Better Than A Budget: Cash Flow Awareness

The ultimate goal of cash flow awareness is to save more each month. Why? Because generously paying yourself first is the foundation of wealth creation. With more savings, you build up capital to invest in cash-flowing assets so you can create time and money freedom.

But across all income levels, most people’s savings habits are anemic, or even on life support. They never get ahead of their spending, so they can’t save. Every month that slips by without a good pulse on your cash flow has you veering further away from financial freedom.

One remedy is to outrun the problem by making more money.

However, making more money often comes with a higher-priced lifestyle. Without the habit and discipline of savings in place, more income does nothing to help you save more.

Podcast: Play in new window | Download (Duration: 54:50 — 50.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

The second solution is budgeting.

But let’s face it – budgeting stinks! It’s stressful, time-consuming, complicated, messy, and usually puts you in a bad mood.

It can seem impossible to squeeze an unpredictable life into a perfect box. There never seems to be a good way to handle irregular and unforeseeable expenses.

Sometimes one spouse is a spender, and the other doesn’t want to instigate conflict by bringing up the subject of tightening up.

And the whole idea of denying yourself all the things you want seems the opposite of living an abundant life.

Most people finally resort to some form of “bank account budgeting.” Their thought is that if it’s in the bank account, it’s available to spend. But the eventual outcome is regret and a rude awakening when you need the money, and it isn’t there.

So, instead of being the ostrich with your head in the sand, how do you commit to self-accountability and gain control of your spending?

With cash flow awareness.

Table of contents

This is For You, I Promise

You may already be saving consistently. If so, cash flow awareness will help you approach your spending more consciously, make you feel even better about your money, and probably find even more dollars to save.

You might be in the top 5% of income earners and feel positive about the lifestyle you’ve had the opportunity to create, but still have a pit in your stomach when you think about the future. If you don’t know where all your money is going, and you want to figure out how to get from active income to passive income, this is for you. Cash flow awareness will show you the steps to get in control and keep more of the money you make so you can make financial progress.

If you feel your income is moderate to low and you haven’t been able to save, these steps will help you shift into a mindset of paying yourself first.

And if you’re here and you’re skeptical because you’ve had a love/hate relationship with budgeting, I’ll raise my hand and say, me too!

How is Cash Flow Awareness Better Than a Budget?

Cash flow awareness is not just a fancy name for budgeting. Instead, it’s a mindful, values-driven approach to tracking your money that helps you approach your spending consciously. It’s a holistic, abundant approach to exercising and improving your stewardship, keeping more of your money, and staying happy while you do so. And it advances you towards time and money freedom.

It’s how you go from not having any idea where your money is going each month to being in complete control of what you spend. And it’s fun, simple, and doable.

The reason many people are afraid of budgeting is that it’s the equivalent of a diet. It cues all the fears, shame, and guilt, archaically attempting to correct behavior with the punishment/reward system. Budgets are about restrictions, everything you can’t have, the dangling carrot promising a reward if you’re good, and a whole lot of cant’s and scarcity thinking.

It’s unfortunate that the only way our society seems to deal with overindulgence is forced misery, self-punishment, and guilt. No wonder we avoid and procrastinate getting our spending under control.

What We’ll Cover

Today, we’ll show you how to enjoy tracking your spending. You’ll find out how to increase your cash flow by paying attention to it.

You’ll gain the framework to run your personal cash flow like your business finances. Because, let’s face it, in business, you already know that cash flow is your lifeblood, so you monitor it carefully. Cash flow is just as critical in your personal life too, so it’s time to start acting like it.

You’ll get the tools and exact steps you need to go from out of control to being the boss of your money, without having to scrimp, cut back, or beat yourself into submission.

We’ll give you a new lens on spending that’s all about what you CAN have, not what you CAN’T. It’s time to stop stepping over dollars to chase pennies.

You’ll go from feeling confused, powerless, and in the dark to empowered with clarity to see where your money is going each month.

