Saving vs. Investing: Should I Save or Invest?

Have you ever wondered, should I save money or invest? How does my investing strategy fit in with my cash flow creation system? How do I get my saving and investing to work together so that I can maximize my whole personal economy?

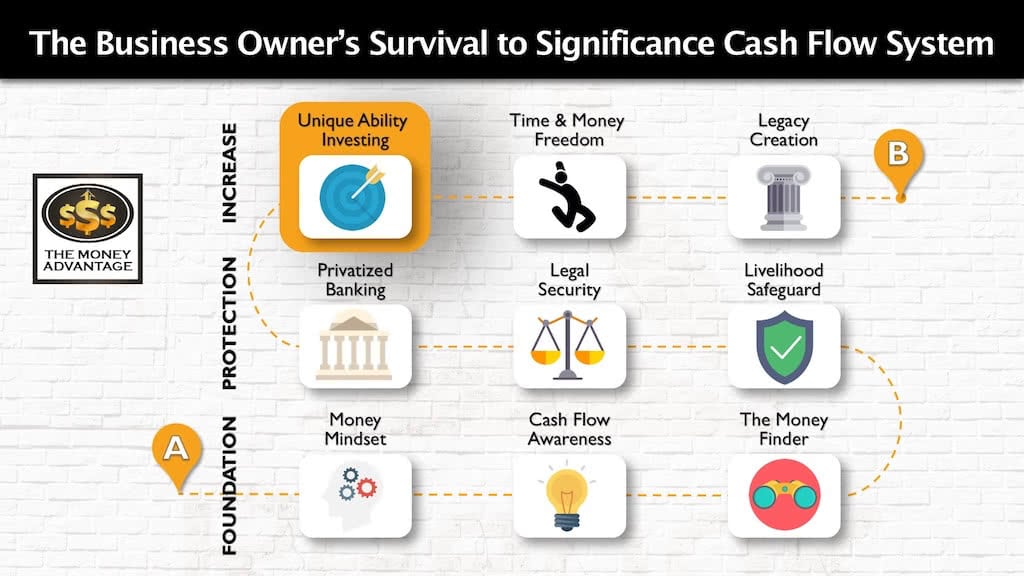

Where Investing Money Fits into the Cash Flow System

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Should I Save or Invest?

Why not both?

As you have income coming in, you want to have a portion of that that is yours to keep. That’s your cash flow, and you want to put that into savings. Saving money comes before investing. Savings is money that’s safe; it’s not going down in value, and it’s liquid, which means you can access it.

As we build that savings, we want to have at the bottom about six to 12 months worth of an emergency fund that we can tap into if we lost income or had something unexpected arise in our life. Beyond that, we’re building an opportunity fund on top, which is money that we can use for our best investments.

Save and Invest

Next, we are saying; I’m comfortable staying in cash until just the right opportunity surfaces. Not just any opportunity. Not someone’s fancy pitch or their perfect deal that is too good to pass up and everyone has to get in right now.

No, it’s saying, I have a clear idea of exactly what type of investment I’m looking for because I understand the value that I have to contribute and I understand the market and the investment that I’m investing in.

Ideally, you have income coming from your “job,” and income from your investments.

The more you invest well, the more you again have to save. To answer the question, should I save or invest, the answer is both. Saving and investing work together, hand in hand. Before you start investing, be comfortable staying in cash until you find just the right deal within your wheelhouse, that meets your investor

Book a Strategy Call

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Discover Wealth Across Borders -Michael Cobb

It is time to discover wealth across borders. Have you ever wondered what it’s like to invest internationally, live as an expat, or find a balance between work and play while enjoying life abroad? In a fascinating episode of our podcast, we sat down with Michael Cobb, a renowned figure in residential resort development and…

Read MoreIs There a Banking Crisis? Silicon Valley Bank 2023

If you’ve paid any attention to the news recently, then you’ve probably heard about what’s happening with the Silicon Valley Bank. The news isn’t good, and it’s probably raising some questions. We’re here to unpack what you might be thinking about. Like, are we entering a banking crisis, and what does this mean for the…

Read More