Early Tap of the 401(k) Replaces Homes as American Piggy Bank (Reviewed)

Piggy banks may seem best suited to our childhood era. We mentally organize them with wagon-rides, tooth fairies, and the endless pencil-sharpening of early grade school. But as adults, we need and use piggy banks; they just come in a different form. When people need money for life’s setbacks and lean times, one of the most accessed “piggy banks” is the 401(k), says Richard Rubin and Margaret Collins, in the Bloomberg article, Early Tap of 401(k) Replaces Homes as American Piggy Bank.

Financial products are designed for a specific job. They may disintegrate when called upon for side jobs outside their area of expertise. The 401(k), intended for retirement planning, presents serious concerns when doubling as a piggy bank. Taxes and penalties add hardship in some of life’s darkest financial times when money is tight.

This article addresses the market and social forces that caused this phenomenon of this shift in asset choice. It honestly assesses the problems with using the 401(k) as a piggy bank and proposes solutions.

In addition to discussing the points of this article, we’ll separate fact from opinion. We’ll help you think through the savings and protection component of your personal economy. Then, you’ll be able to progress toward time and money freedom, while best handling financial challenges along the way.

Podcast: Play in new window | Download (Duration: 36:27 — 33.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

Why You Need a Piggy Bank

Just because you’ve outgrown the childhood scrapes, bruises, and dirt under the fingernails doesn’t mean you’ve outgrown the need for a piggy bank. One of the most predictable financial needs is to have accessible cash that you can save for emergencies and opportunities.

When you need to replace tires, have medical bills to pay, a child’s wedding or college, or want to buy a rental property, where will you get the cash?

Having access to cash is such a consistent and guaranteed need. By planning ahead and storing cash that will be there when you need it, you’ll bolster your peace of mind.

But without available cash, you’ve got to use tools that aren’t ideal, like home equity, retirement savings, or a credit card.

Where a Piggy Bank Fits into Your Cashflow Creation System

Building a stockpile of savings is to help you weather months of tight income or unforeseen expenses will move you light years ahead towards peace of mind and financial stability. But it’s just one small step of a greater journey of building time and money freedom.

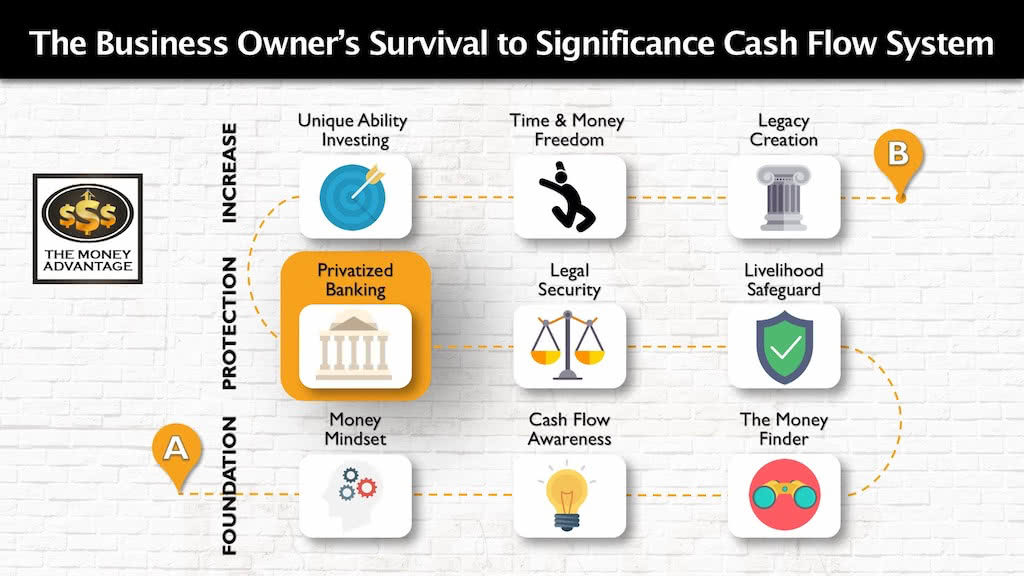

That’s why we’ve put together the 3-step Entrepreneur’s Cash Flow System.

The first step is keeping more of the money you make. This includes tax planning, debt restructuring, cash flow awareness, and restructuring your savings so you can access it as an emergency/opportunity fund. This step frees up and increases your cash flow, so you have more to save, and consequently, more to invest.

