The Right Way to Spend Money: Spender, Saver, or Steward?

Alexander Pope said, “To err is human, to forgive divine.” Financially speaking, it would be more accurate to say, “to spend money is human, to create wealth divine.” No one ever needed a lesson in how to buy things. In fact, with no restraint, we manage quite well to find plentiful ways to spend money. How you spend money has the power to stunt or accelerate your wealth creation. Find out whether your purchase personality is a Spender, a Saver, or a Steward. Learn the practical action steps to up-level your purchasing strategy to keep and control more of your money, starting from where you’re at.

To help you spend money the right way, we’ll answer:

- What are my options for how I spend money?

- Am I a spender, a saver, or a steward?

- What are the impacts of each?

- What action steps can I take from where I am to spend money better and increase my future cash flow?

Understanding your purchase personality will move you from impulse buying and scarcity-based decision-making to abundance-based wealth creation. Instead of never getting ahead, you’ll spend money knowing that you’re increasing your wealth potential. Rather than being out of control, you’ll gain control, options, and increased confidence in your financial future.

Podcast: Play in new window | Download (Duration: 35:55 — 32.9MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

It’s Not So Much What You Spend, It’s How You Spend It

When you review your monthly cash flow, you’ll notice circumstances that call for you to go above and beyond your normal monthly spending. These major purchases may be to maintain your lifestyle or improve it. They may be emergencies, or opportunities, or just for fun. Whether it’s buying your next rental property, a business acquisition or expansion, buying a new car, putting tires on the old one, remodeling your kitchen, paying for your daughter’s wedding, your son’s college education, major purchases are outside your monthly spending plan and require additional thought and planning.

The way you pay for these expenses has more significant impacts on your current and future cash flow than you realize.

How you purchase makes a world of difference in your control or loss of control.

So how will you pay for these future major purchases?

You can know the best way, speculate, guess, dream, and even commit, but the best way to predict your future decision-making is to look honestly at your past decisions to figure out what mindset you used to arrive at where you are today.

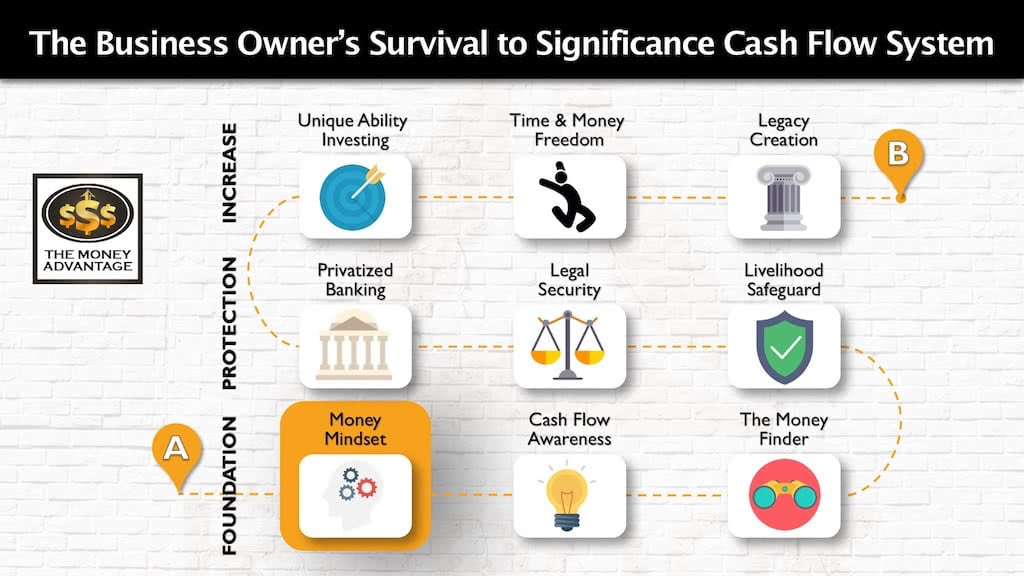

Where Spending Money Fits into Your Cash Flow System

Spending money is just one part of the Survival to Significance Cash Flow System.

