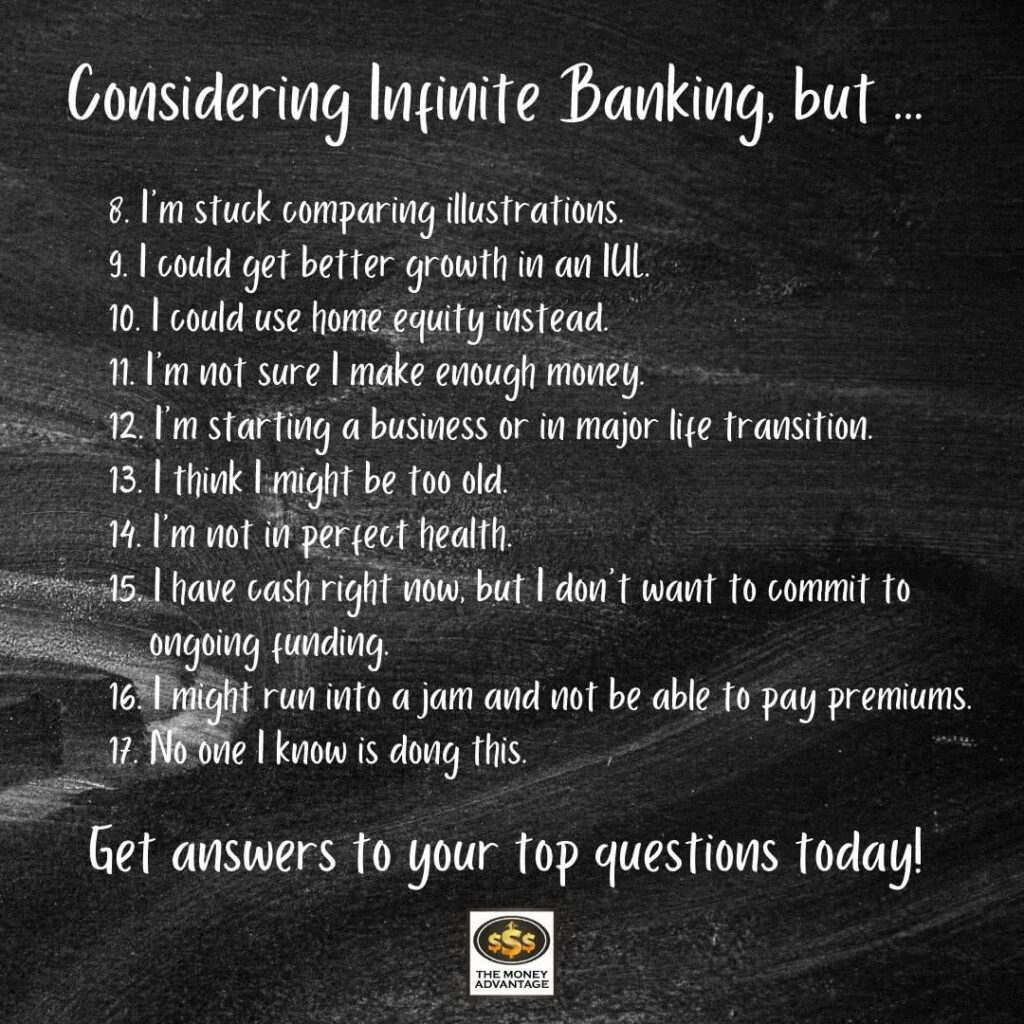

Top Questions About Infinite Banking, Part 2

In part 1, we started discussing the top questions about Infinite Banking that we hear all the time. This week, we’re finishing up the conversation, so that you can make a decision about Infinite Banking with confidence.

Hopefully, we’ll cover the question on your mind. (And if we don’t, check out Part 1 of this conversation to see if we’ve covered it there.)

So, if you want to clear up your doubts, find out exactly what to do about your concerns, and know what to do next, join us for the conversation!

