Irrational Change: You Can’t Reason Your Way Out of Something You Didn’t Reason Into (Reviewed)

Change is hard, even for people, like me, who get started on new things rather quickly. Our habits – the way we’ve always done things – end up running our lives, even when we’d like to choose otherwise.

We react defensively to feedback, even after committing to receive and apply it gracefully. We use poor judgment and overspend again, even though we’ve promised ourselves a million times to stick to the plan. Or we get jazzed about a new health and workout routine, only to hit the snooze button and then cave in when offered dessert.

Podcast: Play in new window | Download (Duration: 26:20 — 30.1MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

So how do you truly apply a growth mindset, continually improve, and create lasting change?

Specifically, how do you change your money mindset to choose a different approach that is more conducive to building wealth?

In his article titled, Irrational Change: You Can’t Reason Your Way Out of Something You Didn’t Reason Into, Steven Handel reveals a change agent that works. He suggests that we should consider making changes irrationally, rather than by using logic.

The article points out a truth we all feel, but rarely act on. Since we didn’t pick our paradigms and worldviews by rational thinking, we won’t be able to shift them by applying the rules of logic either. Instead, we should use a much more irrational approach.

In today’s discussion of this article, we’ll help you think differently about change. With this insight, you can grow, become better, and build a life you love.

Table of contents

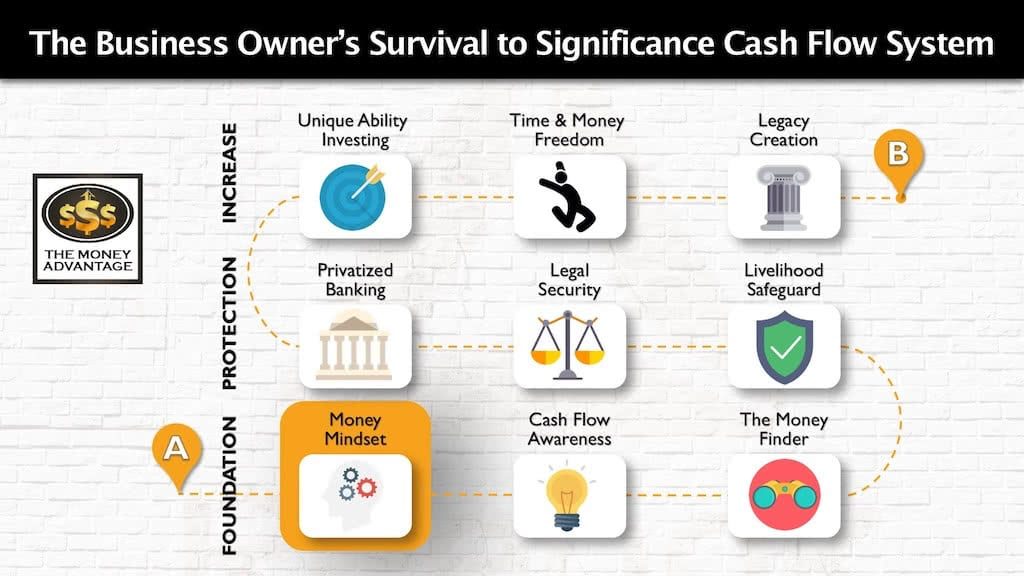

Where Does Money Mindset Fit into the Cash Flow System?

Deliberately choosing a successful money mindset is a crucial part of your financial foundation.

With the right thinking about yourself, your value, money, and human relationships, you’ll create and build wealth. But, with the wrong thinking, you’ll repel wealth, spin your wheels, and continue wealth-defeating habits.

However, your mindset is just one step in the bigger journey to time and money freedom. You need to have all of the pieces in place to produce wealth systematically.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You keep more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you protect your money with insurance and legal protection and Privatized Banking. Finally, you put your money to work, increasing your income with cash-flowing assets.

Your money mindset is part of stage 1. Developing an abundance mindset, and taking control with prosperity thinking are what allow you to become the person that produces wealth.

Why Logic Falls Short

Jonathan Swift, late 1600’s Anglo-Irish author and Dean of St. Patrick’s Cathedral of Dublin, published this insight about 200 years ago. He said,

You cannot reason people out of something they were not reasoned into.

Jonathan Swift

This insight holds true today. Even after centuries of psychology research, theory, and practice, we’re still recognizing the shortcomings of trying to change ourselves or others through logic.

Cognitive Behavioral Therapy has widespread acceptance as a popular and effective method of changing mental conditions and processes. The technique helps you identify faulty logic, reframe negative beliefs, and accept your thoughts. But ultimately, it’s a rational approach to change. And its ability to affect a paradigm shift and new way of being is rather limited because our minds are not often very rational.

Logic falls short because most people don’t consciously choose their current mindset and thinking.