How you spend money is a result of your mindset. When you spend money the right way, you keep and control more money today, giving you more to save and invest in cash flowing assets.

What’s Your Purchase Personality?

Use this simple quiz to help you discover your purchase personality.

- Do you put money into savings each month?

If no, you are a Spender.

If yes, continue. - Think back to your last large purchase, maybe it was an investment property, car, boat, remodel, wedding, vacation. Did you have enough in savings to have the option to pay cash?

If no, you may be a Spender.

If yes, continue. - Did you choose to pay cash?

If yes, you might be a Saver.

If no, continue. - Did you keep your cash and finance the purchase?

If yes, you may be a Steward.

The Three Ways to Spend Money

Two of the most common perspectives, which the majority of people ascribe to, are rooted in scarcity. The third, rare perspective is from a place of abundance.

Scarcity: a mindset and position rooted in the fear of lack, limits, and “not enough”

The Spender

The Spender’s desire to enjoy money and life is right and good; however, their motivation is fear of not enjoying life. They often have an unruly appetite to spend. It could be said that they work so that they have money to spend. They spend everything they make each month in pursuit of the highest quality of life they can obtain immediately.

This is the normal, natural path of least resistance, and the condition of every person who doesn’t have a recognized intention otherwise.

Because their income is consumed as it is earned, they do not have savings habits and do not build up savings. A Spender can’t earn interest, because they have no accumulated savings with which to earn it.

This modus operandum creates significant pressure when major expenses arise. As expenses creep up that are larger than monthly income, the Spender’s only choice is to finance the purchase. Because they have no collateral to back the loan and are least likely of all purchasers to be able to repay the loan, they are among the highest risk to the lender. Consequently, they usually pay the highest rates of interest.

The Saver

The Saver’s desire to save money is motivated by the fear of running out of money. They are compelled by the feeling of never enough, and in the extreme are hoarders. The Saver has conquered their basic impulses and improved upon their discipline to master delayed gratification. They have consistent savings habits that allow them to create substantial cash reserves.

Because they have cash, they earn interest.

Savers save money to avoid “debt,” usually because they hate paying interest. Instead of financing purchases, they opt to pay cash.

Rather than borrowing from a lender, Savers are essentially borrowing from themselves, with the intention to make payments back to themselves to repay the used savings.

The Similarities of the Spender and the Saver

While saving may seem like an advanced way to buy stuff, the Spender and the Saver are two sides of the same coin, with almost all of the same problems.

Both Have a Scarcity Mindset

Unbeknownst to most Spenders, their spending originates from a place of fear. They fear not enjoying life fully, missing out, or being left behind.

The Saver has different fears. They are afraid of running out of money, losing money, and paying interest. The aversion to paying interest and fear of “debt” are driving motivations for many of their financial choices.

Both make choices to avoid something negative, rather than to embrace something positive. This scarcity mindset, in either form, is shrouded in limitations, preventing the capacity to think creatively and expansively.

Neither Can Get Ahead

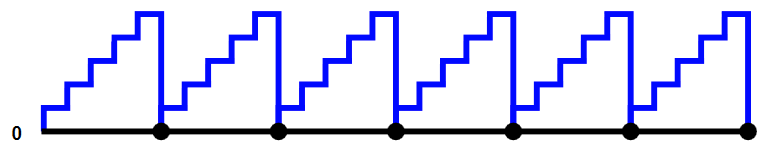

Imagine starting with a zero line, the position of no net worth.

When the Spender finances, they immediately go into a debt position, with more liabilities than assets, causing their net worth to dip below zero. Every payment ratchets them up a step out of this debt pit until the final payment brings them back to ground level at the zero line. The next time they have a major purchase, they spend money the same way, going into debt again because there’s no cash, and repeat the DOWN-UP cycle over and over.

