Ted Benna: Reflections from the “Father of the 401(k)”

If you listen to the “financial experts” on tv or the radio, you will hear the typical blanket advice that you should put money into a 401(k). But the question is, does that advice apply to everybody? To get as much of an insider’s perspective as we could find, we interviewed Ted Benna, “inventor” of the 401(k).

During this insightful conversation, we discussed the purpose of the 401(k), its history, shortcomings, and the need for reform. This interview was forthright about why there’s a coming retirement crisis and what you can do about it if you want to take control of your financial destiny.

In this episode, we’ll help you answer:

- What does the 401(k) help me accomplish?

- Is the 401(k) right for me?

If you remember in How to Find Your Best Investments, we discussed that your investing strategy will be unique to you. You maximize your gains when you take an active role in investing in what you know and control.

So, where does the 401(k) fit for you?

Podcast: Play in new window | Download (Duration: 49:25 — 45.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

Individual Goals Create Individual Strategies

Here at The Money Advantage, our objectives are to help you keep and control more of your money. As an entrepreneur, you want control, access to your money, liquidity, cash flow, and tax advantages as possible. A 401(k) doesn’t support those goals.

However, to promote your education, it’s valuable to round out your perspective by considering the full discussion. When you increase your knowledge, you gain the ability to make decisions and build confidence that you’re doing what’s best.

Whether or not a 401(k) is a fit for you, it’s in your best interest to understand them. 401(k)s may be a part of providing solutions.

The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function. – F. Scott Fitzgerald

In this previous conversation about abundance, we discussed why being open-minded and considering contrasting information is critical to learning:

Unless you’re willing to expand your map, nothing new exists for you. When we come into a conversation with people who see differently, it’s important to recognize that if we both had the same map, we’d think the same way. When we each defend our own interpretation of the facts, it leads to conflict. The only way you can learn something new is to be willing to step off of your map and onto someone else’s. It’s not about who’s right, but about learning what else is possible.

Today, we’re jumping onto the map of someone with a different perspective so that we can expand our own map. We invite you to do the same.

Different Perspectives

While you’ll notice a great deal of common ground in our philosophy and perspective, we don’t agree on everything. We do agree that there are problems, but we do not completely agree about how to solve them.

One specific distinction is that we do not view putting money in a 401(k) to be savings.

We agree that it’s crucial to have a systematic way of setting money aside for the future before spending. The 401(k) has provided a method for hundreds of thousands of people to invest over $10 Trillion.

However, a 401(k) fails to meet the criteria of being a retirement savings tool. Savings

Additionally, it has significant limitations on accessibility, making it unsuitable for storing your emergency/opportunity fund.

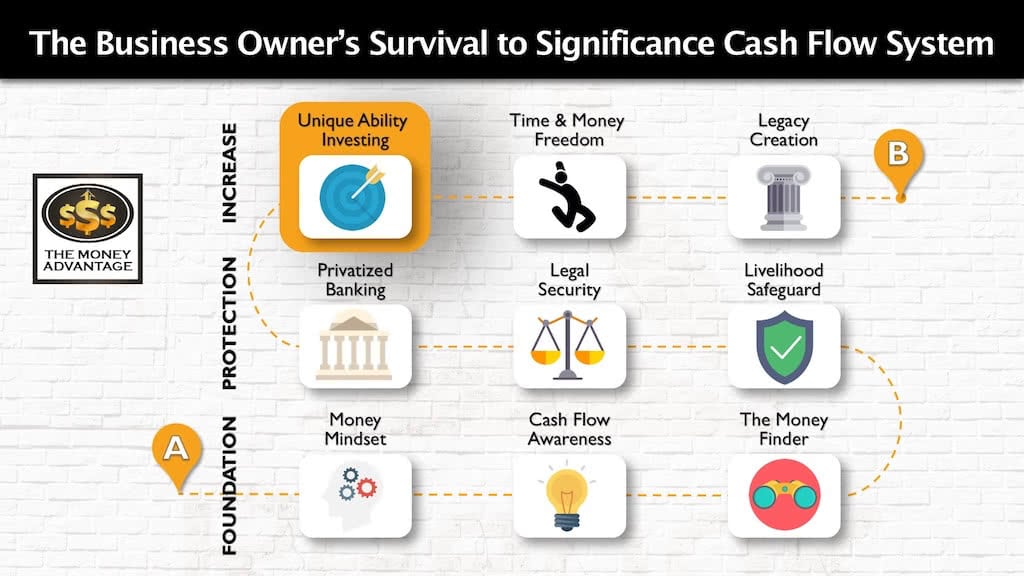

Where Does the 401(k) Retirement Plan Fit in the Cash Flow System?

To gain perspective, let’s zoom out to look at an optimized personal economy.

