Strategic End of Year Tax Moves That Leave You Wealthier

As you count down the days until Christmas, you’re also counting down the days you have before you tie up the loose ends on your fiscal year to prepare for 2018 taxes. We’ll walk you through practical and strategic tax moves you can make to close out the books, stay organized, and save taxes. This will help you keep more money in your pocket and best plan for next year.

There’s lots of information out there. On the one hand, some of the typical advice is so commonplace, it seems like common sense. On the other hand, there may be strategies and options you may not even be aware of yet.

This can lead to financial noise, creating confusion, procrastination, and overwhelm. Instead, we want you face the end of year empowered and proactive.

That’s why we’re helping you sift through the information to discover the strategies that align with our community’s core values and principles. Our filter is an abundance mindset, maximizing cash flow and control, and getting your money to do the most for you.

And if you’re feeling like year’s end is a ticking time bomb with so much left to do, use these simple resources as a guide. You may be able to implement a few changes this year to make a big difference in 2018 taxes. Better yet, you’ll be armed and dangerous with a head start to make 2019 your best year yet!

Podcast: Play in new window | Download (Duration: 58:29 — 53.5MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Customization Required

Your situation and needs depend on whether you’re doing your own accounting and hiring out tax preparation, or have an accountant. In addition, the size and stage of your business, and your plans to scale and grow matter.

We recognize that there may be some things that don’t apply to you. That’s great! You’ll pick up information that will help you right where you are and also with where you are going.

And if you want to consider a shift that would really set you ahead, we have a recommendation for a tax strategist at the end, who may be just what you need to minimize taxes this year and every year going forward.

Many of these strategies translate over to your personal life too, where attention and intention help you make huge improvements!

One necessary disclaimer: we are not CPAs or tax professionals. However, we do have them on our team, because tax savings done right is a crucial part of improving our and our community’s lives. So, make sure you talk with a tax professional about what’s right for you.

Where Tax Planning Fits into the Cash Flow System

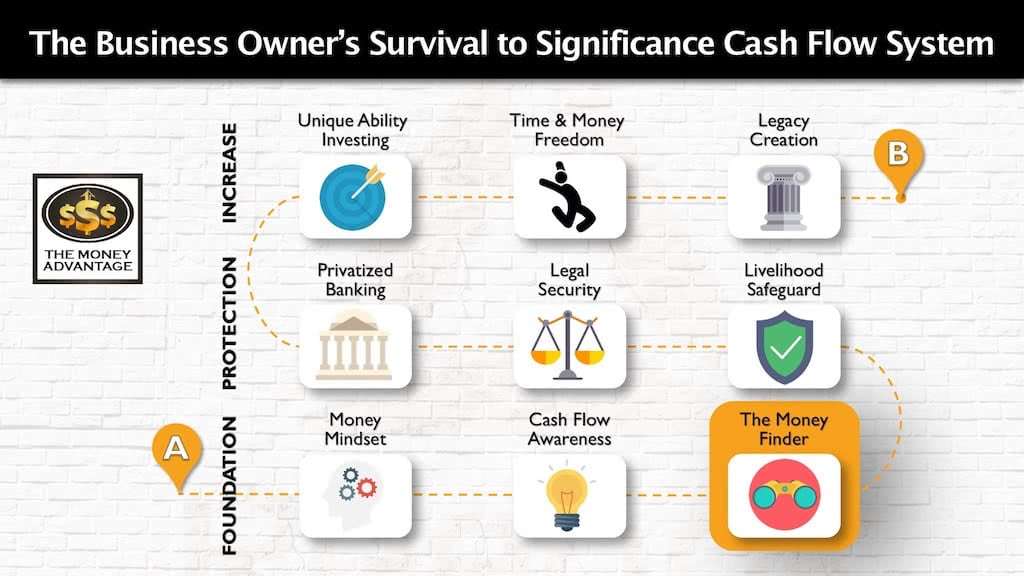

In the Cash Flow System, you first increase cash flow by keeping more of the money you make. Then, you protect your money. And finally, you increase and make more money.

Tax planning and strategy to increase your cash flow is part of Stage 1, your foundation. When you keep more of your money, you increase current cash flow. That is what allows you to build up capital and put it to work in cash-flowing

Five Hand-Selected Articles to Help You Have Your Best Tax Planning Year Yet

Our team has hand-curated five helpful articles to give you the full scope of your end of year closure and preparation. I’ll share a brief synopsis of each here. Be sure to check out the podcast for the full discussion.