Where Cash Flow Awareness Fits into Your Cash Flow System

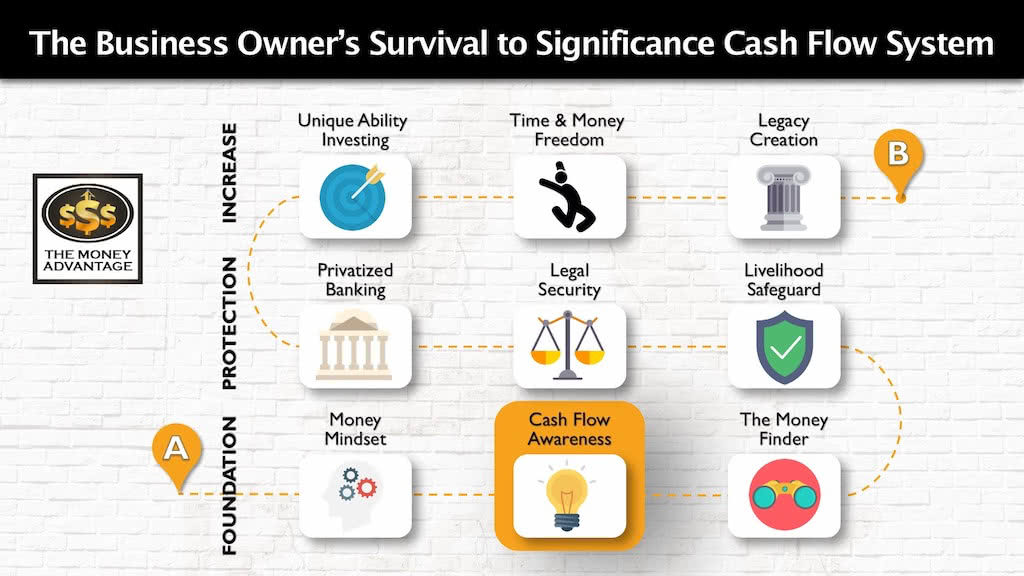

Cash flow awareness is just one step in the greater Survival to Significance Cash Flow System.

It fits into stage 1, the foundation of a financially successful life.

You can’t save to build up capital to put to work if you don’t have a grasp on the fundamentals of your spending habits, how much monthly cash flow you have, and what comes in and what goes out each month.

The Purpose of Cash Flow Awareness

As we mentioned earlier, the purpose of cash flow awareness is to increase your cash flow, the gap between what you make and what you spend each month. Your income, minus expenses.

Ideally, you want your cash flow to be at least 20 – 30% of your income. To do this, you want to elevate cash flow to the top priority in your financial life so that it comes off the top before you spend each month. Instead of spending first and saving the rest, you save first and then spend the rest.

But most people don’t start there. To increase your cash flow from where you are to the target 20 – 30% before spending, you want to raise your level of attention to your inflows and outflows.

You can increase your cash flow in two ways: by increasing income, or by decreasing expenses. Cash flow awareness deliberately attends to both.

The Connection Between Abundance Thinking and Awareness

Rather than working from a mindset of scarcity, restriction, fear, and guilt, cash flow awareness starts with an abundance perspective.

Abundance is expansive, believing that there is more than enough, and enabling you to live your best life.

However, spending on whatever makes you happy right now and being oblivious to your spending habits isn’t abundance, it’s just optimism. And o

Instead, abundance is mindful, realistic, and purposefully maximizes all that you have.

Think of an architect designing a building. The more care and precision he uses, the more proud he’ll be of the elegant outcome. Instead, if he just haphazardly sketched out the final design without instruments or measuring angles, the building will reflect his carelessness. The materials would come up short, joists wouldn’t join correctly, and the result would be poor-quality workmanship.

The same is true in your life’s financial architecture. Cash flow awareness is a way to focus your attention on your cash flow and watch over it diligently so that it can thrive. Similar to your relationships or health, any area of your life where you focus your energy and attention will grow and improve, even before you make any actual changes. However, the areas you neglect and ignore will disintegrate.

In fact, just bringing awareness to where your money is going can often increase your savings. You might find gym memberships or magazine, car wash, or cable subscriptions that you haven’t used in months. One family thought they were spending about $300/month eating out but found that they were actually spending an average of $3,000 each month.

Instead of creating a guilt trip, these discoveries simply bring attention to what is actually happening. Then you can intentionally bring your spending into harmony with your values and goals.

If You’re Already Consistently Saving

If you’re already consistently saving 20 – 30% of your income first and then spending the rest, your spending is in check, and you’ve mastered the end goal. In this position, there’s not as much reason to comb through your expenses, unless you’re looking for ways to free up additional cash flow each month.

However, we always advocate attention to your cash flow at every level of savings, but the level of detail is less important if you are already consistently saving.

Step 1: Start with Your Values

To get started with cash flow awareness, the first step is to get really clear on your top priorities and objectives.

Initiate an honest conversation with yourself or with your partner if you’re making joint financial decisions.

