Paid Up Additions (PUA): Get the Best Policy Design With This Big Shift

What is the perfect funding ratio between base premium and the paid-up additions rider (PUAs)? You may be surprised to discover that this question comes up often in our one-on-one conversations with people who want to implement the Infinite Banking Concept personally. And since whole life policy design is important enough to discuss one-on-one, it’s relevant enough to dedicate some airtime to answering this question upfront.

Podcast: Play in new window | Download (Duration: 42:43 — 48.9MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | Youtube Music | RSS | More

In this article, we dig into the more technical design of a whole life insurance policy. We’ll have a candid conversation about why we design whole life policies the way we do, specifically regarding base and paid-up additions premium.

Instead of looking at it so closely that your eyes start crossing, you’ll zoom out. Then you’ll get the best big-picture and long-term perspective.

If you’re in the consideration stage, this will matter a lot to you. If you’re still doing research, it will direct your attention to what to think about.

You won’t have to merely trust someone else to lead you to your goal. You’ll be more in control of the process of becoming a Infinite Banking user because you’ll be empowered with understanding.

Table of contents

Does It Work vs. How It Works

You may be more of a conceptual person, like me. For instance, I want to know the car is safe, reliable, and drives well. I don’t need to know anything about what happens under the hood as long as it serves me well. Same with a computer. I don’t want to know anything about circuit boards and coding. I just need to be able to use it to write, record, store photos and videos, and use the internet.

If you’re the person who wants to look under the hood and understand how everything works, this episode is for you. This is more about how high cash value whole life policy design works, rather than what it does.

Whole life insurance policy design is like the levers on a soundboard. It’s nuanced and technical, a dance between art and science.

However, whatever your style, it helps to keep the main point in focus. More than understanding the mechanics and adjustments of how it works, you should pay close attention to the resulting performance. This is like turning your attention from the controls on the soundboard to the quality of the sound produced. The outcome is what matters. Your ultimate goal is to deliver a moving and transformative ambiance and experience for the person listening to the music.

However, if you don’t understand the concept, the details don’t matter. And usually, if you do understand the concept, the details don’t matter.

Base Premium vs. Paid-Up Additions

You could think of base and paid-up additions premium as the two opposite ends of a sliding scale. On one side, you could have a life insurance policy with all or mostly base premium. At the other end, you could have a whole life insurance policy with mostly paid-up additions rider premium payments (10/90 Premium Split & Blended Term PUA Rider Risks, with Rodney Mogen).

Whole life insurance policies can be designed with all base and no paid-up Additions rider (PUA), and on the other end of the spectrum, they may have 10% base and 90% paid-up additions. And you’ll also see just about everything in between.

There are differences between whole life insurance carriers and those carrier’s individual product lines, so this isn’t a one-size-fits-all conversation. We’ll talk about whole life insurance policy design (the engine function), but more importantly, we’ll share the resulting performance (how it drives) right away and far out into the future. That’s because what it does for you is what actually matters.

There are reasons one whole life insurance policy design may look better with a different viewpoint.

Where Does Whole Life Insurance Fit into the Cash Flow System?

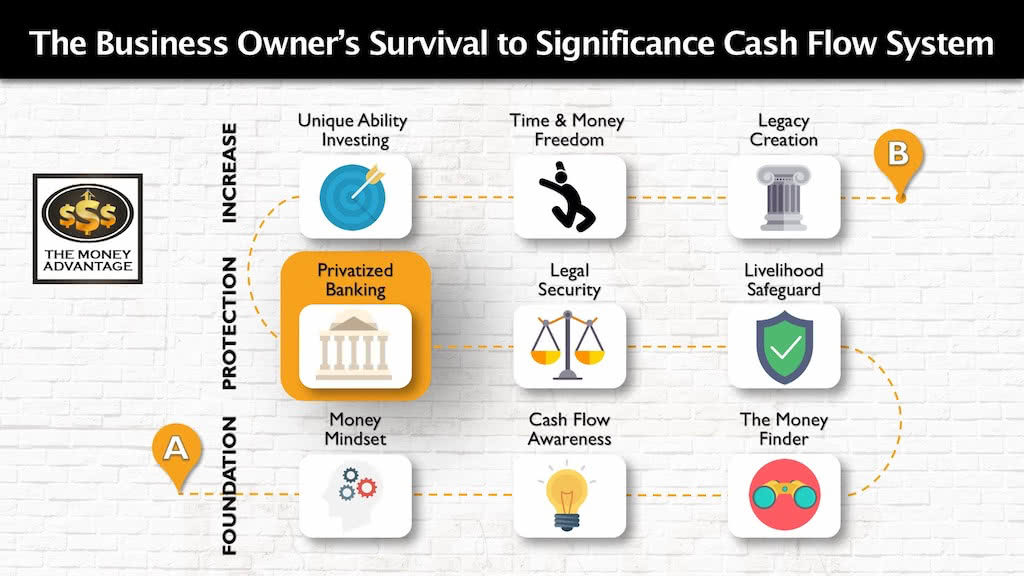

Whole life insurance policies, with paid-up additions for Privatized Banking, is just one part of a bigger journey to time and money freedom. That’s why we’ve developed the 3-step Business Owner’s Cash Flow System as your roadmap to go from surviving to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable.