The Saver also starts at the zero line, with no net worth. Because their savings account is an asset, with each payment they make into savings, they stair step up their net worth into the positive. They wait to make the purchase until they have enough cash. To make the purchase, they use up their savings, plummeting their asset base back down to the zero line. Then they start to bank up the savings again and repeat the UP-DOWN cycle over and over.

Neither the Spender or the Saver create growing wealth. They might run on opposite sides of the zero net worth line, but they both always wind up back at zero. It’s as if the zero line has a gravitational pull that prevents them both from advancing.

The Two Problems with Paying Cash

The Saver starts with the right idea and then veers off course.

They’ve implemented the habit of systematic saving, which is a foundational cornerstone of building wealth. Likewise, they are in a position of control with safe, liquid cash for emergencies and opportunities.

However, the Saver’s propensity to pay cash for everything is their demise. Once they make the purchase, they no longer have the cash. They lose the security and control they once had and reset the compound growth of their money.

You Give Up the Ability to Earn Interest

Every time you reach into your pot of cash and use it, you deplete it, taking away your ability to earn interest. Using your cash causes you to lose out on the interest your money could have earned.

For example, imagine you had $100,000, earning 5% annually (compounded monthly). If you let it sit for 30 years and didn’t add to it or take anything away, do you know how much would be in your account at the end of those 30 years? Your account would have grown to $446,774. That means the 30-year potential of that $100K is the $346,774 it could earn.

If instead, you use up your $100K by paying cash, you give up the ability to earn the $347K. The $347K that will not be created is the lost opportunity cost of using up your $100K.

You Reset the Compounding

Even if you restock your savings by building it back up, you’ve still forgone tremendous wealth potential. Here’s why:

When you use up your savings and drop back down to zero, you set back the starting point of your growth all over again.

Because the magic of compound interest happens the longer you allow it to work for you, every time you move your start point back to a later date, you delay your wealth creation and shrink the wealth you can create.

Imagine the same example above, except that you used all your cash in year 10 and then replenished your savings. At the same 30-year mark, your money would now have only had the opportunity to compound for 20 years. $100,000, earning the same 5% annually (compounded monthly), for 20 years, would grow to only $271,264. By using your cash and restarting the growth curve ten years later, you’ve given up $175,510 that you no longer have the ability to create with that cash, had you let it continue to compound uninterrupted.

Using your cash interrupts the compounding, erasing years of growth and robbing you of tremendous wealth potential.

The Steward

Recognizing the limitations of both the Spender and the Saver, the Steward strategically uses elements of both types, while bypassing all the problems of both.

They habitually pay themselves first and save, so they have money in savings.

Because they have cash, they earn interest.

When they face a major purchase, instead of paying cash and draining their savings, they finance their purchase.

How the Steward Gains the Advantage

The Steward’s spending strategy is the best financing option. They save, build up cash, continue compounding, and use their cash as collateral for financing, allowing them to maximize their wealth potential.

Access to the Best Financing

Instead of paying the highest rates of interest like the Spender, the Steward uses their own money as collateral and borrows against it to finance the purchase. Because they have cash, they are a low risk to the lender. Consequently, they get financing at the best rates and terms, costing them less in interest than the Spender.

Your Money Continues Growing and Earning Compound Interest

The reason the Steward finances instead of paying cash is that they want to have the “miracle” of compound interest working in their favor. Their cash continues growing and earning, while they use other people’s money (OPM) to finance the purchase.

As a Steward, you never interrupt your earnings. Your money continues growing and earning compound interest, sending you up the sweeping compound interest curve. Instead of being subjected to the gravitational pull of the zero net worth line, you rise above and continue to grow wealth exponentially over time.

While you still pay interest every time you finance, you also continue to earn interest, allowing you to control the banking function in your life.