What are your top priorities and values?

For me, that includes long-term optimal health and physical vitality, so I have the energy to live out my potential and purpose. I value the ability to serve as many people as possible to my fullest capacity. And I’m committed to nurturing high-quality relationships with the people I love most.

Be honest here. Nothing will sabotage your financial objectives quicker than living your dream life before you have the income to support it. Beware of making mental shortcuts and listing things like luxurious, exotic vacations, which may be something you want, but not truly a life priority and value. Remember, your dream home and bucket list are not your values. Your values have more to do with the type of person you want to become.

Who you are, then, is what creates your dream lifestyle.

Step 2: Create Financial Priorities Based on Your Values

Next, think through what lifestyle you can create that will support that.

My list of top financial priorities include savings to create peace of mind and allow me to build my business and cash-flowing assets, healthy food to nourish my body, running shoes to promote long-term health, education to enrich my mind, business systems and relationships that help me leverage my unique ability, and experiences with my family that allow us to build lifelong memories.

Your financial priorities may include a great home to relax and entertain. Or maybe it’s an annual vacation to rejuvenate your soul and experience the world.

Whatever your personal priorities, make sure you plan for them first to make sure it happens. Articulate them and write them down so you can revisit them often. This becomes your baseline for conscious spending, preventing all the other expenses from crowding out what is most important to you.

This is the most effective way to fight the “tyranny of the urgent,” the life circumstances and expenses that seem to crop up out of nowhere and demand our attention.

When your financial life is incongruent with your value system, you’re more likely to find inconsistencies like fast food purchases to satisfy hunger. Or you’ll get traffic tickets for rushing frazzled to your next appointment or buy lavish stuff just to impress others or expensive gifts to make up for lost quality time. Health issues crop up because of the stress, adding extra costs. And then you feel you deserve to indulge yourself and spend money because you need a break from it all.

Step 3: Track Your Money

After you’ve outlined your values and financial priorities, you’ll set to work tracking your money.

The goal here is to discover what you’ve spent in the past to assemble a historical account of your actual income and expenses, assigning each to categories that work for your life. Tracking your income and expenses over time will help reveal some of your spending trends, making even the irregular expenses easier to plan for.

There are many ways to do this, and you’ll need to find the best tools that work for you.

If you are technologically-savvy and want a quick way to look at everything all at once, you can use an online account like Mint.com.

I personally use this tool, as it links to all my bank and credit accounts, listing every transaction, and auto-categorizing it for me. Some of the automatic categories will not be accurate. For instance, I might need to move one Target transaction from my grocery category to clothing or gifts, or split it between categories.

For someone who prefers a more tangible, hands-on approach, you can use our cash flow awareness spreadsheet like the ready-to-use one we use with our clients here.

Start by listing your income sources first. Then, you can print account statements at the end of the month and tally the sums of each category of spending, listing each total on paper or in a spreadsheet. Note that you will likely have to look up checks to see what they were written for and remember transactions that you paid in cash.

Make It Simple and Enjoyable Enough to Be Sustainable

Here’s a confession of what didn’t work for me.

I used to keep all receipts and manually enter every one into a spreadsheet, per category, per month. I thought I was pretty fancy because I’d created formulas to total each column, as well as calculate the percentage of the category we’d used for the month. In theory, it would have worked if I logged transactions as they occurred.

The problem was that I didn’t enjoy this cumbersome task at all, so I always put it off. When I did sit down every several months, I had a mountain of receipts that I couldn’t remember actually making the purchase.

I also had to remember to tally any checks, any automatic payments, and what we had used cash for.

My procrastination, perfectionism, and overwhelm were a recipe for disaster. As you can imagine, this grueling routine only lasted about a year before I gave up altogether.

Observer, Not Critic

When you begin, think of yourself as an observer, objectively chronicling your income and expenses. You’re not in the role of judge. Resist the tendency to critique your spending at this point. All you’re looking for is a factual account of what you’ve actually spent.

How Far To Look Back

To get a realistic overview, you want to look back at least a full 3 months, or even up to 12 to get the best idea of your spending trends.

That way, you’ll better be able to find trends and averages in a later step.

Breaking Down Your Categories

Breaking down your categories itself can seem like a behemoth of a task, but don’t let it prevent you from moving forward. You’ll need to find what works best for you here.

Some people prefer to break everything down to the most specific categories, like household, personal care, beauty, grocery, restaurants, fast food, etc. Others prefer to stay higher level. You’ll need to find what makes the most sense for you and your family’s spending.