In the first phase of the Cash Flow System, you build a foundation to keep more of the money you make. Then in the second phase, you protect your money. Finally, in the third phase, you increase your money and make more.

401(k)s may potentially be a part of your investing strategy in the third phase.

Let’s look closer to identify what the 401(k) does and who it benefits most to make that decision.

Meet Ted Benna, the Father of the 401(k)

Ted Benna is commonly referred to as the “father of 401(k),” because he created and gained IRS approval of the first 401(k) savings plan. Additionally, he was instrumental in marketing and popularizing the plans.

Over time, he has received many citations for his accomplishments including:

- 2001 National Jefferson Award recipient for Greatest Public Service by a Private Citizen

- 2001 Player of the Year selected by Defined Contribution News

- One of eight individuals selected by Money Magazine for its special 20th Anniversary Issue Hall of Fame

- Selected by Business Insurance as one the four People of the Century

- One of ten selected by Mutual Fund Market News for its special 10th Anniversary Issue Legends in Our Own Time and

- Lifetime Achievement Award by Defined Contribution News 2005.

He has authored four books, the latest of which is 401(k) for Dummies.

How Ted Benna and the 401(k) Savings Plan Made History

There’s a lot of myth and controversy over the history of the 401(k).

Ted Benna shares what really happened.

401(k) plans came to light during a time when defined benefit plans were starting to die due to unintended consequences of ERISA in 1974. However, the 401(k)s didn’t ride in on a white horse and kill defined benefit pension plans.

After a short 1 ½ page section was added to the internal revenue code through a tax bill 40 years ago in 1978, Ted Benna combined his mathematical and problem-solving skills with his knowledge of the defined benefit pension plan system and some creative interpretation to form what we know today as the 401(k).

Ted didn’t discover something in the tax code that no one else knew existed.

Instead, he interpreted the law differently, adding an employer-matching contribution to get a high level of participation from rank and file employees to get the 401(k) to be a workable program. The tax break, along with additional money from the employer and the ability for employees to make a pre-tax contribution were the two things that made the 401(k) attractive.

In fact, the 401(k) wasn’t even the first thrift savings plan. There were already plans for employee contributions to get an employer match. The problem was that the plans turned into glorified Christmas clubs, where most people put money in all year long, and then took it out at the end of the year. Ted Benna introduced the idea of tax deferral to employer-sponsored retirement plans to help the middle-class prepare for their futures.

The pre-tax feature of the 401(k) made people put it in for the long-term, for retirement, because taking it out, except for hardship withdrawals, would incur a tax.

Increasing Retirement Security for the Middle Class

The purpose of the 401(k) was to provide employers with options to help the middle class have access to retirement planning tools.

Ted Benna says that the 401(k) is really for mid-America, those making $25,000 – $150,000 that need help saving for retirement.

One thing is undeniable: 401(k) retirement accounts has shifted the landscape of financial planning. Over the last 40 years, the 401(k) has given opportunities to many who otherwise may not have prepared for their future.

The Responsibility for Your Financial Future Is Yours

Ted says that the paragraph that enabled 401(k) plans was never intended to become the backbone of the private retirement security.

Going forward, individuals have the responsibility to put a strategy in place to prepare for the future.

He urges people to take control of their financial future, because, “no one else will do it for you.”

What Ted Benna Wants to Change

In 2011, there were a few articles that came out, making it appear that Mr. Benna was out to destroy the 401(k). However, he didn’t regret the 401(k) itself; he wants to reform it.

Over the last 40 years, changes in the workforce and longevity have impinged upon the 401(k)’s effectiveness.

In addition, two significant problems he points out are the complexity of the investment structure and the high fees, as he discusses more thoroughly in this article by Politico.

What Ted Benna Is Doing About 401(k) Reform

To continue creating solutions, Ted is completing and publishing his fifth book, 401k – Forty Years Later. The major topics are the history of 401k fees and how we got where we are, why defined-benefit plans are dying, why participants in defined-benefit plans have as much investment risk as participants in defined contribution plans and the reasons for the demise of these plans, and things to do to make the current system better.

To help small businesses compete for employees, they may often want to offer retirement plans to their employees. They run into the challenge that a traditional 401(k) plan is too complex and expensive for many small businesses. He’s relaunching a guide entitled, Start Your Own 401k, and Save A lot of Money. This guide will help small employers set up alternative plans that have the features of a 401(k) without the cost, complexity, or liability exposure a 401(k) plan has.

Ted provides consulting support to help small employers that don’t have a plan to make the right decision that best fits their needs.

