investments with risk, in one category: paper assets in the market. Remember to leverage your investor identity when deciding the best investments for you. Investing in what you know and can control minimizes risk factors and increases your returns.

Second, before you invest it is important to have savings that are safe, liquid, and growing with uninterrupted compound interest, so you have reserves to use in the right investments when you find them.

You can combine your savings strategy with investments in a process called Privatized Banking to increase your control and certainty, and maximize your returns.

For more information, get our free guide on Privatized Banking.

Book a free strategy call today to learn how to optimise your personal economy and gain more control over your time and money.

FAQs

What is the average rate of return, and how is it used?

The average rate of return is the arithmetic mean of yearly returns over a period. It’s often used to estimate investment performance, but it doesn’t account for losses or compounding effects.

Why is the average rate of return flawed?

The average rate of return can be misleading because it ignores timing, volatility, and compounding. It assumes steady growth, which rarely matches how real investments behave across unpredictable markets.

How do you calculate the average real rate of return?

To calculate, take the average rate of return and subtract inflation. For more accuracy, adjust further for taxes and fees to reflect what the investor actually gains in real terms.

What is the real rate of return?

The real rate of return reflects your investment’s true growth by removing the effects of inflation. It shows your actual increase in purchasing power, rather than just the nominal gain.

What is the average rate of return vs. real return?

Average return shows the mean performance across years, while real return factors in inflation and expenses, offering a more realistic picture of what the investment truly earned.

Financial Planning Mistakes: The Most Risky Moves Aren’t What You Think

Bruce said something on the show that stuck with me because it’s so honest: Everyone thinks they’re an aggressive investor… until they lose money. And it’s true. Most people don’t even realize the biggest financial planning mistakes they’re making until the moment something “unexpected” happens: a market drop, a job change, a medical curveball, an…

How Much Do I Need to Retire? Rethinking the Number, the Risk, and the Cash Flow

The Couple With $8.5 Million… and One Salad “Bruce, I’m afraid we’re going to run out of money.” He had over $8.5 million across different accounts. They were in their early 70s. On paper, they were far ahead of where most people ever get. But his fear was so real that when they went out…

During a 3-months period, the price index increases from 140.50 to 141.30. During the same period, a stock increases in price from $50 to $51.90.

What is the real rate of return on the stock for the 3-month period?

Look up the Compound Monthly Growth Rate Formula.