Borrowing Against Life Insurance vs Bank Financing

Why would I borrow against my life insurance instead of getting a bank loan?

You might be thinking, I could get a great rate from the bank because I have a good credit score. You might be right, but do you want to rely on that?

Let me propose this idea to you.

Back in 2008 when cash was tight for many people, banks had to tighten their lending standards.

Existing lines of credit (business and personal) for many people suddenly dried up. They were either rescinded or recalled. The banks took lines of credit back or shrunk available credit limits, including credit cards.

Think about the possibility of being in a position where your income was tight, or maybe you lost your business or lost your job, and you didn’t have that stream of income. In that position, the bank will now see you as being a significant risk. You will not make it through their approval process, or they will not extend you a favorable loan interest rate.

Where the Infinite Banking Concept Fits into Your Cash Flow System

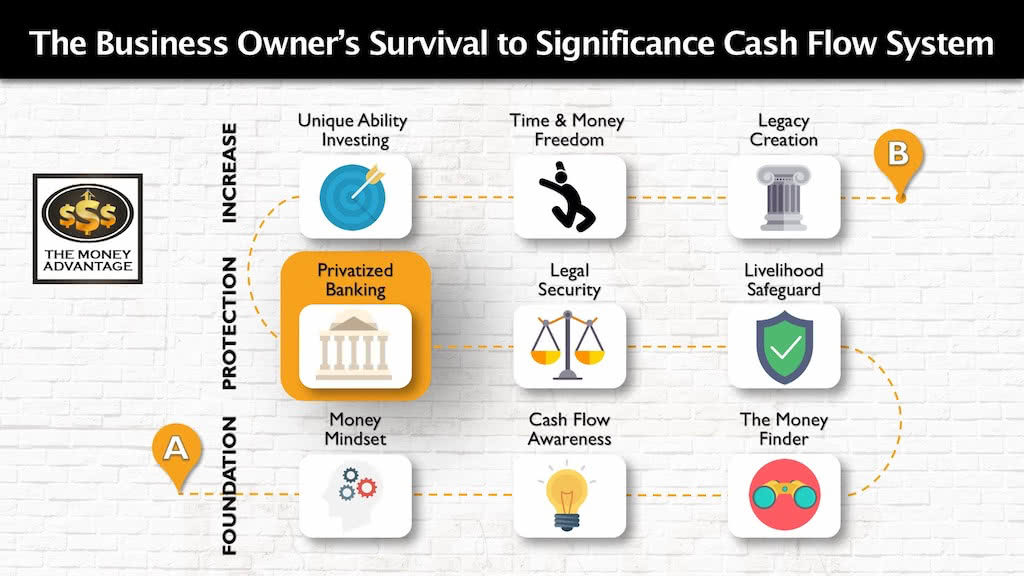

Taking control of the banking function by orrowing from your life policy is a part of Privatized Banking, just one step in the greater Cash Flow System.

Wedged between Stage 1 and 3, Privatized Banking fits into Stage 2, the canopy of protection in your financial life. While protecting your personal economy from the risk of loss, it also helps you keep more of the money you make and amplifies your cash-flowing asset strategy, accelerating time and money freedom.

Life Insurance Loans vs. Bank Loans

Cash Value and Life Insurance Policy Loans

The cash value of life insurance expands your options because you can borrow from your life insurance policies cash value. We use a specially-design whole life insurance contract that accelerates high early cash value. It gives you the ability to access that capital through a life insurance policy loan whenever you may need it.

It is important to note that unlike a savings account you’re not using your capital, rather you are taking a loan from the life insurance company, and using your cash value as collateral. You will continue earning uninterrupted compound interest even while you invest. That is what gives you returns in two places at once.

You don’t need a good credit score or have to prove that you have the income to repay the loan balance. There is no life insurance loan payback schedule, meaning you decide how much you pay back and when you pay back the loan.

You have guaranteed access with a guaranteed loan option. This ability to borrow against your policy with

As valuable as a line of credit is, it can be taken away. However, the guaranteed access to your life insurance cash value gives you peace of mind.

If you’re in a position with no line of credit and no cash, you’re stuck in a cash flow crunch. Needing the capital but having nowhere to get it is a terrifying position to be in.

Instead, we want savings, money that is set aside for emergencies and opportunities. We want a place that earns a competitive return with uninterrupted compound interest, safety, and guaranteed access.

Borrowing against cash value life insurance is ideal because it does not interrupt the compounding. It’s also safe and easily accessible.

Your Decision Point

For more information on leveraging a permanent life insurance policy’s cash value, get our free Quick & Easy Privatized Banking Guide. In the guide, we give an example of borrowing against a permanent life insurance policy to finance real estate.

If you would like to implement life insurance and Privatized Banking in your own life, talk to us about how it would work for you.

Book a strategy call to find out how, and also get the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 28: Infinite Banking Definitions

Have you ever felt like you’re on a financial hamster wheel, constantly spinning but never gaining traction? Join us as we unpack the epilogue and glossary of Nelson Nash’s “Becoming Your Own Banker.” It’s a journey through the intricate philosophy of IBC, as we cover Infinite Banking definitions that shows how effective money management can…

Read MoreNelson Nash’s Legacy: Think Tank 2024 Recap

Embark on a transformative financial odyssey with us as we reflect on our profound experiences at the Nelson Nash Think Tank for 2024. Unlock the doors to personal economic empowerment with the Infinite Banking Concept (IBC), a brainchild of the late Nelson Nash that revolutionizes the use of dividend-paying whole life insurance. We shed light…

Read More