Then, you’ll protect your money with savings, insurance and legal protection. Here, you’ll create the right canopy of protection in your financial life. This second stage encompasses all aspects of Privatized Banking, a key savings and capital deployment strategy that secures your access to capital, maximizing your control, by allowing you to be your own banker.

Finally, you’ll put your money to work and get it to make more by investing in cash-flowing assets to build time and money freedom and leave a rich legacy.

The Problems with Using a 401(k) as a Piggy Bank

The Money is Not All Yours

When you put money into a 401(k), your contributions are tax-deferred. You get a current-year tax break. But it’s not that you don’t owe tax, it’s that you owe it later. And when you owe it later, you’ll pay tax on the amount you put in AND on the growth.

This taxation is often misunderstood, leading people to believe the balance they see on their account statement is all money that belongs to them. However, a portion of that money belongs to the IRS, meaning that what you see is not what you get.

For example, if you have a $100,000 balance in your 401(k), and land in the 32% tax bracket, $32,000 belongs to Uncle Sam, leaving you with just $78,000.

A Penalty to Use Your Money

Because the role of the 401(k) is retirement planning, there are incentives to keep your money in the account until retirement. This amounts to restrictions on using your money today, and more rules to follow in the future.

If you take money out before the age of 59 ½, you’ll pay an additional 10% penalty, in addition to the tax. There are some exceptions, where you won’t owe the penalty on 401(k) withdrawals, such as if you’re taking money out for a disability, certain medical expenses, or leaving your job after age 55. For IRAs, the rules are a bit looser, allowing you to also use a withdrawal for higher education or first-time home buying without penalty.

Then, you have an 11-year window to use your money as you desire.

And at age 70 ½, you have required minimum distributions (RMDs), forcing you to take money out (and pay taxes) each year.

Penalties in the Billions

While withdrawing from qualified plans may seem like no big deal, the penalty exposes the grand nature of this epidemic.

The Internal Revenue Service collected $5.7 billion in 2011 from penalties, meaning that Americans took out about $57 billion from retirement funds before they were supposed to.

Required Repayments Limit Flexibility

If you take the money out as a withdrawal, you pay the tax right away, at whatever tax bracket you find yourself in.

However, if you took the money out as a loan, you won’t pay the tax at that time, as long as you repay the loan. But you will pay back the loan with taxed dollars, only to pay tax again when you take the money out later. A double tax.

If you leave your employer for any reason with an outstanding 401(k), you’ll owe the full balance back, plus interest, usually within 60 days. And what happens if you don’t pay? Then your loan will be considered a distribution, which will require you to pay the taxes and penalties right away.

A Retirement Crisis

The article focuses on the impact that using the 401(k) as a piggy bank has in worsening the impending retirement crisis.

It does this by breaking down the impact to future monthly income. It cites younger workers are the ones who cash out at the highest rates, going on to say:

A 30-year-old who cashes out $16,000 could lose $471 a month in retirement income cash flow by not leaving it invested in a retirement account, assuming retirement at age 67 and death at age 93, according to a Fidelity analysis. That scenario assumed a 4.7 percent annual return and a 401(k) balance at retirement of $87,500. – Early Tap of 401(k) Replaces Homes as American Piggy Bank

The Systemic Financial Crisis in a Different Light

What’s left unsaid is that the real problem is the lack of guarantees and accessibility that make the 401(k) a poor place to store cash.

#1: Compartmentalized Money

It is designed to be used for one thing, and one thing only: retirement. It’s not set up to handle your emergency and opportunity fund needs over time before you get there.

#2: Lack of Accessibility

We discussed that your full account balance can be misleading, since the tax is owed out of this account, leaving you with less than what’s you see on your account statement.

What we didn’t mention yet is that even after you shave down to just what belongs to you, you still can’t use all of that.

If you’re planning to use a 401(k) loan to not disturb the tax and penalty gods, you can borrow up to 50% of your vested account balance, up to a maximum of $50,000. So, if you had a balance of $500,000 and $150K of that was designated for the tax bill, of the remaining $350K, you could only borrow $50K. That leaves $300K of money that belongs to you, completely inaccessible unless you want to pay the taxes and 10% penalties today, of course.

And if you did decide to withdraw it all, your plan administrator would mail you a check for about 70% of your account balance, or $350K. The other $150K would be allotted to cover the 10% penalty and 20% for taxes.

Kind of seems like an impossible puzzle that winds you up in trouble, no matter which option you choose, doesn’t it?