Over years of tracking and making adjustments, we’ve found that we personally like to keep things simpler. We have one category for grocery that includes all household expenses as well (think cleaning and paper products), one category for fun that includes babysitters, fun family outings, eating out, date nights, and travel.

Four Types of Expenses: Tracking Your Spending by Frequency and Predictability

To simplify the process of tracking your spending, especially if you are using a spreadsheet, here’s how you can work through the four basic types of expenses, grouping them by frequency and predictability.

Start with fixed expensesthat predictably show up as the same amount on the same day each month. This will be things like your insurance premiums, your cell phone bill, and your mortgage. Because they are so consistent, these expenses are the easiest to track and plan for.

Then, move onto your variable expenses. These are the payments that you know you’ll make each month, but they’ll have differing amounts and may occur at different times throughout the month. This will include things like groceries, gas, power, clothing, extracurricular activities and sports for the kids.

Next, you’ll want to work through your quarterly or annual expenses. These things happen more sporadically or irregularly, instead of every month, but you know they’ll happen at some point. Spending to categorize here will include Christmas, birthdays, anniversaries, vacations, car licensing and tags, personal property tax, and HOA fees.

Finally, you’ll need to account for true emergenciesthat are completely unforeseen, but still a part of our human existence. These costs could arise, but you cannot plan when or how much the bill may be in advance. This will include things like auto repairs, tire replacements, home repairs, and medical bills.

If you work through your expenses methodically in this way, it will help you more readily understand and process each type of expense.

Step 4: Analyze Your Spending Trends

Here’s where the fun really starts, because you start getting clarity.

As challenging as it may be, stay in the observer role without criticizing what you find. If you’re doing this together with a spouse or partner, this may be even harder, but more crucial. You are each coming from your own perspectives, values, and spending habits. It’s important that this step is one of exploration and curiosity to keep the conversation open. If you slip into judgment, fault-finding, or guilt, the process will break down and be counterproductive.

Remember, your objective is to increase your cash flow and savings while staying in a position of gratitude and mindfulness.

Look at your monthly totals for each category. Are the sums fairly consistent, or do they fluctuate? Do you find categories that the bulk of your spending happens every other month, or every three months? Because you’re able to look back over several months, calculate your monthly averages for each category, based on your past trends.

What do you notice about your totals in each category? How accurate were your estimations before you really uncovered the numbers?

What feelings arise for you as you discover where your money is flowing? Do you feel centered and congruent with your values, or are there areas you pinpoint that you’d like to adjust?

Step 5: Discover Your Monthly Cash Flow

When you’ve calculated your monthly averages in each category, including all of your variable and irregular spending categories, add them all together. This is your total average monthly spending: your outflow.

Subtract your total average monthly expenses from your total average monthly income to arrive at your monthly cash flowtotal.

Your cash flow is the reason we’re doing this awareness exercise in the first place. It tells you everything you need to know. (If you’re using our spreadsheet here, your income, expenses, and cash flow are calculated automatically.)

With positive cash flow, that means you have money left over each month to move to savings. If you’re not already saving that amount each month, there may be other expenses that you’ve forgotten to account for in your cash flow awareness.

If your cash flow is negative, that means that, based on averages, you are spending more than you make each month. In this case, you need to find a way to increase cash flow.

Until you’re in a position where you know that you can save 20 – 30% of your income and spend the rest freely, being conscious and aware of where your money is going helps you to get on track towards being financially free.

The Key of Averages

You may or may not feel that this cash flow number is accurate, for a number of reasons.

You may show a negative cash flow total but know that you have several months that you have money left over in the bank account.

However, if you’ve attended to each of the previous steps carefully, trust this cash flow total. This is what you want to work from, going forward.

While your actual income and expenses may vary from month to month, causing variation in your cash flow, the amount you save or pull out of savings, and your ending account balances from month to month, your cash flow calculation will be your anchor, the constant that you can depend on.

Even if you have variable or cyclical income, the key is to work from averages. Look at your annual average and divide by twelve months. Then run your expenses as if the income were level each month. In good months, you have more left over, and you’ll use up that extra portion during months with tighter income.

Step 6: Create a Spending Plan (Not a Budget) for the Future

When you have a good grasp on what’s most important to you and what your spending track record has been, you’re finally ready to start planning ahead for the future. Notice that we’re on step six, with a solid foundation of the earlier five steps completed.

