Life Insurance Company Ratings and Why They Matter Right Now

Here’s new life insurance company rating information for every wealth creator who wants to be certain that your savings are stable and guaranteed, so you can be sure the financial moves you make to gain safety really are solid and dependable, so you don’t lose money or wonder if an economic crisis could collapse the pillar you’re depending on.

So here’s where we are right now…

We’re in uncertain times. So, you’re looking for financial guarantees, safety, confidence, and peace of mind. And you’ve heard that a whole life policy is a good place to store your cash.

But you’re wondering …

How do you know your savings in an insurance policy are secure and safe? How strong is the life insurance industry really? Could my insurer go out of business? What happens in the worst-case scenario? And how do I use life insurance company ratings to double-check my life insurance purchase to guarantee I’m making the most secure financial move?

Today, we’ll dig deep and answer these astute and pressing questions.

Podcast: Play in new window | Download (Duration: 48:12 — 55.2MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

We’ll Cover Three Key Life Insurance Company Ratings Insights

- #1 – Compared To Commercial Banks And Investment Firms, The Life Insurance Industry Has A Long History Of Financial Strength Under Pressure

- #2 – The Life Insurance Industry Is Highly Regulated To Protect Consumers

- #3 – Insurance Carrier Ratings Are A Window Into The Soul Of The Company

And, we’ll also reveal the radical move the life insurance industry made during the banking holiday of the Great Depression. During one of the worst economic times during American history, insurers sunk the roots of their financial strength even deeper.

But first, let me tell you about a time when …

A Scary Bridge Taught Me About Verifying Financial Stability

When I was about 14, my Dad, siblings and I saddled up the horses and set off for an adventure. We’d set out a on a new route along our country gravel road, tracing the edge of the neighbor’s field. An entrance to a snowmobile and four-wheeling trail beckoned us into an unfamiliar forested section of property. The invitation wasn’t unusual, as we’d easily ridden hundreds of miles of trails through the rural Minnesotan woods. But today, as we came into a clearing, there stood a narrow wooden bridge that made us pull up fast.

We had to decide if it was safe to cross.

It was easily 9 feet over the ditch below, and probably 20 feet across. The kind that makes horses jittery and jumpy, and all the riders shake a little in their boots.

The horses snorted, balked and showed the whites of their eyes in protest.

Now walking on a wooden bridge is the equestrian equivalent of beating a hollow drum underfoot. It’s one of the top potential obstacles to spook a horse, make them rear up and throw a rider. Or jump and stumble over the edge in fright and panic. It also may have loose or rotten boards the concentrated weight of a horse could easily puncture and fall through.

While most of us voted to turn around, my dad never lost character as the brave one of our crew. He got down, tested the bridge on foot, tried to rock it, stomped around, and kicked at the planks to check for rotten boards. At last, we were pretty confident the bridge would hold. So, we coaxed the lightest, calmest horse across first while holding our breath. Finally, after they crossed without falling through or over the edge, the rest of us followed suit.

I learned that when you’re placing your confidence on the intrinsic stability and certainty of a thing, you want to be absolutely sure that thing is really solid.

It’s like that with our financial decisions.

If I’m going to put my confidence in the certainty of permanent life insurance, I want to be certain that it can hold me and protect my life savings, even in the worst case scenario.

That’s why we’re talking about life insurance carrier ratings today. We’re going to test out and explore how and why life insurers are financially strong and can back up their claims.

Life Insurance Company Ratings Are A Part of the Bigger Picture of Creating Wealth

Now, a big secret to understanding the strength of an individual insurance company lies in the ratings.

However, ratings are only a sliver of a much more substantial conversation about the strength of the life insurance industry overall.

And while the stability of the industry is a critical piece of protecting and preserving your wealth, it’s just one small piece of the bigger journey to creating time and money freedom.

