How Do Your Savings Stack Up?

So, here’s an action that you can do right away, in your personal financial life to determine how your savings stack up. Write down any places where you’re storing money. Now I say places because some of those might be accounts. It could be a savings account, a checking account, a money market account, a stock account. It may be in retirement plans, like a 401K, 403b, IRA, or SEP.

Then, write down any places that you have cash that you don’t think of as an account. Maybe it’s the equity in your home or the cash value of life insurance. Those are just a few.

Ask yourself this question as you look at each one, is this money safe, or does it have the potential to go down in value?

That will tell you if this is truly savings, or if it’s an investment?

Money that is safe, and is going to remain at that same dollar value is safe money. Money that has the potential for loss, and can go down in dollar value, that’s an investment.

Next, ask yourself this question, of all of these accounts, what money is liquid, usable for any purpose, and in my control? And that is the luck test.

Can I convert it to cash? Is it usable? Can I use it for anything that I want to, and is it under my control?

How do your savings stack up?

Where Savings Fits into Your Cashflow Creation System

Having a stack of liquid savings helps you weather months of tight income or unforeseen expenses and will move you light years ahead towards peace of mind and financial stability.

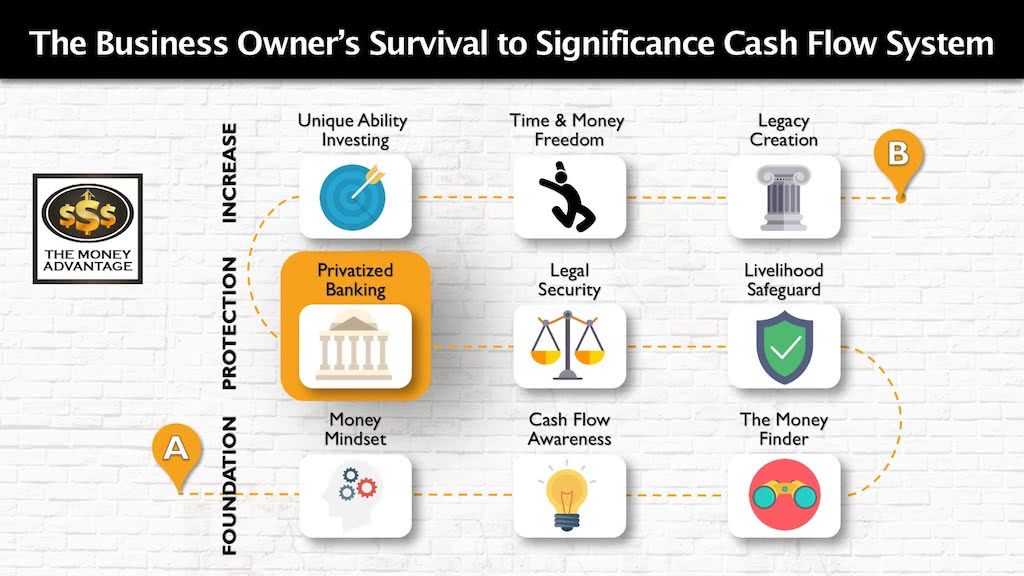

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, insurance, and legal protection.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets.

Turn the Tables on How Your Savings Stack Up

Is a lot of your money at risk, illiquid, unusable, and not in your control? It’s time to turn the tables on how your savings stack up.

Set up an automatic transfer to savings, so that you have money automatically being put into a safe tool. A place where it’s safe, liquid and available for you to be able to use.

Then, find a way to invest intentionally. Do this by thinking through which investment decisions align best with your investor criteria.

In that way, you’re not going to be looking for just any opportunity, but what is the best opportunity to deploy your capital. Often this is going to be looking for ways for you to generate cash flow with that asset.

Your Decision Point

Do you want to begin building your savings stack, putting it to work, and accelerating Time and Money Freedom? To find out the one thing you should be doing to increase your cash flow by keeping more of the money you make, contact us today.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Is There a Banking Crisis? Silicon Valley Bank 2023

If you’ve paid any attention to the news recently, then you’ve probably heard about what’s happening with the Silicon Valley Bank. The news isn’t good, and it’s probably raising some questions. We’re here to unpack what you might be thinking about. Like, are we entering a banking crisis, and what does this mean for the…

Read MorePersonal Finance for Beginners

Here’s a listener question about personal finance for beginners: “What is the foundation or the starting point of wealth building? What are the core things I would want in place to start building wealth?” You might be asking the same question. Do you have savings you want to do something with? Are you wondering if…

Read More