Podcast: Play in new window | Download (Duration: 1:01:34 — 70.5MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

Strategy vs. Product

Before we begin our conversation, it’s important to note the difference between Infinite Banking as a concept, and whole life insurance as a product. As a product, insurance offers many benefits that we advocate for–growth, liquidity, asset protection, and more.

On the other hand, Infinite Banking refers to how you use your products. Insurance, on its own, isn’t “magic.” However, the way you design your policy, combined with the strategies you use to leverage that cash value, is what makes up Infinite Banking.

Now that you have that framework, let’s get into round two of your top questions about infinite banking.

Your Top Questions About Infinite Banking, Answered

1. How do I compare illustrations effectively?

When comparing illustrations between companies, it’s important to note that illustrations are projections, and are non-guaranteed. Although illustrations often have a guaranteed portion, you can expect dividends to be paid. Once dividends are paid, your entire projected illustration will change, as will projected dividends.

You can use illustrations as a good guideline, although so much will change from year to year, and the difference between companies will not be much different in the long run. If you’re trying to choose between a direct or non-direct recognition company, for example, the long-term differences are not that significant.

The most important decision you can make is the decision to get a policy today, for the best results possible. Differences between premiums and face amounts will be more significant in your decision-making process than which company you go with.

2. Can’t I get better growth with an IUL?

You could, potentially, get better growth in an IUL. However, IUL illustrations often leave a lot unsaid. For starters, there’s an increasing term insurance cost within the policy (rather than a level cost) that your growth will have to outpace. On another hand, IULs have fewer guarantees and more risk involved. People often misunderstand the language used in IUL contracts as well–people are told that they cannot lose money, so they buy policies with a false sense of security. And while you cannot lose money from the stock market component, you can lose cash value from the increased cost of your insurance, which correlates to the market performance. Everything in insurance has a trade-off, including the “market-returns” of an IUL.

Ultimately, it’s up to you to decide the purpose of your money, as we mentioned in Part 1. With an IUL, you take on the risk. With whole life, the company assumes the risk. If you are seeking to save and grow money, whole life insurance is likely the better vehicle.

3. Can I use my home equity instead of life insurance?

The more people learn about whole life insurance and Infinite Banking, the more they realize that building cash value is very similar to building equity in a house. The challenge, however, is how you access the equity in your house, via a HELOC. This is often the vehicle used for velocity banking.

The first roadblock is that you must ask the bank for access to that equity. If they see you as unfit to pay back a lien against the equity, they can deny you. The bank has the ultimate authority over your access to that cash. Insurance companies, on the other hand, will give you a policy loan without question because it is collateralized against your cash value.

The other downside is the unpredictable nature of the housing market. If your house were to lose value, your equity will evaporate. Your insurance is not subject to market volatility, and cannot evaporate or diminish in any way because of the contractual obligations.

4. Do I make enough money to have or benefit from insurance?

We see this question often, and we’re happy to say that Infinite Banking can be accessible to just about anyone. You really don’t need a certain amount of income—instead, we recommend having a certain savings amount per month. Having good savings habits, and keeping that savings in a position of safety and liquidity (NOT risk), is the ideal start.

Wherever you can start is the best place to start–10% of your income, or $20 a month, and just gradually increasing what you have. While we recommend starting a policy closer to when you have consistent savings of $1,000 a month, it is possible to start with less. Creating sustainable practices will help you in the long run, and everybody starts somewhere.

If you’re thinking to start, and you want to keep the door propped open, you can consider a convertible term insurance policy. While this won’t allow you to use Infinite Banking strategies, it will help you to lock in your insurability. So if you’re young and healthy now, you can ensure your ability to get whole life insurance in the future, regardless of any changes to your health status.

5. Is it the right time if I’m in a big personal or business transition?

Ultimately, there’s no perfect time for insurance. Life is all about transitions–changing careers, starting a family, building a business, moving states, etc. If you’re interested in executing these strategies, and you have the savings habits in place, then the best time to start is right now.

