Should I Pay Cash or Finance Real Estate Investments?

Do you want to purchase cash-flowing rental real estate? Are you are asking the question: should I pay cash or finance real estate investments?

Assume that you have enough to pay cash and pay for the property outright. But do you want to do that?

In order to determine if you want to pay cash or finance real estate investments, let’s compare the return on investment.

When looking at the return on investment, you use a very simple calculation. You take what your earnings are divided by what you put in.

If I put in $1 and it turns into $2, my earnings are $1. I made $1, divided by what I put in, which is $1, equals 100%.

Now if you follow that simple math, let’s carry this forward into a $100,000 property.

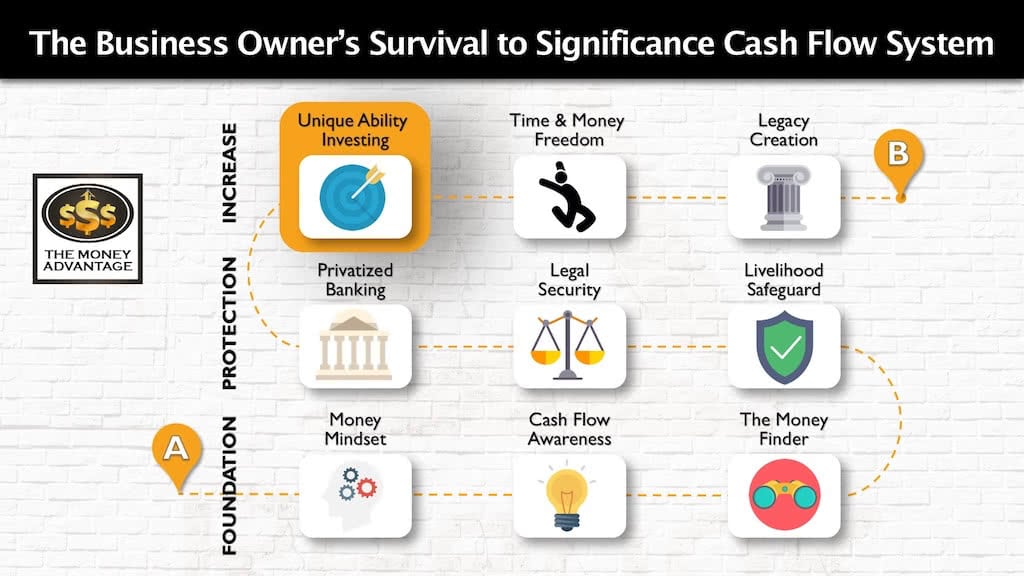

Where Does Real Estate Fit in the Cash Flow System?

We are evangelists for cash flow because cash flow is your ticket to time and money freedom.

Investing in cash-flowing assets is part of the third stage of the Cash Flow System.

Once you have a stocked emergency/opportunity fund, you now have a pool of capital that’s ready to invest. To accelerate your cash flow, you need to identify cash-flowing assets and develop an acquisition strategy.

Real estate has long been an asset choice of the wealthy to create cash flow income.

Pay Cash or Finance Real Estate Investments?

Imagine you were in a position to pay $100,000 cash for the property. And you earn a return of $10,000 per year. Now if you profit $10,000 per year, you get to keep all of that. So let’s take the $10,000 divided by the $100,000 that you put into it. That is a 10% return on investment.

What if instead, we finance? If you finance with a 20% down payment, you will have $20,000 in the deal.

But now you’re going to earn the same $10,000 per year in cash flow, but you will have to pay back a loan. So that’s going to reduce the amount that you keep.

Let’s reduce that $10,000 down to $4,000 because you’re paying back the loan.

Now $4,000, which is what you made, divided by what you put in, which is $20,000, is a 20% return on investment.

This is an important factor to consider when deciding to either pay cash or finance real estate investments.

So you can either use all $100,000 that you have and earn a 10% return with that money, or you can put $20,000 in, which is only 1/5 of the cash, and earn a 20% return.

What if instead of only doing that, you bought five properties? You’re going to earn a 20% rate of return on five different properties. That’s $4,000 of income per property, times five properties.

Now you’re making $20,000 versus $10,000 in the previous example. You’re doubling your returns with the same investment.

Consider the power of leverage when deciding whether to pay cash or finance real estate investments.

Create Your Time and Money Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Investing in Self-Storage, with Paul Moore

Why would a commercial real estate investor, author, and syndicator move away from apartments and become a self-storage investor? Paul Moore, real estate investor and author of Storing Up Profits, demonstrates how to capitalize on America’s obsession with stuff by investing in self-storage. So, if you want to find out what’s to love about self-storage,…

Read MoreMultifamily Real Estate Investing, with Kent Ritter

Would you like to make better investment decisions? Today, we’re talking with Kent Ritter, full-time real estate investor and operator of Hudson Investing about scaling and diversifying your real estate portfolio. So if you want to expand your investing perspective… tune in now! How Kent Ritter Got Started In 2010, Kent started as a partner…

Read More