This is the good stuff, but you can’t start here. Without the foundation, you’ll just be painting dreams in the sky, and you’ll disappoint yourself the minute you step on the track toward reaching that goal.

Using your monthly averages, set a dollar value for what you expect to spend per month going forward in each category. It’s really important to work from what you’ve actually already been spending here, so that you can make steady course corrections, rather than bipolar swings that will leave you disappointed and angry.

Fluid, But Direct Future Spending

Your spending plan will be fluid. It will change over time. It’s not meant to be rigid and unforgiving or feel like a law (or a budget). Why? Because you know that life will adjust, and your plans will need to course-correct along with it.

However, this is the time to calibrate your planned future spending with your goals. If you’ve discovered expenses that have happened in the past that are no longer a priority to you or are incongruent with your values, reduce your planned future spending in that area. For instance, if you realize that you spent $400 at 7-11 grabbing snacks that don’t fit your health priorities, you can adjust that category to allocate that money elsewhere or eliminate that spending altogether.

Your goal here is to slowly and steadily increase your monthly cash flow. Find small areas to make changes. Challenge yourself to reduce some of your variable accounts by 5 – 10% the next month as you increase the intentionality of your spending.

Helpful Mint.com Settings

With Mint.com, you have a lot of flexibility to set your spending plan for each category.

I like that I can set an expected spending amount on a schedule. For instance, if I know that our family will spend $300 every two months for hair appointments, I can preset that into the category. One month, we may spend nothing, but the next month will “catch up” to the plan, leveling out and showing that we’re on track with our plan, even with the monthly difference.

Additionally, I can set up a spending plan like $150/month for clothing and roll forward my unspent balance. We may go for two or three months without buying anything. But then, the category knows that in the third month, we can go on a $450 shopping spree without going over our plan. Meanwhile, the extra unspent money pools in the bottom of my checking account, waiting to be spent.

This works very well also for categories like children’s birthdays and Christmas. You can set your monthly average, and then essentially “save up” all year by rolling forward each month’s amount. Then, you’ll have the grand total available in the month you plan to use it.

The same goes for months that I may go over my spending in a category. I can then find a way to lower next month’s spending in that area to compensate. That way, I bring my spending plans back into equilibrium.

How to Plan for Out of the Ordinary Expenses

No matter how much of a calculating wizard you are, you’re bound to encounter some irregular and hard-to-manage expenses.

For example, you may notice that you spent $20, $280, and then $0 in the last three consecutive months on auto maintenance.

There are two general approaches here. You can either set a spending plan, or you can place these types of expenses in your emergency fund.

If you set a spending plan, you can average these three months and set up a plan to spend $100/month ($1200/year), or $300 every 3 months on auto maintenance, with a rollover spending plan. The money you don’t spend in a given month will stay in your checking account until you eventually spend it.

If you opt to use the emergency fund option, you could move $100/month into savings. Then the money sits at the bottom of your savings account for any unforeseen future expenses.

Either way, it’s important to put a plan in place so the money is there when you need it.

Step 7: Ongoing Maintenance of Your Cash Flow Awareness

You’ve done the bulk of the work to get organized and plan for the future. Now do yourself a favor and reap the rewards of your efforts by consistently monitoring your progress.

Set a calendar appointment on your schedule to have a meeting to track your progress on a regular basis. Ideally, you want to set this appointment for once a week to keep a pulse on your progress throughout the month.

At first, you might need 60 minutes or so for each conversation. As you get more systematic and familiar with the process, you’ll be able to do most of your weekly maintenance in 15 – 30 minutes per week.

Checklist to Maintain Your Cash Flow Awareness

Use this checklist to guide your maintenance meeting. It will help you think through how well you are following your spending plan and increasing your cash flow:

- Review your transaction history. Do you remember all of the purchases? Are there any duplicate charges or unknown expenses to investigate?

- Re-categorize or split any transactions that have ended up in the wrong spending plan. Is something uncategorized that you need to create a category for? Did you buy clothing and groceries on one receipt and need to break down the totals for each category?

- Monitor how you’re trending to underspend or overshoot your spending plans for the month and course correct as needed. If there are expenses in question, why were they made? How did they align (or not) with your value system?

- Discuss upcoming changes in income and how you will handle them. Are there bonuses, commissions, or slow months ahead? Do you have ideas for a side project or items you want to sell?

- Discuss future expenses and where you will categorize them. Decide whether adjustments are needed to other spending plans to accommodate the added costs. Why am I making this purchase? Do you have a major repair you need to schedule? A doctor visit or surgery? Is Christmas approaching and you need to discuss how you’ll spend the allotted amount?