Ted Benna’s Perspective

Average Rates of Return

I learned a long time ago in helping a corporate client select an investment manager that average returns are pretty meaningless, that a higher average return doesn’t mean you will have more money. The key is the extent of the ups and downs and when you are doing your scoring up and measuring, and that exercise taught me that its a lot more important to have less dramatic ups and downs, unless you like riding roller coasters. – Ted Benna

Typical Advice and Taking Risk

What was extremely revealing in writing this book is that retirees and those nearing retirement who are following the typical investment strategy that is promoted out there, are taking much higher levels of risk than they should be, much higher, and the potential to get hammered without being able to recover is pretty scary. – Ted Benna

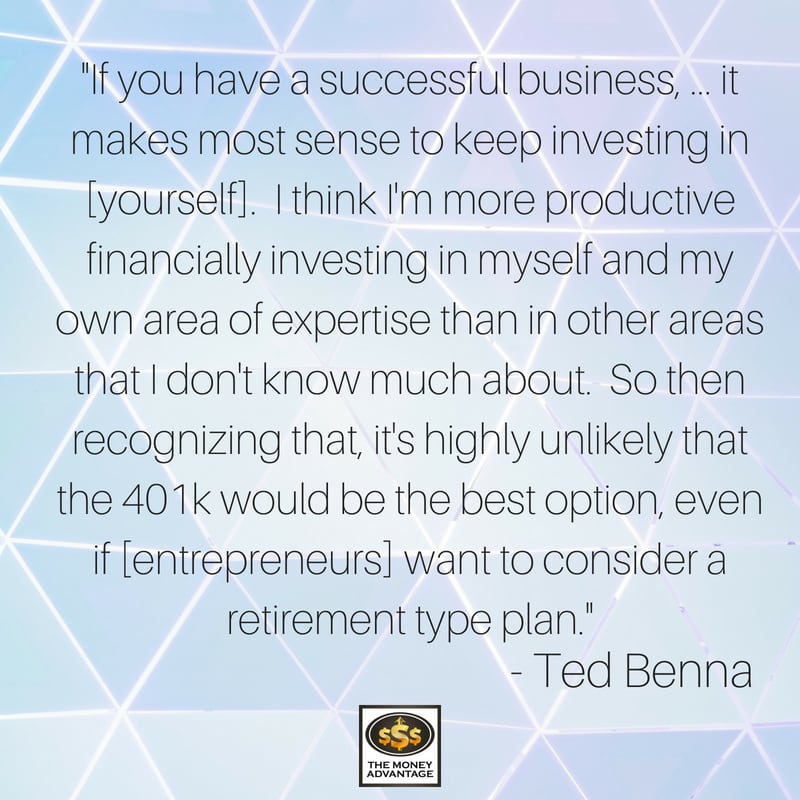

Does a 401(k) Make Sense for Entrepreneurs?

If they are doing quite well, it seems to me what they need to think about is they have a number of alternatives to consider.

If you have a successful business, or you’re a consultant or otherwise, and I put myself in the same category, it makes most sense to keep investing in myself and what I am doing, because the first investment, you know I think I am more productive financially investing in myself and my own area of expertise than other areas that I don’t know much about.

So then recognizing that it’s highly unlikely that the 401k would be the best option even if they (entrepreneur, business owner, consultant) want to consider a retirement type plan. – Ted Benna

Thoughts on Protection

I am a firm believer that once you have accumulated significant assets, that you need to be more protective of what you have built than worrying about maximizing growth. You have worked hard to build what you’ve built, and having to replace it again is not fun. – Ted Benna

Giving Back

Ted Benna is a firm believer in helping others. You see that through his focus on providing solutions for employers and the middle class.

He’s also fundraising. If you would like to say thank you for benefiting from 401k, Ted asks you to support a child or one of Compassion International’s other projects.

Additional Topics Discussed

- How Ted Benna first gained experience in administering defined benefit plans.

- His success in starting a benefits-consulting company, building it to 350 employees, and selling the company.

- Solutions for employers in helping their employees.

- Alternatives to 401(k)s for small employers.

- The risk in defined benefit plans, including Social Security, State or local government or private employer pension plans.

Another Purpose

While a 401(k) may not be the ideal tool to help you keep and control more of your money, it could have another purpose. Beyond your own financial objectives, it may be helpful to consider how you can most effectively help your employees prepare for their future, given the current economic environment.

Connect with Ted Benna

If you would like more details about the history of the 401(k), visit benna401k.com.

To connect with Ted Benna about small employer options or consulting support, email tbenna@comcast.net.

Increase Your Cash Flow, Liquidity and Control Today

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 26: Top 7 Money Myths, Lies That Are Costing You Money

What if what you think about money turned out not to be true? Even worse, what if you’re believing lies that are costing you money? Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns,…

Read MoreHow to Protect Your Lifestyle with Insurance – Meaghan Dowd

Insurance may often seem like an enigma, a complex puzzle that’s challenging to decipher. You’re not alone in feeling this way. However, understanding insurance isn’t just a necessity; it’s the foundation for securing your financial future. Learn how to protect your lifestyle with insurance. In our most recent podcast episode, we were delighted to have…

Read More