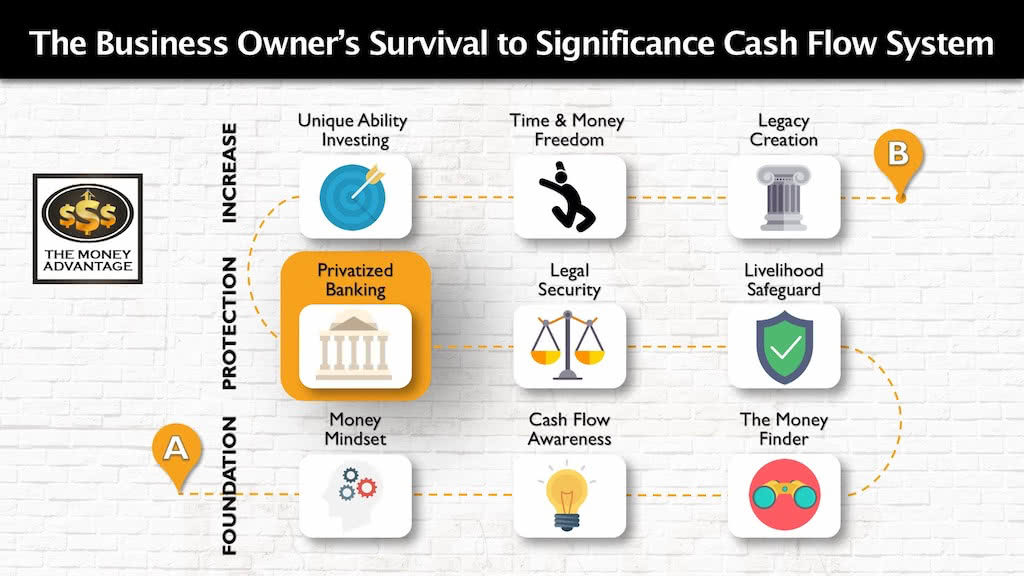

That’s why we’ve developed the 3-step Cash Flow System. It’s your roadmap to go from just surviving, to a life of significance, purpose, and financial freedom.

The first stage is the foundation. You first keep more of the money you make by fixing money leaks, becoming more efficient and profitable.

Then, you protect your money with insurance and legal protection and Privatized Banking.

Finally, you put your money to work, increasing your income with cash-flowing assets.

Life insurance carrier ratings are an indicator of the strength of life insurance itself, which falls in the middle level of Protection. However, their impacts are far-reaching, spanning widely to improve every other area of your financial life.

Insight #1 – Compared To Commercial Banks And Investment Firms, Life Insurance Companies Have A Long History Of Financial Strength Under Pressure

The insurance industry has spanned nearly 200 years, weathering the Civil War, the Great Depression, and the Great Recession.

For context, Penn Mutual was founded in 1848 (172 years ago) and Mass Mutual in 1851 (169 years ago). Both companies existed before and through the Civil War (1861 – 1865).

Western and Southern began in 1888 (132 years ago), long before the Great Depression of 1929 – the late 1930s.

The oldest life insurance company still in existence is Equitable Life Assurance Society. It was founded in the UK in 1762 (258 years ago).

But not only have these companies stood over time, they’ve seen a lot through their years. And historically, life insurance companies have emerged from crisis financially sound, maintaining their core business of issuing policies, paying claims, and servicing in-force business.

Want to see why?

Insight #2 – Life Insurance Companies Are Highly Regulated To Protect Consumers

The insurance industry is highly regulated, both at the federal and state levels. The primary oversight is by state insurance commissioners, and their collaboration through the National Association of Insurance Commissioners (NAIC).

Consequently, insurance companies must then be licensed in each state and comply with each state’s requirements where they want to do business. Additionally, insurance producers must also be licensed with each state.

The regulators hold life insurance companies to a high standard with net worth requirements, risk-based capital tests, cash-flow testing, and layers of solvency surveillance that include third-party analysts, to maintain their fiscal integrity.

Companies must carry capital reserves over and above their liabilities (which are primarily paying death claims).

To increase the stringency, insurance companies must plan for more people to die, thus having more liabilities, and still maintain a cushion of capital beyond that inflated number.

In fact, the top insurance companies have on average $107 for every $100 of claims that they have promised in the future. Some of the companies we work with even have $114 for every $100 of claims promised.

Additionally, the insurance industry requires SAP (Statutory Accounting Principles). This method focuses on solvency – the ability to pay debts and have cash to pay for future needs – which are more conservative than the GAAP accounting every other industry uses.

And what happens if they don’t pass the tests?

Regulators identify carriers that need rehabilitation. Then, the company can first voluntarily course-correct by cutting expenses, selling off pieces of their business, or considering a merger with a stronger company.

