When Things Don’t Go According to Plan

Real life: today, things didn’t go according to plan. Bruce and I had allocated the hour to recording a great podcast with a guest. But there was a misalignment of time zones, and they didn’t show up. Rather than wasting time and energy getting frustrated, we used the moment as an opportunity for our growth and yours.

When Things Don’t Go According to Plan

So instead of the interview that we’d prepared for, we hit record anyway. We talked about what to do when things don’t go according to plan. And we jumped into the conversation at Bruce’s suggestion, at a moment’s notice, and without an ounce of preparation.

For me, that’s a tad out of my comfort zone. I like to be prepared. To think through and organize my thoughts ahead of time. I find it a little unnerving to go into a situation without the least idea of what to expect.

But, here’s us, pressing into the edge of our comfort zone to lead you to do the same.

See, in life, business, and wealth creation, you will encounter probably tens of thousands of times when things don’t go according to plan.

A client commits and then backs out. A deal you thought was sealed falls through. The negotiation doesn’t go in your favor. Your webinar has zero registrants. A simple project takes more time, effort, and resources than expected.

Sometimes, it’s a high-stakes situation. But more frequently, it’s the smaller, seemingly inconsequential, but life-shaping moments.

In today’s show, we demonstrate how to lean into the discomfort of the unknown, when factors outside your control deal you the unexpected.

You’ll learn how to see these moments as opportunities to get out of our comfort zone, roll with the punches, rise to the occasion, and grow.

Here’s the real us. Unfiltered. It reminds me of how valuable it is to “be ready in season and out of season.” (2 Timothy 4:2)

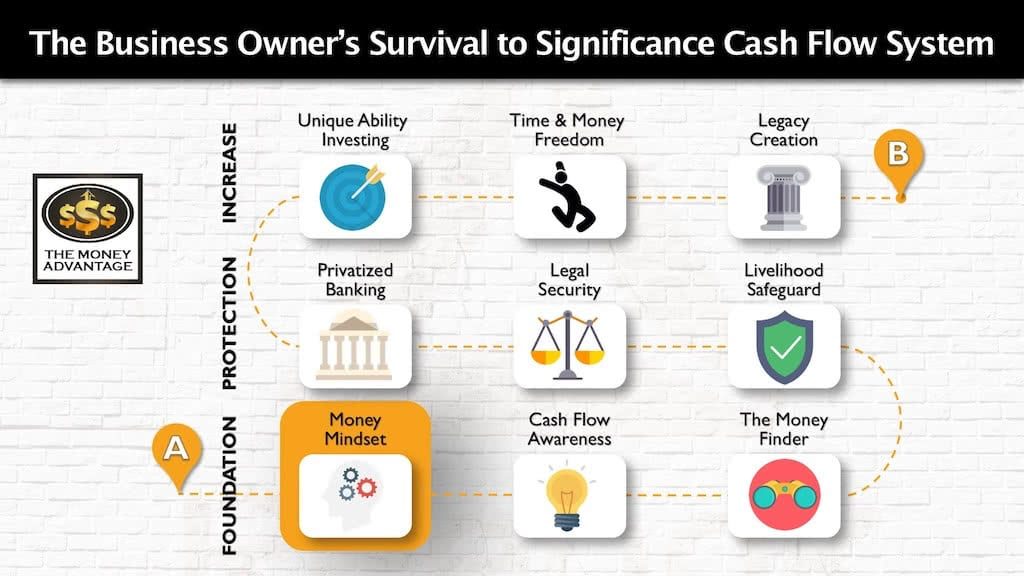

Where Does Your Mindset Fit into the Cash Flow System?

We’ve developed the 3-step Business Owner’s Cash Flow System as your roadmap to go from just surviving, to a life of significance, purpose, and financial freedom. The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you protect your money with insurance and legal protection and Privatized Banking. Finally, you put your money to work, increasing your income with cash-flowing assets.

Your mindset is a part of stage 1, your foundation. It takes the right mindset to succeed in business, craft a fulfilling life, and create sustainable wealth.

Conversation Highlights & Resources

- You can rewire your brain by choosing to think positive thoughts and envision good outcomes.

- The perspective you continually, repetitively choose becomes easier.

- Your mindset often becomes a self-fulfilling prophecy.

- Choose, routinely, to step out of your comfort zone.

- Develop a habit of gratitude. Check out these 12 Laws of Gratitude for a refresher on why and how gratitude leads to greatness.

- The movie, Lionheart, is a fabulous story of grit and rising to the best version of yourself in business, especially when things don’t go according to plan.

- Hear my story of choosing resilience and gratitude when my daughter’s birth story didn’t go according to plan.

Prepare for When Things Don’t Go according to Plan

To personally implement Privatized Banking, discover cash flow strategies to keep more of the money you’re making, or locate alternative investments, book a Strategy Call.

It’s the first step in designing a financial life that flourishes in the widest range of circumstances. Even when things don’t go according to plan.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreBecoming Your Own Banker, Part 26: Top 7 Money Myths, Lies That Are Costing You Money

What if what you think about money turned out not to be true? Even worse, what if you’re believing lies that are costing you money? Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns,…

Read More