Why You Want Insurance Part 3: It Costs More to Self-Insure

To navigate your insurance decisions, you must weigh the costs and opportunity costs of each option. While some choose to self-insure as a solution to reduce insurance costs, there are additional costs hidden beneath the surface that you need to be aware of.

Insurance is fairly polarizing. Chances are, you either love it or you hate it. And for most, it all boils down to cost.

If you’re in the maximum-insurance-for-all-time camp, you want as much protection as you can get. You see no expiration on your desire to be insured, and you have no problem paying for it.

However, if you lean towards just-the-minimums-ma’am, you begrudgingly pay for just what’s legally required. You would rather do anything else with your money.

Podcast: Play in new window | Download (Duration: 37:11 — 34.1MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | RSS | More

Table of contents

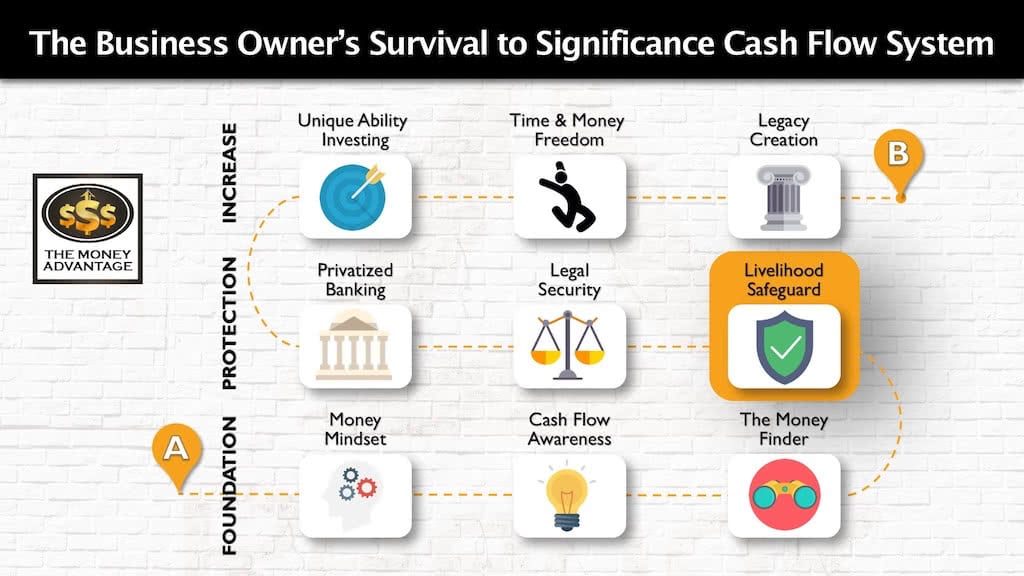

Where Insurance Fits into Your Whole Personal Economy

Let’s zoom out for a moment to remember where and why insurance fits into your Cash Flow System.

Your foundation starts with keeping more of the money you make. Second, you protect what you’ve built. Finally, you increase your income to create time and money freedom and expand your legacy.

Insurance fits in the protection stage. With it, your livelihood is no longer at risk, but secure, regardless of the life circumstances you face.

Your protection is like a roof on your financial house. When the shingles are sufficient and cover the whole house, it keeps storms outside your house, preventing them from getting inside and destroying your belongings. Similarly, when you have adequate insurance protection, your income and assets you’ve built are safe from financial storms that may occur in your life.

Everyone Wants Insurance

Let’s address one misconception so we can start off on the same page. The truth is that everyone wants insurance and as much of it as they can get.

Why?

If it were free, how much would you get?

You and just about everyone else would want it all. I think the lines would be even longer than the ones camped outside a new Chick-fil-A grand opening that give the first 100 a year of free chicken sandwich meals.

Now, we all know that we can’t get something for nothing. No insurance company would agree to that arrangement, because it’s unsustainable. They’d always lose money, go out of business, and that would put you right back in the same position of having no insurance.

Because there’s a cost to transfer risk, you now have to decide if it’s worth it to you.