But What If An Insurance Company “Fails” and Becomes Insolvent?

If a company has gone too far, the insurance commissioner will take over the company in a regulatory seizure.

At that point, because insurance companies operate in a competitive profit and loss environment, they must provide their own safety nets. Consequently, even an insolvent insurance company has substantial assets of real value to sell off.

The company’s assets are sold. The liquidation prioritizes making policy-owners whole, after cost of administration and employee salaries, but before all other creditors and shareholders.

The state’s Guaranty Association steps into action, funded by the assets of the failed life insurer and other insurance companies in good standing. It provides coverage and benefits, and transfers policies to other insurers. And the new insurer picks up where the old one left off. The policy-owner experiences a seamless transition and continuation of the policy they started with.

When you buy a life insurance policy, you’re part of a family. And that family has a family.

You’re not only welcomed and upheld by the company whose name is on your life insurance product, but also, by the trust and valor of an entire industry that protects it’s policy owners.

This nearly cinematic, tribe-strengthening mentality is like a bond of brotherhood amongst the insurance companies that uphold the reputation of the industry as a whole.

Now, let’s turn to one of the most turbulent times in American history to witness this strength in action.

The scene is the Great Depression, when 38% of banks failed. At the same time, only 14% of life insurance companies failed. And as we just described, most of those companies were taken over by other insurance companies. To date, we haven’t been able to find evidence that a single policy-owner experienced any loss.

But let’s look a little closer at what actually happened.

Let’s Peek In On How Life Insurance Companies Handled the Great Depression

During the Great Depression, banks were struggling to provide cash to depositors who wanted and needed their money.

Without going into depth on what caused this problem, due to fractional reserve banking, banks weren’t holding all deposits in reserves. If you had $1,000 “in your bank account,” the bank had about $100 of that in the vault. They’d loaned out the other $900. So, giving you your money wasn’t a problem. But if everyone wanted their money at the same time, the bank didn’t have enough cash to go around.

A Holiday That Wasn’t a Party

To stop the run on the banks, Franklin Delano Roosevelt declared a banking holiday on March 6th, 1933, and closed all the banks.

Three days later, Congress passed the Emergency Banking Act, allowing the President to reopen banks when they were in satisfactory condition to do so as early as March 13th.

Unfortunately, 2100 banks never reopened. This added to the cascade of bank failures reaching a grand total of 9100 during the Great Depression.

The Banking Holiday Spun Off an Insurance Holiday

In those days, storing money in a whole life policy was more common than it is today.

Without being able to access bank deposits, people turned to their life insurance policies to get cash.

That’s because life insurance policies provide contractual access to cash through policy loans.

But at this critical time, the volume of policy surrenders and loan requests skyrocketed. This made it difficult for insurers to invest their cash appropriately to keep up with their reserve requirements.

The financial strength of insurers was being pushed to the limits, and had the potential to force them to failure.

The same day the banking holiday began, New York declared an insurance holiday. And then 28 other states followed suit.

At that time, policy-owners could not access cash through cash surrender values or life insurance loans, except for $100 if they showed dire need.

The insurance holiday lasted six months, with restrictions relaxing at several intervals along the way before insurance law was again back in force. It was April 3rd, 1933, when New York began to allow loans or cash surrender values for paying rent or taxes; then June 7th when you could access cash if you stated your intended use. Finally, on September 3rd, the emergency was over, and things were back to normal for the life insurance companies.

But Here’s the Kicker

All throughout the insurance holiday, insurance companies continued it’s core business operations and never stopped providing death benefits. And, they never completely suspended access to cash, because you could still get $100, worth relatively $1,545.60 in today’s dollars. To top it off, insurance companies emerged from the crisis with the financial strength and ability to make their contractual payments, including policy loans.

This means, that although the life insurance industry went through dark days, their light never went out. Because they handled that crisis with grace and maintained their commitments, you can be confident that they will continue to do so into the future of unknowns.

And if you want full transparency, you can see for yourself just how strong a company is, in real time!

Insight #3 – Life Insurance Carrier Ratings Are A Window Into The Soul of the Company

One of the ways the insurance commissioner monitors the fiscal fitness and solvency of an insurance company is through the third-party analysis of independent ratings agencies.