1) Five Things Business Owners Can Do at Year-End to Lower Their Taxes, by Stephen Fishman, published on NOLO

This article covered most of the typical advice you hear about big financial moves to offload cash and raise this year’s deductions.

They recommend purchasing business equipment for the deduction and the depreciation, but without a clear caution to not purchase stuff you don’t need. While this seems like it should go without saying, way too many business owners buy a new truck at the end of the year to save taxes, meanwhile bleeding out cash flow in the form of an expense they didn’t need in the first place.

The article also suggests funding retirement plans, which has significant limitations on the control of your capital, and potentially raises your future tax burden by rolling it forward to a time when tax rates may actually be higher. And as they recommend selling losing stocks, it seems as though they assume all people own stocks, leaving out those of us who would rather stick with certainty.

They do propose opening an HSA and donating to charity, both of which can be very advantageous moves, if you’re aware of the limitations.

HSA’s are one of the only ways to get an above-the-line deduction, and still be able to use the money tax-free. Just make sure it’s paired with a high-deductible health plan. And check out the podcast for one great recommendation for funding it to make sure you get the full advantage.

Then, donations to charity can only be deducted if you itemize deductions, not if you claim the standard deduction. And make sure you’re doing it for a cause you’re passionate about, not just for the financial benefit.

2) Tax Tips for Small Business Owners, a Merrill Lynch article

UPDATE: The article was taken down so the link has been removed. This helpful article chock-full of suggestions to bring to your tax professional for lowering this year’s tax. There are a few similarities to the previous article, and some status quo advice that doesn’t fit our model of cash flow and control, but there are some great gold nuggets here.

They discuss the 20% deduction for flow-through entities and suggest considering a change in your entity type to a C corp to take advantage of the lower corporate tax rate of 21%. But they fail to mention the double-taxation of the C corp structure that raises your total tax.

This article nicely mentions something we all know, but many don’t do: plan ahead for the tax bill. Whether you’re setting aside reserves or pre-paying quarterly estimates, don’t approach April (or October if you file an extension) like you didn’t realize taxes were an eventuality.

You’re getting a very similar conversation about retirement plans, equipment deductions, and charitable contributions.

The gold nugget is a powerful tip to strategically defer revenue and accelerate expenses, or vice versa to bump income from one year to the next, or from next year into this year, to moderate expected revenue, tax bracket, or tax rate shifts.

3) End of the Year Checklist for Small Business Owners, by Trailhead Accounting Solutions

This article is a very nicely done, practical checklist for all of the accounting needs at the end of the year to wrap it up, tie it with a bow, and move into the new year without anything hanging over your head.

They discuss reconciling your accounts between your bank statements and accounting software, addressing any “wacky” looking accounts and moving everything out of the infamous “Uncategorized” category.

Then, clean up accounts payable and accounts receivable, and take physical inventory.

They wisely recommend scheduling a meeting with your CPA before tax season but sell it on the basis of saving tax prep fees, rather than on the merit of strategically planning ahead, which I believe, is much greater incentive.

Then, you get a nice reminder to send out 1099s, and a list of accounting statements to print out and hold for your records. The article then concludes with budgeting and forecasting growth and considering hiring a fractional CFO.

For the accounting-challenged, this article is like a GPS to tell you the next steps to take, giving you the confidence to move forward gracefully.

4) An End of Year Checklist for Small Business Owners, by Cristina Garza, published on Accountingprose

In this article, you get most of the accounting to-do list of the previous article, in a quick-read version, with a bonus printable checklist. The steps are broken down, as if you had a professional sitting down with you and walking you through what to do, step by step.

First, you’ll save a copy of your financial statements.

Then, you’ll go through your income statement to check multiple areas for completeness and accuracy. You’ll walk through unidentified transactions, how to ensure payroll is accurate, and how to fix the common mistake of accidental personal purchases on the business account and vice versa.

Next, you’ll review your balance sheet for accuracy, including ending account balances, depreciation, and payroll.

Then, you’ll find your list of forms to file.

Finally, you’re ready to set your plans and goals in place for next year.

With that complete, you get a next year’s checklist to stay organized in the coming year to relieve the stress you may have felt this year as you went through the process.