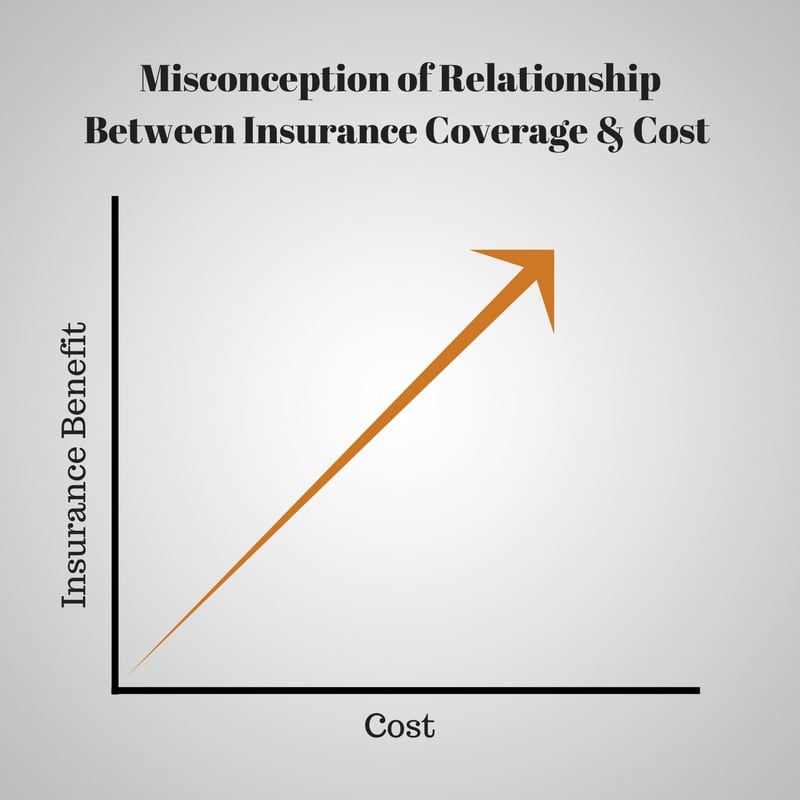

Perception of Cost vs. Reality

On the surface, it appears there’s a positive correlation between the amount coverage and the cost. When the amount of insurance goes up, so does the price tag. Logically then, the way to achieve the lowest cost would be to have the least insurance.

Given that perspective, most people run the cost-benefit analysis throughout their life to calibrate how much coverage to have at any given point in time. They carefully measure needs and weigh the benefits and costs like two kids on an old-fashioned see-saw, looking for equilibrium. Do the benefits outweigh the costs or is it the other way around?

But that’s not the whole story. Most don’t see the big picture because of the opportunity costs that lurk just out of view.

Let’s dive into the heart of the matter so that we can gain some clarity in our decision-making.

The Panoramic View

As with all parts of your financial life, the whole system is more important than the individual components. To make sure each piece fits the larger purpose of your life, let’s come back to the big picture of an optimized personal economy that’s in your control.

You’re earning, spending, giving, saving, and investing from a perspective of abundance. You know that you have everything you need and that you create wealth by serving others.

Because you protect what you have built, you have future guarantees that your assets and cash flow will be there for you.

You find and fix the places where money is leaking out of your control so that you keep more of the money you make.

And, you’re accelerating wealth by earning cash flow from your assets.

Previously in This Series

This series outlines the 11 reasons why you want to protect your money. If you haven’t seen the first seven reasons, check out the prior posts:

In Why You Want Insurance Part 1: Insurance Transfers Risk, we discussed what insurance does. The job of insurance to contractually intercept the financial risk of adverse life events.

In Why You Want Insurance Part 2: It Protects Your Human Life Value, we pulled back the why of insurance and how it’s meaningful to you. Insurance protects your greatest asset: you – the source of your assets, income, and cash flow.

The Questions We’re Answering Today

Today, we’re tackling the costs and opportunity costs to determine how expensive insuring or not insuring is. We’ll dig into the last four reasons why you want to protect your money, and help you answer:

- How much insurance do I need?

- Why pay for insurance if I can self-insure instead?

- Why protect my money when I could make more instead?

- Is the cost worth it?