In fact, most people never really consider where their current beliefs came from. Usually, we accept and assimilate most of our behavior-governing views through our environment and the opinions of others, including our caregivers during the formative years. And they, too, accepted their thought patterns, rather than choosing them rationally.

It’s hard to shift ingrained worldviews with logic and reason, because higher-level cognition isn’t responsible for deciding what to think in the first place.

Change Starts by Thinking About Your Thinking

Instead, it’s crucial to think about your thinking.

Rather than just allowing your thinking and actions with money to fall into the rut worn by years of habit, challenge your beliefs. Consider what your thoughts about money are, where they came from, and whether they’re serving you. If your money mindset and habits have become a hindrance to your wealth creation goals, maybe it’s time to change them.

But how?

You probably won’t be able to change your thought patterns by cold facts and pure reason. Even deep-diving into learning the technical aspects and mathematical soundness of a new perspective may not help you.

You may be contributing to a 401(k), but hear about how you lose control, accessibility, and will be taxed at unknown and potentially higher future tax rates.

You may be paying off your house as quickly as possible, but now learn that there could be a better place to store cash where you have control.

Or you may be overspending and haven’t been a consistent saver your whole life, but now you want to pay yourself first.

Since we didn’t adopt our mindset and habits logically, it will be hard to change them with logic as well.

So, what does work to help you break the cycle and develop new financial habits?

An Irrational Approach to Change … That Actually Works

The article suggests using imagination, creativity, symbols, and rituals to turn our brain into a mental playground. That is how you cause real change, irrationally.

Several options include placebo effects and playing pretend. The reason it works is that if you believe something, it works and is true for you.

Playing pretend is a big part of growing and evolving as a child. Part of why it works so well, is you’re not forcing yourself to do something. Instead, you’re letting it unfold naturally, out of curiosity.

Here are a few ways we use this personally:

- Bruce counts to five before making a difficult phone call, promising himself that when he gets to 5, he’ll make the call.

- I reframe fear as excitement when I’m getting ready to do something new. It changes the story I tell myself and the meaning I ascribe to my state.

Create Financial Change

Set up your environment for success. For example, put the tasks that are most critical to your success on your calendar, so you accomplish them first.

Financially, don’t expect you’ll start spending less, just because it’s the logical thing to do, if you’ve had a life history of overspending. Instead, make it impossible to spend too much. Mike Michalowicz shares in his book, Profit First, that you should divide up your income into smaller plates. That way, you can still spend it all. You’re just spending all of a smaller portion. Don’t try to overcome your human behavior. Instead, work with it to your advantage.

Another way you could apply this is with a celebration ritual when you make a small step of progress towards your financial goals. The reason this works is that there’s an emotional release in making the financial choices that have not been serving you well. So, you’ll want to create that same rush of excitement and satisfy your need for gratification about the things that get you closer to financial freedom.

For example, celebrate freeing up another $1,000 per month, buying another cash-flowing property, or reaching another level of cash flow from assets. Maybe you crack open a special bottle of wine or take that vacation you’ve been waiting forever to go on.

The only limit to your improvement is your imagination.

Create New Convictions

In The Science of Being Great, Wallace Wattles discusses change through creating new habits and why it works.

The use of prayer and affirmation is to change your habit of thought. Any act, mental or physical, becomes a habit. The purpose of mental exercises is to repeat certain thoughts over and over until the thinking of those thoughts becomes constant and habitual. The thoughts we continually repeat become convictions.

Wallace Wattles

If you want to change something, make small incremental changes that become habits, which turn into convictions.

This is how you can reframe your brain to adopt new thought patterns.

Turn Your Mind into A Mental Playground

Find irrational, fun, imaginative, creative ways to change, when you realize that there are better things that could be serving you.

Start Building Your Cash Flow System Today

If you want to explore your financial picture and find out how you could improve, we’d love to be a part of helping you make that change. And we promise not to overwhelm you with the logic and facts to help you see a better way. Instead, we’ll help you make small changes, see how it feels, and how your brain reacts to it. Then, you’ll gain confidence and make real changes that get you closer to your goals.

To personally implement Privatized Banking or discover cash flow strategies to keep more of the money you’re making, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Family Business Longevity, with Rob Ferguson

Family businesses have a shrinking lifespan. Families in business together face conflicts and challenges that have made it increasingly difficult to build a business that lasts generations. Yet Rob Ferguson, founder of Ferguson Alliance, says that family businesses can live to infinity with the right systems and tools. Today, we’re discussing how the key components…

Read MoreStop the Hustle and Grind, with Christine Jewell

Are you an ultra-high achiever, but feeling the cost of that success? Christine Jewell, author, keynote speaker, faith-based executive coach, and host of the Breaking Chains podcast, joins us today to provide a fresh solution. In her new book, Drop the Armor, Christine teaches you a transformational approach that allows you to stop the hustle…

Read More