You Retain Your Cash for When You Need It

Additionally, because you maintain your capital, you always have cash to fall back on for emergencies or opportunities. You’re not left in the cash-strapped position of having just paid cash and then needing money for something and having no way to get to it.

You Can Pay Off Your Loan If You Want To

The Steward recognizes the difference between loans and debt. They aren’t afraid to use loans productively. They know that if they have the cash to pay off their loans, they are not in debt. They have positive net worth and could pay off the loan at any time if they wanted to.

Improving How You Spend Money

Given the benefits of being a Steward, how do you move forward from where you are now, so you can keep and control more money?

Steps for Spenders

If you’re a Spender, find ways to save money by setting a spending ceiling.

You can also consider restructuring loans or using long-term tax reduction strategies to free up cash.

When you free up cash, commit to saving it, not spending it. Develop the discipline of monthly savings.

You’ll not only get better rates on financing; you’ll have more options for purchasing, and more cash in your control along the way.

Steps for Savers

If you’re a Saver, you have solid savings habits and cash at your disposal.

You value having a strong cash position, but you’re frustrated that every time you use it, it disappears from your personal economy, taking with it what it could have earned.

Or perhaps you’re frustrated with the low rates of return you’re earning in bank savings accounts and want something more robust that will increase your rate of return, without restricting your access to capital.

If you recognize the problems with spending cash, giving up control of your capital and resetting your compounding, make the leap to become a Steward by prioritizing earning interest over not paying interest.

To make a major capital purchase, you can finance with loans secured against your capital. This allows you to keep your cash and use OPM (other people’s money) for the purchase. Even if you pay a higher interest rate on a loan than you earn on your savings, having access to cash is often more valuable, because it puts you in control. Remember, there’s always a cost of capital, so it’s best to weigh these decisions in light of your financial picture and what maximizes your wealth creation.

Start Creating Wealth Today

Given the pros and cons of each way to spend money, you now have a choice to make.

If you stay stuck with the Spender/Saver polarity, you’ll find yourself either paying interest or giving up the ability to earn it.

Or, you can step into a new paradigm of abundance as a Steward and wealth creator who maintains control and earns interest. Keeping your capital and financing increases your control, safety, and growth.

The Whole Series on Debt

Check out the rest of the articles, podcasts, and videos in the series on debt here:

- Why Debt Free Doesn’t Make You Financially Free

- The Right Way to Spend Money: Spender, Saver, or Steward?

- Opportunity Cost: The Invisible Cost of Financing

- Cash Flow Index: The Smartest Way to Pay off Debt

Build Your Time and Money Freedom

If you’re a Spender who’s struggling to pay down debt, hoping to save money someday, but looking back at your historical decisions, haven’t found a way to do so yet, we invite you to subscribe to the podcast and join the Money Advantage Community to get ideas on how to increase your cash flow today.

If you are a Saver who would like to learn more about increasing your rate of return on liquid cash, maintaining control of your capital, and earning uninterrupted compound growth, consider using Privatized Banking to elevate your stewardship.

If you would like to implement life insurance and Privatized Banking in your own life, talk to us about how it would work for you.

Book a strategy call to find out how, and also get the one thing you should be doing today to optimize your personal economy and accelerate time and money freedom.

Success leaves clues. Model the successful few, not the crowd, and build a life and business you love.

How to Get Business Credit, with Ty Crandall

Need capital in your business, fast? Today, we’re talking about another way to get a capital infusion through business credit. The problem is that most business owners who want financing don’t get as much as they could, because they haven’t worked on the qualification process. That’s where CreditSuite can help. Ty Crandall has become a…

Read MoreMaximizing Your Financial Potential, with Scott McCright

Most people never maximize their full financial potential. That means they don’t accumulate the assets they could, and what they do save and invest isn’t protected and gets eroded too quickly. Then they take distributions in a way that shrinks their income, and they’re always trying to outrun the fear of running out. Sound too…

Read More