Explode Real Estate Returns with Privatized Banking – Jimmy Vreeland

Jimmy Vreeland is maximizing his real estate returns by using the premier financing strategy of the wealthy.

As stand-alone tools, both real estate and high cash value life insurance are top-notch. Their powers of cash flow, appreciation, equity, leverage, tax advantages, and a hedge against inflation are unrivaled by any other product.

But when you combine these two high-quality assets together, your money does two things at the same time. This gives you an unfair advantage parallel to none.

If you’re a believer in one or the other, see how using these two assets symbiotically will supercharge your results.

Podcast: Play in new window | Download (Duration: 48:28 — 44.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

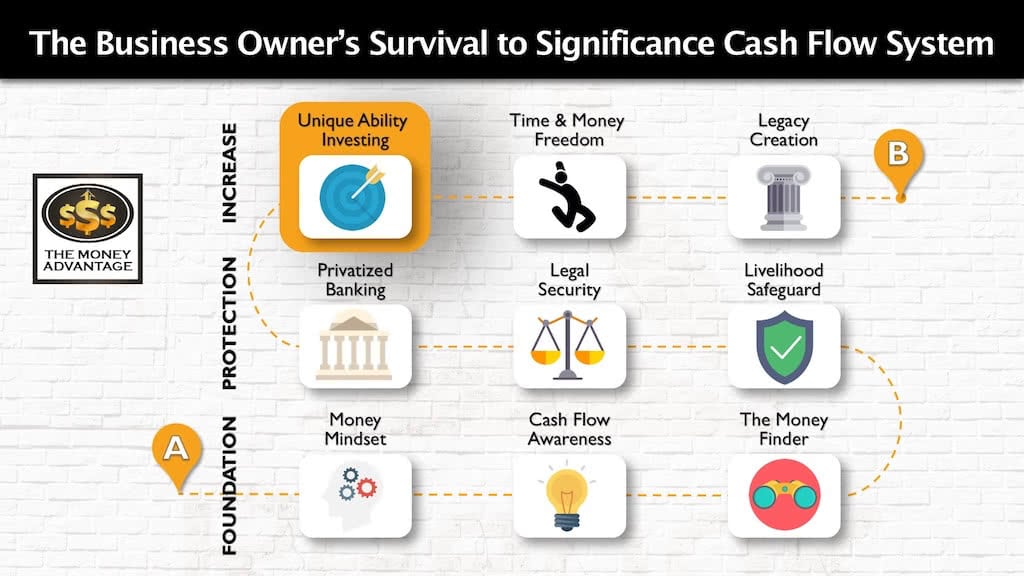

Where Real Estate Returns Fit in the Cash Flow System

We love cash flow. Cash flow today is the stepping stone for cash flow tomorrow.

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then you protect your money. Finally, you increase and make more.

Investing is part of stage 3. Building a cash-flowing asset portfolio of real estate and business accelerates time and money freedom.

Two Starting Points to the Same Bridge

You may be starting from one pillar or the other.

On the one hand, perhaps you have cash value life insurance. You want more than just to let the money sit in the policy. You’re asking: How can I use my cash value life insurance to invest in cash-flowing real estate to accelerate my financial freedom?

On the other hand, perhaps you are a real estate investor. You want to finance most efficiently to increase your gains. You’re asking: How do I amplify my real estate returns, by financing through cash value life insurance?

We found no one better to help you understand this strategy than Jimmy Vreeland. He’s a real estate investor who is exploding his real estate returns by building a bridge between these two assets.

Jimmy Vreeland is a passionate real estate investor who is helping other investors to reap the rewards of real estate investing.

The Advantages of Real Estate Returns

Jimmy Vreeland was an Army Ranger and US military officer who read Rich Dad, Poor Dad while he was in Afghanistan.

He realized that he wanted to create systematic, scalable wealth through cash flow in a low-tax environment.

He wanted an asset that he controlled, where he could build wealth by creating value instead of gambling through investments on Wall Street.

