4 Ways to Save Money on Life Insurance

Now, when you’re shopping, you want to make the best decisions, and it’s not always about the price. If you wanted to save money on everything, you would buy only at the dollar store, right? In this video, we discuss four ways to save money on life insurance without being cheap.

We want to not only spend as little as possible; we want to get the most for that. So how do we do that when it comes to life insurance?

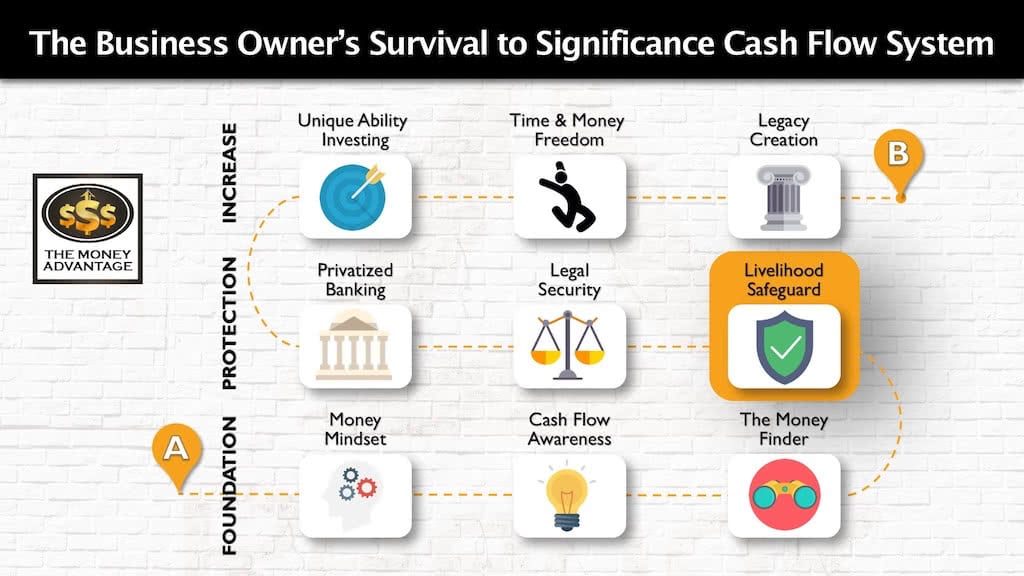

Where Insurance Fits into Your Whole Personal Economy

Let’s zoom out for a moment to remember where and why insurance fits into your Cash Flow System.

Your foundation starts with keeping more of the money you make. Second, you protect what you’ve built. Finally, you increase your income to create time and money freedom and expand your legacy.

Insurance fits in the protection stage. With it, your livelihood is no longer at risk, but secure, regardless of the life circumstances you face.

Your protection is like a roof on your financial house. When the shingles are sufficient and cover the whole house, it keeps storms outside your house, preventing them from getting inside and destroying your belongings. Similarly, when you have adequate insurance protection, your income and assets you’ve built are safe from financial storms that may occur in your life.

4 Ways to Save Money on Life Insurance

1) Ensure Your Life Insurance Is Not Just an Expense

All of the premium dollars you put toward a term policy are eaten up, and you will never get them back.

On the other hand, we have whole life insurance. If in fact you keep a whole life policy and are living at age 121, you would personally get your death benefit paid to you. No matter how you look at it, a whole life policy will pay out as long as you keep it in force.

2) Get the Most For Your Money

Term insurance may seem like the best way to save money on life insurance. However, don’t be deceived by the low cost of term insurance when you are young and healthy. If you had a 30-year policy say from age 35 to age 65 and wanted to renew after that, the cost could easily be 10 to 100 times the cost that you paid initially.

Whole life seems more costly early on because you’re averaging the cost over the span of your whole life. Overall, you’re putting in fewer dollars to keep a policy in force, and you’re guaranteeing a payout.

3) To Save Money on Life Insurance Start Young

I know this is challenging because when we’re young and healthy, our mortality is probably the last thing on our mind.

We do ourselves a huge favor if we lock in lower rates when we are young and healthy. You will look back and be incredibly thankful.

4) Start With a Convertible Term Policy

If you can’t afford whole life insurance today, then get a convertible term policy. You’ll pay a little bit extra to make sure that that’s convertible to whole life, but you will have the ability to leverage your excellent health status today when you convert into whole life later.

If you would like to learn more about how you can save money on life insurance check out: How to Shop for Insurance Part 3: Life, Health, and Disability Insurance

Your Decision Point

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read MoreNelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read More