Then, you protect your money with insurance and legal protection and Privatized Banking.

Finally, you put your money to work, increasing your income with cash-flowing assets.

Whole life insurance is a tool for protection. It provides a death benefit that protects your family’s lifestyle, even if you aren’t here to create it with them. And it ensures that what you want will happen, no matter what.

In addition, whole life insurance improves everything else in your financial life. That’s because Privatized Banking works as a cash flow management system that puts more money in your control and amplifies your investments.

Privatized Banking Introductory Resources

This article digs into the more nuanced and technical design aspects of a cash value life insurance policy.

If you’d like an introduction to what Privatized Banking is and why you want to use it, check out these foundational resources.

- The Quick and Easy Privatized Banking Guide for Investors

- Infinite Banking Concept: The Golden Key That Unlocks Your Financial Life

- What Kind of Policy Do You Use?

- High Cash Value and Long-Term Growth

- Life Insurance Policy Loans and Why We Use Them

- The Best Life Insurance Companies

- Top Mistakes Buying Life Insurance

The Art and Science of Policy Design

What Are Paid-Up Additions (PUA)?

Paid-up additions are a whole life insurance rider that allows the policy owner to buy more life insurance coverage. This additional coverage is paid-up insurance, meaning no more premium payments are due for the death benefit purchased.

Whole life insurance policy owners have multiple dividend options. If your goal is cash value accumulation, you can set your policy dividend option to purchase paid-up additional insurance. Paid-up additions also earn dividends, which in turn can buy more paid-up additions, accelerating your life insurance policy’s cash value. When you use your life insurance policy dividends to purchase paid-up additions, you get immediate cash value and death benefit.

Each insurance company will have a different name for their paid-up additions rider. Additionally, it is important to note that the features and capabilities of paid-up additions riders vary across each insurance company. Bottom line: a paid-up additions rider improves your cash value and death benefit.

Base vs. Paid-Up Addition Premium

Base premium is like making a mortgage payment on a house. Over time, you incrementally pay off a house. In the same way, base premium gradually pays up the death benefit in a whole life policy. Base premium proportionally buys more death benefit but contributes less to early cash value.

Paid-up additions are like fully paying for an added garage. That premium fully pays up a smaller amount of death benefit that’s annexed to your main life insurance policy. Dollars put into paid-up additions add to your life insurance policy’s cash value immediately. Proportionally, a paid-up additions rider buys less death benefit but contributes more to the cash value.

Because of this interaction, finding the balance point of the right amount of each of the premium payments is critical. If you have too much base premium, you’ll end up bottom-heavy with a lot of death benefit, but a cash value that can’t readily be put to work for Privatized Banking.

It could seem like the ideal insurance policy has as narrow a margin of base premium as possible, with a maximum paid-up additions rider.

However, imagine whole life insurance policies were racehorses. The heavier base policies would start out more slowly but could overtake the growth on other policies at the end of the race. The skinny base life insurance policies can start out with more initial cash value but run out of steam towards the finish line as their growth becomes more sluggish.

(Find out more about maximum early cash value and long-term growth here.)

To Understand Long-Term Cash Value Growth, Follow the Dividends

Whole life policies earn dividends, which are a main contributor to cash value growth. As stated earlier, policyholders can set their policy’s dividend option to purchase paid-up additions. They’re applied on top of the guaranteed interest.

While interest growth is fixed, guaranteed, steady, and easy to compare from one illustration to another, dividends are a little harder to pin down.

That’s because dividends are not guaranteed. They’re a part of the non-guaranteed portion of the insurance policy illustration. Non-guaranteed means that the life insurance company isn’t obligated to pay dividends exactly as seen on the illustration. However, because they have paid out historically through some of the worst times in history, there’s a huge reason to believe that they’ll continue to pay out every year going forward.

But just how much will dividends be in the future is an astoundingly complex matter.

We have an in-depth discussion about dividends here: Whole Life Insurance Dividends Demystified

So, what stock can you place in the illustrated dividends?

Dividend Rates Over Time

The non-guaranteed side of a whole life illustration could be said to be “vapor on paper.” Today’s dividend is declared by the life insurance company and applied to the illustration as today’s dividend rate copied and pasted indefinitely into future years.

But since next year’s dividend rate will be different from this year’s, and so will every year’s dividend afterward, the actual performance of a policy looking backward will not be exactly what you see on the non-guaranteed side of the illustration looking forward.