All the indicators pointed to real estate.

Consequently, he bought his first property in 2006 and began adding one property per year.

The Beginnings of a Real Estate Lease Options Empire

In 2014, Jimmy Vreeland and Bob Scott, both former US Military officers and Academy Graduates, partnered to create Joint Ops Properties. To capitalize on unique opportunities in the US Real Estate market.

Joint Ops is now a leader in lease option investment properties. They have decades of combined experience behind them, with an emphasis on the St. Louis area.

Joint Ops Properties has been able to secure over 160 distressed properties. AND another 40 turnkey properties, often at just 30 to 40 cents on the dollar. Joint Ops currently focuses on single-family homes and tenants seeking a lease to own option. This results in tenant buyers with more “skin in the game”. As opposed to a traditional tenant with no long-term interest in the home.

Providing Value to Tenants and Investors

Joint Ops is providing value to tenants, investors, and the community of St. Louis.

A New Lease on Life for Tenants

They offer lease options to tenants in the St. Louis, MO area, allowing them to sign an option to buy at an agreed-upon price in 2 years in exchange for 5% of the value up front. This allows the tenant time and consistent payments to fix their credit so that they can work their way into an FHA 30-year mortgage.

Real Estate Returns (Cash Flow) for Investors

For investors looking for monthly cash flow, Joint Ops offers private lending and turnkey real estate options.

Private lending puts the lender in the 1st and only lien position for a single property. As the financier of the property, the lender receives monthly cash flow income. If the tenant exercises the option to purchase, the lender receives the initial payment back.

They also provide turnkey solutions as a viable choice for high-paid professionals or business owners who want to get started in real estate investing, but don’t have the knowledge or experience, and don’t want to spend the time and energy figuring out how to become a professional real estate investor.

These investors want to invest with knowledge and control to mitigate their risk. They can “stand on the shoulders” of professional real estate investors and leverage their expertise to make sound investment decisions.

Investors using Joint Ops’ turnkey solution put 20% down on a cash-flowing property from Joint Ops and receive monthly cash flow, while Joint Ops manages the property. An investor would expect to receive about 15% cash on cash returns.

In this case, if the tenant exercises the option to purchase, the turnkey owner receives about $10 – 15K of capital gains. The owner gets their initial payment back, the principal payment, plus cash flow. If they use the 1031 exchange option to put it back into another real estate deal, they won’t pay capital gains taxes on the transaction.

Life Insurance: A Parallel Asset

In the midst of the 2008 market crash, Jimmy Vreeland discovered Austrian Economics and Privatized Banking with whole life insurance, in his quest to withstand the boom and bust cycles in the economy.

Whole life insurance is another asset with many of the same advantages of real estate: tax advantages, equity, appreciation, leverage, and a hedge against inflation.

Whole life insurance grows tax-free. The value appreciates over time. It offers a safe, reliable rate of return between 3 – 5%, tax-free (which is comparable to a 5-8% taxable return). It’s shielded from market ups-and-downs, so it’s safe and won’t go down in value. You have guaranteed access to your cash value through policy loans, so it’s ready to use as leverage for any expense or new purchase.

On top of that, it also protects your family if you met an untimely death and were no longer able to provide income to your family.

Satisfying the Investor’s Need for Liquidity

As a real estate investor, Jimmy Vreeland needs a place to store liquid money to hedge against vacancies and maintenance costs. He wants a safe vault that allows access to the cash, while having it grow at a rate that at least keeps up with inflation while it’s waiting to be used.

He now uses high cash value whole life insurance to satisfy his need for liquidity and access to capital.

The Advantages of Cash Value Life Insurance as a Funding Source to Boost Real Estate Returns

Jimmy Vreeland has discovered a valuable secret hidden in plain sight. It’s given him a competitive advantage and boosted his real estate returns. The magic: he’s financing his investments with cash value life insurance.

