Applying Poker Game Theory to Entrepreneurship, with Jordan River

In today’s podcast, we interview Jordan River. You’ll hear about how he turned a $50 deposit into $50,000 in online poker winnings in 12 months using GTO (game theory optimization). He’ll share how using the principles of GTO will help you grow your business.

Podcast: Play in new window | Download (Duration: 42:17 — 48.4MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

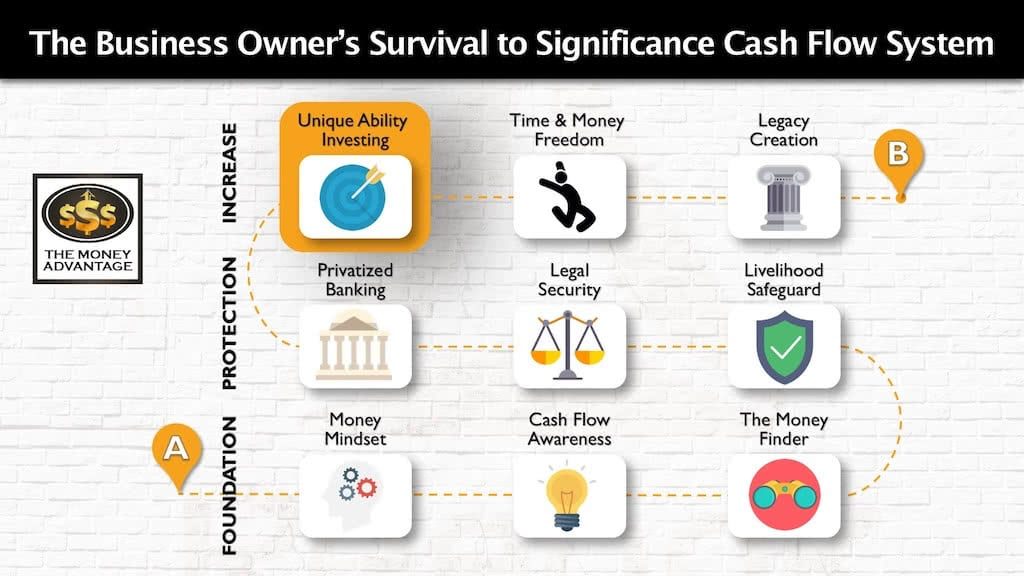

Where Building Your Business Fits into the Cash Flow System

Investing in your business is one of your best investments because it’s what you know and can control. And turning your business into a cash-flowing asset is a big part of creating time and money freedom.

However, your business is just one step in the bigger journey to time and money freedom. You need good money habits to produce wealth systematically.

That’s why we have created the 3-step Business Owner’s Cash Flow System. It’s your roadmap to take you from just surviving, to a life of significance, purpose, and financial freedom.

The first step is keeping more of the money you make by fixing money leaks, becoming more efficient and profitable. Then, you protect your money with insurance and legal protection and Privatized Banking. Finally, you put your money to work, increasing your income with cash-flowing assets.

Who Is Jordan River?

Jordan River is a podcaster, entrepreneur, and semiprofessional poker player. Jordan has been working in media production for 15 years, and currently focuses on podcasting as his main medium.

His work in the personal development field includes shows like The Lifebook Podcast and The Mastering Happiness Podcast, with Dr. Joel Wade.

In 2018, Jordan turned semi-pro while having a strong year at Texas Hold’em. He continues to play daily, hone his game, and frequently donates 25% of his final table winnings to charities.

Jordan River is also the son of Jon and Missy Butcher, founders of LifeBook.

Jordan River Conversation Highlights

- Poker tournaments are analogous to creating and running a business.

- It’s all about making the right moves and detaching yourself from the outcome. Whether or not an idea (or a poker hand) works out isn’t solely dependent on if it was a good decision. All you can do is make moves that SHOULD be +EV (expected value), and don’t worry about how the cards are dealt out after that.

- Focus on what you can control.

- To calculate beyond your capabilities, learn from people who know more than you, and use technology. Copy strategies that work and forget about the ones that don’t.

- Everyone is in the same pool. Some talented players fail, some foolish players succeed, and everything in between. If you don’t get a good grasp on reality through studying outcomes and statistics, you’re left with many powerful and often negative emotions. Then, you can develop superstitions and unhealthy beliefs.

- If you want to succeed next time you try your hand, focus on game theory optimal decisions. That’s the only path to sustained success.

- Poker, like a business, is a balance of three aspects: risk, stake, and reward. Every action you make should yield a +EV formula (i.e., high risk, high reward, but low stake; Or high stakes and high reward, but low risk).

- Trust your instincts and exercise them. Logic and math get you very far, but sometimes they put you in a tough spot – a hard decision with no clear, logical answer. Here, you have to trust and rely on your instincts.

- Be charitable. Building relationships by helping others will supercharge you. And so will giving away some of your earnings.

- Have fun. They say when you stop having fun, you should stop playing poker. It’s the same in business. That doesn’t mean that you’ll have no stress or zero anxiety, but you HAVE to love it on some level.

Connect with Jordan River

You can find Jordan River and keep up on his poker exploits by following him on Instagram @jordanriverig.

Visit jordanriverproductions.com to find more about his podcasting work.

Start Building Your Cash Flow System Today

To personally implement Privatized Banking or discover cash flow strategies to keep more of the money you’re making, book a Strategy Call.

You’ll find out the one thing that you need to be doing right now to accelerate your path to financial freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

Becoming Your Own Banker, Part 27: 7 Money Myths that are Costing You, Continued

Is what you think about money actually true? Is it helping or hurting you? Moving you forward and expanding your influence, or limiting you and your potential? If you joined us last week, you know that in true Bruce and Rachel fashion, we only covered half of our intended conversation, so we’re back to reveal…

Read MoreBecoming Your Own Banker, Part 26: Top 7 Money Myths, Lies That Are Costing You Money

What if what you think about money turned out not to be true? Even worse, what if you’re believing lies that are costing you money? Embark on a journey as we unravel the twisted web of money myths holding you back from true wealth. Inspired by Nelson Nash and flavored with insights from David Stearns,…

Read More