- With limited resources, how do I prioritize paying for protection?

Self-Insuring is The Opposite of Insurance

If you want to discuss your full range of options, it’s most telling to contrast the extremes.

So, what is 360 degrees the opposite of the maximum, highest quality, most enduring coverage you can get?

It’s having no insurance at all.

Another term often used for this is to “self-insure.”

Essentially, here’s the line of thinking: Only pay for what you need. When you have enough cash built up, drop the coverage, since you can pay for the emergency yourself. If you have enough money, you no longer need insurance. Why spend all that money in premiums to have someone else cover costs for a potential emergency. You’ll be financially better off to keep the premiums and pay for the crisis yourself if anything ever actually happens.

Imagine you have a 1 Million-dollar home and 1 Million dollars of cash. If you decide to self-insure, you would cancel the homeowner’s coverage. If your home were destroyed by fire, wind, flood, or rain, you would have the money to rebuild on your own, without the aid of an insurance company. Instead of paying premiums, you would keep those dollars instead.

In truth, to “self-insure” is just a fancy term for being uninsured.

The Limitation of Needs

The idea to “self-insure” originates from the belief that insurance is a necessary evil. Instead of valuing the peace of mind and the production made possible for you, it views insurance as a requirement to cover your needs. From that perspective, as soon as the need dissipates, you are free to wriggle out from under the heavy burden of insurance.

But if you only insure what you need, you’ll tune your perspective to the minimum and miss out on creating what’s possible.

With life insurance, you may only cover the remaining balance on your mortgage.

If you’ve only covered the minimums, your spouse may be able to pay off the house, but what about replacing the basic things you were planning to provide? What about maintaining their current lifestyle the rest of their life and allowing them to get remarried for love, not money? What about their ability to travel and give charitably? Would they be required to return to the workforce? Is that what you want to happen?

Instead, a more empowering perspective is to focus on using insurance to guarantee what you want to happen will happen, regardless of whether you’re here or not.

If you want to create an abundant future, you’ll need to look up from minimum needs to the greatest possibilities.

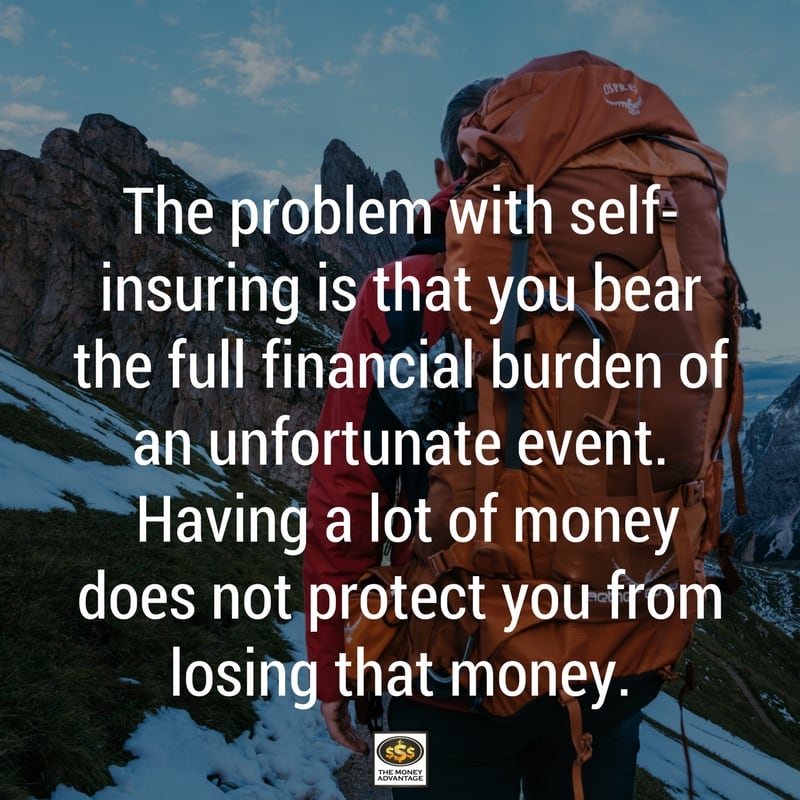

You Retain Risk When You Self-Insure

The problem with self-insuring is that having a lot of money does not protect you from losing that money.