#3: Lack of Guarantees

When you put money in a jar for a rainy day, you expect it to be there when you need it.

But when you put money into a 401(k), it’s usually invested in the stock market, with no guarantees for what your money will grow into. Sure, there’s always an advertised average rate of return, but it takes a discerning eye to understand what that means.

For instance, a 6% average return means that, considering the cumulative past gains and losses over a time period, divided by the number of years accounted for, you averaged 6% return each year. But it would be entirely incorrect to assume you will get a 6% return each year going forward (or anything remotely close to that).

Why? Two reasons. First, historical averages do not guarantee future results. Second, there’s a huge difference between average returns and actual returns.

Average vs. Actual Returns

A positive average return does not mean your account will continue to rise in value. It doesn’t even guarantee that you’ll have more money at the end than you started with. In fact, drops in the market can cause account losses that wipe out gains.

If that sounds crazy, consider an account with $100K, that first loses 10% and then gains 10%. Your average return is 10%, but look at your account value. Your balance would drop down to $90K, and then bounce back up to $90.9K. Considering you had gains and losses with equal percentages, why didn’t your account recover back to the starting point? That’s because you need a much higher gain to recover from a loss.

Actually, you need a 100% gain to recover from a 50% loss, a 25% average return, just to get back to the same starting point, a real return of 0%. A 90% loss would require a 900% gain to recover, a 446% average return that lands you back with exactly the same cash you started with.

What exactly do average rates of return mean? In truth, not much at all.

The Shift from Using Home Equity as a Piggy Bank

So, if there are so many problems, why did people start using 401(k)s for their emergency fund, anyway?

Before using qualified plans as piggy banks, Americans used their homes to save money for a rainy day.

But here’s what happened:

For decades, Americans’ homes were their piggy banks. As values rose, they refinanced or took out second mortgages. Since the housing collapse of 2008, that’s often no longer an option. Taking money from a 401(k) — and worrying about the consequences later — became a more attractive alternative and a record number of Americans made early withdrawals in 2010.

‘They didn’t have access to the home equity that they had in the past,’ Cramer said. ‘And families looked around for what was left, and they actually drained the value from the 401(k).’ – Early Tap of 401(k) Replaces Homes as American Piggy Bank

Suggestions to Fix the Problem

There’s been debate as to what legislation can be enacted to fix the problems created by using 401(k) money early, with sharp disagreement about the best course of action.

One camp proposes higher penalties for using money early to discourage cashing out.

The other suggests lower or no penalties, making it easier to use your money.

Instead of either, we believe that financial freedom can only be achieved through personal responsibility and taking ownership of the principles of wealth creation. No amount of government legislation can fix a problem that government legislation paved the way to create in the first place.

The One Question We Should Ask Instead to Gain Control

In fact, the real question is this: should we be compartmentalizing our money to “plan for retirement” at all?

You can’t make improvements to something that doesn’t work. You need to get a whole new lens to solve the problem, so you can create a brand-new solution.

Planning for retirement is planning to accumulate a big enough pile of cash to live off the interest and hope it doesn’t run out. The concept is fraught with uncertainty. Instead, design your whole personal economy to create time and money freedom.

The first step is keeping more of the money you make to increase your cash flow. Next, protect your wealth. One giant step in this stage is building an emergency/opportunity fund. This account is available to use for life’s setbacks, big-ticket items, and the capital to invest in assets that increase your cash flow.

And finally, put your money to work to create multiple streams of income.

A Better Alternative to Store Cash

In your personal life, ask yourself, what financial needs do I need to solve? Then, how can I get more certainty and accessibility?

Go back to the drawing board to find the best savings around.

We’ve found that Specially Designed Life Insurance Contracts (SDLIC) fulfills your emergency and opportunity fund needs better than any other tool we’ve compared it to. It has guaranteed growth. You can access it with a guaranteed loan feature. You determine your payback schedule. And you get uninterrupted compounding, even while you use your money.

For more information on Specially Designed Life Insurance Contracts, get our free 20-minute crash course Privatized Banking The Unfair Advantage.

Contact us to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreSurviving the Storm: Navigating War in Israel with Rabbi Lapin

When war across the world could mean war close to home or a whole world war … when conflicts thousands of years old can’t be solved overnight … when truth seems defined by who’s in power … when totalitarianism seems stronger than freedom and free markets … when open borders looked like compassion but instead…

Read More