Investing in Mortgage Notes: How to Get Big Returns with as Little as a $100 Investment

In this episode, we interview Jorge Newberry, CEO of American Homeowner Preservation, about how to invest in distressed mortgages with as little as $100.

So if you want to get between 7 – 12% annual cash returns paid out monthly, understand your investment, and make a huge difference in families, neighborhoods, and communities, starting with a small investment, without having to be an accredited investor with a $50K minimum, tune in now!

Podcast: Play in new window | Download (Duration: 39:39 — 45.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

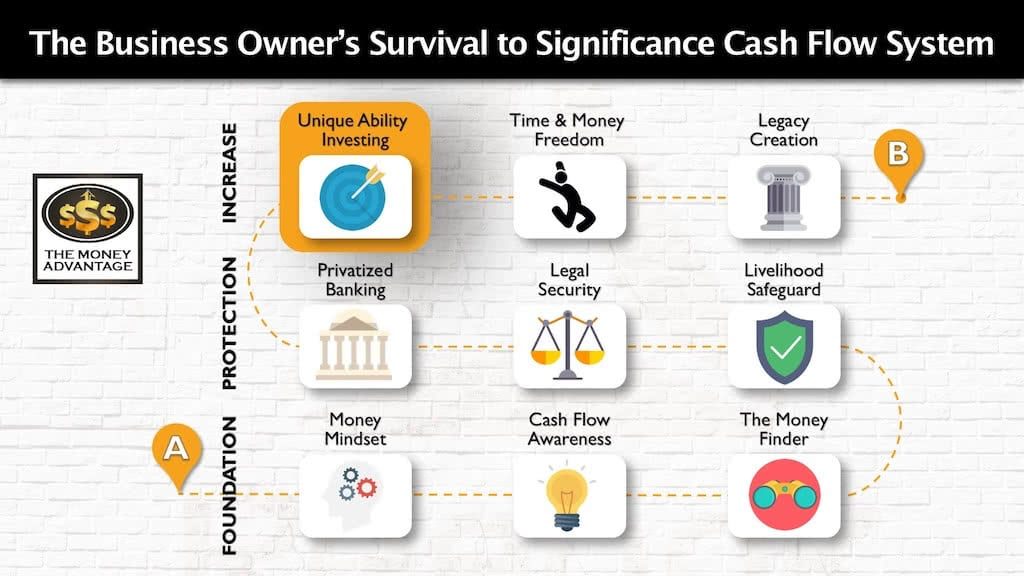

Where Investing Fits into the Cash Flow System

Here at The Money Advantage, we are a community of entrepreneurially-minded wealth creators who are taking control of our lives and financial destiny.

It’s not enough to just make a great income. You have to figure out how to keep more, protect that money, and finally, increase and make more through the right investing decisions.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you’ll protect your money with insurance and legal protection, and Privatized Banking.

Finally, you’ll put your money to work, increasing your income with cash-flowing assets.

Today’s conversation will give you a fresh perspective on an investing opportunity for big returns with a small investment.

Jorge Newberry Conversation Highlights

In this episode, you’ll discover:

- What led Jorge Newberry to found AHP 12 years ago

- The purpose and mission of AHP

- The prevalence of defaulted mortgages today, 10-years after the housing crisis

- How AHP helps homeowners stay in their homes

- How AHP offers a minimum investment of only $100

- The returns, payout, and liquidity investors can expect when investing with AHP

- The current investment opportunity with AHP’s fund re-opening

- What a potential upcoming housing downturn will mean for AHP and distressed mortgage note investors

About Jorge Newberry:

Jorge is an expert in investing in mortgage notes whose accomplishments include:

- Jorge Newbery is an author, entrepreneur, CEO and investor.

- He is the Chairman and CEO of AHP Servicing LLC, which crowdfunds the purchase of non-performing mortgages from banks at big discounts, and then shares the discounts with struggling homeowners.

- Jorge is the Founder and Partner of Activist Legal, LLP, a DC-based law firm that facilitates default legal services, and the Founder and CEO of DebtCleanse Group Legal Services, a nationwide legal plan to help consumers and small businesses get out of debt without filing bankruptcy.

- A 2004 natural disaster triggered the financial collapse of Newbery’s former business, leaving him with $26 million in debts he could not pay. Newbery rebuilt himself through AHP, sharing what he learned from his challenges to help families at risk of foreclosure stay in their homes.

- Jorge is also the author of Burn Zones: Playing Life’s Bad Hands; Debt Cleanse: How To Settle Your Unaffordable Debts For Pennies On The Dollar (And Not Pay Some At All); and Stories of the Indebted.

Get Financial Clarity Today

If you would like to implement Privatized Banking, cash flow strategies, or alternative investments, so you can accelerate time and money freedom, we can help. We’ll review your situation to help you decide what moves are best for you.

To start the conversation, book a call with The Money Advantage advisors now.

Investing In Mortgage Notes Links & Mentions From This Episode:

- American Homeowner Preservation

- Burn Zones: Playing Life’s Bad Hands, by Jorge Newberry

- Debt Cleanse: How To Settle Your Unaffordable Debts For Pennies On The Dollar (And Not Pay Some At All), by Jorge Newberry

- Stories of the Indebted, by Jorge Newberry

Thanks for Tuning In!

Thanks so much for being with us this week. Have some feedback you’d like to share? Please leave a note in the comments section below!

If you enjoyed this episode on how to invest in distressed mortgages with as little as $100, please share it with your friends by using the social media buttons you see at the bottom of the post.

Don’t forget to subscribe to the show on Apple Podcasts to get automatic episode updates for The Money Advantage Podcast!

And, finally, please take a minute to leave us an honest review and rating on iTunes. They really help us out when it comes to the ranking of the show and I make it a point to read every single one of the reviews we get.

Please leave a review right now.

Thanks for listening!

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreHow to Invest Like a Billionaire, with Richard Wilson

Want to get billionaire investing strategies and learn how to model the successful few? If you want to know how to invest like a billionaire, you’ll want to pay attention to our guest Richard Wilson. Today, we’re talking with Richard Wilson, CEO and Founder of the Family Office Club. Richard has helped create and formalize 100+…

Read More