Taking Time Off Can Increase Your Productivity and Better Your Company (Reviewed)

For the business owner who wants to perform at their best and make the most out of life, the answer may be in working less, not more. In his insightful article Taking Time Off Can Increase Your Productivity and Better Your Company, Dan Sullivan, of Strategic Coach, reveals the leverage that taking time off can give your work life, your non-work life, your company, and your employees.

His advice runs against the grain of our culture that is addicted to workaholism. We live on caffeine, harried, hurried, incessantly busy, multitasking, distracted and idolizing the hustle. Embracing a slower pace seems to be a sign of weakness.

But sometimes the things we think are making us better, are actually making us worse.

Taking time off helps you get more done, not less.

It’s time to view free time as a necessity, not just a delicacy.

Free time isn’t just a reward for hard work; it’s a necessary prerequisite for doing good work.

Podcast: Play in new window | Download (Duration: 23:52 — 21.9MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

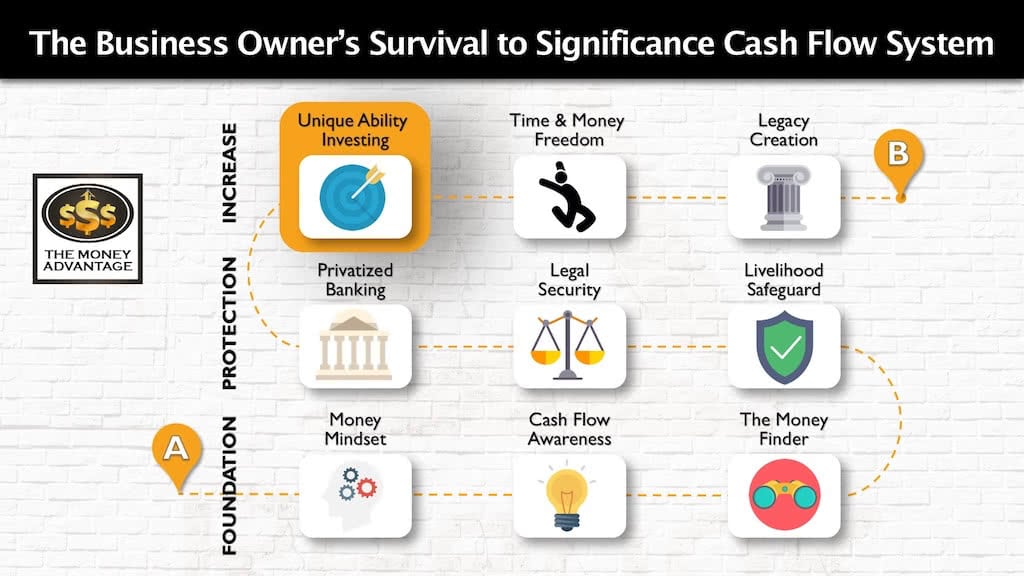

Where Entrepreneurship Fits into the Cash Flow System

We love Entrepreneurship. Business owners emphasize and focus on cash flow over accumulation.

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Entrepreneurship is part of Investing in stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Why Taking Time off Works

Taking time off refreshes and rejuvenates you, giving you more creativity, and fresh ideas to innovate. When you take time away from your business, it requires you to streamline systems, processes, technology, and your team, instead of relying on yourself. The result is that you increase your output, without increasing your input. You become the leader that sets the standard, modeling a culture of valuing yourself, which improves the company culture and decreases burnout, turnover, and associated costs.

Best of all, it develops you into an interesting multi-dimensional person who can enjoy life now. It gives you the room to excel in your health, family, friendships, hobbies, and create a life of meaningful experiences.

Sullivan not only teaches this way of life, but he also champions it in his own life. He uses the Entrepreneurial Time System, a plan of focus days, buffer days, and free days. He shares his personal rule to work only 210 days per year. When he takes time off, he completely unplugs, being completely unreachable by phone or email. This requires him to develop a team he trusts, and then trust them to work well. It’s the way to build a truly self-managing company, an asset that produces revenue independent of the time you contribute. That’s how you move out of the rat race of trading time for money.

While we aren’t there yet in our own lives, we’re using these principles to value our creativity and contribution, work with more focus, and take more time away from our work. This helps us build a bigger vision.

What about you? What are your rules about taking time off? How will you give yourself more freedom to enjoy life today and take time off?

Get More out of Your Money Without Working Harder

If you would like to get more out of your money without working harder, gain more enjoyment satisfaction and abundance, book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreBecoming Your Own Banker, Part 26: Top 7 Money Myths, Lies That Are Costing You Money

What if what you think about money turned out not to be true? Even worse, what if you’re believing lies that are costing you money? Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns,…

Read More