Paying Cash Destroys Compound Interest

Let’s talk about paying cash. Now it certainly has its pros, but it also has its cons.

The reason people often pay cash is that they don’t want to pay interest. They don’t want to go into a position of what they feel is debt. They would rather pay cash to avoid an interest charge.

However, there is also a cost to paying cash. And it probably is not saving you as much money as you think.

The reason is because of the interest principle:

You finance everything you buy.

You either pay interest by financing, or you give up the ability to earn interest by paying cash. This is the opportunity cost on your money.

Let’s say you pay cash to buy a house. Doing so, you give up the ability to earn a rate of return on that cash in a savings environment.

What does this look like?

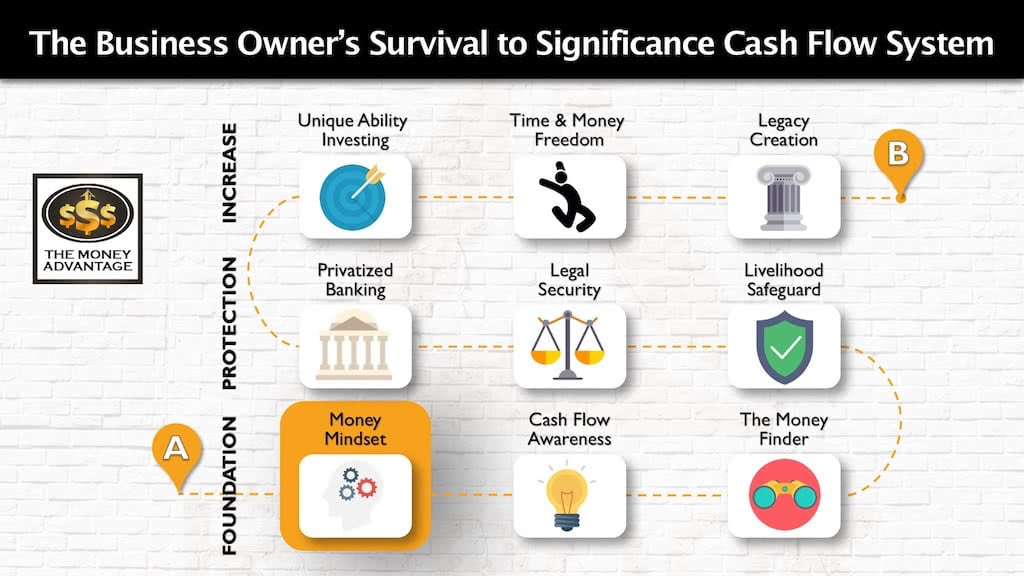

Where Paying Cash Fits in the Cash Flow System

How you spend money is just one part of the Survival to Significance Cash Flow System.

How you pay for the large ticket items is a result of your mindset. When you spend money the right way, you keep and control more money today, giving you more to save and invest in cash flowing assets.

Paying Cash Destroys Compound Interest

Imagine you’re the saver above who chose to pay cash to buy a house.

You are stacking up your savings every month so you can pay cash because you want to be debt free. Now it’s time to buy a car, for instance, and you pay cash for that car.

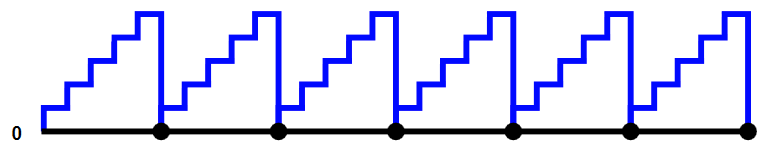

Your savings that were earning interest, specifically compound interest, drop back down to zero. At that point, you have no more cash to earn compound interest with. You’re going to have to build up your savings again. Usually, you’re building that up to make another purchase, so the cycle repeats.

Every time you pay cash, you interrupt the compounding and reset the compound interest curve. If you have studied geometry, you know that compound interest is this parabolic curve that curves upward. It starts off slowly and later turns into explosive growth.

In the first few years, it’s going to look like compound interest is doing barely anything for you. As you get out to year 30, 40 or 50, you are having significant growth. The growth happens even if you don’t put any more money in. This is because of the growth that you’ve earned over time, and the growth on that growth.

Opportunity Cost of Paying Cash

Next time you pay cash for something, think about this:

What could those dollars have earned for you if you kept them in your control and kept them earning?

I’m going to give you a very quick example. Assume you have $100,000 that you put into savings today. You never add to it and you never take anything out, and you’re able to earn a guaranteed 5%.

This is not an average 5% rate of return, it’s an uninterrupted compound 5%. You’re going to get 5% every single year from now through the next 30 years.

What would that $100,000 turn into for you?

Your account at the end of those 30 years would be $446,774 (compounded monthly).

What that means is that $100,000 has the ability and capability of producing far more if you don’t reset the compound interest curve.

If you interrupt the compounding by paying cash, you reduce the wealth that you could have created.

That’s a powerful thing, because those specific dollars will never flow through your hands again, and you’re giving up wealth that you could have created.

Build Your Time and Money Freedom

If you are a saver who would like to learn more about how to increase your rate of return on liquid cash, maintain control of your capital, earn uninterrupted compounding, use your cash as collateral, and have a guaranteed loan option to access your cash, consider using Privatized Banking to elevate your stewardship.

Book a strategy call to find out how, and also get the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

How to Get Business Credit, with Ty Crandall

Need capital in your business, fast? Today, we’re talking about another way to get a capital infusion through business credit. The problem is that most business owners who want financing don’t get as much as they could, because they haven’t worked on the qualification process. That’s where CreditSuite can help. Ty Crandall has become a…

Read MoreMaximizing Your Financial Potential, with Scott McCright

Most people never maximize their full financial potential. That means they don’t accumulate the assets they could, and what they do save and invest isn’t protected and gets eroded too quickly. Then they take distributions in a way that shrinks their income, and they’re always trying to outrun the fear of running out. Sound too…

Read More