And huge plus, you get a checklist that you can use as a guide as you execute each step.

5) These 3 Simple Year-End Tax Moves Give Big Results to Small Business Owners, by Garrett Gunderson, Wealth Factory

We left the icing on the cake for last. This article by Garrett Gunderson comes from a like-minded, abundance-focused professional who really walks his talk, so here are recommendations that you can implement with a great conscience. It’s also surprisingly detailed, offering enough information to give you confidence to move forward.

The first strategy discussed is to defer income and accelerate expenses when moving into a new year where taxes are going down. He provides an understanding of what this actually means, when you can’t use this strategy, and the timing required on postmarking the payments that determine which year will get the credit.

He then gives full disclosure on how to get instant depreciation up to $1M for new or used business equipment through with Section 179, and the bonus depreciation of 100%. And he articulates with clarity that you should never make purchases you don’t need.

Lastly, he strongly advises to get a second opinion on your taxes to see what your regular CPA or tax preparer missed. He shares actual stories where he or a client discovered where they had overpaid on taxes, filed an amended return, and received a check back from the IRS! In one case, the return was over $55K. In another situation, someone went from owing an extra $2,750, to receiving a $2,702 refund check, a net gain of $5,452.

It’s the perfect reason to be proactive with your tax planning and strategy to make sure you are paying the least legal tax, this year AND every year going forward.

Top Tax Moves Discussed

To boil down the whole show and condense all the articles, here’s the best steps to take before the end of the year that will help you save taxes and grow wealthier:

- Get the deduction of up to $1M, and 100% bonus depreciation for buying new or used business equipment, that you need. Don’t make purchases you don’t need, even if you’ll save some tax. An expense uses up proportionately more cash flow than the expense’s deduction will save in tax. Don’t buy equipment you don’t need, no matter how much tax it will save you.

- Push out receiving payments into next year, or pre-pay some of next year’s expenses, as tax rates will be lower next year.

- Consider an HSA (health savings account) to get an above-the-line deduction AND be able to take it out tax-free for out-of-pocket medical expenses. To maintain as much control of your cash as possible, you can wait until you have a payment to make, and then put the cash into the HSA. Then, you eliminate the risk that you put money in and can’t use it for something else, but you’ll still get the excellent tax treatment.

- Charitable donations are an excellent way to marry meaningful, social responsibility with a tax deduction, or even a tax credit. But if you claim the standard deduction, you won’t be able to write off charitable giving. You’ll see a true tax advantage only if you deduct more than $24K for married-filing-jointly, or $12K for single filers.

- Get a second opinion on your taxes to check areas you might have overpaid in the last three years. There may be changes you haven’t even thought of that put more of your money back in your pocket.

Get A Second Opinion on Your Taxes, and Recover Overpayments Up to Three Years Back

We promised our own recommendation for a tax strategist, and here it is! If you would like to see how these ideas could work for you to permanently reduce your tax, talk with our tax team at Incite Tax and Accounting.

They’ll help you strategize to best prepare not only this year, but every year going forward.

They’re busy strategizing with their clients, so they may not be able to fit you in until early next year. However, it’s never too early to start making sure next year is off on the right foot!

If you’d like to hear more conversations about permanent tax reduction and tax reform, check out both of these podcasts with the Incite Tax team.

- How to Pay Less in Taxes Legally, with Dustin Griffiths

- Trump’s Tax Reform: What Entrepreneurs Need to Know, with Dustin Griffiths

Book a Call to Find Out How To Accelerate Your Time and Money Freedom

Contact us to find out the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom. When we talk, you’ll also find out how tax planning could help you reach your goals easier and faster.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

The Power of Trusts for Generational Wealth with Joel Nagel

If you’re reading this, chances are you’ve already taken the first step towards securing your financial future. But what about the financial futures of your children, grandchildren, or even your great-grandchildren? The journey towards financial stability isn’t a one-generation game; it’s about creating a lasting legacy that will provide for your loved ones long after…

Read MoreEstate Planning 101: Protecting Your Loved Ones

Can you confidently say your family’s financial future is protected? Staring down the barrel of a life-altering moment, I was forced to confront the fragility of existence and the critical importance of having one’s affairs in order. That harrowing experience became a catalyst for today’s soul-searching episode of the Money Advantage podcast, where we navigate…

Read More