Having cash to replace things does not transfer risk. Instead, you’ve entirely assumed the cost of all of the risk, and you bear the full financial burden of an unfortunate event.

Instead, the more assets you have, the more you have to lose.

Therefore, the more assets you have, the more insurance you should have.

But again, it comes back to cost.

Reasons You Want Insurance

#8) It Costs More to be Self-Insured

The Cost of Being Uninsured vs. the Cost of Insurance

Being uninsured indeed doesn’t require you to pay premiums, which is why people think they will save money.

On the flip side, you also have costs when you don’t have insurance.

The Full Cost of Replacement

Let’s say you went without homeowner’s insurance. You would then need to pay for all of the jobs that insurance does instead. To come out whole, you would need to financially assume you have a 1:1 odds of losing your home. That would require you to set aside 100% of the costs involved in replacement as if it were a guaranteed event.

You’d need to employ the construction company to rebuild and set aside the full cost of a new house.

In fact, self-insuring results in double losses. The loss would be even worse for you because you’d not only lose the asset itself, but you’d also lose the cash to replace the lost asset.

The Cost of Insurance

The cost of owning insurance is the recurring premiums, which are a fraction of your full replacement costs.

Insurance

Because insurance companies

#9) Self-Insurance Creates Stagnant Assets

So far, we’ve just looked at the visible cost of each decision. However, when comparing the option to self-insure vs. buy insurance, you might also want to consider the opportunity costs.

Whenever you lose a dollar, you lose that dollar and also everything it could have produced.

Let’s uncover the hidden opportunity costs you incur by not having insurance.

Lost Earning Potential

If you self-insure, you would need to keep cash on hand equivalent to the value of all of your assets. This money would be set aside to cover the unknown.

Let’s compare two scenarios for a person with a $1M paid-off home, $1M in cash, and a homeowner’s insurance policy costing $10K/year.

First, he chooses to self-insure to save the $10K/year. He puts the $1M cash into CDs to make sure it’s available if needed to replace the home. He earns 2%/year, totaling $20K/year. Between saving $10K/year and earning $20K/year, he has $30K/year in cash flow.

The question becomes, what else could he do with the $1M cash? Stated another way, what is the opportunity cost of having to keep the $1M liquid and available?

If he continues to pay the insurance, transferring the risk to the insurance company, he has an outflow of $10K/year for premiums.

Because the house is covered, he frees up the $1M cash to do its most productive work. If he uses the $1M cash to buy rental properties with a 10% net return, he’ll generate $100K/year in cash flow. Accounting for the cost of insurance, that’s still $90K/year cash flow, which is $60K more than if he had chosen to self-insure.

Insurance gives us a permission slip to utilize all of our other assets. It unlocks the productive potential of our assets because when properly insured, we are free to utilize them without fear of loss. – Garrett Gunderson, Killing Sacred Cows

The Cost of Lost Production

Additionally, the costs of being uninsured or underinsured includes intangibles like lost freedom, peace of mind, ability to create, production, confidence that come from protection.

You’d have to use your mental energy to recover, losing production potential.

#10) Protection Is One of Your Good Expenses

We spend money all day, every day. Often, we feel we spend too much. But before we lament all the money we spend, it’s important to recognize that some expenses are good expenses.

Consumptive Expenses

Consumptive expenses pay for whatever lifestyle you choose. They are neither good nor bad. They are a result of your value system.

There are basic needs we have to spend money on, and things we spend for our enjoyment. You have to pay taxes, buy food, pay for some type of shelter, etc. but the quality of the food, housing, transportation, and enjoyment depends on your choices.

To cut costs, you could live in a tent, ride a bicycle everywhere, grow all your food, and get a goat to mow your lawn.

It all comes down to what is important to you.

Productive Expenses

Next, you have productive expenses that help you make more money. These are among the good expenses that may include business and marketing costs that help you operate or expand your business and increase your income.

Destructive Expenses

Then, you may have destructive expenses. These expenses are the ones to watch out for because they siphon money out of your control.