He owns six whole life policies and is using them as a private bank. With any excess money, he capitalizes his policies to store liquid cash. He then borrows against the cash value to purchase properties. With cash flow from his real estate investments, he can repay the loan or pay the annual policy premiums. He can recycle the transactions and use velocity of money to increase the number of jobs each dollar can do in his personal economy.

Because of these attributes, life insurance is often called the great “AND” asset, allowing you to reap the tax-free gains in the life insurance, AND earn a return in another cash-flowing asset that you’ve purchased with a life insurance loan. The money is working in two places at the same time.

Additionally, to the bank, the whole life cash value is a liquid asset on your balance sheet that can be used as the collateral to secure a bank loan, just the same as if the money were in an account with the bank.

Plugging the Two Assets Together

When these two powerful assets come together, they multiply their effectiveness.

Building a bridge between cash flow real estate investing and high cash value whole life insurance turns your policy into a workhorse, amplifies real estate returns, and supercharges your personal economy.

Starting with Life Insurance and Adding Real Estate Returns

If you have high cash value life insurance for the lifelong death benefit it provides, consider the power of your asset as a funding source that’s meant to be used during your lifetime. Don’t just leave it sitting there. You can use the cash value as collateral for opportunities to create additional streams of income.

As you pay your policy premiums, you’re building accessible cash value, a part of your death benefit. When you leverage your cash value into cash-flowing real estate and repay your life insurance loan with investment cash flow, you maximize your wealth potential.

How is this possible? The Cash value continues to compound, even while you are using a loan from the life insurance company to earn a return in another investment. You get to “stack” investments, essentially double-dipping. Your cash value is working in the policy to earn interest and dividends, AND it’s working in the real estate to produce cash flow AT THE SAME TIME.

You’re shrinking your opportunity cost, because you’re not giving up your capital or resetting the compound interest growth. It continues to earn a rate of return while you’re deploying it into an opportunity.

Starting with Real Estate Returns and Adding Life Insurance

If you’re a real estate investor, who is always on the lookout for new capital for deals, consider storing your cash in a better bank with greater safety, liquidity, and growth.

As you grow your operations, you’ll reach a threshold to what the bank is willing to lend you, unless you have liquidity. Consider supercharging your real estate returns by funding your purchases and holding your reserves in cash value whole life insurance.

It’s a ready source of capital to invest in opportunities that you know and control. It continues to earn compound growth while you use it in your investments. You’re using the same money you would use in real estate, but you’re running it through life insurance first. In this way, you’re building reserves that will continue to earn tax-free compound interest, have protection against creditors and lawsuits, and have a guaranteed loan provision, all while providing death benefit protection to your family.

On top of your real estate returns, you’re also earning in the life insurance, with the same money, at the same time.

Find out More in the Podcast

The conversation was filled with insight and on-the-ground strategy from a real estate investor in the trenches. Listen to find out more about:

- The educational journey that led him from burned-out and working 80 hours a week, to charged up and using his unique ability to provide value to others.

- Why he’s not interested in flipping properties, but instead wants to build systematic, scalable cash flow.

- How investors can use a 1031 exchange to minimize capital gains taxes on the sale of a property.

- The strategy he’s used to minimize overall taxes.

- How his clients are boosting real estate returns by combining Privatized Banking with real estate.

- How he’s minimizing taxes and putting his money to the greatest use by using velocity of money to get his money working as many times in as many jobs as possible.

- The Lease Option Empire coaching program he’s launched to help other people start a turnkey system like Joint Ops.

Podcast Resources

- The quick guide to understanding the advantages of real estate and high cash value life insurance independently, and the impact of combining both assets together through Privatized Banking. Get it HERE.

Learn More About Privatized Banking

To learn more about using high cash value whole life insurance to store liquid capital with safety, liquidity, and growth get our free 20-minute guide: Privatized Banking The Unfair Advantage.

Along with the guide, we’ll give you The Money Advantage’s Privatized Banking Video Course. You will discover how to use it with cash-flowing investments to boost investment returns.

Create Your Time and Money Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Nelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read MoreThe Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read More