- Carefully watch your cash flow and discuss ways you can increase it. Is there extra left over this month to move to savings? Or would you be better served by leaving that cash in your checking account to spend next month? How could you comfortably adjust the limits by 5 – 10% on variable accounts to increase your savings by a little more than last month?

- Monitor your emergency fund. Is it fully stocked with your 6 – 12 months of expenses? Have you recently had to use some of your emergency fund? Do you need to replace the sum to bump it back up to ensure you have enough set aside?

- Make adjustments to your planned limits for categories as you see fit. After you’ve been tracking your average history for a couple of months, it will be easier to set a realistic spending plan for each type of expense.

An Evolving Process

It’s important to think of your cash flow awareness as an evolving process.

You’ll have new expenses that arise as your life unfolds, and other ones that no longer are a priority.

Prices will rise on gas, or you might begin working from home, causing adjustments to your transportation costs. Another addition to the family may bring an increased cost of groceries. Extracurricular activities, sports, and seasonal childcare costs will change over time. You may add dance lessons, join a book club, adopt a new hobby, or start running. All of these will bring changing expenses.

Instead of getting frustrated that things aren’t turning out as you had planned, maintain an awareness of your cash flows with an end goal of increasing your monthly cash flow, while staying flexible and adapting the plan as your life changes.

Make It Fun

If sitting down with your partner seems too boring, spice it up! Make sure cash flow awareness isn’t something that you end up avoiding.

You could combine it with a glass of wine. Or make it your pre-movie activity or use a part of your date night to discuss your cash flows.

Find something that works for you. Then it becomes regularly incorporated into your life as something to look forward to, not a chore or drudgery.

The Long-Term Benefits of Cash Flow Awareness

So, there you have it! This is the cash flow awareness exercise you can use to gain control of your spending. Without all the yuck of budgeting fears, limits, and shrinking thinking.

Right away, you’ll begin feeling better about your money. Over years and a lifetime, you’ll find that you save more by paying attention to your cash flows.

Because of your expansive intentionality, you’ll watch your cash flow increase.

Because you’ve mapped out your goals first, your spending will more closely match your values. Instead of reactive and compulsive spending, you’ll find yourself being proactive and intentional most of the time.

You’re able to spend on fun, eating out, shopping, going to movies, shows, hosting dinner parties, or whatever you like to do. And you can do it guilt-free because you’ve planned for it in advance.

You and your spouse relieve financial tension and conflict by intentionally planning together. It becomes enjoyable to set goals, commit, plan, execute together, and be proud of what you achieve together.

And you’re regularly raising the peace-of-mind-o’meter, knowing that you’re getting closer to your goals of time and money freedom.

Best of all, you know what you’re creating and why, and your spending is congruent with what’s most important to you.

Your Decision Point

You now have a choice. You can stay frustrated and confused with the lack of clarity on where your money is going. If you stay here, you let your lack of cash flow govern your destiny.

Or, you can take action, ownership, and self-responsibility, and direct the course of your financial life. But you have to do the work. You’re armed with the right perspective, reflection on your values, study of your past spending trends, conscious planning for future spending, and a checklist for ongoing weekly maintenance. With these tools, you can systematically increase your cash flow.

It’s up to you to use these action steps. Gain awareness of your cash flow and get on the path towards time and money freedom

To make it easier, get our ready-made, customizable, hands-on cash flow awareness spreadsheet tool that you can use to quickly gain perspective on your own cash flow awareness. It’s the same exercise we use with our clients.

If you’re already saving each month, but you want to get higher tax-exempt growth and have increased access to liquid capital, let us help you determine whether Privatized Banking may be a fit for you.

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Lifetime Annuity Income

By popular demand, we will be continuing our conversations from last week on annuity strategies! This time, we are joined by special guest Joseph DeFazio! Joe is a seasoned financial educator and will bring a fresh perspective on lifetime annuity income and how annuities can benefit your financial life! If you’re interested in guaranteed lifetime…

Read MoreAnnuity Strategies: The Truth About Generating Cash Flow with Annuities

Are you interested in knowing the truth about generating guaranteed cash flow with annuity strategies? Learn about the benefits and drawbacks of annuities, as well as some annuity strategies that will help you create guaranteed cash flow. Are annuities the unsung heroes of guaranteed retirement income flow, or are they just another intricate financial product…

Read More