They are harmful habits, wasteful spending, duplicate charges, services you no longer use, higher rates on loans because of inaccurate credit history, overpaying in taxes, etc.

Protective Expenses

Finally, you have protective expenses that protect you against negative events and help you keep everything else you have. These expenses are also good expenses like insurance and legal protection that increase your peace of mind and allow you to produce more.

While you may believe that not thinking about something bad happening is abundance and positivity, ignoring or neglecting something cannot create real abundance. Protection from, rather than avoidance of negative circumstances is what gives you a true abundance mindset.

#11) It’s Easier to Keep What You Have Than to Make More

Preventing yourself from going backward is even more valuable than moving forward.

Imagine you had the opportunity to make 10% on your money, or you could ensure that you wouldn’t lose 10% of your money. Most people would be more distraught at losing 10% of their money than at missing the opportunity to get ahead by 10%.

This is what insurance does. It prevents you from going backward and losing what you’ve worked so hard to gain.

Without protection, it doesn’t matter how much you make. It can all be taken away in an instant.

With protection, you have a solid foundation. Because you’ve valued the fundamentals, what you build on top is certain and secure vs. unstable and at risk.

Here’s a story that demonstrates how prioritizing spending money on insurance is like building a fence around everything else you own.

The cattle rancher said he could not afford to build a fence. The pioneer told him to “Pay the boys to build you a fence. Pay in cattle, to be able to protect your cattle.” The rancher did not understand the pioneer’s wisdom. Without a fence to guard and protect the cattle, the rancher’s cows wandered off and got lost. After rounding up what he could, some had died, some were stolen, and some were unable to be found. He only had 25% of his cattle left. He lost not only his cattle but also his peace of mind. If he had sold half of his cattle to pay for building a fence for the other half, he would have twice as many cattle as he ended up with by not being able to “afford” to build the fence. – source unknow

In Conclusion

Yes, the cost is worth it. The intangibles and the productive capacity you create far outweigh the cost. It’s more expensive to self-insure, creates stagnant assets, insurance premiums are a protective expense that

We’ve been given stewardship over our Human Life Value, our families, our material possessions, and all of the people that we have the ability to impact. Utilizing insurance properly is one of the most important ways that we can fulfill, protect, and increase the value we deliver to others in any possible case. – Garrett Gunderson, Killing Sacred Cows

Take Action

Consider this: if you knew the event you’re insuring against would happen tomorrow, how much protection would you get today? Buy as much as possible of the most enduring, highest quality, certain coverage you can get.

If you’ve recognized the opportunity to shore up your protection, please reach out to us for a Financial Picture Conversation.

What’s Up Next

In the closing discussion on this series, we’ll discuss the types of insurance you want to have and how to maximize your coverage while minimizing your costs with each type.

The Whole Series on Insurance Protection

Check out the rest of the articles, podcasts, and videos in the series on insurance protection here:

- Why You Want Insurance – Part 1: Insurance Transfers Risk

- Why You Want Insurance – Part 2: It Protects Your Human Life Value

- Why You Want Insurance – Part 3: It Costs More to Self-Insure

- How to Shop for Insurance – Part 1: 7 Tips to Save on Insurance

- How to Shop for Insurance – Part 2: Home and Auto Insurance

- How to Shop for Insurance – Part 3: Life, Health, and Disability Insurance

Create Your Time and Money Freedom

Book a strategy call to find out the one thing you should be doing today to optimize your personal economy and accelerate financial freedom.

New Agent Licensing and IMOs

Are you a new agent or looking to join the insurance industry, and wondering exactly just how and where to get started? In today’s podcast, Bruce and Rachel will help you know how to set up your business, how to get licensed, and what you need to know about joining an insurance IMO or a…

Read MoreAnnuity Strategies: The Truth About Generating Cash Flow with Annuities

Are you interested in knowing the truth about generating guaranteed cash flow with annuity strategies? Learn about the benefits and drawbacks of annuities, as well as some annuity strategies that will help you create guaranteed cash flow. Are annuities the unsung heroes of guaranteed retirement income flow, or are they just another intricate financial product…

Read More