The dividend rates overall generally follow the bond market. Today’s historically low interest rate environment has suppressed whole life insurance policy dividend rates to historic lows as well. As interest rates rise, we anticipate future dividends to rise as well. This means that it’s highly likely your dividend performance in real life will be better than ones on paper if you’re looking at a new illustration today, when this article was published.

Differences Between Mutual Insurance Companies

When comparing illustrations between whole life insurance companies, you may notice that one has a higher current dividend rate. That rate then is what gets projected out into the future.

But proportional to each other, a carrier who over-projects a dividend may have to dial their dividend back in future years. However, a carrier who under-projects their dividend may increase their dividend in the coming years.

So, unfortunately, comparing expected performance isn’t as easy as making a line-by-line comparison of two different illustrations 30 years out the non-guaranteed cash value.

Realistically, most of the major whole life insurance companies’ future dividend performance over the next, say 40 years, will be relatively equivalent. That’s because Carrier A’s dividend may be higher than Carrier B’s this year, and they may alternate back and forth who has the leading rate several times over the coming decades.

Dividend Application to Base vs. Paid-Up Additions

There’s another nuance about dividends. It’s that they apply much more proportionally to your base policy than to your paid-up additions rider.

For some of the illustrations I’ve seen, this is substantial. We’re talking like 10X as much dividends paid per dollar of base premium compared to dividends paid per dollar on paid-up additions.

So, if dividends rise over today’s levels in the future, and we expect they will, a policy with more base premium will tap into more dividends than one with a narrower slice of base premium and more paid-up additions. That means that if you weighted a policy with only 10% base and 90% paid-up additions rider, you could be jeopardizing your long-term performance, especially in a rising interest-rate-environment.

PUA Rider and Policy Design Considerations

Policy design has a direct impact on a few other factors that really matter to your experience. One is your flexibility in paying future premiums.

Premium Payment Flexibility

Base premium is required to be paid each year to keep the policy in force. Paid-up additions are not usually required in full.

That means that a policy with more base premium has little wiggle room to pay less premium in future years. At the same time, a policy with a higher percentage of paid-up additions has a lot more flexibility if you encounter a year of hardship, and paying premiums becomes difficult.

More about minimum premiums, payment flexibility, and what to do if you can’t pay your premiums here.

Policy Utilization

If your policy has a higher illustrated dividend rate compared to another whole life insurance company, there could be differences between the way those companies pay dividends on the portion of cash value that has collateralized an outstanding loan. Usually, companies that project higher dividend rates are direct recognition.

This would mean that when you take a whole life policy loan, the portion of cash value borrowed against will accrue a lower dividend than the portion of the cash value that’s still available. This life insurance policy would then have a squeeze on dividends if you use the cash value.

More about direct vs. non-direct recognition here.

The Big Shift: Policy Performance More Important Than Policy Design

To simplify, let’s bring it back to the main point. With Privatized Banking, you’re looking for high early cash value – a maximum percentage of total premium dollars available in the first year that you can use to invest in cash-flowing investments like real estate – without, and it’s a big without, giving up the long-term growth of your cash value through dividends as the policy ages.

To do that, there is no one-size-fits-all funding ratio. That’s because all carriers are different, and all products are also different. If someone tells you that there’s only one ideal funding ratio, they’re focused on the wrong thing, or maybe have an optimal design with a particular carrier and product. But you can’t take one product’s recipe and apply that to every other product.

For instance, one of the products we use with a 50%/50% design performs on par with another company doing a 20% base, 80% PUA split.

At the risk of sounding like having a technical understanding of a policy’s inner workings doesn’t matter, it’s more important to work with someone who understands the big picture and the macro environment, who understands what you want to accomplish in your financial life.

The end goal is to maximize your resources in every way – with maximum early cash value, maximum long-term growth, maximum flexibility, and maximum performance when you utilize your policy to the fullest. This puts the power in your hands by maximizing your resources and control.

Start Your Whole Life Policy Today

To personally implement Privatized Banking, discover cash flow strategies to keep more of the money you’re making, or locate alternative investments, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Emergency Fund Alternatives: Liquidity That Protects Your Family—Without Sacrificing Growth

The Day the “Emergency Fund” Met Real Life Rachel here. Many tell us the same story: “I saved the emergency fund, but I’m worried I’m losing ground to inflation and missed opportunities.” Because for most people, the “emergency fund” is a lonely pile of cash—stuck in a corner doing next to nothing. It feels safe,…

Indexed Universal Life Lawsuit: Kyle Busch vs Pacific Life—and the Lessons Every Family Needs

Why the Indexed Universal Life lawsuit is a wake-up call The headlines about the Kyle Busch vs Pacific Life indexed universal life lawsuit sparked the same question I hear from thoughtful families: is my policy designed to serve me, or to serve a sales incentive? This isn’t tabloid noise. It’s a real-world reminder that choices…