Building up your cash value takes time, and the sooner you start a policy, the sooner you will be able to utilize the strategies of Infinite Banking. Conversely, the longer you wait, the less optimal your growth will be and the longer it will take.

If you’re starting a new business, whole life insurance can be a great place to store profits and a pool for funding investments.

6. Am I too old for life insurance?

You may be surprised to hear this, but you’re probably not too old. We’ve seen people in their mid-70s get insurance and reap the benefits as well. Actuarial science actually supports this, by ensuring that dividends are paid in a way that will help all age groups benefit.

Additionally, you can own a policy on someone else. In other words, you can pay to insure someone else’s life, such as your children or parents, and still use the Infinite Banking strategy.

7. What if I’m not in perfect health?

Health can be a big hurdle for many. Maybe everything besides health is in place—your age, savings, etc—yet you have a condition you feel may disqualify you. In reality, it may not be as big a barrier as you believe. High blood pressure or blood sugar, or even cholesterol, are fairly common conditions. If you’re treating this kind of condition, insurance companies look favorably on this, because they can be assured that you take care of your health. And most people can live a long and relatively normal life when managing these conditions.

There’s also a possibility that you qualify, albeit at a higher rate. If this is the case, locking in that insurance now can guarantee your insurability in the future, should your health change, which may be worth the higher premium.

And finally, if you cannot insure yourself, you can insure the people close to you and be able to benefit from Infinite Banking strategies.

8. I have stores of cash now, what if I don’t want to commit to ongoing funding?

We’ve found that some people would like to plop a lump sum of cash into a whole life policy to reap the rewards and eliminate future premium payments. We like to think of insurance as a marriage—it’s a long-term commitment which, when nurtured, can enrich your life in infinite ways. It is not a one-night stand, where you make a payment and then forget about that relationship.

From a pure tax standpoint, funding your policy in one sum will cause that policy to become a Modified Endowment Contract (MEC), which doesn’t receive the same tax benefits as a life insurance policy. This prevents people from abusing the tax benefits of insurance.

9. What happens if I become unable to pay my premiums?

This is a really important thing to consider—after all, life happens! Fortunately, when you have a properly designed insurance policy and you’re unable to make premium payments, you have a lot of flexibility. If you’re in a lean year, you can pay only the base premium, rather than any Paid-Up Additions.

Another option is to use a policy loan to pay that premium. While these increase your lien and accrues interest, it allows you to ride out tough times if you are anticipating a windfall in the future. You can also reduce your death benefit and halt your premium payments permanently. There are some additional options, just rest assured that you have plenty of flexibility.

10. How can I trust this if no one I know is doing Infinite Banking?

We hear this question about Infinite Banking frequently. Those that understand this concept, are probably wondering why so many people aren’t doing this. However, the wealthy have been using these strategies for over a century to build and protect their wealth. And often, people who use this type of strategy are very conservative about their money and don’t brag about their strategies.

Ultimately, following the crowd, when it comes to wealth, is rarely the best strategy. After all, how many people have found success in the stock market, or with qualified plans? They may be doing okay, yet they do not become wealthy from these tactics.

Success leaves clues—follow the lead of the successful few, rather than the average masses.

Book A Strategy Call

Do you want to coordinate your finances so that everything works together to improve your life today, accelerate time and money freedom, and leave the greatest legacy? We can help!

Book an Introductory Call with our team today https://themoneyadvantage.com/calendar/, and find out how Privatized Banking, alternative investments, or cash flow strategies can help you accomplish your goals better and faster.

That being said, if you want to find out more about how Privatized Banking gives you the most safety, liquidity, and growth … plus boosts your investment returns, and guarantees a legacy, go to https://privatizedbankingsecrets.com/freeguide to learn more.

Becoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read MoreNelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read More