The Big Three

The “Big Three” credit ratings agencies assess the financial strength and solvency of both public and private companies, and assign a credit rating, based on the borrower’s ability to meet their financial commitments. This provides transparency to the public, allowing you and I to make safer and informed choices.

S&P Global Ratings (Standard & poor’s), the largest of the top three rating agencies, started in 1860 by Henry Varnum Poor to assess the finances and operations of US railroad companies. In 1906, Standard Statistics Bureau began offering similar financial information about non-railroad companies, and in 1941, the two companies merged to become Standard & Poor’s. Now they offer investment-grade ratings of AAA down to BBB, and Non-investment grade ratings of BB down to D.

Moody’s, another of the Big Three, was founded in 1909 to provide bond credit ratings. Moody’s emphasis is on measuring the expected investor loss if the company went into default. It uses a similar alphabetical scale ranging from Aa through Caa, adding numbers 1, 2, and 3 to differentiate the gradient of strength within a category, with lower numbers being assigned to higher ratings.

Fitch’s, the smallest of the Big Three, is a newer credit ratings agency used by the U.S. Securities and Exchange Commission. It’s often used as a tiebreaker when S&P and Moody’s rate companies differently.

AM Best and COMDEX Score

AM Best, a United States based credit rating agency, focuses specifically on the insurance industry.

The COMDEX score is the Big Kahuna of financial strength scoring for life insurance companies. Provided by Ebix’s VitalSigns software, it is a composite score of insurance company ratings that factors in all the data from multiple top ratings agencies. This common standard of measure allows you to easily compare all insurance companies. The Comdex score ranks companies on a scale of 1 – 100, with 100 being the best.

Here’s How to Navigate Life Insurance Carrier Ratings

Insurance companies disclose their financial strength on their websites, most often as a badge of honor for their high marks.

For instance, Lafayette Life Insurance proudly shares their A.M. Best rating of A+ (Superior), and their Comdex score of 95. Here’s where you can easily locate the ratings for Penn Mutual, New York Life, and Guardian, to name a few.

Regardless of whether you are shopping for term life insurance or permanent life insurance products, you can ensure you are working with one of the best life insurance companies. To ensure you’re working with a financially strong insurance company, we recommend a company with A ratings on the independent rating agency’s scales, and a Comdex score of at least 80 or better.

But Even Life Insurance Carrier Ratings Aren’t the Full Story

While insurance company ratings offer transparency so you can depend on an insurance company and know they will be able to fulfill their claims, the data-driven approach is still limited in scope.

Find out our 8-point checklist to make sure you get the best life insurance company here.

So, here’s the bottom line for every wealth creator…

- You can be certain that whole life insurance is a safe place to hold your savings.

- Because you can use life insurance carrier ratings to verify the relative strength of your insuring institution, the transparency gives you confidence.

- Knowing how the insurance industry weathered the Great Depression will give you the security of knowing a worst-case scenario

- When shopping your life insurance coverage options don’t just go with the lowest life insurance costs. Maximize your life coverage for your beneficiaries by working with a strong company.

The bottom line here is that you can be certain of the cash value in your life insurance policy, without having to wonder if an economic crisis could collapse the pillar you’re depending on.

Oh, before I forget, if you’re a wealth creator who is genuinely interested in how to turbocharge this process, take a minute to check out the Quick and Easy Privatized Banking Guide for Investors. This makes it easy for you see exactly how whole life insurance can give you the stability, guarantees, peace of mind, and financial confidence you crave … while earning a rate of return with the same money in two places at the same time, which is insanely cool for boosting your investment returns.

Article Resources

- Life insurance company impairments and insolvencies, from the National Organization of Life & Health Insurance Guaranty Associations (NOLHGA).

- Bank failures, according to the Federal Deposit Insurance Corporation (FDIC).

- How Safe Are Insurance Companies, by L. Carlos Lara, in the June 2017 BankNotes Monthly Newsletter, published by the Nelson Nash Institute.

- Banks vs. Insurers During the Depression, by Robert P. Murphy, in the December 2012 BankNotes Monthly Newsletter, published by the Nelson Nash Institute.

- What Happens When an Insurance Company Fails, The National Organization of Life & Health Insurance Guaranty Associations (NOLHGA).

Becoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read MoreNelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read More