Smart Asset Opportunities, with Ross Stryker

Ross Stryker, CEO of Smart Asset Opportunities, is the poster child for taking control of your life and financial destiny. In fact, just 4 years after he made a shift from typical thinking to investing in cash-flowing assets, he achieved financial freedom. He was liberated by the power of his choices. His key decisions to direct his mindset and investing strategy are what made all the difference for him. His story proves that financial freedom is possible for you too.

Ross Stryker models the way and offers a hand up to anyone who would like to follow. He’s now helping others create financial freedom through alternative investments, real estate, and cash flow.

Podcast: Play in new window | Download (Duration: 59:21 — 54.3MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

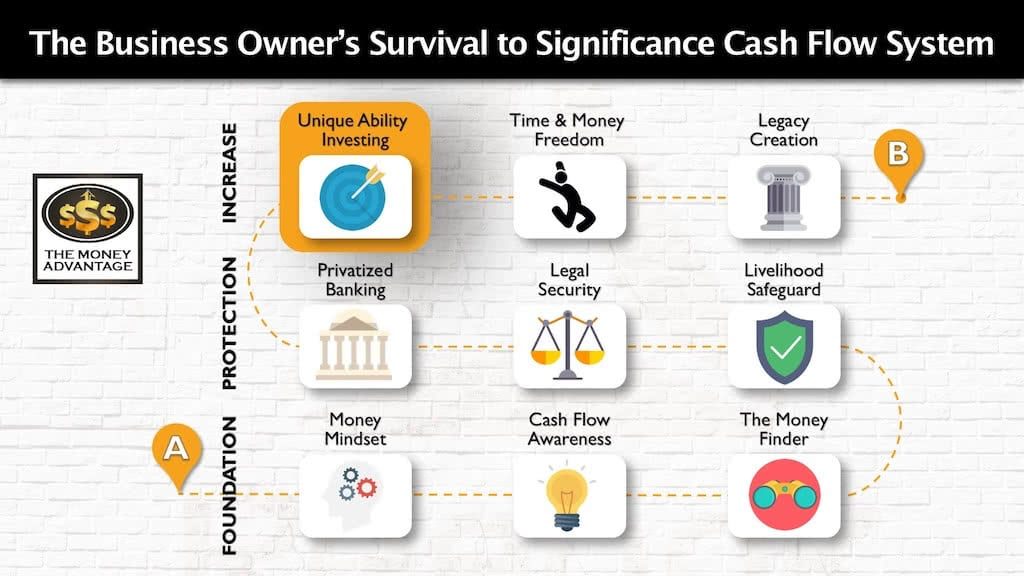

Where Mindset and Investing Fit into the Cash Flow System

We often talk about mindset. Every action you take has its roots in your thinking. Therefore, your mindset is the initiation, hinge, and critical entry point to building time and money freedom.

But you don’t build something great just with your mind. You must take action towards your goal.

Finding the right investments is one of those action steps. It’s how you create financial freedom with cash flow from assets.

As you can see, both your mindset and your investing strategy are just two steps in the bigger journey to time and money freedom.

Our 3-step Entrepreneur’s Cash Flow System first helps you keep more of the money you make. From cultivating the right mindset to strategic moves in tax planning, debt restructuring, cash flow awareness, and restructuring your savings to where you can access it as an emergency/opportunity fund, this step frees up and increases your cash flow, so you have more to invest.

Then, you’ll protect your money with insurance and legal protection, and Privatized Banking.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets. This empowers you to build time and money freedom and leave a rich legacy.

Who Is Ross Stryker, of Smart Asset Opportunities?

After 12 years serving in the military and over 20 years running a successful private practice, Ross Stryker realized if he didn’t alter his course, he’d be trading hours for dollars forever. It was this belief that led him to launch Smart Asset Opportunities.

He’s been involved in projects totaling over $100 million and owns 40+ single family homes, 14 ATM’s, a coffee farm in Panama, apartment complexes, office parks, storage units, and ownership in a Belizean resort. Ross is living proof that your money is better off of Wall Street, and that you can achieve financial freedom.

Just four years after his “awakening,” Ross’s investments and passive real estate income streams have surpassed his former transactional income (i.e., hours for dollars). With over $2.5 million out in total commercial project loans, Ross has an eye for tangible assets that have a proven tax advantage, high returns, and allow for stable, continuous cash flow.

Ross shares his wealth of real estate knowledge in a weekly blog and in his two books, including The Ultimate Freedom Prescription: Secrets from 14 Doctors … How They Created Generational Wealth in Less Than 5 Years.

To be an SAO investor is to understand your “why,” beyond extra zeros in your bank account. For Ross, it’s sharing everything he knows, so that others may find their own financial success and freedom. When he’s not working in real estate deals, you might find him boating with Robert Kiyosaki, better known as Rich Dad Poor Dad.

The Definition of Accredited Investor

Most of the investments offered to the Smart Asset Opportunity community are for accredited investors only.

If you do not know what accredited means, here’s a quick definition.

An accredited investor has at least $1 Million of net worth, not including the value of their home, or is making at least $200K if single, or $300K if married.

Most of our listeners fall into this category and are actively looking for ways to put their cash to work earning a return most productively.

If you aren’t there yet, this is an excellent opportunity to expand your knowledge in preparation.

Conversation Highlights

- Ross Stryker’s conversion experience from transactional income to passive income. He realized that all his time working as an orthodontist would lead to retiring at a reduced lifestyle.

- How Ross Stryker overcame the typical financial mindset. Instead of believing the lie that says you are too stupid to know anything about building financial freedom, so you should leave it to the experts, he took control.

- Achieving financial freedom is possible with way less money than you think.

- How Robert Kiyosaki’s book, Cashflow Quadrant, made a tremendous difference in Ross’s thinking.

- How to combine education and action to make personal progress.

- Ross Stryker’s path to financial freedom through education, mentorship, and buying assets with his own capital.

- How Ross started out with non-performing notes, mobile homes on acreage, and single-family homes. He then added duplexes and fourplexes in cash flow markets. Now, he’s involved in commercial real estate, multifamily, assisted living, mobile home parks, office buildings, and more.

- How to maximize your tax advantage in real estate, using depreciation, cost segregation, a 1031 exchange.

- The value of investing in recession-resistant self-storage.

- What to think about when calculating your personal break-even point.

- How time freedom is the best indicator of real wealth.

- Find your investor identity by being in mentorship and mastermind groups to learn and expand your experience.

Connect with Ross Stryker and Smart Asset Opportunities

Visit Smart Asset Opportunities to get your Break-Even Blueprint and sign up for the weekly blogs.

If you mention that you found out about Smart Asset Opportunities through The Money Advantage, you’ll also get a copy of Ross’s book, Why Not Freedom: Get Off the Treadmill.

Once you’re a part of the Smart Asset Opportunities community, you’ll gain access to their webinars about investment opportunities, primarily for accredited investors.

Create Your Time and Money Freedom

Do you want to begin building capital, putting it to work, and accelerating time and money freedom? To find out the one thing you should be doing to increase your cash flow by keeping more of the money you make, book a Strategy Call with us today.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreThe Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read More